400tmax

Investment Thesis: I rate Tripadvisor as a hold at this time.

In a previous article back in January, I made the argument that Tripadvisor (NASDAQ:TRIP) could have the capacity for upside if revenue continues to see growth and selling and marketing costs as a proportion of overall revenue decline from here.

While the stock did subsequently see upside in the interim, Tripadvisor has seen a sharp drop in stock price as a result of the company’s special committee turning down a takeout offer:

TradingView.com

The purpose of this article is to assess whether Tripadvisor otherwise has the capacity to rebound based on recent earnings results.

Performance

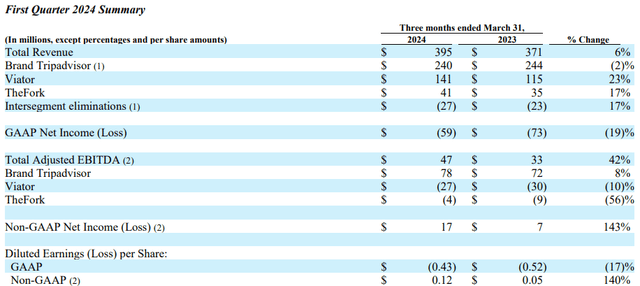

When looking at the first quarter 2024 financial results for Tripadvisor (as released on May 8, 2024), we see that total revenue was up by 6% with total adjusted EBITDA growth of 42%. According to the company, the growth we have seen this quarter reflects the ongoing diversification of Tripadvisor’s portfolio to higher growth experiences offerings.

Tripadvisor: First Quarter 2024 Financial Results

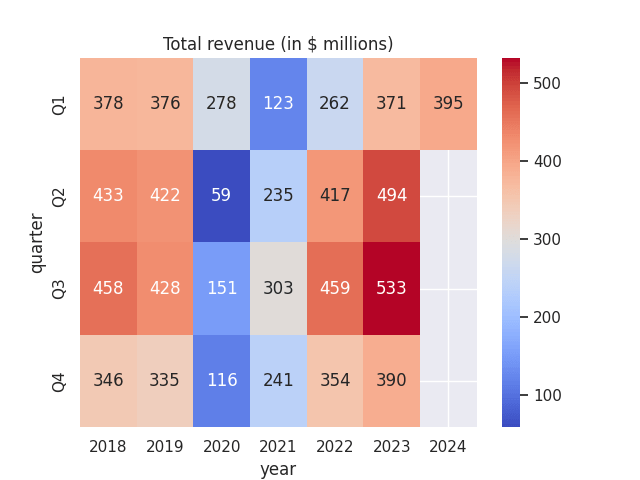

When taking a longer-term view, we can see that revenue growth last year was higher for each quarter in 2023 as compared to the previous year. It is also notable that Q2 and Q3 were the best performing quarters by revenue for the company last year – and it is probable that we will see a similar trajectory going forward this year as customer activity increases over the high season for travel.

Figures sourced from historical Tripadvisor quarterly earnings reports. Heatmap generated by author using Python’s seaborn visualisation library.

I had previously stated that I would be watching to see whether Tripadvisor could not only grow revenue, but also reduce its selling and marketing costs as a proportion of overall revenue. At the time, selling and marketing costs were at 51% of overall revenue for Q3 2023, as compared to 51% in the previous year.

Subsequently, selling and marketing costs came in at 46% of consolidated revenue for Q4 2023 (compared to 55% in the prior year quarter), and 56% of consolidated revenue for Q1 2024 (compared to 59% in the prior year quarter).

In this regard, we can see that revenue growth has indeed been outpacing that of selling and marketing costs, and a continuation of this trend going forward will be very encouraging.

From a balance sheet standpoint, we can see that the quick ratio (calculated as cash and cash equivalents + short-term marketable securities + accounts receivable)/current liabilities, we can see that the ratio has decreased slightly over the course of the year, but still remains above 1 – indicating that Tripadvisor is still in a good position to cover its current liabilities using its existing liquid assets.

Jan 2024 Jan 2023 Cash and cash equivalents 1171 1132 Short-term marketable securities 0 0 Accounts receivable 248 210 Current liabilities 892 763 Quick ratio 1.59 1.76 Click to enlarge

Source: Figures sourced from Tripadvisor Q1 2023 and Q1 2024 Financial Results. Figures provided in USD millions, except the quick ratio. Quick ratio calculated by author.

My Perspective and Looking Forward

In terms of my take on the above results – notwithstanding the downward pressure we have seen on the stock price as a result of a takeout offer being declined – I am encouraged by recent earnings results in that we have continued to see revenue growth, a decline in selling and marketing costs relative to revenue, as well as a respectable quick ratio.

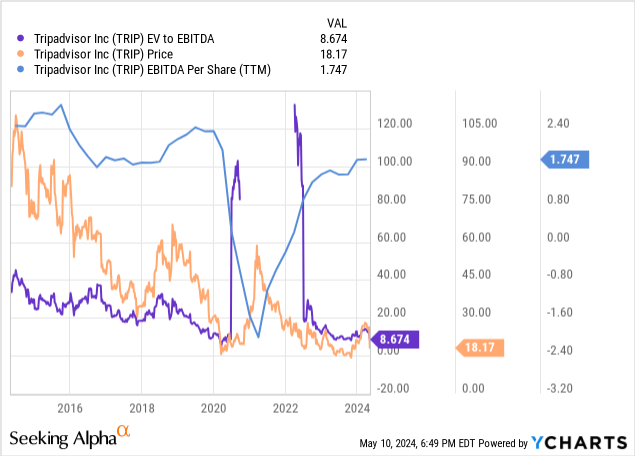

I had previously expressed my opinion that if EBITDA per share can rebound to the $2.00-2.40 range as seen pre-2020 – then the stock could stand to see upside back to the $30-50 price range once again.

My rationale for making this argument was that back in 2018-2019, we saw the stock trading between the $30-50 range in spite of the stock trading at a similar EV/EBITDA ratio at the time.

ycharts.com

From looking at the above, we can see that both EV/EBITDA and EBITDA per share are trading at levels last seen during this period, but the price still remains lower than that seen previously.

In this regard, I take the view that the market is potentially being overly pessimistic on Tripadvisor’s prospects at this time – and I maintain the view that the stock could ultimately rebound to the $30-50 range over the longer term.

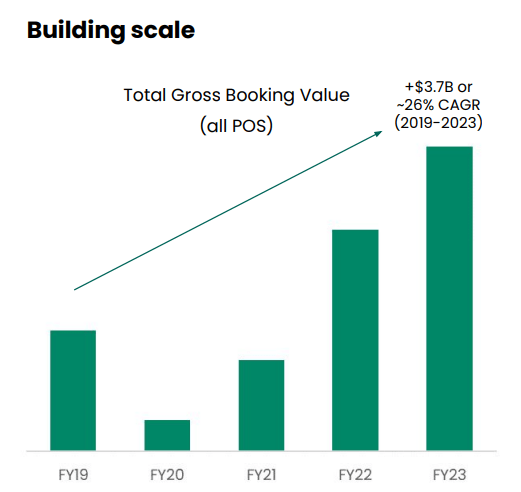

In my opinion, Viator will be a key driver of growth for the company as a whole going forward. With spend on experience-related services coming in at four times that of goods, gross booking value for Viator has seen growth of 26% CAGR between 2019-2023:

Tripadvisor Q1 FY 2024 Investor Presentation

Moreover, the company’s plan to use artificial intelligence as part of its advertising campaign to boost brand awareness would allow for the capacity to review the content of ads and social media posts for that of Viator and its competitors, and in turn classify by topic. Such an approach reduces the risk of brand campaigns by maximising the probability that a campaign will deliver the most compelling message in attracting potential customers. With Viator having accounted for 40% of Tripadvisor’s revenue in 2023, I am optimistic that this is likely to prove an effective approach in further growing the brand.

Risks

In terms of the potential risks to Tripadvisor at this time, the online travel review market continues to grow ever more competitive – and such competition may place pressure on Tripadvisor’s growth prospects going forward.

For instance, recent changes in Google search has meant that Tripadvisor has seen reduced visibility of late – and the fact that Google (GOOG) competes with Tripadvisor in this regard could mean that Tripadvisor may see a reduced capacity to attract customers from online searches alone going forward, and need to rely more on brand awareness.

More broadly, the fact that Tripadvisor has seen such a sharp drop on the news that a takeout offer has been turned down means that in spite of otherwise strong performance – investor confidence in the stock may not return for some time and the price could still remain low in the short to medium-term.

In spite of these risks, I take the view that the company maintains a strong brand in its marketplace – and recent revenue growth indicates that customer demand remains robust.

Conclusion

To conclude, I am optimistic about the long-term prospects of Tripadvisor overall. However, I still rate Tripadvisor as a hold given that we have yet to see net income rebound into positive territory and uncertainty remains following the recent rejection of a takeout offer.