Torsten Asmus

Thesis

As growth stock investing has been a consistently winning strategy for over a decade, many analysts believe that the current explosion in AI will only fortify this trend, improving profitability and growth rates further within the technology sector. In this analysis, I will explore some key trends in growth stocks looking forward, also under the prism of Vanguard’s S&P 500 Growth ETF (NYSEARCA:VOOG), the key attributes and performance characteristics of which are also explored in this analysis.

VOOG ETF Identity & Past Performance

Vanguard’s S&P 500 Growth ETF is one of the most popular growth ETFs that Vanguard currently offers, aiming to track the returns of the S&P 500 growth index that includes the fastest-growing of the top 500 public companies in the U.S. VOOG has been around for a while, incepted in late 2010 and currently charges an attractive 0.10% – a relatively inexpensive ratio. Compared to other growth funds, VOOG also offers a relatively attractive dividend yield of 1.02%. Top holdings include, as expected, technology mega-caps like Microsoft (MSFT), Apple (AAPL), Nvidia Corporation (NVDA), Amazon (AMZN), and others.

Since its inception, VOOG has recorded an impressive 15.64% annualized return, while shorter-term returns also remain attractive (10.24% annual return over the trailing 3-year period). The fund is also diversified across 208 equities, with technology sector stocks, however, covering more than 47% of VOOG’s total weighting.

Earnings Getting Harder to Predict

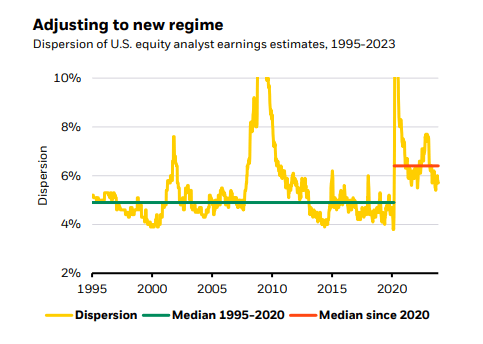

As the post-Covid-19 pandemic era is characterized by an – almost unprecedented – mega-cap growth rally, it has also been a period of turmoil and uncertainty. Earnings volatility has also increased and analysts find it increasingly difficult to forecast future earnings accurately. As shown in the chart below, the dispersion of earnings estimates has reached an elevated baseline, above the 6% level, after 2020.

What this suggests is that perhaps shocks to the market have become more common. If one thing is certain, it is that the market outlook is very uncertain and volatility is likely to stay elevated.

Blackrock

With uncertainty and volatility usually come sharp rallies but also sell-offs that can present excellent buying opportunities for long-term investors, especially in the normally pricey growth equities universe.

Tech & A.I. Monopolizes the Hype

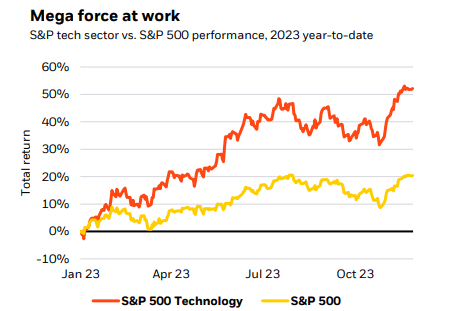

Growth Stocks today are inevitably heavily exposed to the technology sector, and this is no exception when it comes to ETFs like VOOG, which has 47.7% of its weighting geared toward technology stocks.

With AI, in turn, dominating conversation/interest and innovation in technology over the past few years, the tech component of the S&P 500 has dramatically outperformed the index. In the current market, a bet towards the growth factor is without a doubt a commitment to technology stocks and the adoption of the view that their fast-paced trajectory will continue going forward.

Blackrock

An Era of Profitability in Growth

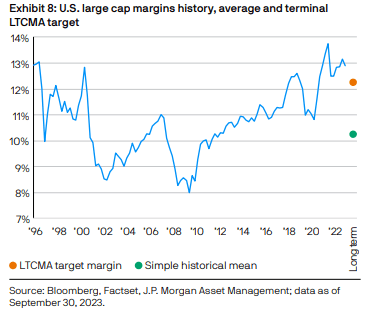

The last decade, marked by outperformance of the growth factor, has also brought an aggressive margin expansion, especially in large-cap stocks that drive returns almost exclusively in growth ETFs. Specifically, since 1996, the historical average margin for large-caps has been just above 10%, while it currently stands just shy of 13%. Even more importantly, margins have been consistently elevated above historical for almost one decade, despite the Covid-19-induced shock to the market in 2020.

The elevated profitability levels arguably explain to some extent both growth’s outperformance in recent years as well as the factor’s raised valuation multiples. Investors and market participants seem to expect higher profitability levels to persist over the mid-term. The same seems to be the thesis of J.P. Morgan Asset Management, as they expect (shown in the chart below) target margin to stay at the 12%+ level, in their long-term capital market assumptions.

J.P. Morgan Asset Management

Growth vs S&P 500

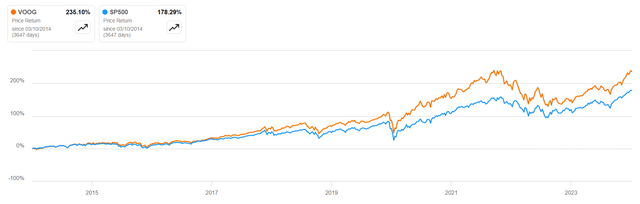

Over the past decade, the growth factor has progressively risen in popularity, separating in terms of performance from the S&P 500, especially after 2019. This prolonged period of outperformance by growth stocks is shown in the following chart by comparing VOOG versus the S&P 500. Over the last decade, VOOG has recorded a total return of 235% compared to the S&P 500’s 178%.

on

VOOG vs VUG vs IVW vs IWF

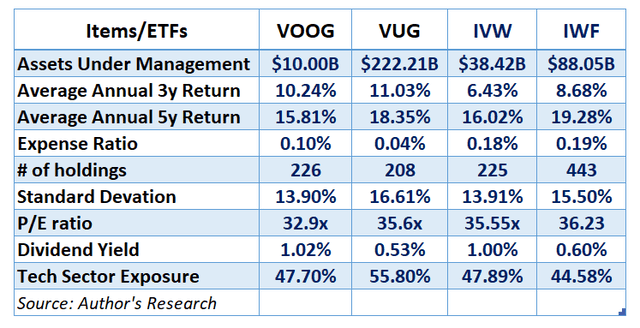

While there is no shortage of growth ETFs in the market for investors to choose from, in this segment a summary attribute/performance analysis is provided, between VOOG and three of its most prominent counterparts; Vanguard Growth Index Fund ETF (VUG), iShares S&P 500 Growth ETF (IVW) and iShares Russell 1000 Growth ETF (IWF).

While VOOG is the smaller fund of the group ($10.00B in Assets Under Management), it has recorded the second-highest 3-year average return in the peer group. VOOG also appears attractively valued compared to its competitors, carrying a 32.9x P/E ratio, with IVW being the second-cheapest ETF at a 35.6x P/E ratio. This can be an especially desirable attribute, given the current, overextended state of the stock market.

In terms of expense ratios, VOOG places relatively well within the group, while it also offers the highest dividend yield of 1.02% and, even more importantly, the lowest standard deviation, hinting at a promising risk/return tradeoff. Overall, VOOG seems to perform well for growth ETF standards, across a different set of metrics.

Author’s research

Final Thoughts

After all things are considered, VOOG represents an attractive ETF proposition for investors looking for targeted growth stock exposure, chasing more aggressive returns. The fund places well among its peers in terms of risk and performance, while also exhibiting a strong record, since its inception in 2007. Heavy exposure toward the technology sector, as with all growth funds, should be one thing for investors to notice when thinking of diversification. Overall, I would currently rate VOOG as a buy.