Bloomberg/Bloomberg via Getty Images

US Steel (NYSE:X) has fallen into quite the predicament as the firm announced being acquired by Japanese steel producer Nippon Steel (OTCPK:NPSCY) for $55/share, an implied enterprise value of $15b. This deal has received tremendous pushback from all ends as competitive bidder, Cleveland Cliffsor “unidentified company D” as CEO Lourenco Goncalves disclosed in their FY23 earnings call, believes that the deal will falter under antitrust law and places the US steel market at risk of anticompetitive pricing from the inside out. The Biden administration has even raised concerns and believes the deal requires “serious scrutiny,” Donald Trump has even mentioned that he would block the deal upon reelection. JPMorgan (JPM) has even suspended rating both US Steel and Cleveland Cliffs on February 1, 2024 as the firm acts as advisor for Cleveland Cliffs in the acquisition deal. I believe that given the recent updates and the verbiage from Cleveland Cliffs’ management that if a deal with Nippon were to falter, a new acquisition offer would be significantly reduced, resulting in a lower valuation for US Steel shares. With these updates, I provide X a SELL recommendation with a price target of $20.67/share at 4.25x eFY25 EV/EBITDA, well in line with US Steel’s historical trading premium.

Operations

Corporate Reports

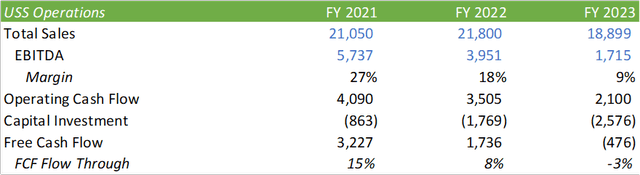

US Steel experienced significant declines across the top line down to free cash flow as the firm faced a softer steel market in FY23. Net earnings declined by -65% y/y on the back of increased capital investments (+46%), pushing the firm to experience a cash outflow.

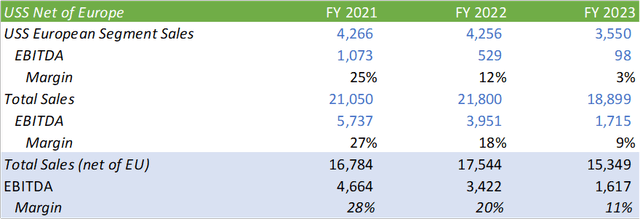

In December 2023, US Steel commissioned their DRI operations at their Keetac mining operations, broadening their competitive carbon-reducing product to Cleveland Cliff’s DRI. European operations experienced a significant y/y decline in revenue of -17% with EBITDA margins contracting to 3%. The price decline was offset by higher volumes shipped as the firm received strong demand for steel in Europe in q4’23.

Though higher volumes in USS Europe is a promising factor, there are signs that the European Bloc is facing significant growth challenges that may lead to flagging growth for US Steel’s European operations. CNBC reported on January 30, 2024 that Germany is on the brink of a recession. If the European Bloc were to remain in slow-to-no contracting growth, US Steel’s European operations may be significantly impacted as the segment contributes 18% in revenue and 5% in EBITDA to the firm’s total operation. Overall, I believe that the impact as a result of lower revenue and EBITDA in the European segment could positively impact overall margins. Excluding European operations, US Steel’s EBITDA margin would have been 11% for the year.

Corporate Reports

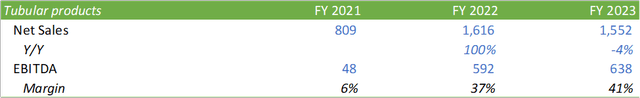

Management guided a challenging environment for q1’24 with headwinds for raw materials and CO2 costs. The firm also experienced high demand in tubular as the firm experienced tailwinds from a strong construction and infrastructure environment.

Corporate Reports

On the macro front, there is a significant amount of opportunity for US Steel on the infrastructure front as the IRA, the Infrastructure Bill, and the CHIPS Act are each expected to begin allocating funding this year. Though there had been some previously announced projects under the IRA, projects had since been canceled due to high financing costs. Li-Cycle’s (LICY) planned EV battery recycling facility in Rochester, New York, was one such project that was postponed due to the high cost of borrowing.

Orsted also announced the cancellation of two offshore wind projects in early November 2023 citing that the high cost of borrowing has made these projects uneconomical. Accordingly, 4.4GW of renewables capacity projects in New York have been cancelled due to higher costs and the cost to borrow.

Many renewable energy projects may be sidelined until the cost of borrowing comes down, which may not be as soon as one might presume. Many analysts and traders had predicted six rate cuts; however, Federal Reserve Chairman Jerome Powell suggests that the Fed will hold rates steady until the market shows further evidence of inflation coming down.

Aside from these projects, NextEra Energy (NEE) has 20GW of backlog capacity coming online over the next three years. In addition to this, many of the US-based EPC firms, such as Quanta Services (PWR) and MasTec (MTZ), have each expressed strong backlog growth for infrastructure, power transmission, and renewable energy projects, which I had outlined in my report covering Nucor (NUE).

On the electric vehicle front, as also expressed in my report covering Nucor, Ford, GM, and Tesla have each expressed a major slowdown in EV production as well as cancelled or capacity reduction for battery facilities. These are significant near-term challenges as 22% of US Steel’s steel production in terms of volumes is sold to the transportation and automotive industries. More specifically, 33% of domestic flat-rolled steel production is sold to this sector.

US Steel, along with the rest of the steel industry, faced significant headwinds in FY23 as revenue declined by -13% with an EBITDA margin contraction from 18% to 9% in FY22 and FY23, respectively. The challenges do not appear to be dissipating anytime soon as the industry must undergo a massive transformation towards decarbonization.

“At some point, the global steel industry is going to have to understand that trade needs to be linked to [carbon dioxide] emissions.” – Philip Bell, President of Steel Manufacturers Association

Management at US Steel discerned their decarbonization goals as the firm is planning to use more DRI and pig iron in their EAFs. I believe that this should bring the firm further into alignment with the broader industry’s goal of decarbonization. US Steel may piggyback on Cleveland Cliff’s use of hydrogen as an oxygen reductant in their blast furnaces as hydrogen becomes more available.

US Steel Acquisition Updates

One important detail that appears to be getting no attention is that Nippon Steel was recently penalized for dumping steel on the US market. Though this is purely my speculation and may not hold any merit, I do believe that if Nippon Steel were to acquire US Steel, Nippon Steel would have the flexibility to circumvent antidumping duties as the firm will have domestic steel production under their control. Though this may never occur if the acquisition does go through, I do believe this factor should be taken under serious consideration as the firm has previously participated in anticompetitive behavior.

I have seen a lot of pushback, primarily in my comments section, towards Cleveland Cliffs during the acquisition process as some would perceive their initial offer as a lowball offer. I believe that this presumption couldn’t be further from the truth. Below is an outline of the pre- & post-acquisition announcement of US Steel’s market value.

Corporate Reports

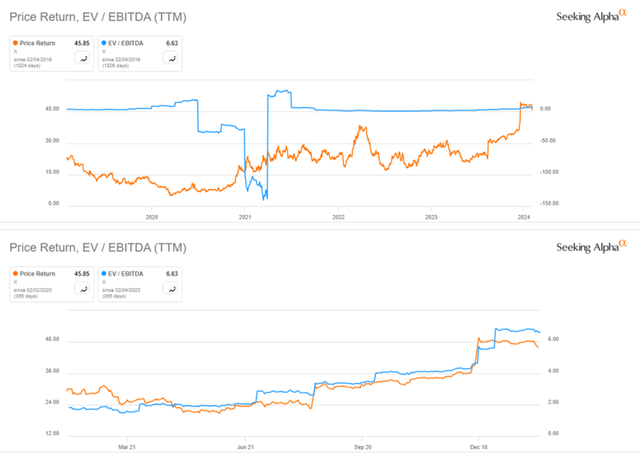

Looking back further into US Steel’s historical valuation, shares have seldom traded above the offer multiple.

Seeking Alpha

At the early stages of the bidding process, I believe that Cleveland Cliffs was the only material offer on the table as Esmark quickly backed out of their all-cash offer and ArcelorMittal never directly put forth an offer. Though ArcelorMittal weighed making an offer, a cash offer was only speculated on.

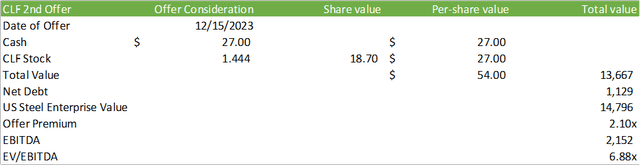

Cleveland Cliffs from there had made a second bid that was announced on December 15, 2023, valuing the firm at just under $15b in enterprise value. Though the initial valuation was significantly above US Steel’s pre-announced valuation, the second offer was valued at over 2x US Steel’s pre-announced enterprise value.

Corporate Reports

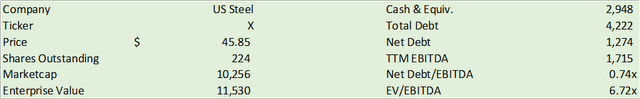

Valuation & Shareholder Value

Corporate Reports

I’m a firm believe that the US Steel and Nippon Steel merger will be blocked and that US Steel will either be left with Cleveland Cliffs as an acquirer or remain as a standalone firm. Given the verbiage from Lourenco Goncalves, I firmly believe that the new offer will be significantly reduced from the current standing offer, not out of spite, but as a result of the macro challenges faced in the steel industry. As a result of the bleak industry outlook, I do anticipate more industry consolidation to occur following Steel Dynamics’ (STLD) 2022 acquisition of New Process Steel. Similar to the O&G industry consolidation, I believe that this would alleviate some of the volumetric pressure and allow for some breathing room in pricing dynamics.

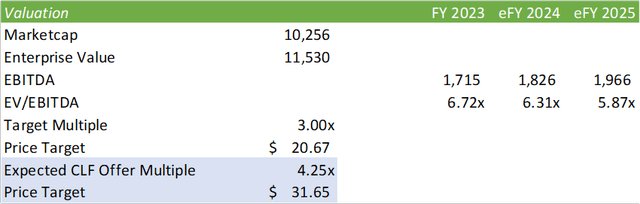

Given US Steel’s historical valuation, I do anticipate the new price to be more in line with Cleveland Cliff’s initial offer at 4.13x EV/EBITDA. Given consensus’s estimates for eFY25, I anticipate US Steel to generate just under $2b in EBITDA in eFY25. For a valuation multiple of 4.25x eFY25 EBITDA, I value X shares at $20.67/share, well in line with the firm’s historical trading premium. I provide X a sell recommendation on this premium adjustment.

Corporate Reports

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.