JHVEPhoto

NVIDIA Corporation’s (NASDAQ:NVDA) earnings release for the first quarter of the year (referred to in its reporting convention as “Q1 of FY 2025”) held few surprises. As my previous article detailing the company’s “FY 2024” (or calendar year 2023) results described, the company had quite effectively swapped out its crypto miner and gamer niche in favor of “corporate” clients by continually burnishing its product offerings. By virtue of having a strong corporate clientele, the company was expected to have strong results, and the company didn’t disappoint.

Within the various line items and revenue segments, however, lie some causes for concern, as well as the degree by which the company’s performance is overlapped with its stock performance.

Trend Drilldown

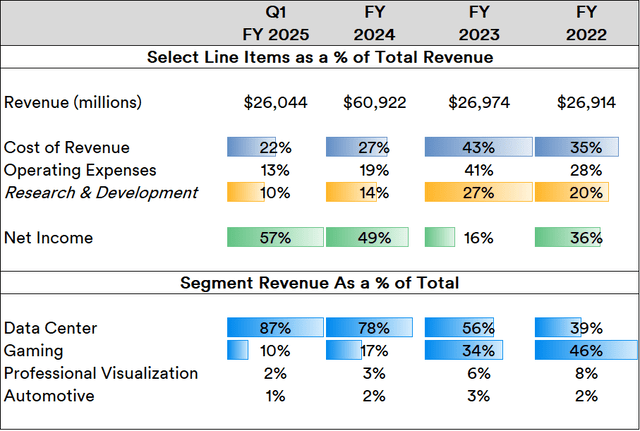

The company’s revenues are well set to establish all-new highs in 2024 relative to previous full years.

Source: Created by Sandeep G. Rao using data from NVIDIA’s Financial Statements

If Q1’s trends continue, it can be expected that FY 2025 will end with revenues nearly 35-45% higher than its previous year, which in itself was a stalwart year. Both cost of revenues and operating expenses continue to trend downwards as its customer base is increasingly populated in volume and prominence by a corporate clientele. Interestingly, research expenses trending downwards indicate that product releases are likely to be less “revolutionary” and more inclined towards incremental improvements in performance. The share of net income – which has a strong correlation with earnings per share – also shows steady improvement.

On the other hand, the company’s evolution has shaken up the diversified pillars of its financial success. While 2021 had two leading revenue segments – “Data Center” and “Gaming” – running neck and neck in revenue contribution, the company is now almost completely dependent on its “Data Center” clientele. While a corporate clientele ensures a steady demand for the company’s products, it also imposes limits: if the products are deemed overpriced relative to requirements, said clientele would show no reluctance to move on to another more accommodating supplier. Also, important is the clients’ usage cycle: once costs have been sunk into a set of products, there will likely be a tight set of requirements before substantial investments are made into upgrades. This means that after a certain volume of sales, there will inevitably be a slowdown in sales growth.

As it stands, a slowdown isn’t evident, but this evolution has implications for the stock’s forward outlook.

P/E Ratio Trends

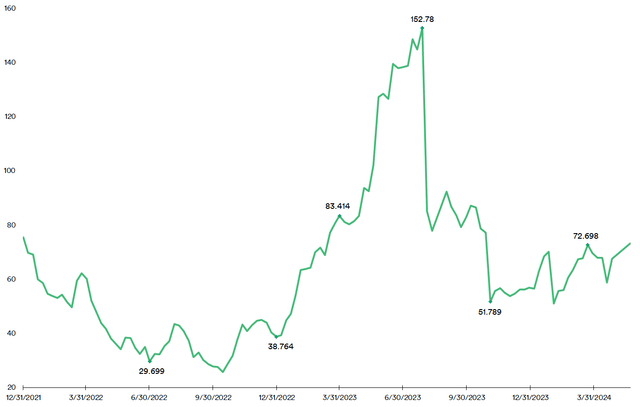

As it stands, the company was quite well-received before 2023. But the stalwart year of 2023 was also the period in recent history when the company’s stock reached dizzying heights in Price-to-Earnings (P/E) Ratio valuations, after which the stock’s trajectory rationalized.

Source: Created by Sandeep G. Rao using data from Zacks’

2023 set out to be the year when it was increasingly evident that the company had secured a foothold in an extremely resilient consumer segment and ended with the aforementioned limits being realized by a growing cross-section of market participants, including institutional “buy-and-hold” players.

So far, in the Year To Date (YTD), the stock has been traversing the 60-75 range, but there is resilient resistance that brings this ratio down to the 50-60 range. This doesn’t necessarily mean a massive decline in price performance: since the company’s net income pass-through efficiency is running high, the company’s earnings are rising. However, the stock likely won’t run as wild as it used to in 2023.

Other Considerations and Conclusion

The earnings press release highlights the company’s strong commitment to its “Data Center” clients: the recently unveiled Blackwell platform as well as the Quantum and Spectrum X800 series switches delivers to clients trillion-parameter computing capability that will essentially pave the way for AI-driven supercomputing. This also augments the company’s positioning in supercomputing that its “Grace Hopper Superchips” had heralded. Furthermore, the company’s diminutive yet impactful “Automotive” segment with deepening relationships with Chinese carmakers BYD Company Limited (OTCPK:BYDDF), XPeng Inc. (XPEV), and GAC as well as American autonomous vehicle solutions startup Nuro (which itself has a strategic tie-up with BYD).

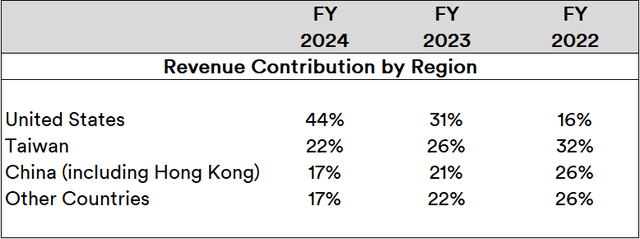

Over the past year, China’s net contribution to the company’s revenues has shown some signs of weakness:

Source: Created by Sandeep G. Rao using data from NVIDIA’s Financial Statements

This might be attributable to the fact that the U.S. government continues to be increasingly concerned (on a largely bipartisan basis) over the export of AI-relevant technology to China. Nvidia’s high-powered products lay square within the government’s targets twice: both when restrictions were introduced and subsequently amended. Yet, at the same time, the company’s likely banking on deepening relationships with Chinese companies to boost revenues.

“AI-relevant technology” is a complicated matter: even if the company were to successively produce restrictions-compliant products for the Chinese market, it is entirely possible to replicate “restricted” levels of computing proficiency via some configurations that effectively “chain” these “allowed” products in a series. This is a perpetual risk factor for the company in terms of global reach.

The company’s growing edge in supercomputing is another potential headache: supercomputers had long featured on the list of export restrictions and severe regulatory oversight, both during and after the Cold War. This essentially leaves the company’s growth prospects promised via its excellent products at the hands of the U.S. government’s deliberations, which will inevitably be onerous and taxing even on the company’s top executives.

All in all, the company’s excellence both in product design and operational efficiency is undeniable, but it’s stepping progressively deeper into murky geopolitical territory. It wouldn’t be entirely unreasonable if consensus market opinion drives down Nvidia Corporation stock’s P/E Ratio by about 25-35% from its present 70+ levels over the course of the year.