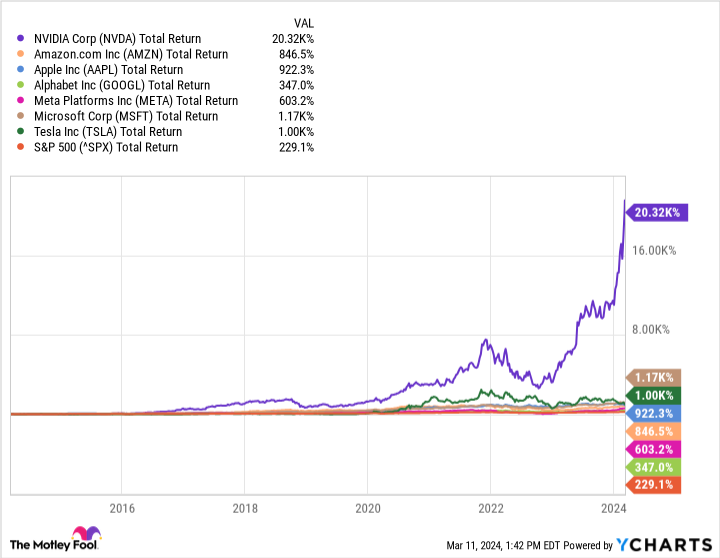

The aptly named “Magnificent Seven” is a group of (mostly) technology companies that have generally delivered above-average returns, especially over the past decade. Here is every member of this clique: Alphabet, Amazon, Apple (NASDAQ: AAPL)Meta Platforms, Microsoft, Nvidia, and Tesla. Though all have been admirable in delivering outsize returns, one of them, Nvidia, is in a class of its own.

None of the other Magnificent Seven members even get close to Nvidia’s performance in the past 10 years. Yet, I still wouldn’t invest in this company.

Heed advice from Warren Buffett

When shares of companies rise as much as Nvidia’s have, one of the first problems investors tend to think of is valuation. It’s often the case that these corporations’ future success is baked into their stock prices. Their shares will drop if they fail to live up to the market’s lofty expectations. That may be the case with Nvidia, but that’s not my rationale for staying away.

There is a simple and straightforward reason I wouldn’t invest in Nvidia stock: My knowledge of the company’s business is practically nonexistent. Nvidia is the leading player in manufacturing graphic processing units, critical electronic device components. This sounds like a great business model, but that is about the extent of my expertise, or lack thereof, in this area.

So, while Nvidia looks like a terrific company from an outsider’s perspective, considering just how successful it has been over the past decade, I am in no mood to invest. Warren Buffett, the world’s greatest investor, once said: “Investment must be rational; if you can’t understand it, don’t do it.”

There is no shortage of options

For what it’s worth, I would also avoid investing in Tesla for the same reason. Am I missing out on some massive gains as a result? It’s hard to say. If I made it a habit to invest in businesses I know nothing about, I might end up with some excellent stocks that have performed splendidly, like Nvidia and Tesla. But this approach would almost certainly result in some terrible investments, too.

Story continues

It’s unclear whether the net effect on my overall returns would be positive. Thankfully, the rest of the Magnificent Seven stocks are all businesses I understand reasonably well. All of them, I think, are worth serious consideration. Let’s pick Apple as an example. Though not as impressive as Nvidia’s over the past decade, Apple’s returns have also been excellent.

Further, the company has strong growth prospects. The iPhone is no longer the growth driver it used to be, but underestimating Apple’s innovative capabilities would be a mistake. After all, the company didn’t create cellphones — it just made better versions of them and made a fortune in the process.

Apple’s habit of creating a better mousetrap is well established. It now aims to do the same within generative artificial intelligence. Apple is trailing some of its peers in this area, but that has never stopped the company. Then, there is Apple’s services segment, with an installed base of more than 2 billion active devices. The company has enough flexibility to monetize its user base in various ways.

The sky is the limit for Apple despite its recent slowing top-line growth. In my view, the company’s shares still look like a buy. I’d say the same about Alphabet, Amazon, Meta Platforms, and Microsoft. Here’s the lesson for investors: Missing out on some potentially amazing companies due to a lack of understanding regarding how they make money is not the end of the world.

There will always be other exciting stocks on the market whose businesses are much more comprehensible to each investor.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of March 11, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Nvidia Is the Best-Performing “Magnificent Seven” Stock: Here’s Why I Wouldn’t Buy was originally published by The Motley Fool