Nastassia Samal/iStock via Getty Images

The pivotal labor market data

The payrolls data reported on the first Friday of each month is always important, and it usually sets the tone for the rest of the month. Thus, the stock market usually has a significant reaction to the payrolls report.

The payroll report for April, last month, was truly a pivotal report, which sets the stage for the May payroll report. The S&P 500 entered the month of May in a 5% dip territory, and the expectations were that the Fed would not be cutting interest rates significantly in 2024 due to the previously strong labor market data and the “hot” inflation readings in 2024.

The actual payroll data for April was well below expectations, with 175K jobs new jobs created against the expectations of 243K. Further, the wage growth was also below expectations at 0.2% MoM. Thus, the market started to price the Fed cut earlier than previously expected, as interest rates fell, and the S&P 500 roared back to new all-time highs in early May.

Technically, the 2Y Futures (US2Y), the 10Y futures (US10Y), and the S&P 500 (SPX) all breached the 20-day moving average on May 3rd when the payrolls were reported. Here is the chart of 2Y Treasury futures, with the trigger to the upside on the job’s day, May 3rd. The peak was reached right after the May 15th CPI data, and the breakdown was reached after the surprisingly strong flash PMIs on May 23rd.

2Y Futures (Barchart)

The 2Y Treasury futures are now at the 20-day DMA level waiting for the May payrolls report, and this level specifically implies that there is about 60% probability that the Fed will cut in September.

The May labor data expectations

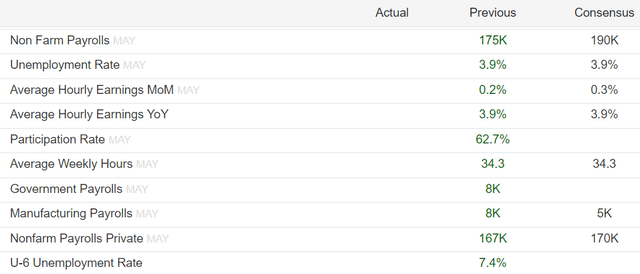

The consensus market expectations are that the labor market will be slightly stronger in May, compared to April, but still weaker than what it was during the first quarter of 2024.

Specifically, the market expects that there will be 190K new jobs created, with the unemployment rate staying at 3.9%, but with stronger wage growth at 0.3% MoM.

The May expectations (Trading Economics)

Let’s try to predict the number

Obviously, the ability to predict the actual number, versus the expectations, would be a great advantage in trading the S&P 500 over the near term.

So, what do we know about the recent state of the labor market, that can help us predict the actual number? First, let’s go back to the April report and evaluate where the weakness was.

Government jobs: The government created only 6K in April, which was well below the level in previous months (72K in March, 55 in February). This number alone accounts for the difference between the actual and expected. Leisure and Hospitality: This cyclical sector created only 5K new jobs in April, well below the 53K new jobs created in March.

So, the question is whether the weakness in these two sectors will also continue in May?

Second, let’s look at some key early data that could predict the May payrolls data.

Weekly claims for unemployment: the initial claims spiked to 232K on May 4th, but this was the peak, as the numbers declined the following weeks, suggesting that there is some weakness in the labor market, but generally the labor market remains tight. The S&P Global US Composite PMI was released on May 23rd, and this is a flash report, or the first data estimate for May. The PMI number came very strong at 54.4, well above expectations, suggesting that both service and manufacturing activity picked up in May. With respect to the employment situation, the reported noted:

Despite ongoing job cuts, the pace of employment decline slowed as businesses showed increased confidence in the coming year and saw greater order book intakes.

Note, as previously discussed, the S&P Global US Composite PMI release on May 23 was the key trigger, as this suggested that the May data will be stronger than the April data, which caused interest rates to increase, and the stock market to fall.

With respect to the employment situation, the S&P Global US Composite PMI also suggests that there is some weakness in the labor market, but the situation is improving.

Thus, given what we know from these reports, it is reasonable to expect the payroll number to come slightly above 175K.

However, the theme of “strong May” is already facing a serious challenge. Specifically, the ISM manufacturing for May declined more than expected, and the new orders fell to 45 – that’s recessionary. Yet, the employment number came at 51, well above expectations. Note, the 2Y yield spiked after the ISM manufacturing report, as the market is starting to price a possible recession, as suggested by the new orders.

Thus, in my opinion, there is a greater probability of a negative surprise or a sub-175K actual number – given the wealth of weaker than expected data. As a result, my prediction for payrolls is 150K, and an uptick in the unemployment rate to 4%.

Implications

The first part of the challenge is to predict the actual payroll data. The second part is to predict the stock market reaction.

Let’s start with the assumption that the actual number will be slightly weaker than expected, possibly at 150K. In this situation, the 2Y Treasury futures will rise, meaning short-term interest rates will fall. The long-term interest rates will fall as well, as the bond market would start pricing a slowdown, and ultimately a recession.

The S&P 500 (SP500) could in this situation 1) sharply fall due to a higher probability of a recession, or 2) rise as interest rates fall, in expectations of Fed cuts.

My opinion is that in this situation is that the S&P 500 would fall. Usually, the stock market falls with the first interest rate cut, if it signals an imminent recession, which I think is the case in the current situation.

This thesis is supported by the reaction to the ISM manufacturing report on June 3rd, where the economically sensitive Russell 2000 (IWM) reversed the opening gains and fell, as well as the Dow Jones (DIA). The S&P 500 (SPY) also fell but closed higher due to the meme-mania spreading to megacaps, and especially Nvidia (NVDA). Nvidia cannot keep the entire market up forever, and eventually this bubble will burst as well.

There is plenty of data until Friday, and the situation could change. More importantly, the payrolls will be followed by the CPI report, and the worst-case scenario is that the labor market weakens (as I expect), but inflation fails to moderate, which is currently a consensus given the 0.3% expected increase in core CPI for May. Unfortunately, the data is pointing in this direction – stagflation.