Richard Drury/DigitalVision via Getty Images

Elevator Pitch

TPI Composites, Inc. (NASDAQ:TPIC) shares are rated as a Buy.

Earlier, I assessed TPI Composites’ prospects for the short term and the long run in my November 22, 2023, update. The focus of this latest write-up is TPIC’s recent quarterly results and the company’s guidance for the current year.

TPI Composites’ top line and EBITDA for Q4 2023 didn’t meet expectations, but TPIC is anticipating a significant turnaround in the future. The company sees its revenue decline narrowing in 2024 and expects to generate positive EBITDA this year. TPIC also thinks that it can improve its EBITDA margin from 2% for FY 2024 to a high single-digit percentage next year. The turnaround is in sight for TPI Composites, but that hasn’t been completely factored into the stock’s valuations. TPIC’s shares are undervalued based on historical and peer comparisons, which warrants a rating upgrade from a Hold to a Buy.

Q4 Performance Wasn’t As Good As What Headline Earnings Suggest

TPIC revealed its financial performance for the fourth quarter of 2023 with an announcement released on February 22, 2024, after trading hours.

The company was profitable in the most recent quarter, contrary to the market’s expectations. As per financial data obtained from S&P Capital IQ, TPI Composites reversed from a GAAP net loss per share of -$1.38 for Q4 2022 to achieve a GAAP EPS +$0.31 (or positive net income of $11.6 million) in Q4 2023. In contrast, the Wall Street analysts had anticipated that TPIC would report a GAAP net loss of -$0.88 per share (source: S&P Capital IQ) for the final quarter of the previous year.

In its Q4 2023 results announcement, TPIC attributed the good bottom line performance to “a gain on extinguishment of $82.6 million associated with the refinancing of our Series A Preferred Stock into a Senior Secured Term Loan.” In other words, TPI Composites’ above-expectations bottom line for the latest quarter was driven by non-operating items. In fact, the company’s other key Q4 2023 financial metrics fell short of the market’s expectations.

Revenue for TPI Composites fell by -36% YoY and -20% QoQ to $297.0 million in the fourth quarter of last year. This translated into a -12% top line miss, as the analysts’ consensus revenue forecast was higher at $337.4 million as per S&P Capital IQ data. Also, TPIC reversed from a positive EBITDA of +$21.2 million in Q4 2022 to record an EBITDA loss of -$28.1 million for Q4 2023. Its actual EBITDA loss in the recent quarter was worse than the sell side’s consensus EBITDA loss estimate of -$14.4 million (source: S&P Capital IQ).

In my prior November 22, 2023 article, I shared my expectations of “difficult times for the company in the very near term,” and my view has been validated by TPI Composites’ top line and EBITDA misses for Q4 2023. At its Q4 2023 earnings call, TPIC cited a “production slowdown,” “inventory reduction,” and “higher startup and transition costs” as the major reasons for its top line contraction and EBITDA loss in the recent quarter.

But TPI Composites’ shares surged by +19% on February 23, 2024, a day after it disclosed its Q4 2023 results. TPIC’s stock price outperformance is likely linked to the company’s prospects, rather than its latest quarterly performance.

But Profitability Outlook Is Positive

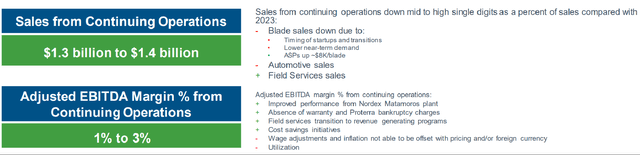

TPIC is expecting a revenue of $1,350 million and a 2% EBITDA margin in the current fiscal year based on the mid-point of its FY 2024 guidance. This implies that TPI Composites’ YoY top line decline will narrow from -17% in FY 2023 to -7% for FY 2024. More significantly, the company is expected to turn around from an EBITDA loss of -$86 million last year to register a positive EBITDA of around +$27 million this year.

The Key Assumptions Supporting TPI Composites’ FY 2024 Financial Guidance

TPI Composites’ Q4 2023 Results Presentation Slides

At its fourth quarter earnings briefing, TPI Composites also outlined its expectations of delivering a “high-single digit” EBITDA margin and an EBITDA over $100 million in FY 2025 on the belief that “the operational and quality challenges we experienced in 2023 are now behind us.”

An example of an operational issue will be lower-than-expected production in Q4 2023 due to certain out-of-specification raw material supplies that drove its EBITDA lower by -$8 million in that quarter. This is an illustration of a one-off item that shouldn’t recur in 2024 or 2025.

Separately, TPIC highlighted in its Q4 2023 results presentation slides that its “quality improvement initiatives have been successful” after incurring “higher costs for quality control measures” in 2023. Notably, TPI Composites had recruited a former executive from Vestas Wind Systems A/S (OTCPK:VWDRY, OTCPK:VWSYF), Neil Jones, to be its Chief Quality Officer, starting in August last year, which should have paid off in the form of quality improvement. As a reference, TPIC recorded “$50 million of warranty charges” last year as revealed at its Q4 2023 results briefing.

As such, the company’s profitability is likely to be better going forward without such headwinds (i.e., production and quality control issues) this year and next year.

Shares Have Legs To Run

TPI Composites’ FY 2025 EBITDA target of $100 million and the market’s consensus FY 2025 Enterprise Value forecast of $500 million (source: S&P Capital IQ) translate into a forward EV/EBITDA multiple of 5.0 times for the stock.

Prior to 2022 when TPIC turned EBITDA negative, TPI Composites’ historical five-year (FY 2017-2021) mean consensus next twelve months’ EV/EBITDA was much higher at 17.5 times.

Also, the company’s peers are also trading at relatively more demanding EV/EBITDA multiples. The consensus FY 2025 EV/EBITDA metrics for CS Wind Corporation [112610:KS]Titan Wind Energy Suzhou [002531:CH]and Gurit Holding [GUR:SW] are 6.5 times, 6.4 times, 5.7 times, respectively as per S&P Capital IQ data.

Therefore, I hold the view that TPIC’s shares still have legs to run, despite the +19% jump in its share price on February 23, 2024.

Concluding Thoughts

I have a favorable view of TPI Composites, Inc.’s profitability outlook. The company’s expected EBITDA margin expansion for FY 2025 hasn’t been priced into its shares, as the stock’s EV/EBITDA valuation multiple is still below historical and peer averages.