kyoshino

I continue to believe that the cycle will turn to favor both mid-caps and small-caps, as well as dividend plays. Large-cap tech can only be the leader for so long, and mean reversion eventually will kick in. If you’re of the same mindset, then the ProShares S&P MidCap 400 Dividend Aristocrats ETF (BATS:REGL) is worth keeping on your watch list and even maybe allocating to here.

REGL is basically trying to mimic the S&P MidCap 400 Dividend Aristocrats Index. The fund is trying to get investors exposure to high-quality, mid-cap companies that have a proven track record of financial stability and growth. REGL has a price-to-earnings ratio of 16.43 and a price-to-book ratio of 1.99, indicating a balanced valuation relative to its underlying assets.

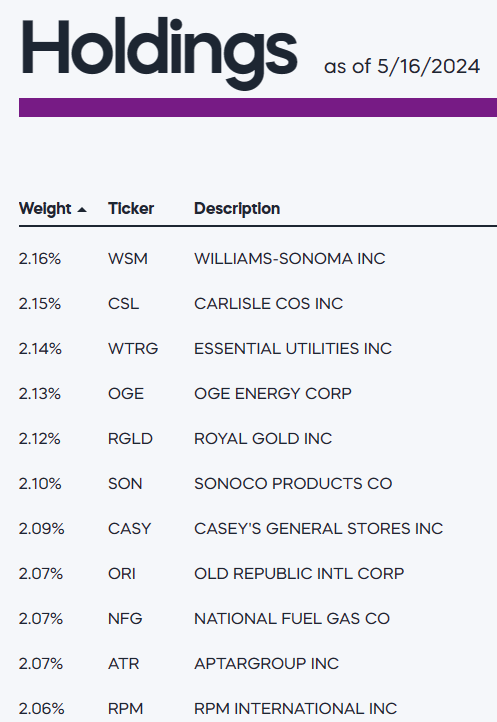

ETF Holdings

REGL’s portfolio is composed of 50 companies, each selected based on their ability to consistently grow dividends. No position makes up more than 2.16% of the portfolio, making this well diversified and evenly spread out across these high-quality companies.

proshares.com

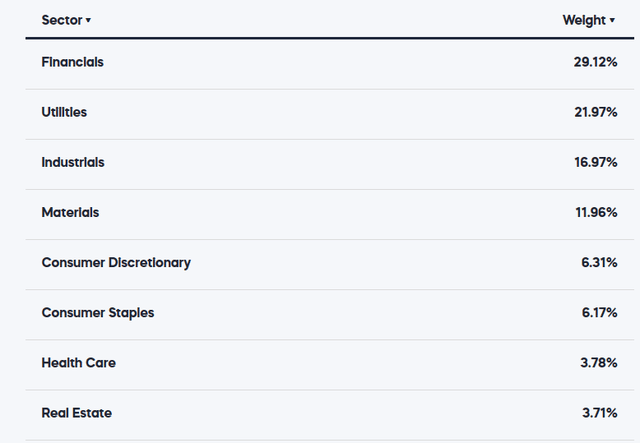

Sector Composition and Weightings

I find the sector composition especially interesting and appealing here. Nearly 30% of the fund is Financials. This shouldn’t be surprising. The real eye-opening allocation is Utilities at a whopping 22% of the fund. Personally, I love this. Utilities are among the most differentiated sectors of the market, have high dividends, are considered defensive, and stand to benefit from longer-term demand as electrification becomes ever more important in an AI-driven future.

proshares.com

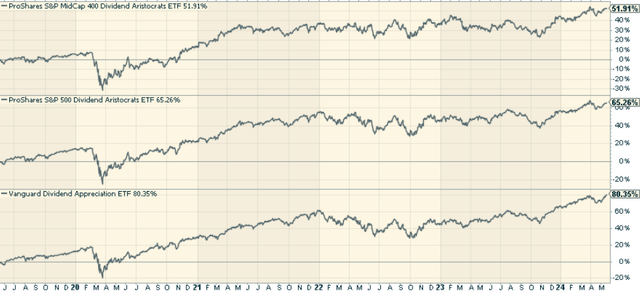

Peer Comparison

Dividend-centric funds aren’t unique, but they often track different parts of the cap spectrum. For example, the S&P 500 Dividend Aristocrats ETF (NOBL) focuses on large-cap companies with a similar dividend growth focus. While NOBL offers exposure to more established companies, REGL provides a unique opportunity to invest in mid-cap companies that are often in a growth phase, potentially offering higher returns. Another one? The Vanguard Dividend Appreciation ETF (VIG). That fund includes companies with a history of increasing dividends but does not specifically target mid-cap stocks. It’s still large-cap tilted.

It should be no surprise that REGL underperformed because, as noted earlier, it’s been a large-cap-focused world. I suspect this will change as investors broaden out their allocations, ultimately to mid-caps on a go-forward basis.

StockCharts.com

Pros and Cons of Investing in REGL

I like the fund’s focus on dividend growth, which provides a measure of stability and income. This can be particularly important in volatile markets. Companies that consistently increase dividends are often a place for investors to flock to when things get uncertain. Additionally, the mid-cap focus of REGL offers a balance between the growth potential of smaller companies and the stability of larger firms. Mid-cap companies are often in a growth phase, providing opportunities for capital appreciation.

The real issue is more about market-cap. Mid-cap stocks can be more volatile than large-cap stocks, which may lead to larger price fluctuations. Additionally, while the fund’s focus on dividend growth is a strength, it may also limit its exposure to high-growth companies that reinvest earnings rather than paying dividends. This could result in lower capital appreciation compared to growth-focused ETFs.

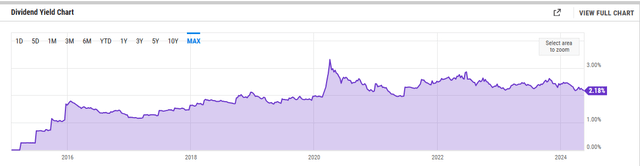

Now, to be clear, mid-caps are broadly more volatile than large-caps, but dividend stocks are also broadly less volatile than capital appreciate plays. The two somewhat balance each other out, which is what you’d ideally like to see when tilting smaller in your portfolio anyway. That yield isn’t huge, (currently at 2.18%) but it does still provide some defensive characteristics.

YCharts.com

Conclusion

ProShares S&P MidCap 400 Dividend Aristocrats ETF checks the boxes in my view. It offers a nice balance of income and growth. Its focus on mid-cap companies with a strong history of dividend growth provides a measure of stability and potential for capital appreciation. The fund’s diversified sector exposure further mitigates risk, particularly with its heavy exposure to Utilities, making it different in a good way. However, potential investors should be aware of the inherent volatility of mid-cap stocks and the limitations of a dividend-focused strategy. Overall, REGL is a solid option for those looking to invest in high-quality, mid-cap companies with a proven track record of financial stability and growth.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.