NicoElNino/iStock via Getty Images

Thesis

The BlackRock Short Duration Bond ETF (BATS:NEAR) is a fixed income exchange traded fund. We have covered this name before extensively, with the last article dealing with the mandate change for the fund:

On September 29, 2023, iShares filed to change the investment policy and fund name for the BlackRock Short Maturity Bond ETF (Cboe:NEAR). On or around October 31, 2023, the fund’s investment objective, principal investment strategies and benchmark will change. The fund’s investment objective will be to seek total return in excess of the reference benchmark and the new reference benchmark will be the Bloomberg U.S 1-3 Year Government/ Credit Bond Index. The fund name will also change to BlackRock Short Duration Bond ETF. As a result of these changes, the Fund will increase its effective duration under normal circumstances from one year or less to three years or less.

NEAR used to be a cash parking vehicle via its build and duration profile, thus represented an instrument to enhance short term risk free rates. With the mandate change we highlighted to investors, the new potential risks associated with the name, and thought it would be prudent for investors to switch.

In this article we are going to revisit the name under the umbrella of the new mandate, parse out its collateral and risk factors, and articulate why the name represents a good buying opportunity for investors looking for duration and credit spread risk.

New mandate, new fund name, new holdings

After its mandate and name change, the ETF also altered its allocation:

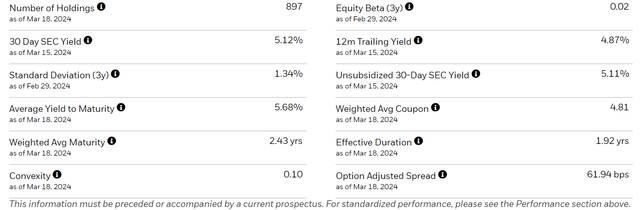

Fund details (Fund Website)

The fund is now taking both duration and credit risk via its composition, with a portfolio effective duration of 1.92 years and an option adjusted spread (‘OAS’) of 61.9 bps.

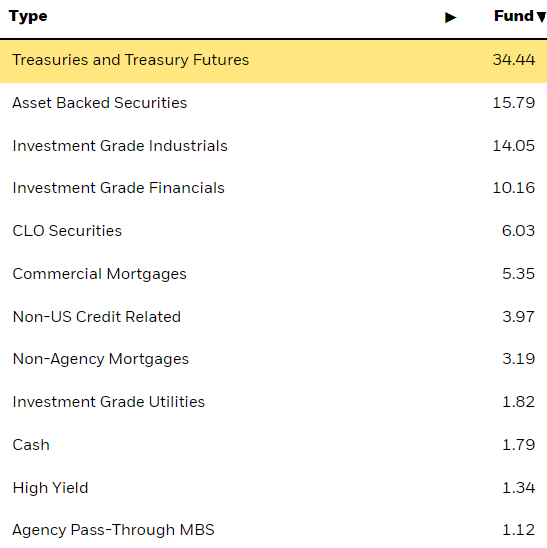

While treasuries now represent the largest fund sleeve, the ETF composition is diversified:

Holdings (Fund Website)

A large ABS allocation is present here, as well as a 6% holding of CLOs. NEAR used to be a fund most focused on short dated corporate paper, but it has transitioned to a multi-asset one. Corporates are now only roughly 24% of the fund, composed by the ‘Investment Grade Industrials’ and ‘Investment Grade Financials’ buckets.

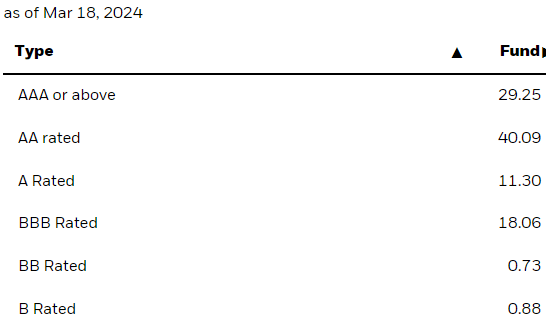

Although its composition is diverse from an asset class stand-point, the fund does not take significant credit risk:

Ratings (Fund Website)

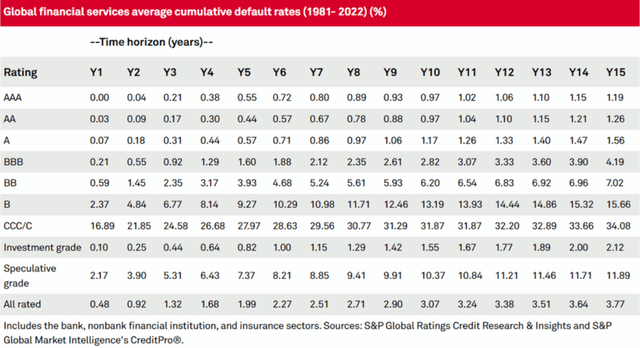

Most of the names in this ETF are either AAA or AA, the safest rungs of the spectrum. Outside BBB names the rest of the portfolio’s default probability for the short tenor is fairly negligible:

Probability of Default (S&P)

If we reference the above table from S&P representing probabilities of default, we can see for example that the cumulative default probability for AA names after two years is 0.09% for corporate bonds falling in the ‘financial services’ bucket. We are using the respective tenor bucket because it equates the fund duration. As we go down the rating spectrum we can see how probabilities of default increase, with CCC names exhibiting levels above 20%.

The main risks for the fund reside with its duration profile, thus interest rate risk is the main risk factor in our opinion.

The volatility profile has now changed

When it was a cash parking vehicle, NEAR had a duration of only 0.3 years and a very suppressed volatility profile given its build. The fund now takes interest rate risk, thus its price is dependent on interest rate moves:

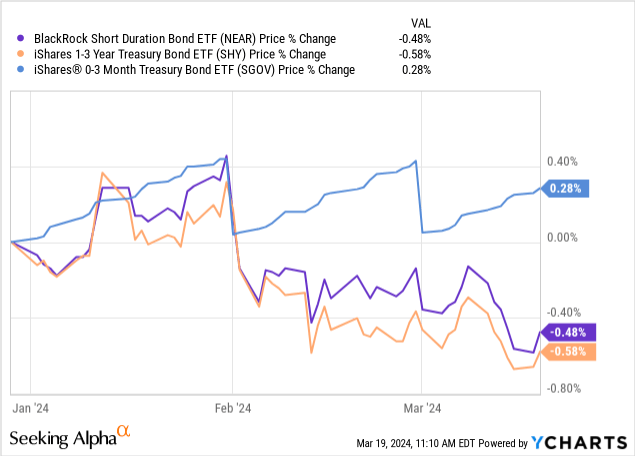

In the above chart we are plotting NEAR versus the iShares 1-3 Year Treasury Bond ETF (SHY) and the iShares 0-3 Month Treasury Bond ETF (SGOV). SGOV (which we have covered on the platform) represents a good way to capture the short end of the treasury curve, and is a classic cash parking vehicle. SHY on the other hand takes duration risk via treasuries, with a 1.8 years duration profile.

NEAR and SHY are now very well correlated since NEAR purely represents a credit risky version of SHY, albeit with very little credit risk. As interest rates moved higher in the beginning of 2024, both funds saw their price decrease, all while SGOV continued to exhibit the price stability which we have observed in the past few years.

Peak rates are behind us

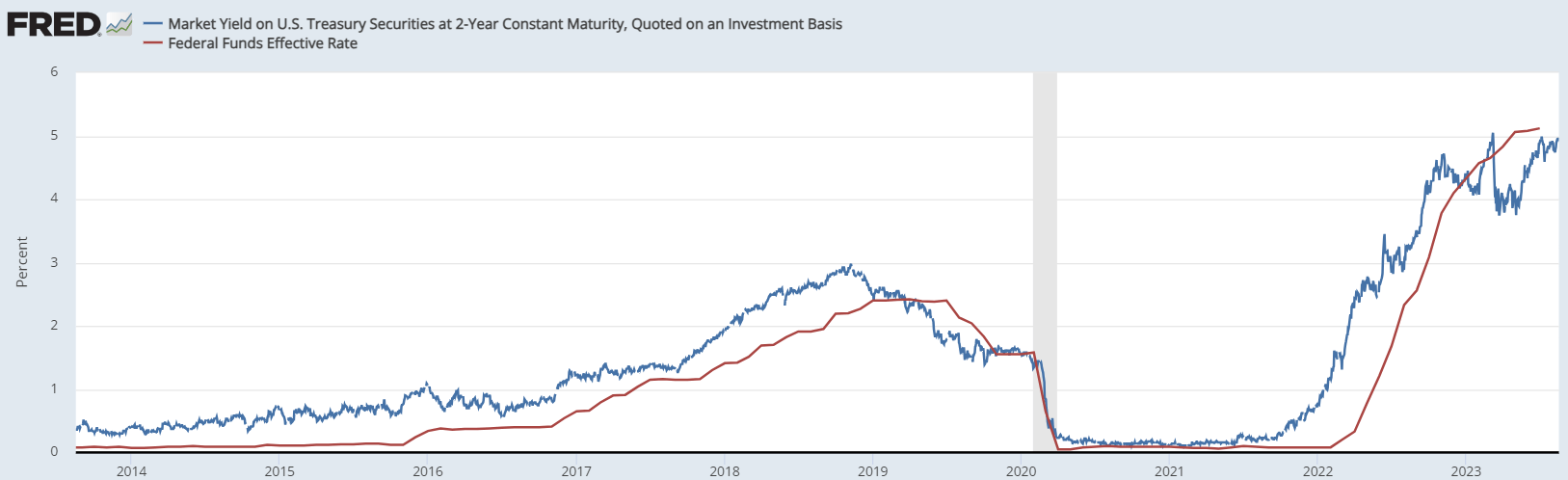

We believe peak rates are behind us, and while inflation has proven to be sticker than expected, the Fed is done hiking. The 2-year point in the yield curve has a very high correlation to Fed Funds, thus as the Fed cuts, two year rates will come down:

2Y Treasuries vs Fed Funds (The Fed)

When two year rates move lower, NEAR will benefit from its duration profile, with a 2% gain for each 100 bps lower in rates.

What we have experienced so far this year in terms of the front end of the curve represents a repricing of lofty expectations. Remember that the market was pricing seven cuts for 2024 late last year, with the first one coming in March 2024. The current re-pricing has seen the front end adjust for a June/July Fed cut, rather than a first half one.

We believe that even if inflation continues to fluctuate above 2%, the Fed will eventually be forced to cut and potentially re-set their target higher down the road. We do not see any scenario in which the Fed will move rates higher in an election year, and we view the ‘no cuts 2024’ scenario as an outside one. They might do just a ‘token’ cut of 25 bps or tighten the target, but they will need to take action to show the market an easing monetary stance is in the cards.

Conclusion

NEAR is an exchange traded fund from BlackRock. The vehicle changed its mandate and name late last year, and has now become a fund which takes duration risk. With an effective duration of 1.9 years, the vehicle is comparable to SHY. NEAR, however, does contain credit risky assets, and has a portfolio OAS of 61.9 bps. The fund is overweight AAA and AA names, thus its credit riskiness is very muted, with interest rates the main risk factor. We expect the Fed to cut this year and the fund to benefit from lower 2-year rates, thus are penciling in a 7% total return for the name in the next 12 months, coming from its yield and duration profiles.