beast01

At a Glance

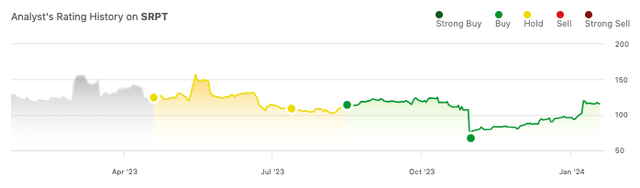

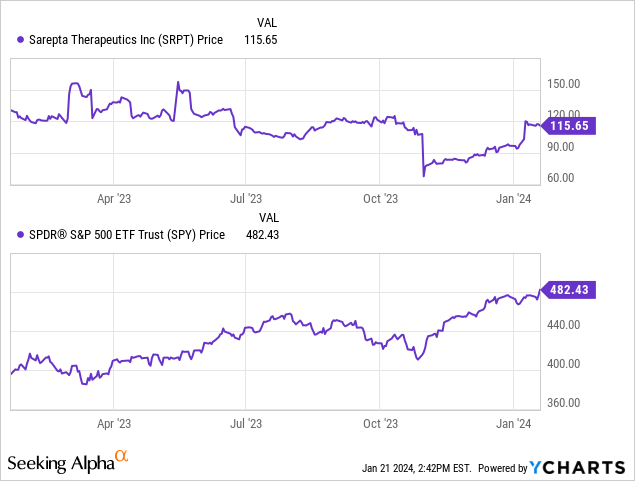

Sarepta Therapeutics, Inc. (NASDAQ:SRPT) has “closed the gap” following my last update and “Buy” recommendation in October.

Seeking Alpha

The late October dip was at the expense of EMBARK data, which missed its primary endpoint but hit important secondary endpoints. Investors likely overreacted, leading to a sudden and staggering 42% decline. I remained optimistic.

The FDA’s guidance on DMD drug development emphasizes clinically meaningful benefits, focusing on the progressive loss of muscle function, which the secondary endpoints in the EMBARK study addressed effectively. The absence of new safety signals and the manageable adverse event profile of Elevidys, further contribute to its regulatory outlook.

The totality of the evidence from the EMBARK study, including significant improvements in secondary functional endpoints and a favorable safety profile, in my view, could be compelling for regulatory authorities. The accelerated approval of Elevidys, recognizing its potential to address unmet medical needs in DMD, also sets a precedent favoring its full approval.

The advantage of closely following a number of biotechs is that you learn to distinguish between noise and signal. On that day, the market had, in my view, incorrectly exaggerated the odds of regulatory failure.

The company has since submitted a supplemental BLA and hopes the FDA will approve the expansion in the second half of this year.

The following article analyzes Sarepta’s market opportunity and financials and makes a stock recommendation.

ELEVIDYS’ Crucial FDA Verdict and Market Expansion

Sarepta Therapeutics stands at a pivotal juncture. Full FDA approval for ELEVIDYS could redefine their market scope. Currently, ELEVIDYS targets a narrow demographic: 4 to 5-year-old ambulatory patients with a confirmed DMD gene mutation. An expanded label, encompassing all DMD patients regardless of age or ambulatory status, could exponentially widen their reach.

Duchenne muscular dystrophy (DMD) remains rare yet prevalent. According to NORD, it affects 1 in 3,500 to 5,000 male newborns globally. This equates to about 400 to 600 new U.S. cases annually. Gene therapy’s hefty price tag, combined with DMD’s severity, underscores ELEVIDYS’ substantial market potential, especially globally.

Sarepta’s alliance with Roche Holding AG (OTCQX:RHHBY) is a strategic masterstroke. Tasked with ELEVIDYS’ global commercialization, Roche amplifies Sarepta’s international footprint. This partnership promises accelerated market access worldwide, boosting potential revenues.

Per an RBC Capital Markets analyst, ELEVIDYS could net over $3 billion in peak annual revenue if the FDA expands the label to include older children, although the analyst believes this is an unlikely scenario. Assuming just full approval without significant label expansion (e.g., age and ambulatory status), ELEVIDYS remains a blockbuster drug (over $1 billion in peak annual revenue).

Yet, investment risks loom large. ELEVIDYS’ stumble in the EMBARK trial, failing its primary endpoint, casts shadows on its regulatory future. Despite encouraging secondary outcomes, the specter of further trials hovers, potentially delaying approvals and denting market confidence. Such developments could sway Sarepta’s stock, a critical factor in market opportunity assessments.

Q4 Earnings

Sarepta Therapeutics’ preliminary Q4 2023 report indicates a revenue increase, with ELEVIDYS reaching $131.3 million in just that quarter, indicating strong market penetration. The RNA-based PMO sector also shines, earning $234.3 million, indicating a healthy portfolio trajectory. However, the report’s preliminary status leaves gaps, including information on quarterly expenses and share dilution.

Financial Health

Sarepta Therapeutics’ fiscal landscape presents a complex tapestry. In their coffers, ‘cash and cash equivalents’ plus ‘short-term investments’ tally to a robust $1.733 billion. This comprises $541.932 million in cash and $1.191 billion in short-term assets. Liabilities loom at $2.345 billion. A notable highlight: the current ratio. Sitting at 5.44, it emerges from dividing $2.451 billion (total current assets) by $450.743 million (total current liabilities). This ratio heralds a solid short-term financial standing.

A deeper dive into recent cash flow reveals nuances. Over nine months, operations devoured $446.336 million in net cash. Monthly, this translates to a $49.6 million burn. Simple math gives a 35-month runway, assuming current liquidity and the burn rate maintain their course. But remember, these figures echo past trends, not future guarantees.

Sarepta’s substantial reserves juxtapose intriguingly against its burn rate. Within a year, their need for fresh capital infusion seems improbable. Two pillars fortify this view: the current ratio and the projected cash runway. Both signal financial resilience in the short run. Yet shadows linger over the long-term horizon. A hefty deficit and persistent operational expenses hint at future funding needs or a pivot to revenue escalation for sustained viability.

Market Sentiment

Seeking Alpha reveals a market cap of $10.82B for Sarepta. Its growth outlook is strong, as evidenced by sales forecasts that jump from $1.23 billion in 2023 to an impressive $2.98 billion by 2025. Yet, the stock momentum has underperformed the S&P 500 (SPY). A -9.51% annual decline contrasts sharply with the S&P’s +24.13% surge.

Short interest stands at a noteworthy 5.25%. This equates to 4.69 million shares short, hinting at a cautiously optimistic market view. Institutional ownership dominates at 88.53%. Vanguard upped their stake by 41,465 shares. BlackRock added a substantial 530,269. Janus Henderson Group increased holdings by 334,782. Conversely, Avoro Capital Advisors liquidated 602,888 shares. Insider activity over the past year shows a net positive of 140,710 shares, bolstering confidence in the firm’s path. Thus, I would describe Sarepta’s market sentiment as “robust.”

Is Sarepta Therapeutics’ Stock a Buy, Sell, or Hold?

Sarepta remains a leader in DMD. The FDA will likely approve ELEVIDYS and potentially broaden its label, but not to the extent Sarepta seeks. I still like Sarepta’s stock over a $10 billion valuation and maintain a “Buy” recommendation. Rare diseases, like DMD, are difficult to develop therapies for. Saretpa’s stronghold in this arena is unlikely to be easily reversed.

Still, investors must be careful not to overlook the risks here. The FDA could decide to pull ELEVIDYS off the market and demand additional data. This would result in a significant and sudden drop in market valuation-larger than the one seen following the EMBARK data. Even if the FDA allows full approval, investors may be upset with a limited label. ELEVIDYS could prove unsafe with increasing use on the market. Moreover, competitors in DMD may develop therapies that are more effective, safer, etc. than Sarepta’s offerings and begin to partake in Sarepta’s pie.

As always, investors should remain vigilant and stay tuned to the company’s progress. Diversify holdings, avoid noise, and pay attention to signals. Sarepta’s stock is likely to continue to be a bumpy ride for some time, but it seems worth holding onto at this moment.