Aleksandra Aleshchenko/iStock via Getty Images

Investment Thesis

The foundational elements of my portfolio include Technology, Healthcare, Personal Care Consumer Goods, and “Panem et Circenses” — Latin for “bread and games”. This is a concept originating from the Roman Empire, suggesting that people are satisfied when they have access to affordable food and are well entertained. Entertainment persists even during politically challenging times and could almost be considered a basic human need, with sports media and sports betting forming one of the central components of this sector. Today, I want to take a closer look at a potentially promising representative from this field.

Recent Seeking Alpha analysts’ coverage of Sportradar Group (NASDAQ: SRAD) has been overwhelmingly bullish, with some analysts proving to be right in the short term. In my article, I delve into what expectations are implied by the current stock price of around $11.50 USD for Sportradar. I also explore the expectations behind a price target of $15 USD mentioned by another analyst, which aligns closely with the average bullish Wall Street price target of $14.50 USD. Additionally, I examine expectations associated with a price target of $20 USD – in the direction of the IPO price – to assess their realism. Ultimately, the earnings quality of Sportradar will not convince me enough to invest personally. Due to this high-risk natureI classify the stock as a “bet.” Even expectations of quintupling EPSprimarily through three-fold net margin expansionare possibly already priced in. However, for those who want to engage in the industry, Sportradar might be a solid choice.

Business Model Of A Sports Data Giant

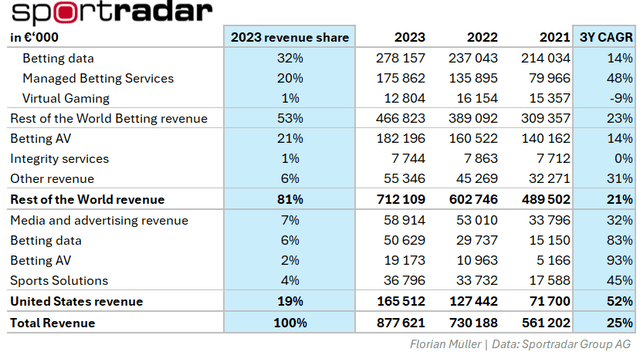

Below you find a breakdown of Sportradar’s revenue distribution. 19% is generated in the USA, with the majority of 81% spread worldwide. Especially in the past 3 years, US revenues have skyrocketed by 52% annually, while the rest of the world has also seen significant double-digit growth. Worldwide, Sportradar primarily operates as a “data backend / data provider” for sports betting operators (Betting data). This encompasses providing services like betting odds, game statistics, live data, risk management, and fraud prevention. Additionally, Sportradar offers livestreaming solutions for sports bettors (Betting AV). The company also derives revenue from media and advertising in the US and globally (other revenue). In the USA, Sportradar provides visual statistics and analytics on players, teams, and specific games, enabling teams to analyze their performance in real-time to enhance their understanding of strengths and weaknesses.

Refer to the table below to understand that among all these, it is evident that betting services are the pivotal market for Sportradar – whether by revenue share or growth.

In terms of business model, I particularly want to align with a point made by Seeking Alpha analyst Dan Victor who emphasizes that while the company benefits from the sports betting industry, it “avoids the direct regulatory risks and financial compliance that its betting operator partners need to navigate when dealing with individual users”. This is a distinct advantage for Sportradar.

Author | Data: Sportradar Group AG

Sportradar has two different classes of shares, but we only need to focus on one of them – the Class A shares – as founder Carsten Koerl owns all Class B shares. These Class B shares carry significantly higher voting rights but represent a much smaller portion of the total value. As a result, Koerl holds substantial voting power of 81.6% over the company, including some Class A shares. This significant control suggests that a minority discount may be appropriate when valuing the Class A shares from our perspective.

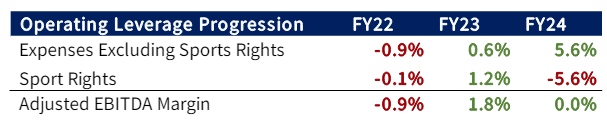

What Recently Moved Sportradar

In the first quarter of 2024, Sportradar continued the trend of previous years with 35% YoY growth in betting technology & solutions and a moderate 5% growth in sports content, technology & services. However, the widely reported adjusted EBITDA margin remained nearly unchanged at 18% for the first quarter. This was primarily due to significantly increased costs for sports rights, which offset great savings from all other expense line items. Nevertheless, Sportradar anticipates long-term margin expansion to 25-30% for adjusted EBITDA.

Changes of line items contributing to adj. EBITDA margin changes (Sportradar Group AG)

For the full year, the target remains at 19% adj. EBITDA margin, with growth expectations for both revenue and adj. EBITDA raised from 20% to 21%. This modest increase likely didn’t justify the 14% jump in premarket trading following the earnings report. Given this marginally raised outlook, I would advise not to get ahead of ourselves. Additionally, I find the frequent use of adjusted EBITDA metrics uninformative and will completely disregard them from now on. It seems like a metric that’s overly varnished, especially considering EBITDA itself already seems to tell only half the story.

Almost needless to mention, the year of major events like UEFA EURO 2024 or the Olympic Games in Paris can reignite industry interest. Not only the temporary or sustainable impacts on the fundamentals of some companies, but also investor interest in potential beneficiaries alone could open trading opportunities. Nevertheless, I am not the right person for that. Instead, I will focus on fundamental valuation going forward.

On another positive note, Sportradar recently expanded its partnership with UEFA to include non-exclusive data distribution rights to non-betting media, enhancing AI products with advanced tracking data across UEFA competitions, and reinforcing a 15-year integrity alliance to combat match-fixing. Recently authorized share buybacks might be another significant catalyst for Sportradar.

Sportradar’s Financials Unvarnished

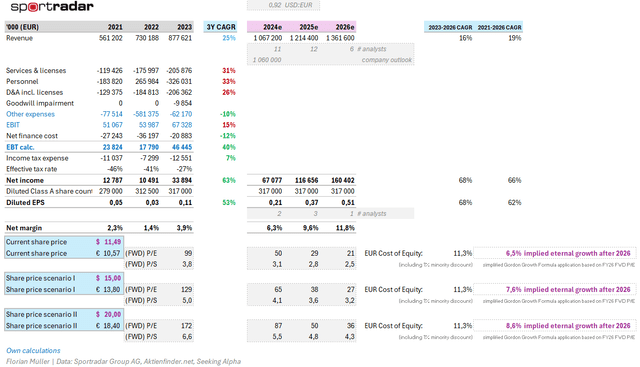

Let’s keep it brief: Sportradar’s net income has been lackluster so far because licensing costs are spread over their usage period. On the other hand, operating cash flow is significantly higher, as some of these expenses are non-cash in respective periods. However, license payments should be viewed as investment activities, which drastically reduce free cash flow. In short: sports rights cost a fortune, no matter how we twist and turn it. When we don’t look at the embellished, operating cash flow-like adjusted EBITDA, Sportradar’s net margin has only been between 1 and 4 percent in the past three years.

License expenses, license amortization, and personnel costs increased faster than revenue. On the other hand, other expenses, net interest expenses, and taxes were reduced significantly or grew slower than revenue, so that net income, though very low, could grow above average. This is encouraging, but the FY23 P/E ratio remains at 99. Analysts expect a flattening but still significant double-digit revenue growth until the end of 2026. There are few EPS estimates, and the ranges vary widely. Using the median, we see a quintupling of net income by 2026, mainly due to a tripling of net margin, expected to reach 12%. FY26 Forward P/E ratio, based on this optimistic scenario, is 21 today.

USD estimates and figures translated to EUR at current exchange rate (Author | Data: Sportradar Group AG, Aktienfinder.net, Seeking Alpha)

For Sportradar, I derived a 10.3% Euro Cost of Equity, primarily driven by a 1.6 Blume-adjusted beta, based on average of Seeking Alpha’s 24-month and 60-month raw beta regressions. This beta assumes reversion to the mean and is even somewhat progressive in this case. The USD Cost of Equity would be higher since USD risk-free rates are higher, indicating expectations of an appreciating EUR against the USD. In other words, valuing Sportradar in EUR requires a lower CoE due to the expectation of appreciation through FX effects from a US investor’s perspective. On top of my calculated CoE, I apply a standard 1% minority discount as previously described.

We now know 2 out of 3 variables of the rearranged Gordon Growth formula:

1 / (CoE – TVg) = PE

where

CoE = Cost Of Equity TVg = Terminal Value growth PE = Price/Earnings ratio

which can be solved for TVg as follows:

CoE – (1/PE) = TVg

This leads me to estimate implied eternal growth rates after 2026 based on forward P/Es for different share price scenarios: current $11.5, aforementioned $15, or $20. Outcomes range from around 7 to 9 percent eternal growth/terminal value growth (TVg). All of these growth rates appear highly optimistic and additionally assume that the forecast period up to 2026 with quintupling EPS is a given. Therefore, I see no sufficient safety discount whatsoever and am not prepared to undertake an investment in Sportradar from a fundamental valuation perspective. However, from a short- to mid-term trading view, a bet might pay off due to the mentioned catalysts.

Sportradar’s balance sheet carries significant capitalized sports data rights on the asset side, which are matched by correspondingly high liabilities. Aside from that, Sportradar’s liquid assets significantly exceed its interest-bearing debt.

Odds For Sportradar Appear Balanced

Sportradar sees rapidly improving net margins coming from a low level and might profit from several catalysts, not least the ongoing summer full of major sports events. Nevertheless, the stock has so far failed to break out significantly from the range it has been stuck in for more than two years, despite all the positive developments. Therefore, many believe that Sportradar is an underestimated company. However, from a fundamental perspective, I find the current share price to be quite justified. After all, Sportradar is associated with high risks, given the earnings quality that has yet to be proven over extended time periods. In this context, the positive outlooks seem to be priced into the current stock price. For investors who want to engage in this sector at any cost, I consider Sportradar a better choice compared to betting operators themselves. Additionally, for mid-term trading, the margin tailwind and the sports year of 2024 could be worthwhile. For me, it remains a bet from a fundamental perspective, one that hasn’t sufficiently convinced me. Moreover, the constant emphasis on adjusted EBITDA is not very informative and, from a value perspective, is almost a small red flag.