Pakin Jarerndee

I have been covering Oaktree Specialty Lending (NASDAQ:OCSL) since early January this year, with the previous article issued right after the publication of OCSL’s Q2 2024 earnings report. Starting from my initial thesis, the total return performance has been negative ~ 14%, while the overall BDC market has continued to advance. In the previous article I explained the key aspects that have pushed down the Stock price (e.g., build-up of non-accruals and spread compression), but, at the same time, I underscored several reasons that still justify holding OCSL in a portfolio. For example, the improving bad debt expense component in combination with positive net funding volumes gave a substantiated hope that the performance should improve from Q2 2024 and onwards.

However, OCSL’s market cap levels continued to decline and the recently published Q3 2024 earnings report embodies rather pessimistic data points that have caused the market to reprice OCSL’s Stock price to an even lower level.

So far, OCSL has been my absolute worst BDC pick.

Let me now elaborate on the key data points of the Q3 earnings deck and outline my current thinking on this BDC.

Thesis review

The main metric, which measures the underlying cash generation of a BDC – adjusted net investment income – came at $0.55 per share, marking a $0.01 per share decline from the previous quarter. With this quarter, OCSL has now suffered its third earnings report in a row, where the adjusted net investment income figure has dropped.

There were a couple of pressure points that caused this metric to decrease. First, given the previous additional equity issuances, the weighted average share count has gone up, which per definition introduces a headwind on adjusted NII generation on a per-share basis unless the incremental equity is not deployed in an accretive manner. Second, the adjusted total investment income dropped by $1.8 million despite the positive net funding volumes over the past quarters, which should theoretically provide a boost on the cash generation front for OCSL. Yet, a continued build-up of non-accruals did their thing, by really offsetting the additional income streams stemming from new investments. Third, non-recurring income that is associated with OID acceleration as well as prepayment fees and amendment fees were lower than in the previous quarter.

An element that helped offset the aforementioned dynamics was the lower Part I incentive fees, which were already pre-communicated in the prior quarter. The Management has now also decided to lower the base management fee from 1.5% to 1.0%, which should keep the net expense component balanced and keep the adjusted net investment income as stable as possible.

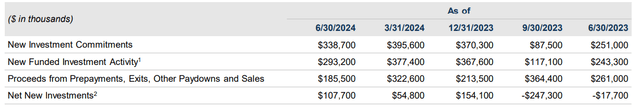

An additional positive, worth underscoring before I elaborate more on the negatives, is the fact that OCSL has managed to keep the net funding volumes in surplus territory for the third quarter in a row. As stated above, this is an inherently accretive aspect that allows OCSL to benefit from spread capture even though the Q3 fundings were underwritten at slightly lower yields (i.e., a drop by 20 basis points relative to the Q2, 2024 period).

OCSL Q3, 2024 Earnings Presentation

Turning to the negatives, there are three important issues I would like to bring up, which are critical to factor into the overall decision-making process of whether to invest in this BDC.

First, even though the adjusted net investment income has dropped and OCSL has issued more shares, the net debt to equity ratio has continued to go up. During this quarter, the leverage went up from 1.02x to 1.1x, which is only 0.05x below the sector average. However, the most important aspect to digest is the underlying dynamic of decreasing cash generation and increasing leverage despite the higher share count.

Second, with the adjusted net investment income now being at the $0.55 per share level, the distribution coverage level has reached 100%, meaning that there is no margin of safety left in terms of OCSL covering its dividend on a go forward basis. The only way to de-risk this situation is through enhanced earnings, which has taken the opposite direction for three quarters in a row.

Third, and this was already a problem back in Q1 2024, the non-accruals went up materially, completely neutralizing the positive effects of a larger portfolio asset base. As of Q3 2024, OCSL had placed 5.7% of its investments (cost basis terms) on non-accrual, which marks an increase of 4.3% from the last quarter. As a result of this, the NAV per share dropped to $18.19, down from $18.72 per share in Q2, 2024.

However, if we look at OCSL’s portfolio statistics, we will see a rather solid picture, which is on par of the average BDC out there (or even better given OCSL’s scale and the relevant diversification benefits). For example, the software portfolio company LTV stands at 41%, the interest rate coverage ratio is at 1.9x and the median portfolio company EBITDA is $147 million, all of which is indicative of a healthy portfolio.

Yet, what we do not see, are the underlying details of how businesses are performing and how, for instance, the lower quality (say, bottom quartile) of OCSL’s investments have been handling the elevated borrowing costs. This is where a track record and strict underwriting policy come into play, where looking at the recent quarters, the overall picture does not look that good.

Finally, as stated above, the only way out of this situation is to execute on two fundamentals elements: 1) keeping the non-accruals low (which is very difficult to project) and 2) continuing to record positive net funding volumes to provide a tailwind for income generation.

On the second component, the current dynamics send an encouraging signal, especially considering the commentary in the recent earnings call by Armen Panossian – Chief Executive Officer & Chief Investment Officer:

The private credit markets also remain optimistic that M&A activity will increase in the second half of this year. In general, private market borrowers remained healthy, demonstrating EBITDA growth and favorable coverage ratio. However, we remain focused on the fundamental risks that many have heard me express before.

The bottom line

In a nutshell, the Q3 2024 earnings data has led me to downgrade the rating for OCSL from buy to hold. While the funding volumes have come in strong and are set to remain in surplus territory, the headwinds stemming from non-accruals impose just too much of a drag and, most importantly, unpredictability for OCSL’s ability to cover the current dividend.

It was positive to see that the Management has taken some efforts (e.g., fee reduction) to avoid the dividend coverage falling below 100%, but in the context of negative momentum in adjusted net investment income and the volatility on the non-accrual side, the dividend coverage is still a notable concern.

In my humble opinion, investors, whose primary objective is to capture sustainable current income streams (as it is in my case) should seriously consider rotating out of this BDC or making sure that the portfolio allocation is not that material here.