josefkube’s

Investment Thesis

SAP (NYSE:SAP), the German software maker of enterprise software, reported its Q1 FY24 earnings after the market closed yesterday. The results seemed to be in line with consensus expectations that were benchmarked for the company. SAP’s management also gave an update on the progress of their Transformation Program as the European tech giant inches closer to their Ambition 2025 operating model targets.

Per my observation, SAP continues to advance their turnaround as they reposition their enterprise tech business to better compete with their larger tech rivals in this era of AI. Per my review, cloud revenues continued to grow in strong double-digit numbers, while the cloud backlog rose at an even faster rate.

These are impressive numbers put up by SAP in the first quarter of this year. However, with no significant change seen in their prior FY24 outlook, I believe most of the expectations have been priced in at the moment.

For now, I recommend holding a neutral view of SAP.

SAP’s Q1 FY24 Earnings Review

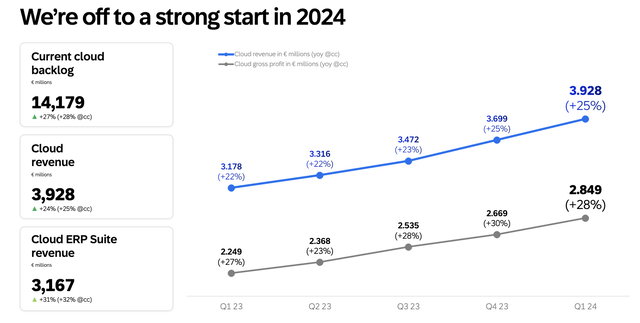

In Q1, SAP reported total revenues of €8 billion ($8.56), meeting consensus expectations. Again in the quarter, adjusted cloud revenue led the way, with this segment rising 25% at constant currencies from a year earlier to €3.9 billion ($4.2 billion) as can be seen below.

SAP’s Q1 Fy24 earnings results show the company’s cloud migration and business pivot to AI is well in progress (Q1 FY24 Earnings Presentation, SAP)

For the sake of contrast, in Q1 FY23, SAP’s Cloud Revenues had grown 22% y/y in constant currency, so the incremental growth that I noted in this quarter was good to see.

SAP’s SaaS/PaaS sub-segments, which are mostly SAP’s Cloud ERP Suite, continue to assume the flywheel for SAP’s cloud revenue growth. SAP’s SaaS/PaaS sub-segments rose 26% y/y to €3.77 billion ($4.03 billion). With these results, SAP’s share of the more predictable portion of the company’s revenues now stands at ~84% of total revenues, gaining two hundred basis points over the same period last year, demonstrating the progress SAP was making towards its transformative journey. In addition, I also observed that gross margins from SAP’s cloud revenues stood at ~72.5% versus the total gross margins of ~71.8%.

On the call, management highlighted the strength of their sales pipeline for cloud deals, noting that cloud pipeline growth was one of the best ever recorded by the company. In addition, management also said that they were seeing more customers pull forward their cloud migration projects to migrate to SAP’s cloud. Customers were more inclined to sign longer-term deals with SAP, indicating a deepening relationship with SAP’s cloud products, as management was seeing Annual Contract Values (ACVs) and Total Contract Values (TCVs) were rising.

On reviewing SAP’s backlog metrics, I noticed that SAP recorded one of the fastest growth rates in their cloud backlog volume, growing 27% y/y to €14.2 billion. Comparing that to the growth rates seen in SAP’s cloud backlog of 25% y/y growth seen in the same period last year, I believe that this was another area of strong performance that SAP demonstrated. Here is what management had to say about its Q1 FY24 results:

We have powerful growth drivers in place – Business AI, cross-selling across our cloud portfolio, and winning new customers particularly in the midmarket. The strength of our current cloud backlog reaching a record growth rate is a testament to that momentum. Our transformation program is also well on track and will help us to capture this growth and increase efficiency.

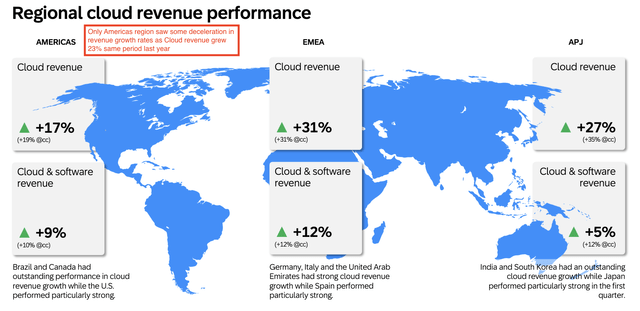

In terms of its global business segments, I did see that business in the Americas region came in softer than the growth the company had seen last year, as I have annotated in the chart below. The rest of the other geographical regions continued to record strong growth. I would have preferred to see a continuation of growth in the Americas region.

SAP’s Americas region was the only business geography to register slight slowdowns in growth rates. (Q1 FY24 Earnings Presentation, SAP)

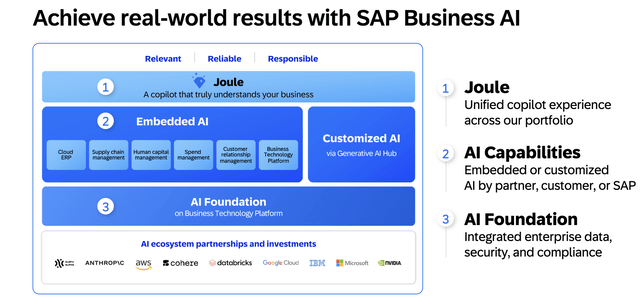

On the call, management also revealed that the pace of their pivot to Business AI offerings was also increasing. Management mentioned that they had begun embedding GenAI directly into most of their cloud products. The company, reportedly, has over 100 AI-focused features and products to launch this year. SAP had already launched their AI assistant, Joule, last year, which was designed to help SAP’s customers intelligently sift through their ERP data. The company gave an update on how they plan to deepen SAP Joule’s integration across all the other SAP modules.

SAP’s Joule is expected to drive more synergy across product modules for the customer (Q1 FY24 Earnings Presentation, SAP)

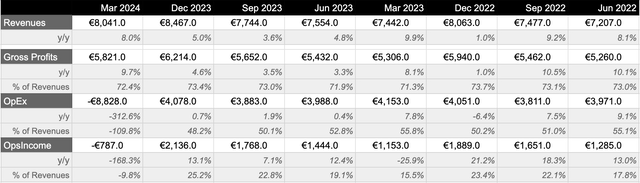

Moving to the bottom line, the company’s profits were expected to take a hit in the first half of this year as it was rolling through the bulk of its restructuring program it had announced earlier. Therefore, despite SAP’s gross margins actually improving versus the same period last year, its operating profit took a big hit with the restructuring expenses, as seen below.

SAP’s Q1 FY24 earnings and margins versus previous quarters (Company sources, SA)

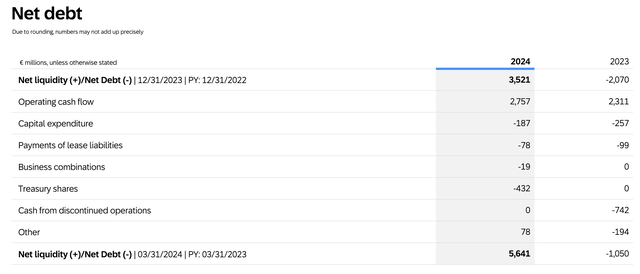

To me, SAP looks well capitalized, as the company increased its operating cash flow by 19% after accounting for restructuring charges. Note that these are the first results that SAP reported this quarter that include expenses such as share-based compensation in their non-IFRS expenses, which were announced in December last year.

SAP’s debt, capex and cash flow metrics (Q1 FY24 Earnings Presentation, SAP)

Unfortunately, SAP looks priced in at the moment

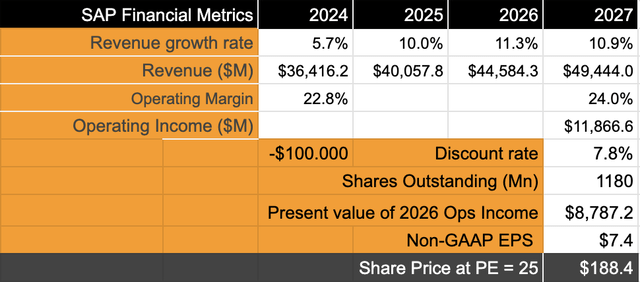

To estimate my target price for SAP, I have factored in the following assumptions:

My assumptions for growth rates are based on the targets that management laid out in their Ambition 2025 transformation program earlier this year. These projections are unchanged based on management’s updates in the Q1 presentation.

All previous growth rates assumed an exchange rate of $1.10 USD per euro. Since the dollar has gotten stronger over the past quarter, I have revised my estimates to account for the stronger dollar.

Discount rate of 7.8% at market estimates.

SAP’s stock looks fully valued at current levels with little upside (Author)

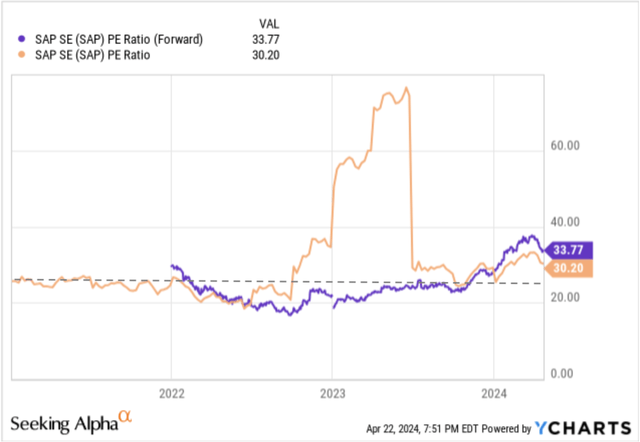

Given these growth rates, I expect SAP to grow its revenue by a compounded growth rate of ~9.5% between FY23 and FY27. At the same time, SAP’s operating profits are expected to grow by a compounded growth rate of ~13.5% over the same time period. If I compare SAP to the S&P 500’s growth rates, a PE of 25x is warranted for SAP. This is in line with the longer-term PE for SAP too, which rests at ~25x, as shown below.

SAP’s PE vs trailing PE (YCharts)

With a forward PE of 25x, SAP has very little room for upside, keeping me on the sidelines. In addition, the company’s stock has already run up ~16% so far this year as it heads into earnings. The run-up so far in the stock gives me more belief in my thesis that the upside in the stock will be capped.

Risks and other factors to know

The dollar continues to be a risk, as I have accounted for in my valuation model. However, if the dollar moves higher, it can pose a greater threat to SAP’s revenue growth rates.

In addition to the dollar, most of the growth that SAP has seen so far seems inherent, in my opinion. This is because the company is heavily incentivizing existing customers to move to the cloud, and the growth rates of new customers remain to be seen. Despite SAP launching its migration tools in 2021, SAP only recently started seeing traction after they launched discounts of almost 50% to get customers to migrate to the cloud. Once the migration is complete for its existing customer base, I expect the company to demonstrate similar momentum in new customer acquisition.

In my valuation model, I also took the company’s own assumptions at face value that they may not need any more restructuring in their organization. So far, the company has mentioned that the total cost of their restructuring was ~€2.2 billion. However, if their current transformation does not go as planned, they may be faced with additional restructuring charges. However, the likelihood of this happening is minimal, in my opinion, based on the ramp of product updates and launches that the company has planned around its Business AI proposition and its Land-and-Expand business acquisition strategies.

Conclusion

SAP’s Q1 FY24 results show that the company is progressing well towards its Ambition 2025 transformative targets. Certain questions remain in terms of the breadth of customer adoption of its cloud products, which currently looks to be seen mainly in its existing customer base. I believe the company is positioned on a long-term basis to pivot to a user acquisition strategy once its transformation is complete. At the moment, valuation seems to be the biggest short-term headwind.

For now, I rate SAP as a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.