Walter Bibikow

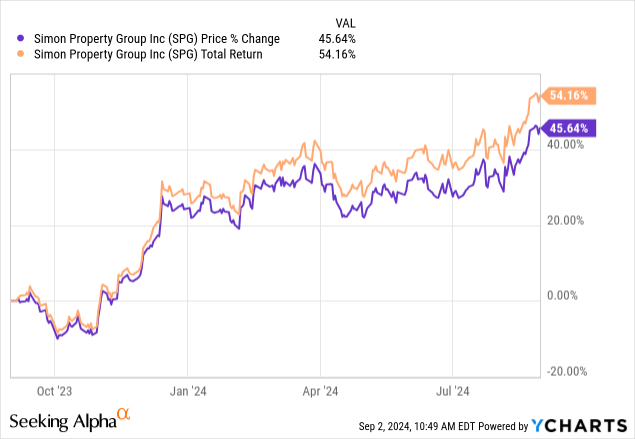

Today’s article examines Simon Property Group, Inc. (NYSE:SPG), a U.S.-centric real estate investment trust that invests in high-quality malls. Simon Property Group’s market value has increased by more than 45% year-over-year. Therefore, the question becomes: Is Simon Property Group overvalued, or does it have additional room to roam?

I assessed various fundamental, systematic, and market-based variables to address the central question. Let’s traverse into a discussion about my core findings.

What Is Simon Property Group?

As mentioned, Simon Property Group invests in high-quality malls, whereby it uses a core anchor approach to drive traffic to its malls.

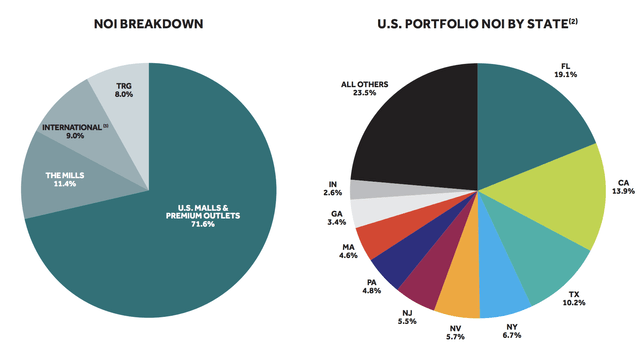

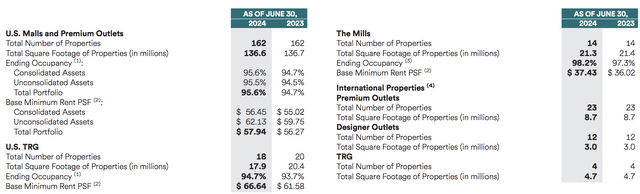

The following diagram provides a breakdown of Simon Property Group’s portfolio exposure, showing that about 71.4% of the REIT’s net operating income derives from U.S. malls and premium outlets. Moreover, 11.4% of Simon Property Group’s revenue comes from The Mills, a premium outlet property entity acquired in 2007.

Portfolio Exposure (Simon Property Group)

The REIT’s tenant base presents a blend of high-quality anchors with long lease terms and Veblen goods retailers, which I deem favorable as core anchors can stimulate rental demand from smaller tenants, concurrently increasing the REIT’s pricing power.

A glance at the following diagram will provide a more granular understanding of Simon Property Group’s business model.

Top Tenants (Simon Property Group)

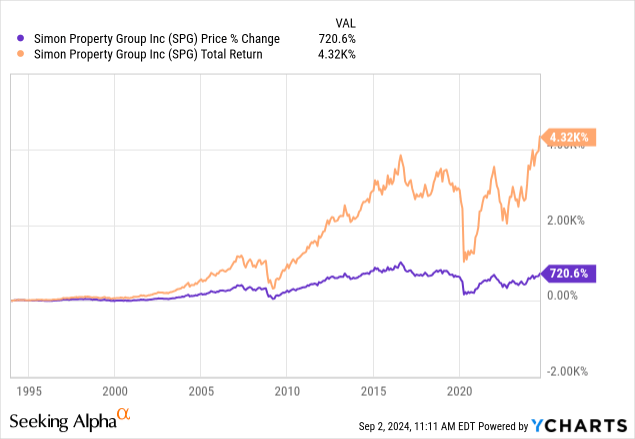

Finally, for this section, it is critical to note that the bulk of Simon Property Group’s returns are from dividends. Nevertheless, the volatile economic climate dictates a discussion of the REIT’s market price.

Why I Like The REIT

Asset-Level: Veblen Goods and High-Quality

The Fed-rate pivot narrative and bond yields suggest that interest rates are on the cusp of receding. However, I’m not too fond of the idea that commercial REITs will gain momentum when interest rates fall because I think it is an oversimplified argument.

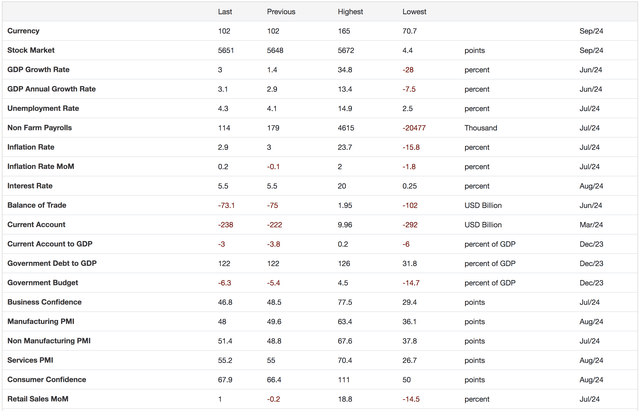

Interest rate cycles aren’t homogenous, meaning a closer observation of the variables driving a rate cycle must be considered. Although U.S. GDP growth is holding up better than many economists expected, unemployment is rising, business confidence is lowering, manufacturing PMI is wavering, and broad-based retail sales are inconsistent.

U.S. Economic Indicators (Trading Economics)

Given the status of the U.S.’s salient economic parameters, I think we’ll see a case where interest rates decline alongside real economic growth. Moreover, lower interest rates will likely have a lagged effect, only playing a role in re-inflation when the salient economic variables within the U.S. are enhanced through a combination of fiscal measures, business confidence, and eventually higher borrowing.

I believe lower-quality REITs will succumb to the uncertain economic environment. However, Simon Property Group probably has the necessary attributes to combat such headwinds. Why? Well, I reiterate the REIT’s high-quality anchors and Veblen goods tenants. I believe companies like LVMH (OTCPK:LVMHF), DICK’S Sporting Goods (DKS), The Gap (GAP), Capri Holdings (CPRI), and others within the REIT’s portfolio have investment-grade and/or throughout-the-cycle attributes, providing Simon Property Group secular growth possibilities.

Company Credit Rating Credit Outlook Simon Property Group A3 (Senior Unsecured) Stable Click to enlarge

Source: Moody’s

Simon Property Group’s high-quality attributes are reflected in its second-quarter earnings report. According to its second-quarter report, Simon Property Group achieved stellar domestic property growth, including a 5.2% year-over-year increase in net operating income. Furthermore, the REIT’s base rent increased in line with the U.S.’s inflation rate, reaching 3%, while its U.S. malls’ occupancy increased by a commendable 90 basis points.

Another noteworthy factor is Simon Property Group’s diluted funds from operations, aka FFO. The REIT’s diluted FFO increased by two cents year-over-year, illustrating resilience.

Metric Q2 2024 Q2 2023 Domestic Property NOI Growth +5.2% +4.8% U.S. Malls & Premium Occupancy 95.6% 94.7% Diluted FFO-Per-Share $2.90 $2.88 U.S. Malls & Premium Minimum Base Rent $57.94 $57.24 Click to enlarge

Source: Simon Property Group

What do I make of Simon Property Group’s key operating metrics?

Simon Property Group’s broad-based NOI growth outpaced U.S. REITS’ median same-store NOI growth in Q2. According to S&P Global (SPGI), median same-store NOI growth is around 3.8%. Although not a direct comparison, broad-based NOI growth below Simon Property Group’s 5.2% domestic NOI growth illustrates the REIT’s secular and best-in-class performance.

Furthermore, according to Floris van Dijkum of Compass Point Research and Trading, occupancy rates of class-A mall owners like Simon Property Group and Macerich (MAC) remain below their averages. However, a distinctive view of Simon Property Group’s occupancy communicates solid growth, especially if we include an observation of The Mills, which has a 98.2% occupancy rate and premium tenants.

Operating Statistics (Simon Property Group)

Now, to Simon Property Group’s funds from operations.

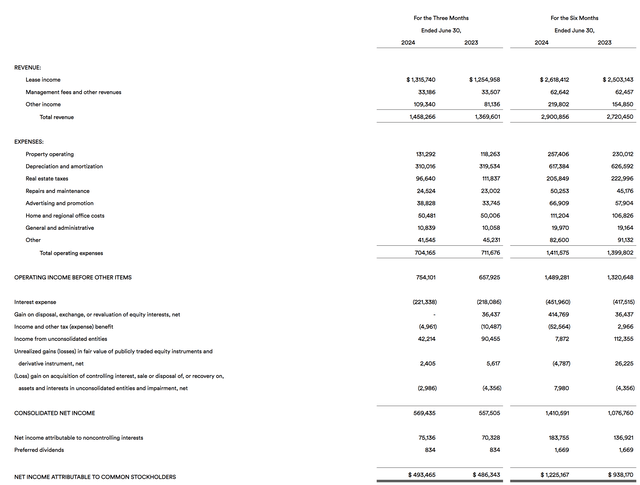

I looked at Simon Property Group’s income statement and didn’t notice any unusual items, such as write-downs or outlying gains. Therefore, I find the REIT’s diluted FFO growth compelling as it shows consistent accretive earnings.

Comprehensive Income Statement – Click On Image To Enlarge (Simon Property Group)

In essence, Simon Property Group’s core results reflect much of what I mentioned in my top-down argument. I anticipate the Group’s performance to be sustained toward the back end of 2024 and into 2025.

Liability-Level: A Better Spread Outlook

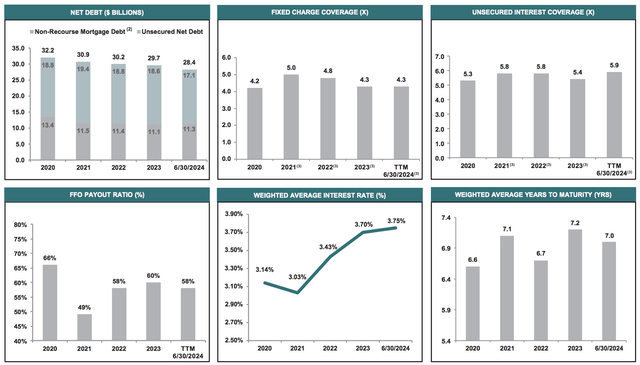

A glance at Simon Property Group’s liabilities indicates that a lower interest rate environment can allow it to decrease its funding costs.

The vehicle’s fixed-charge coverage and unsecured interest coverage ratios remained constant throughout the latest interest rate cycle. However, the REIT’s weighted average interest rate has increased by 72 basis points since 2021.

A lower interest rate environment might allow Simon Property Group to refinance and, in turn, deliver higher shareholder distributions (assuming its diluted FFO growth stays constant).

Liabilities (Simon Property Group)

Valuation and Dividends

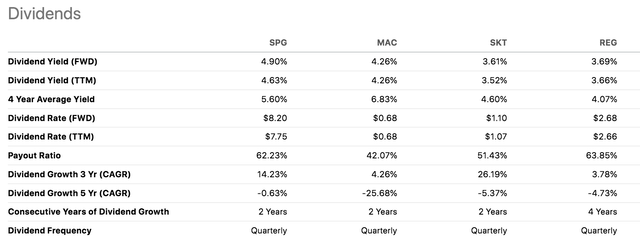

I compared Simon Property Group to a set of peers to contextualize its valuation outlook. Although alternative peers exist, I decided to confine the analysis to Simon Property Group, Macerich, Tanger (SKT), and Regency Centers (REG).

Peers (Seeking Alpha)

I find an isolated view of Simon Property Group’s forward price-to-funds from operations and adjusted funds-from-operations ratios are commendable, as they are below their trailing figures. Moreover, a peer comparison shows that the REIT’s multiples are in the upper echelon.

Aside: In my experience, the P/FFO is the most broadly used multiple, whereas the P/AFFO conveys economic reality by backing out non-cash costs.

REIT P/FFO (Forward) P/AFFO (Forward) Simon Property Group 13.06x 14.79x Macerich 9.75x 12.17x Tanger 14.57x 18.21x Regency Centers 17.18x 20.75x Click to enlarge

Furthermore, Simon Property Group’s forward dividend yield of 4.6% trumps those of its peers. Moreover, the REIT’s three-year growth rate is compelling compared to its counterparts.

Despite my optimism, I flag the negative five-year growth rate as a risk factor. Moreover, the sustainability of dividend growth can be questioned if we look at the second-last line item in the following diagram.

Peers (Seeking Alpha)

All in all, I think Simon Property Group flashes signs of relative value and best-in-class dividend attributes. Factors such as unconvincing cyclical dividend growth and outlying peer-based market performance are worrisome. Nonetheless, I remain net bullish about the REIT’s broader return picture.

Risk Factors

Let’s consolidate a few risk factors to add balance to the analysis.

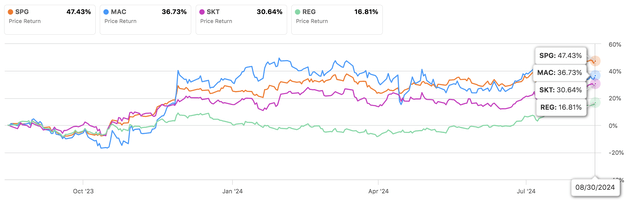

Firstly, it can be argued that Simon Property Group has reached a cyclical peak. The REIT’s year-over-year performance is staggering, especially compared to its peer group, which underperformed Simon Property Group by a telling amount.

Is a retracement possible? I think so.

Peer Performance (Seeking Alpha)

Furthermore, a view of Simon Property Group’s portfolio shows that the REIT is highly exposed to the retail sector. Although I deem its constituency high-quality, Simon Property Group’s retail tilt can introduce concentration risk in an economic downturn.

Lastly, much of my analysis assumed a systematic view of the vehicle. Simon Property Group possesses peculiarities that must be assessed before formulating a holistic conclusion.

Concluding Thoughts

My analysis shows that Simon Property Group likely possesses the necessary attributes to perform throughout the economic cycle, which is pivotal as the uncertain economic environment might introduce hesitant behavior from commercial REIT investors.

I believe Simon Property Group’s secular traits, best-in-class dividend, growing short-term results, and commendable valuation multiples contribute to a bullish outlook.

I’m optimistic about the REIT’s prospects and deem it a momentum play!