Alona Siniehina/iStock via Getty Images

Investment Thesis

When we talk about the most basic good for human beings, without a doubt, water stands out as one of the primary necessities. Not only is it essential, but it is also becoming increasingly scarceand drought problems are becoming more frequent, making the optimization of its use essential.

In the midst of this problem, we can find companies like Pentair (NYSE:PNR), which are dedicated to manufacturing equipment for residential, industrial, and commercial water treatment. In this article, we will discuss this significant business, the tailwinds it has, and I will conduct a valuation to justify why I believe it is somewhat expensive, and it is best to wait for a better opportunity.

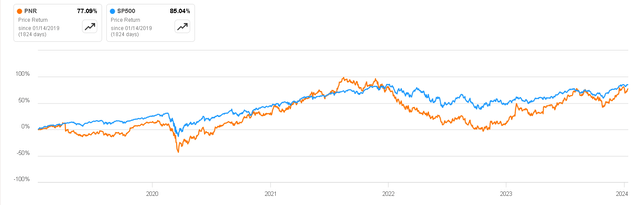

Price Return vs S&P500 (Seeking Alpha)

Business Overview

The company operates in the water treatment, fluid handling, and other industrial sectors. Pentair offers a diverse array of products and solutions, encompassing pumps, filtration systems, water treatment systems, and equipment designed for application across residential, commercial, industrial, and agricultural industries.

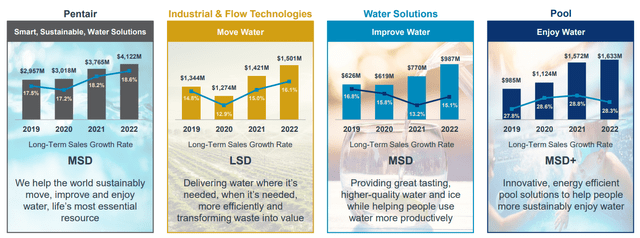

Over its history, Pentair has undergone several restructurings in how it reports its business segments. In the current year, there has been a transition from the Consumer Solutions and Industrial & Flow segments to a new structure, which now includes Water Solutions and Pool segments while maintaining the Industrial & Flow segment.

Water Solutions: This segment offers commercial and residential water treatment products and systems. These include pressure tanks, control valves, and commercial ice machines designed to filter residential water and convert it into drinking water. Additionally, the segment provides water management services for commercial operators. Pool: The goal of this segment is to provide energy-efficient pool equipment and accessories. This includes pumps, filters, heaters, maintenance equipment, and pool accessories. These products are utilized in both the construction and maintenance of swimming pools in the residential and commercial sectors. Industrial & Flow: This segment aims to efficiently deliver water to where it is needed and transform waste into consumable water. It achieves this goal by selling pump and fluid treatment products and systems. The product offerings include pressure vessels, wastewater reuse systems, advanced filtration solutions, agricultural spray nozzles, and other products that cater to residential, commercial, industrial, and agricultural markets.

In general, these products are essential within the industrial sector, serving companies that use water in the production of goods. They are also significant in the residential sector, particularly in relation to home swimming pools, and in the commercial sector with establishments like restaurants or stores, where bathrooms are present or tap water is used in various ways, these water treatment products play a crucial role. Ultimately, water stands as the most utilized and fundamental resource for human beings.

Pentair Q3 2023 Presentation

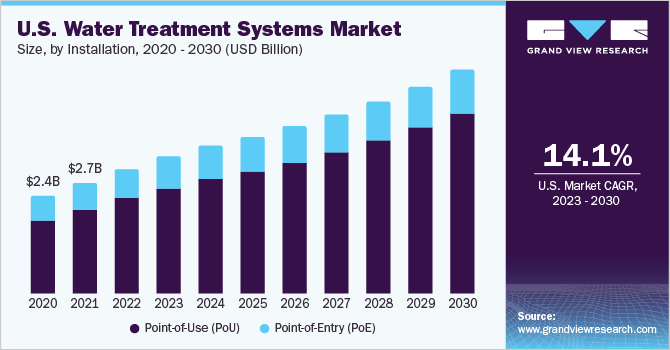

It’s not surprising that the water treatment market is expected to experience a growth of 15% between now and 2030, as indicated by a recent study from Grand View Research. While Pentair may not be directly involved in water treatment services, it serves as a supplier of essential equipment and solutions for companies dedicated to this field.

Basically it would be the supplier of ‘picks and shovels’ for companies dedicated to water treatment.

Grand View Research

Therefore, the company is poised to benefit from the expected growth, acting as a provider of tools and technology for those engaged in water treatment services. This positions Pentair to capitalize on the increasing demand for clean water, driven by global population growth, urbanization, and the rising concerns about water scarcity. The heightened demand for water treatment, along with any systems that enhance the optimization of water usage, creates favorable conditions for Pentair’s continued growth in the coming years.

Key Ratios

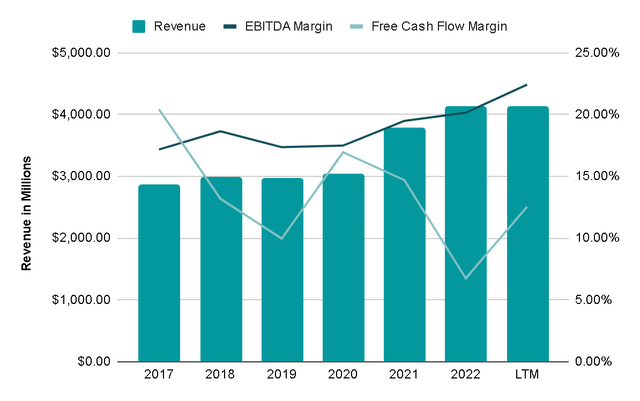

In April 2018, Pentair separated its Electrical business from the rest of Pentair. Therefore, it is better to analyze the performance from this year onward. Starting from FY 2017, the company’s revenue has grown by almost 8% annually, and EBITDA margins have expanded each year, reaching 22% annually.

This growth has been attributed to the company’s ability to set prices at the rate of inflation. During this period, it increased prices by 4% annually. On the other hand, volume growth, indicating the increase in demand for Pentair products, has been only 1.5% annually since 2017. An additional 1.8% annual growth has occurred thanks to acquisitions made.

Author’s Representation

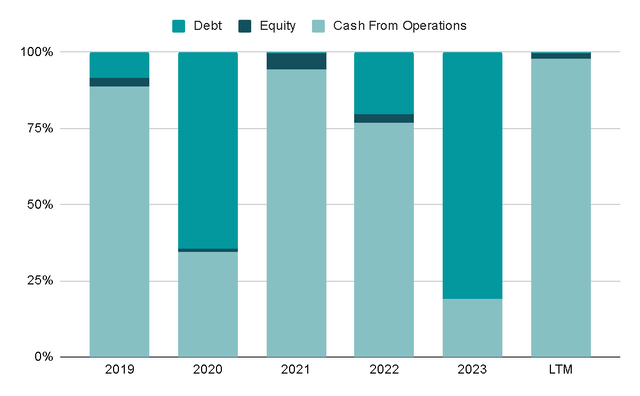

The growth has been financed with an almost 50/50 combination of debt and cash generated by business operations. It is notable that debt is usually issued only in years when the company is very active in M&A, such as 2019 and 2022. This is very positive because it indicates that Pentair does not typically issue debt just for the sake of it but rather uses it as a tool to finance growth.

Author’s Representation

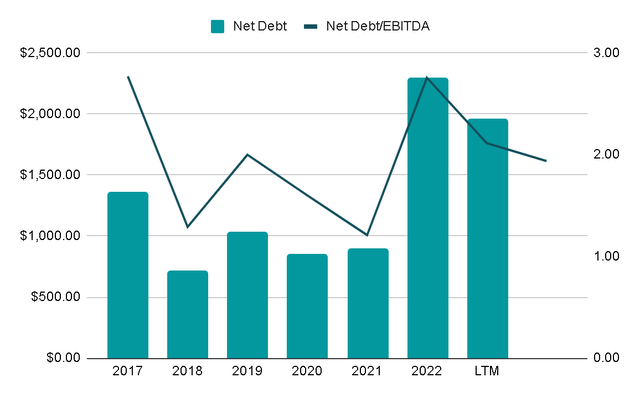

Although they issued $1.5 billion in debt during 2022, the net debt/EBITDA ratio did not even rise to 3x. Currently, they have been dedicated to reducing this debt to healthier levels, and the leverage ratio is already around 2x and debt shouldn’t be a problem for the company.

Author’s Representation

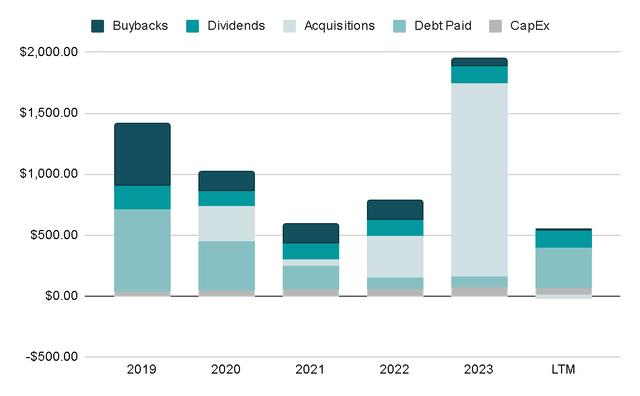

As could already be guessed, in the last five years, 40% of the capital has been allocated to making acquisitions. In 2022, they allocated $1.6 billion to the acquisition of Manitowoc Ice, which manufactures ice machines and related equipment. In this regard, I have to admit that I am somewhat skeptical about allocating three years of Free Cash Flow to a company that has little to do with the core business. Yes, obviously ice is water, but the water treatment business seems better to me because it provides a mission-critical solution and can be more recurring than selling machines that make ice. However, I will remain open to observing the performance of this business in the coming years.

On the other hand, another 30% of the capital has been allocated to buybacks and paying dividends, which currently have a yield of 1.3% with a payout ratio of 28%. Theoretically, it is a very safe dividend with a margin that it will be increased in the coming years, although I do not think this is a priority for the company.

Author’s Representation

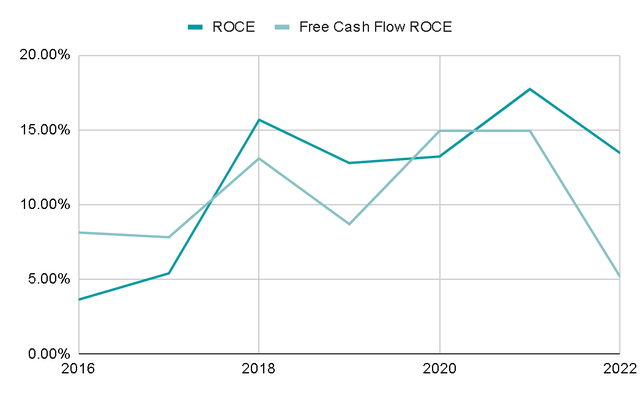

To evaluate the performance of the company’s acquisitions and investments, we can observe the Return on Employed Capital in recent years. Since 2016, this has averaged 13%, and in the last twelve months, it stands at 14.85%. However, as mentioned, the company usually makes many acquisitions that generate goodwill on the balance sheet. This ends up distorting the calculation of the ROCE. So, if we adjust it as a reference for the purely operational return, it would be 38% on average since 2016. This adjustment shows us that if the company stopped acquiring companies, then the ROCE of the company would be considerably higher because the underlying business is very good.

Author’s Representation

Valuation

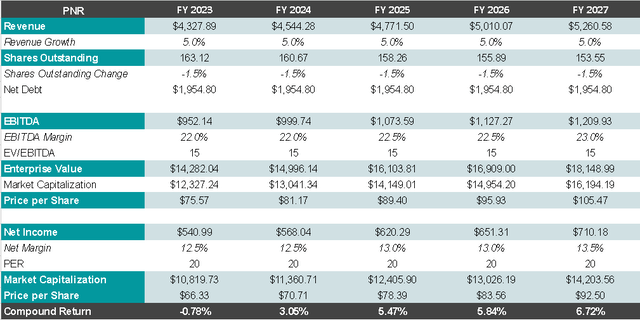

Considering growth opportunities through acquisitions and frequent price increases, I estimate that the company could achieve a 5% annual revenue growth over the next five years. While not implying a consistent 5% growth each year, this represents the annual average. However, for FY2023, the current guidance suggests a decrease of approximately 1%, primarily due to a volume drop of around 10%.

Author’s Representation

Furthermore, the company has consistently discussed plans to reduce operating and administrative costs. I believe that current margins are sustainable and could continue to increase slightly until reaching a 23% EBITDA. With an exit multiple of 15x EV/EBITDA, this would yield an expected return between 6% and 7%, plus the annual dividend of 1.3%, which seems to me to be a rather unattractive return, although it was expected considering that the company made a 40% return during the last year. Reaching $55 USD per share again would bring the return closer to 15% with dividends included and while the achievement of this price remains uncertain, given the numerous options in the market, I prefer to wait for the stock to offer a compelling return, regardless of the quality of the company.

Final Thoughts

It seems clear to me that the company offers products essential for optimizing and treating water. This, combined with the challenges related to the scarcity of this resource, creates tailwinds for the future growth of the company.

In the long term, the company expects mid-single-digit growth, which appears feasible and even conservative to me. However, the issue is that the current valuation doesn’t seem entirely attractive, considering the risk that the company’s products may not be entirely recurring and are exposed to cyclical sectors such as residential and industrial. I believe it’s best to wait for a more compelling opportunity to present itself. Therefore, a ‘hold’ seems like an appropriate rating to me