FG Trade/E+ via Getty Images

Summary

I am positive on Smartsheet (NYSE:SMAR). My summarized thesis is that SMAR has a dominant position in the industry for the customer base that it is targeting. Given how the working environment is today, I believe there will be more need for a proper project management tool vs. legacy methods like Microsoft (MSFT) Excel. SMAR’s strong competitive advantages should enable it to continue growing, at least at 20%, for the years ahead.

Company overview

SMAR is the leading software provider for collaboration and workforce management. You can think of SMAR as an evolution of Microsoft Excel, where it leverages spreadsheet-based templates to help streamline various project management tasks but also includes more added functionality such as creating a hierarchy within sheets, automated workflows via various event triggers and notifications, and visualizing work schedules with various views. Effectively, SMAR software enables organizations to plan, track, manage, automate, and report on work, all using one single platform. SMAR is a global business, but 85% of its revenue still comes from the US. As of FY24, SMAR generated $904 million in subscription revenue and $54 million in service revenue, summing up to a total of $958 million in revenue.

Dominant position in the industry

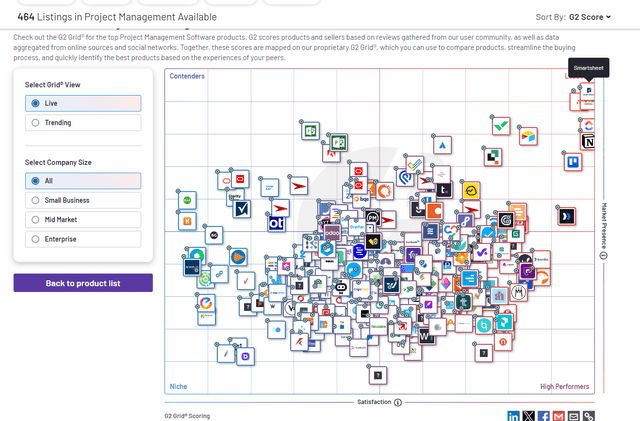

G2

SMAR is the leader in the industry, as you can see from the G2 grid above. It has various competitive advantages that I believe enabled it to stay at the top of the industry, and these advantages should continue to drive robust growth moving forward.

The first advantage is that SMAR is built on a similar concept that organizations are already familiar with—spreadsheets. The user interface [UI] of SMAR leverages familiarity with spreadsheets to reduce the learning curve and speed up platform adoption in organizations when compared to a UI that is completely new. This is huge because, when it comes to user adoption, any form of friction can lead to organizations looking for other solutions. Notably, this open-ended flexibility enables SMAR to expand into thousands of use-cases, such as customer feedback forms, company milestone tracking, onboarding new employees, managing IT tickets, etc., and this increases the value proposition to organizations. This also gives organizations a better bang for their buck because they can leverage SMAR across almost all functions.

This leads to my second advantage, which is the extremely high switching cost. Users of SMAR can integrate with other platforms, such as Salesforce and Jira, to build automated approval processes or workflows. These workflows can also incorporate free users, who are considered external collaborators. Note that SMAR had 12.16 million collaborators in 4Q24, which is about 85% of the total user base, and this really shows growth potential if SMAR can convert them. Organizations become more reliant on the platform when business processes are integrated into workflows, which increases stickiness and switching costs.

Lastly, SMAR’s simple licensing model leads to viral adoption. Although this may appear to be a simple point, I think it’s crucial because the SMAR licensing model only requires a paid user to create a sheet; collaborators are free to view and make edits to the sheets. This simple licensing model facilitates the sharing of SMAR (the sheets) among various stakeholders, which in turn accelerates its viral adoption curve. That is a stark difference compared to the legacy model of having a paid license for each user, which creates a lot of friction in adoption because organizations need to get past the psychological barrier of paying again.

Large enough TAM to continue growing at 20%

The market is definitely large enough for SMAR to continue growing at >20% for the coming years, especially given how organizations are working today. The modern workplace is more decentralized, with tasks performed by remote teams using a variety of devices. As such, a secure, real-time platform with an easy-to-navigate user interface is necessary to manage projects and workflows. Given that many organizations are still using legacy tools like Microsoft Excel to do project management, I see plenty of room for SMAR to win customers.

In terms of market size, according to IDC, the industry is expected to grow to the low teens and reach a size of $12 billion in 2028. While it is hard to exactly size this TAM, if we think from a qualitative point of view, the market is definitely huge. For instance, there are around 1 billion knowledge workers worldwide, and a large portion of them are in work hybrid mode, which significantly drives up the need for work collaboration and project management tools.

Many will compare SMAR against monday.com (MNDY) and Asana (ASAN) and say that SMAR has lost share to them over the past few years (SMAR growth was slower). I beg to differ because SMAR does not compete in the same customer space as MNDY and ASAN. SMAR’s main customer focus is large enterprises that have complex and heavy customization requirements, and the SMAR platform checks the box. Whereas MNDY and ASAN mainly target smaller organizations, The data that supports my view is that annual recurring revenue [ARR] per user for SMAR is close to two times that of MNDY and ASAN (SMAR average annualized contract value per domain-based customer is $9.9k in 1Q25; MNDY average ARR per customer is 3.9k in FY23; ASAN average annualized contract value per customer is $4.5k). SMAR growth slowdown is likely due to organizations cutting back on tech spending given the high rate environment (which is expected to come down as the Fed seems likely to cut rates in 2H24).

As such, if you refer to the G2 chart above and remove MNDY and ASAN, SMAR is really the only dominant player in the enterprise space.

Valuation

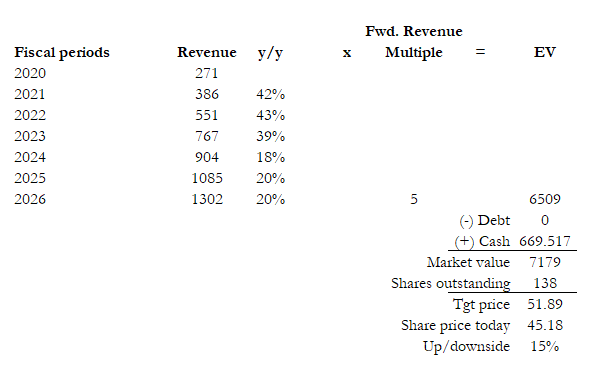

Source: Author’s calculation

I believe SMAR is worth 15% more than the current share price. My target price is based on FY26 $1.3 billion revenue and a forward revenue multiple of 5x.

Revenue bridge: SMAR should have no issues growing at 20% for the next few years given its leading position and large addressable market. As a reference point, subscription revenue grew 27% in FY24, and 1Q25 growth remained at 21%. This is all despite the macro situation where high rates are causing organizations to tighten their budgets.

Valuation justification: SMAR valuation has traded down by a lot relative to when it was trading at 10x forward revenue previously. I don’t think it is possible for SMAR to revert back to 10x, given that rates are unlikely to go back to 0% and SMAR growth has slowed compared to the past. However, relatively to where ASAN is trading today, which has slower growth (mid-teens) and a much poorer profit profile (ASAN adj EBIT margin was -9.1% in 1Q25) vs. SMAR (Adj EBIT margin of 16% in 1Q25), I believe SMAR should trade at a premium to it (ASAN trades at 4x forward revenue).

Investment Risk

Competing with mega-vendors like Microsoft, Google, and CA Technologies could be challenging for SMAR if they create features similar to Smartsheet. These companies can afford to offer these tools at heavily discounted prices or even for free as part of larger customer engagement packages. Any deterioration in the macroeconomic situation could prompt organizations to step up their budget scrutiny, which could adversely affect Smartsheet.

Conclusion

My positive view on SMAR is because of its dominant position in the enterprise project management software space. SMAR’s user-friendly interface, built on familiar spreadsheet concepts, minimizes adoption friction and drives high user engagement. Additionally, the ability to create automated workflows, integrate with other platforms, and share with collaborators creates high switching costs. With a large addressable market and a focus on the complex needs of large enterprises, I believe SMAR is well-positioned to continue growing at 20% ahead.