AlizadaStudios

Summit Midstream Partners (NYSE:SMLP) first watched its share price collapse in the mid-2014 oil price collapse, followed by COVID-19 having a massive impact. The company’s share price has recovered by more than 50% from its mid-2020 lows, but it remains well below pre-crash prices. As we’ll see throughout this article, the company’s strong assets and commitment to shareholders make it a valuable long-term investment.

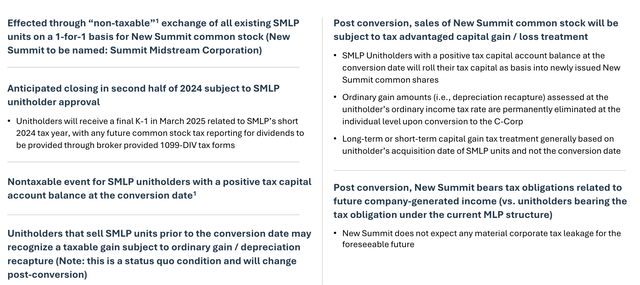

C-Corp Conversion

The company is planning to convert to a C-Corp with a 1:1 stock conversion.

Summit Midstream Partners Investor Presentation

The transaction is subject to SMLP unit holder approval, but it’s expected to close in the 2nd half of 2024. The event is expected to not be taxable, however, depending on your situation and when you sell, there are potential taxable impacts. After that conversion, the company’s C-Corp status will follow standard taxation rules.

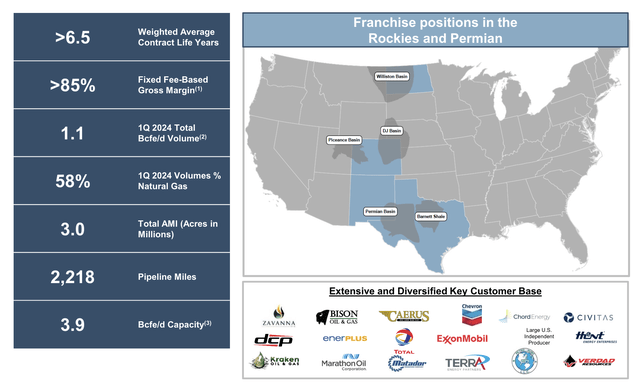

Summit Midstream Partners Positioning

The company continues to maintain a strong portfolio of assets, though it continues to have some risks.

Summit Midstream Partners Investor Presentation

The company has a weighted average contract life of more than 6.5 years. The company has >85% fixed fee-based gross margin, highlighting the strength shared between midstream companies. The company’s total volume was roughly 1.1 billion cubic feet equivalent / day and 58% of the company’s volumes were natural gas.

In the United States, natural gas tends to be less profitable, so moving oil is a strong benefit. The company has roughly 3 million acres of gathering, but it still has some low utilization. Capacity remains well above volumes, a consistent concern we have with the company.

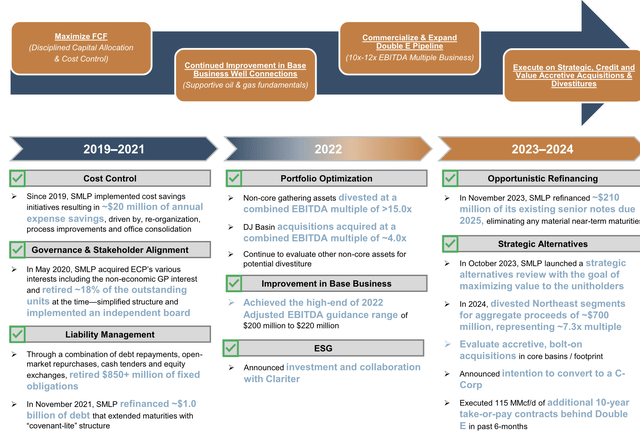

Summit Midstream Partners Accomplishments

The company has continued to have strong accomplishments with a great cost-cutting program after COVID-19 pushed it towards bankruptcy.

Summit Midstream Partners Investor Presentation

The company has continued to clean-up its capital stack and rollover debt despite bankruptcy risk. The company managed to retire or rollover a substantial amount of debt. The core value of the assets is shown in for example the company’s divestment of its Northeast segments for ~$700 million (a strong 7.3x multiple).

We’d like to see the company work to pay down its debt and take advantage of its C-Corp strength. The company has managed to grow some of its key assets.

Summit Midstream Partners Investor Presentation

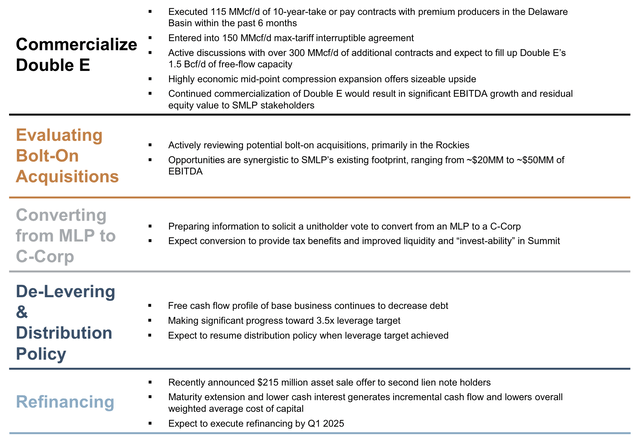

The company commercialized Double E with 115 MMcf/d of 10-year take or pay contracts in the last 6 months on the Double E. The company is continuing to find contracts expected to fill up the entire capacity, and there is a growth upside for higher volumes. Given the strength of the Permian Basin and the backing by Exxon Mobil, we’d like to see the asset continue its growth.

The company is looking at various bolt-on acquisitions, showing how it is making sure to optimally use cash despite volatility in the markets.

Summit Midstream Partners Utilization Issues

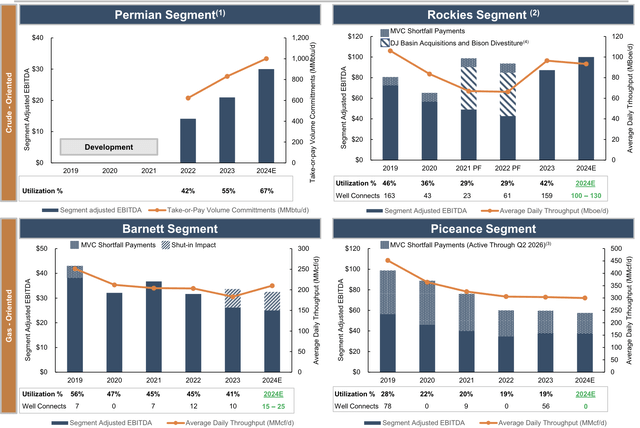

Among our concerns about the company is continued utilization issues.

Summit Midstream Partners Investor Presentation

The company is building up its Permian Segment (Double E) heavily and EBITDA is continuing to grow. Utilization is at 67%, and we expect that to grow towards 100%. However, the company’s other segments have concerns, especially Piceance where utilization is <20% and the company's EBITDA is supported by MVC shortfall payments.

These payments are expected to stay for the next 2 years. 2024E is expected to have no well connects. The company has seen increased consolidation, which could result in future growth. Barnett is seeing well connects increase and the Rockies have seen growth despite MVCs with >40%.

Seeing higher natural gas prices and increased utilization here could help the company long-term.

Summit Midstream Partners Returns

Overall, the company remains committed to driving shareholder returns.

Summit Midstream Partners Investor Presentation

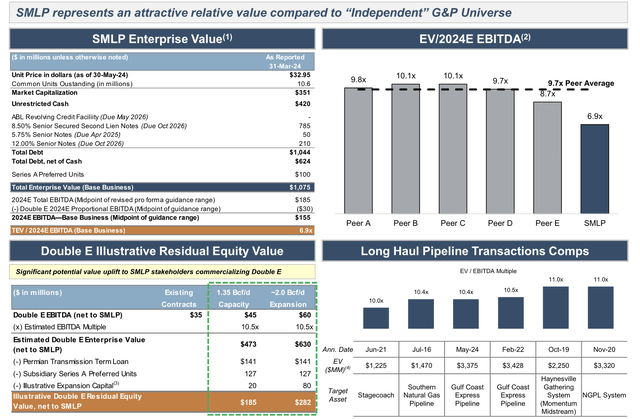

The company continues to have an unrestricted $420 million in cash, more than its entire market capitalization, as it looks to find a way to repurchase debt. The company’s lower risk has made it harder to repurchase loans at par value. Given the company’s timeline for debt being due, it might be better off saving its cash for the due date if it would have to overpay for debt.

The company has no debt on its revolving credit facility and only $50 million due April 2025. In 2026, the company has $995 million in high interest debt due. Overall, the company’s $1.05 billion in debt costs it $93 million in annual interest payments. Paying that down could dramatically help its financial position.

Saving half of that interest with cash on hand, could make it much easier for the company to pay down the rest, and enable hefty market capitalization growth. We see this as the path over the next several years of strong shareholder returns.

Summit Midstream Partners Valuation

Putting this all together, we calculate the valuation for the company.

The company currently generates over $200 million in annual EBITDA post the sale of its Utica assets and more than $100 million in DCF. The company has more than $600 million in net debt that it can pay off, and paying off the entirety of its debt can help its EBITDA conversion substantially. The company, counting Double E growth and increased utilization, could approach $200 million in annual DCF.

At a reasonable valuation, that could put the company’s market capitalization towards $1 billion by the end of the decade, making it a multi-bagger. That would move the company’s share price towards $100 / share, supporting long-term returns. The company is a risky investment, but the potential for these returns make it a valuable long-term investment.

Thesis Risk

The largest risk to our thesis is the company’s existing assets. The company is seeing weak utilization here, and while it’s worked to improve some new assets like the Double E pipeline, there’s no guarantee that it can achieve strong long-term utilization. That could hurt its ability to generate long-term EBITDA from its assets.

Conclusion

Summit Midstream Partners has an impressive portfolio of assets, especially with the Double E pipeline, supported by Exxon Mobil. The company also sold its northeast assets for more than $700 million, providing a substantial amount of cash. The company can use that cash to pay down almost half of its debt, saving on interest expenditures.

Going forward, we expect the company to continue to remain committed to its balance sheet. We’d like to see the company focus on paying down debt, with the conversion to C-Corp helping it out. We’d like to see the company continue to clean up its capital stack with its Series E preferred and Double E recourse debt. Regardless, we expect it to generate strong returns.

Let us know your thoughts in the comments below!