Kira-Yan

Introduction

Per my February 5 article, Meta (NASDAQ:META) is returning capital to shareholders with buybacks and dividends. We received key AI updates since that time, including revelations from the 1Q24 call where CEO Mark Zuckerberg said Meta could become the leading AI company in the world. Meta AI, creator AIs, business AIs and internal coding AIs were all discussed on the call. My thesis is that Meta’s AI developments have huge implications.

During the 1Q24 call, CEO Zuckerberg said 30% of Facebook feed posts are delivered by the AI recommendation system, which is up 2x from the last couple of years. He also noted how 50% of the content people see on Instagram is now AI recommended. Later in the 1Q24 call, JPMorgan Chase (JPM) Analyst Douglas Anmuth asked what has changed in the last three months, and the answer from CEO Zuckerberg was telling. Previously, the team was excited about Llama 2, but we are now at a different level with Llama 3 (emphasis added):

But now I think we’re in a pretty different place. So with the latest models, we’re not just building good AI models that are going to be capable of building some new good social and commerce products. I actually think we’re in a place where we’ve shown that we can build leading models and be the leading AI company in the world. And that opens up a lot of additional opportunities beyond just ones that are the most obvious ones for us.

Unified Models

Morgan Stanley (MS) Analyst Brian Nowak spoke with Facebook Head Tom Alison at the March 11th Morgan Stanley Technology, Media & Telecom Conference where they went into details on AI innovation for the recommendation space. Historically, there have been separate AI recommendation models for Reels, Groups and Feed. It was not ideal the way this old AI architecture was set up with disparate silos. Late last year, Meta decided it is worthwhile to try having one recommendation architecture for all these products. They put Facebook Reels on this single unified model and gave it the same data as the old separate model. The new unified model gave them a gain of 8% to 10% in Reels watch time, which showed the new model architecture is learning from the data much more efficiently than the old model. The investments being made now for the next steps are exciting (emphasis added):

So for example, instead of just powering Reels, we’re working on a project to power our entire video ecosystem with this single model. And then can we add our Feed Recommendations product to also be served by this model. And if we get this right, not only will the Recommendations be kind of more engaging and more relevant, but we think the responsiveness of them can improve as well. So if you see something that you’re into in Reels and then you go back to Feed, we can kind of show you more similar content in Feed as well very seamlessly and responsibly.

About a month and a half later on the 1Q24 call, Morgan Stanley Brian Nowak continued exploring recommendation engine improvements by asking a new question on the subject. CFO Susan Li repeated much of the March 11 conclusion from Facebook Head Alison with her answer. Additionally, she was encouraging about the potential for unified models with respect to ads:

We’ve talked a little bit about the new model architecture, Meta Lattice, that we deployed last year that consolidates smaller and more specialized models into larger models that can better learn what characteristics improve ad performance across multiple services, like Feed and Reels and multiple types of ads and objectives at the same time. And that’s driven improved ad performance over the course of 2023 as we deployed it across Facebook and Instagram to support multiple objectives.

Meta AI

On the 1Q24 call, Zuckerberg said Meta AI is so fast at generating images that it can do it while one is typing the image description (emphasis added):

We believe that Meta AI with Llama 3 is now the most intelligent AI assistant that you can freely use. And now that we have the superior quality product, we’re making it easier for lots of people to use it within WhatsApp, Messenger, Instagram, and Facebook. Now in addition to answering more complex queries, a few other notable and unique features from this release. Meta AI now creates animations from still images and now generates high-quality images so fast that it can create and update them as you are typing, which is pretty awesome.

I’ve tried this out by going to meta.ai, and it is incredible! Other AI image generators out there are slow and clunky, but this is unbelievably responsible. I typed the following of the other day:

Imagine a panda sitting straight up drinking a plain mug of coffee.

Here is the image which was generated from the above prompt:

Meta AI picture (Meta AI)

Zuckerberg said he thinks Meta AI can be the best AI assistant in the world, which will be extremely valuable. Based on what I’ve seen so far, I think they’re making great progress in this area.

Advertising AI

Meta’s two end-to-end AI-powered ad tools are Advantage+ Shopping and Advantage+ App Campaigns. During the 1Q24 call, Zuckerberg said revenue through these tools has more than doubled since last year. Later in the call, Truist Securities Analyst Youssef Squali asked about Advantage+. CFO Susan Li answered by saying Meta is seeing good traction (emphasis added):

So on the single-step automation, Advantage+ Audience, for example, has seen significant growth in adoption since we made it the default audience creation experience for most advertisers in Q4, and that enables advertisers to increase campaign performance by just using audience inputs as a suggestion rather than a hard constraint. And based on tests that we ran, campaigns using Advantage+ Audience targeting saw, on average, a 28% decrease in cost per click or per objective compared to using our regular targeting. On the end-to-end automation products like Advantage+ Shopping and Advantage+ App Campaigns, we’re also seeing very strong growth. Mark mentioned the combined revenue flowing through those two has more than doubled since last year. And we think there’s still significant runway to broaden adoption, so we’re trying to enable more conversion types for Advantage+ Shopping.

Valuation

I am sanguine that AI will drive up Meta’s valuation in the long run, but the stock will likely be volatile in the short run, depending on the patience of investors. Capex and energy expenses are going to increase as AI investments are made, and it will take some time before we will see meaningful revenue from these investments. Historically, this has worked with Reels, Stories, mobile News Feed and other initiatives, but investors had to be patient. Zuckerberg talked about the monetization potential in the 1Q24 call (emphasis added):

On the upside, once our new AI services reach scale, we have a strong track record of monetizing them effectively. There are several ways to build a massive business here, including scaling business messaging, introducing ads or paid content into AI interactions, and enabling people to pay to use bigger AI models and access more compute. And on top of those, AI is already helping us improve app engagement which naturally leads to seeing more ads, and improving ads directly to deliver more value. So if the technology and products evolve in the way that we hope, each of those will unlock massive amounts of value for people and business for us over time.

Per the 1Q24 release, $15,008 million was spent on buybacks in the quarter, which is more than 3/4ths of the entire $19,774 million amount spent on buybacks throughout the entire year of 2023. However, this doesn’t necessarily mean management thought the stock was exceptionally cheap during the period, and we want to be careful not to make annual buyback extrapolations because of what was said in the 1Q24 follow-up call (emphasis added):

One dynamic that is worth being aware of is, in Q1, that is when we issue our annual equity refresher grants to employees. So we have typically bought back more shares in Q1 in that period basically to neutralize the dilution that comes from stock based compensation.

WhatsApp is now generating considerable revenue per, Finance VP Chad Heaton’s comments in the 1Q24 follow-up call. It could noticeably increase Meta’s valuation in the future (emphasis added):

There’s a couple different ways that we monetize WhatsApp. One is through click to messaging ads and then the second is on paid messaging. On click to message, that continues to grow at a healthy pace. We’ve seen click to WhatsApp growth be very strong in particular, and we’re seeing a lot of opportunity to scale that line. As we look to paid messaging, that has now surpassed a $1 billion annual revenue run rate and is growing at a really strong pace.

One valuation risk is a change in the digital ad space such that the ability to target is reduced. We saw this not too long ago when Apple (AAPL) made privacy changes with the Identifier for Advertisers (“IDFA”). Loop Capital Analyst Rob Sanderson asked about this in the 1Q24 follow-up call with respect to layers of cookies. CFO Susan Li answered by saying Meta should be more resilient to ad space changes in the future (emphasis added):

Yes. I mean, I think in the period of time since Apple implemented the iOS 14.5 changes, we have really rebuilt our systems to perform well even when we have less access to granular data. And we feel pretty confident that both our rebuilt systems and the advancements that we’ve made in AI and a lot of the model and ranking advancements we’ve made will be more resilient to future changes.

The stability of global advertisers impacts Meta’s valuation. A March WSJ article notes how China-based advertisers such as Temu (PDD) and Shein boost Meta’s revenue. China-based ad revenue has been volatile in the past – especially during the Covid pandemic. On the 1Q24 follow-up call, Jefferies (JEF) Analyst Brent Thill said it was mentioned in the past that China-based advertisers accounted for roughly 10% of revenue, and he asked if there were any changes in the quarter (emphasis added):

We didn’t quantify this this quarter, and this won’t be a quarterly quantification for us. But what I would say is growth and spend from China advertisers remains strong. Online commerce and gaming are still strong verticals there, and you can see that our Asia-Pacific advertiser segment continues to be the fastest growing region at 41% year-over-year in Q1.

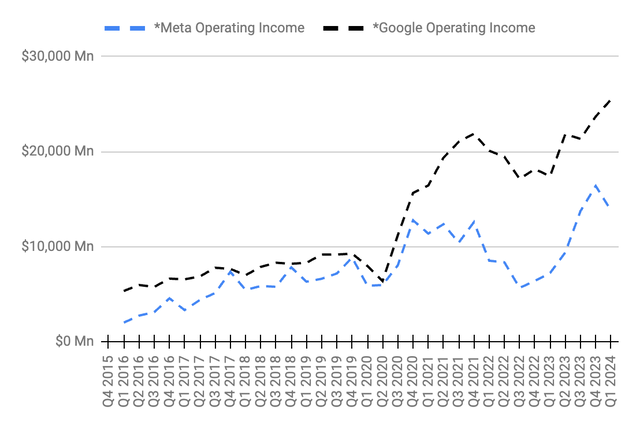

Meta’s operating income was disappointing in 2022, but it steadily climbed back in 2023:

Meta operating income (Author’s spreadsheet)

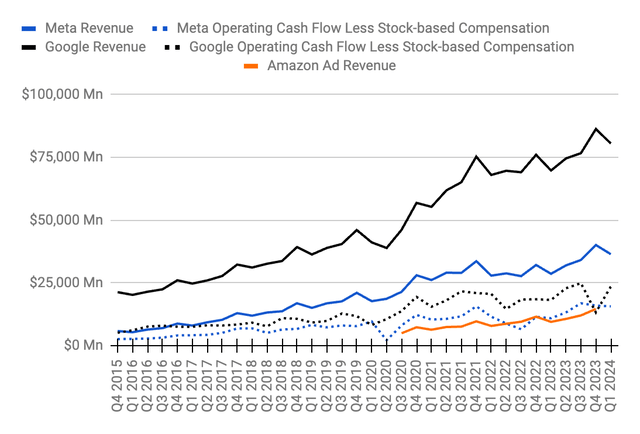

Meta has a better cash flow margin than the other big digital advertiser, Google (GOOG) (GOOGL). Both companies have done remarkably well over the years, and they both got back on track in 2023. Amazon (AMZN) is also becoming a substantial part of the picture with respect to digital ad revenue:

Meta revenue (Author’s spreadsheet)

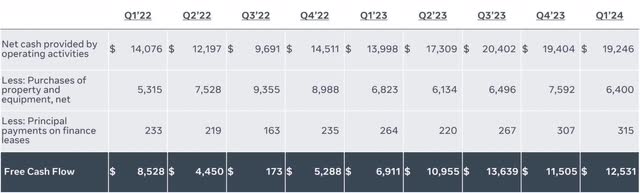

Looking at the 1Q24 presentation, trailing twelve months (“TTM”) free cash flow (“FCF”) is $48,630 million. Net cash provided by operating activities has been above $19 billion since 3Q23:

FCF (1Q24 presentation)

Normally, I treat share-based compensation (“SBC”) like a cash expense, and this lowers FCF. However, much of the capex is for AI growth as opposed to what is required to maintain unit economics, so this raises economic FCF. If we think of these considerations as being somewhat close to a wash, then we can go with the numbers from management above.

I think it’s reasonable to value Meta at about 24 to 26x TTM FCF, which gives us a valuation range of $1,165 to $1,265 billion when rounding to the nearest $5 billion.

Looking at the 1Q24 10-Q, we have 2,191,446,233 A shares plus 345,087,958 B shares as of April 19 for a total consideration of 2,536,534,191 shares. Multiplying by the April 25 share price of $441.38, we have a market cap of $1,120 million. The market cap is near the low end of my valuation range, so I think the stock is a buy for long-term investors willing to hold the stock for at least three years.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.