Toyota bZ4X on a road. One of very few Toyota EVs currently in production. Tramino

The uproar over alleged regulatory cheating by Toyota Motor Corp. (NYSE:TM) and four other Japanese automotive companies made juicy headlines. A closer inspection of the infractions looks more embarrassing than substantive.

In one instance, Toyota is supposed to have conducted a crash test of one of its models at a higher speed than indicated. (The tests mandated by the government are largely self-administered.) The deviation from the norm was supposed to show the superiority of the car’s ability to withstand a collision. Instead, Toyota was sanctioned by the government for improper testing.

Much ado, nothing

In no cases did the government’s findings result in a recall or discovery of any safety defects. Earlier this week, Toyota chairman Akio Toyoda was re-elected by shareholders to his post at a margin of 72% approval, down from 85% last year and 92% the year before. Toyota announced it’s taking steps to tighten procedures relating to regulatory certification.

Akio Toyoda, chairman (Toyota Motor)

Although the automaker had come under fire from two proxy solicitors on the grounds of lax regulatory oversight, another issue may have played a role in the declining approval of management. Toyota has pursued an independent and much-criticized strategy with regard to battery-electric vehicles (BEVs).

Critics say Toyota has dragged its feet with a relatively slow, deliberate approach to introducing BEVs. Environmental activists and media pundits have publicly chastised Toyota. The automaker has offered rebuttals, arguing that its approach of emphasizing gas-electric hybrids will result in cleaner air.

Moreover, Toyota points out that global consumers prefer to exercise choice, which from a business standpoint dictates offering a variety of propulsion technologies.

Maddeningly for Toyota’s critics, BEV sales have slowed as consumers, especially in the U.S., question whether the current charging network is sufficient. Consumers also complain about insufficient battery range during cold weather and on long trips – not to mention the price premium paid for BEVs.

Switching off

A recent mobility survey by McKinsey gave weight to the astuteness of Toyota’s strategy, reporting that 46% of BEV owners in the U.S. and 29% globally want to switch to non-BEV propulsion with their next vehicle purchase.

In its latest fiscal year ended March 30, Toyota posted $298 billion of revenue, a record high, and $32.7 billion of net income, also a record. Its operating profit for the year topped 5.35 trillion yen ($34.5 billion), nearly double the previous year’s total, making it the first Japanese company to surpass the 5 trillion yen mark.

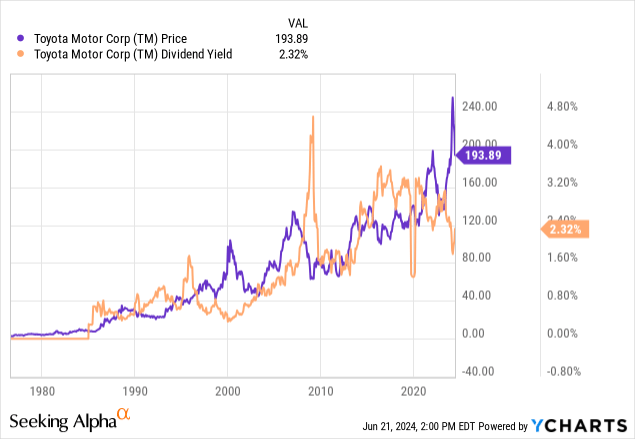

I have been a long-time admirer of Toyota and an owner of its ADRs. In the past year, Toyota ADRs advanced from $157.15 to the current $195.20, as of this writing. Assuming the payment of dividend and reinvestment in additional shares, that nets to a 26% total return.

Since late March, however, when the ADRs were trading at a peak of more than $250, the share price has dropped about 24% to its current level. The chart suggests that vigorous selling began just after the latest ex-dividend date of March 27.

Toyota has been anything but steady or predictable when paying dividends, a record that shareholders can easily see by reviewing the automaker’s payout history. According to the latest earnings call transcript, Toyota intends to revise its dividend policy. In the future, dividends should increase irrespective of short-term financial results – a big boost to dividend-sensitive investors.

“In terms of return to shareholders, in order to reward our long-term shareholders, we have a new dividend policy to increase dividends stably and continuously,” said Yoichi Miyazaki, Toyota’s chief financial officer during the earnings call. Previously, the guideline had been a consolidated dividend payout ratio of 30%. He later added, in answer to a question, that Toyota will focus more heavily on dividend payouts than on share repurchases.

Looking forward

Notwithstanding Toyota’s cautionary pace of BEV introductions, the automaker has said it’s planning to sell 3.5 million EVs annually across 30 different Toyota and Lexus model lines by 2030, which compares with global EV sales of just over 100,000 in 2023. Long-range battery packs will provide up to 500 miles of range by 2026 and 620 miles by 2027.

The game-changing development expected by Toyota is the mass market introduction of solid-state batteries starting in 2027. As a successor to the lithium-ion batteries of today, solid-state batteries promise to be lighter, cheaper, more energy dense, and faster to charge. Such batteries already can be fabricated in small numbers for demonstration and experimental purposes. The difficulty, until recently, was the know-how to manufacture solid state quickly and in large number.

According to Toyota’s technology roadmap, the first solid-state battery for the mass market could provide a driving range of 621 miles and a 10-minute charging time; further evolution could boost the range to 750 miles.

Naturally, the projections won’t be real for another three years. But Toyota does not have a history – as do some other automakers – of promising bold new products that fail to materialize.

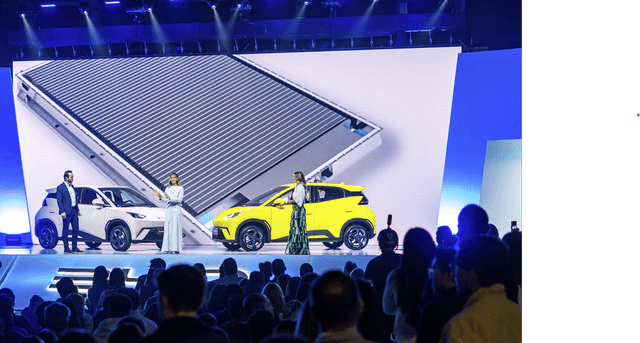

A factor that could disrupt Toyota’s plans is the rising global prominence of Chinese automakers and BEV models that perform decently are shockingly low-cost and aesthetically pleasing. I recently drove BYD’s Atto 3 crossover, which I found to be extremely quiet, quick, well-mannered and attractively priced. So far, Chinese models are effectively barred from the U.S. by virtue of a high tariff and are only starting to gain popularity in the EU.

BYD Seagull introduced in Colombia (BYD)

A number of Chinese companies have announced breakthroughs in solid-state battery technology, which I would expect to begin appearing in their models soon. As Chinese BEVs gain traction worldwide, the trend will spell difficulties for all Western incumbent automakers, not just Toyota, which has joint ventures with two Chinese automakers, GAC and FAW.

Nonetheless, Toyota shares at their current price, down significantly from their one-year peak, look attractive – particularly with the strong suggestion from management of regular dividend increases. Accordingly, I maintain the Buy rating.