Elena Uve/iStock via Getty Images

Introduction

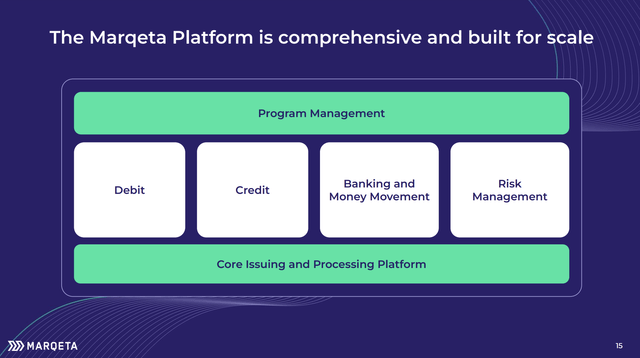

Marqeta (NASDAQ:MQ) is the leading modern issuer processor that enables companies such as Block (SQ), Affirm (AFRM), and DoorDash (DASH) to launch customized card programs that are highly rapid, scalable, and configurable.

Marqeta Investor Day 2023

The company recently released strong Q4 results and FY2024 outlook. However, the stock sold off following its earnings reports with little to no negative news.

The selloff seemed unjustified.

With nearly 40% Net Cash and trading at only 4x its 2024 Revenue, Marqeta stock looks reasonably cheap and offers a decent upside for investors.

Growth

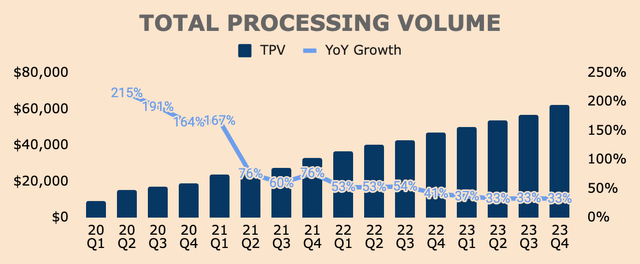

Looking at Q4 results, Total Processing Volume, or TPV, was $62B, growing 33% YoY for the third consecutive quarter, displaying strong adoption in fintech.

Author’s Analysis

According to management, TPV growth turned out better than expected, driven by:

Non-Block TPV growing 10 points faster than Block VAT Financial services vertical growing “a little faster than the overall company” as demand for accelerated wage access increased. Lending vertical growing “several points faster than the overall company” due to the ongoing adoption of buy now pay later. On-demand delivery vertical growing by “double digits” due to product and geographic expansion. However, growth was partially offset by the expense management vertical, which grew “a little slower than the overall company” as the vertical matures.

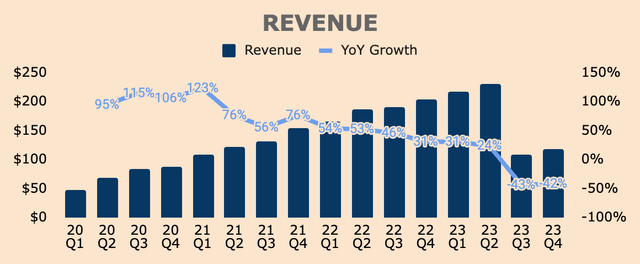

As a result of better-than-expected TPV growth, the company’s Revenue decline was less severe than anticipated. In Q4, Revenue was $119M, down by 42% YoY, versus management’s guidance of a 46% drop. This also beat analyst estimates by $8M.

Author’s Analysis

Regardless, the massive drop in Revenue was due to the Cash App contract renewal, which went into effect in July 2023. As a reminder, the new contract negatively impacted Revenue recognition from Block — in Q4, it was a negative impact of 59 percentage points.

Excluding Block Revenue, Marqeta’s growth is still robust, which is great to see.

Non-Block Revenue growth accelerated by more than 5 points as we begin to lap prior year renewals and newer, faster-growing solutions such as BNPL, pay anywhere cards and accelerated wage access increase in their contribution.

(CFO Mike Milotich — Marqeta FY2023 Q4 Earnings Call, emphasis added)

That being said, revenue numbers will continue to be ugly until the effects of the Block renewal are fully lapped in Q2 this year.

Other than that, TPV growth remains robust which reflects Marqeta’s differentiated platform, the growth of its customers, as well as the increasing adoption of fintech applications.

More importantly, Marqeta has secured over 80% of its TPV in renewals, which pretty much guarantees strong TPV growth over the next few years.

Profitability

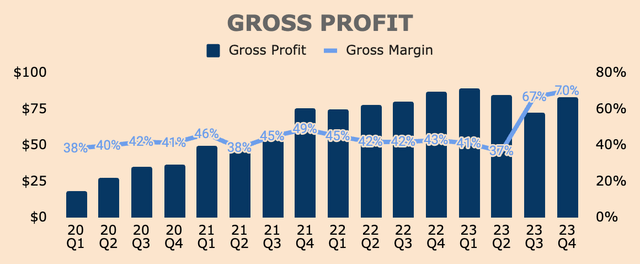

In Q4, Gross Profit was $83M, down by 4% YoY. This was much better than management’s guidance of a 9% decline for the quarter.

In addition, Non-Block Gross Profit accelerated by more than 5 percentage points.

Because of the much lower revenue, Gross Margin expanded significantly to 70% in Q4 — also higher than management’s guidance in the high 60s.

Author’s Analysis

Regardless, the YoY drop in Gross Profit was mainly due to lower pricing for the Cash App program, which reduced Marqeta’s Gross Profit growth by “mid-20 percentage points”.

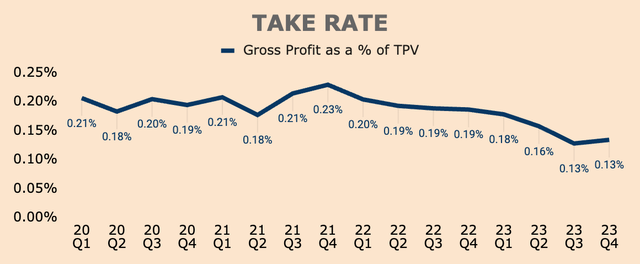

Gross Profit Take Rate — which is a proxy for Marqeta’s pricing — dropped from 0.19% last year to just 0.13% in Q4, reflecting Cash App’s reduced pricing. However, on a QoQ basis, take rate remained stable. Moreover, excluding Cash App, take rate improved by 1 percentage point QoQ, due to higher network incentives.

Hopefully, take rate can climb up from here — lower take rates reflect weak pricing power. According to management, they expect “take rate stability for the most part”.

Author’s Analysis

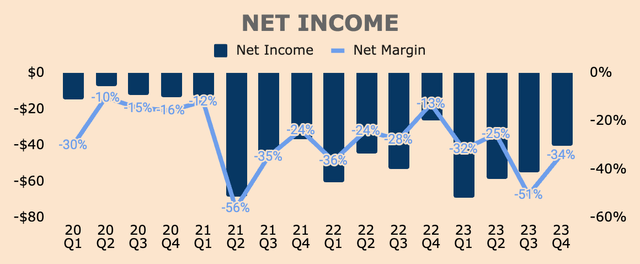

Jumping down the income statement — while Net Income seems to be gradually improving over the last few quarters — Net Income is still severely negative at $(40)M, due to:

Lower Gross Profit High Stock-based Compensation of $45M Non-cash Acquisition-related Expenses of $11M

Author’s Analysis

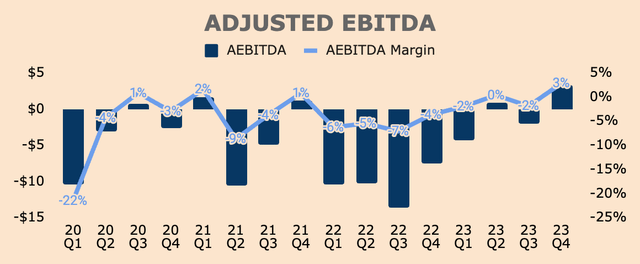

On a positive note, Q4 Adjusted EBITDA was $3M at a 3% Adjusted EBITDA Margin. This was significantly better than management’s guidance of (3.5)%, primarily driven by a 16% YoY decrease in Adjusted Operating Expenses due to “restructuring, operational efficiencies, and delayed investments”.

Author’s Analysis

As you can tell, Marqeta is displaying some operating leverage despite lower Gross Profits.

In addition, the company’s take rate is stabilizing, and once the side effects of the Cash App renewal are fully lapped, Marqeta will show more favorable comps figures, which should be well accepted by the markets.

Health

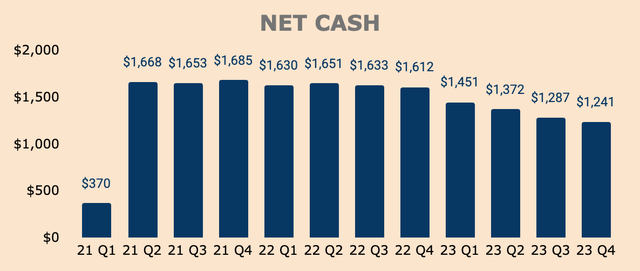

Marqeta’s balance sheet remains strong with a Net Cash position of $1.2B and virtually no debt. As it stands, Net Cash represents nearly 40% of Marqeta’s Market Cap of $3.3B.

Author’s Analysis

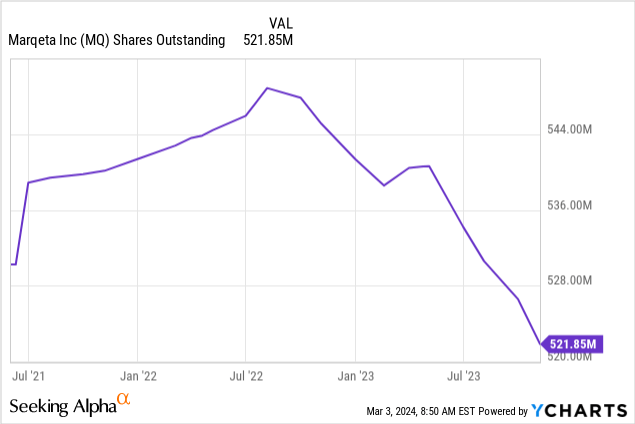

Net Cash has been dropping over the last few quarters due to the Power Finance acquisition as well as share buybacks. On the second point, the company announced a $200M share buyback program in Q2 and has since purchased 31M shares at an average price of $5.36 for a total of $168M — based on the current price of $6.40, the repurchases were well-timed.

As you can see, the company’s buyback program did a great job in reducing overall share count, even despite high Stock-based Compensation.

As of Q4, the company still has $32M available for future repurchases — at this rate, we should see a new buyback program announced soon, most probably when the company releases Q1 earnings results.

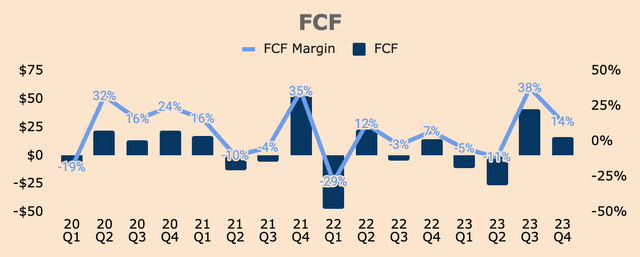

Free Cash Flow is also positive, which was $17M in Q4 at a FCF Margin of 14%. For the full year, FCF was positive at $20M.

Author’s Analysis

Outlook

During the earnings call, management provided more details on the company’s Q1 and FY2024 outlook.

Keep in mind that the first and second half of the year will look very different, given the fact that the negative effects of the Cash App renewal will end only in Q2.

That said, here’s what management expects for the full year:

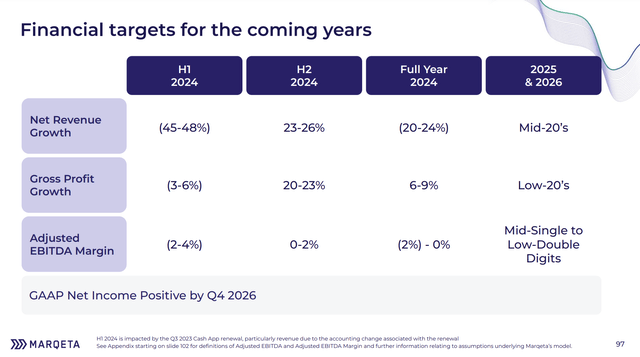

FY2024 Revenue to decrease 20% to 24% YoY as the Cash App renewal puts pressure on growth in the first half of the year. FY2024 Gross Profit to grow 6% to 9% with a Gross Margin in the high 60s. FY2024 Adjusted EBITDA to be around breakeven.

Let’s break it down by half.

For the first half of 2024, management expects the following results:

Q1 Revenue to decline by 45% to 48% YoY, which includes a 65 to 70 percentage point negative impact from the Cash App renewal — expect a similar level of contraction in Q2. Q1 Gross Profit to decline by 8% to 10% YoY — expect a similar level of contraction in Q2. Q1 Gross Margin is expected to be in the high 60s but Q2 Gross Margin is expected to be 7 points lower as Marqeta’s network incentive tiers reset in April. Q1 Adjusted EBITDA Margin is expected to be between 0% to 2%. On the other hand, Q2 Adjusted EBITDA Margin is expected to be -7% to -9% due to lower network incentives.

Here’s what things will look like in the second half of 2024:

H2 Revenue growth to reaccelerate to 23% to 26% mainly due to fully lapping the Cash App renewal. H2 Gross Profit growth should also reaccelerate to 23% to 26%. H2 Adjusted EBITDA Margin to be positive 1% to 3%.

Most of these metrics were better than the numbers provided during the company’s Investor Day back in November, reflecting better-than-expected growth momentum and operating leverage. Hopefully, this will lead to the company achieving GAAP Net Income profitability sooner than Q4 of 2026.

Marqeta Investor Day 2023

In short, 2024 will start off weak for Marqeta, but things will only get better as the company progresses through the year — especially when the company enters the back half of the year without the negative effects of the Cash App renewal dragging the business down.

In other words, the outlook looks very strong for Marqeta.

In addition, the pipeline is strong with over 50% bookings growth in 2023. Furthermore, management highlighted that they have significantly cut the time to launch new programs, which ultimately leads to faster bookings-to-Gross Profit conversion.

On average, the time between close and launch in Q4 of this year was about 100 days better than the previous year.

(CEO Simon Khalaf — Marqeta FY2023 Q4 Earnings Call, emphasis added)

Given faster execution, Marqeta’s differentiated platform, and the secular growth of the fintech industry, management is confident of achieving 30%+ TPV growth in 2024, which is impressive considering its 34% growth in 2023.

So our TPV growth, we expect it to be about 30% throughout 2024, and it will be relatively consistent each quarter.

(CEO Simon Khalaf — Marqeta FY2023 Q4 Earnings Call, emphasis added)

Valuation

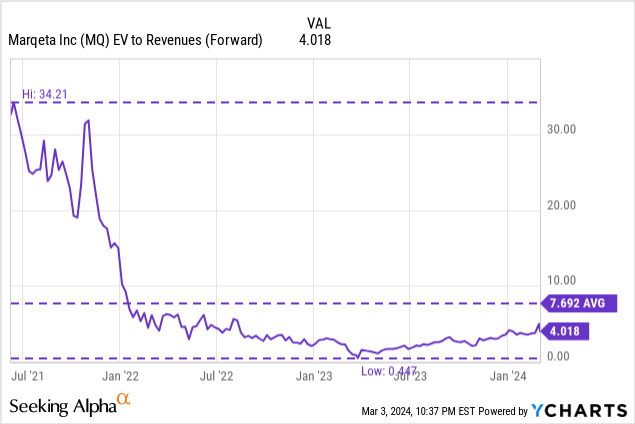

Marqeta trades at an EV to Forward Revenue multiple of 4.0x, which is a significant discount from its highs of 34.2x and average of 7.7x — the stock still offers good value relative to historical multiples.

I have a 12-month price target of $8.56, which is slightly higher than the average analyst price target of $7.75. This is based on the following assumptions:

FY2033 Revenue of $2.2B with growth following analyst estimates in the first three years. Analysts expect Revenue to drop by 23% in 2024 and then reaccelerate by 25% in both 2025 and 2026. As for the remaining years, I expect growth to slow down to just 12% by 2033, which is fairly conservative. FY2033 FCF Margin of 25% by 2033. Assigning a long-term FCF Margin is the tricky part given all the moving parts currently. FCF Margin was 38% in Q3 and 14% in Q4, so I will assign Marqeta a figure somewhere in the middle, which is 25%. FCF Margin can definitely go higher than 30% or even 40% as the company scales, but I just want to be conservative here. Perpetual Growth Rate of 2.5%. Discount Rate of 12%.

I have also included my bull and bear cases below.

Based on the current price of $6.40, I see a potential upside of about 34% for my base case.

Author’s Analysis

That said, I think we won’t see much upside for Marqeta stock in the near term, given negative growth and severe unprofitability.

However, as we enter the back half of the year, we should see growth reaccelerate and margins expand, which should bring more positive sentiment to the stock.

Also, given the momentum of the business, I believe the company will achieve positive GAAP Net Income sooner than management’s Q4 2026 target. This should be a positive catalyst for the stock — yet again, it is still years away.

Risks

Competition in the fintech space remains fierce, which could lead to slower growth and lower margins. Competition includes legacy processors like Fiserv (FI) and other fintech firms like Adyen (OTCPK:ADYEY), Stripe, and SoFi (SOFI). Concentration is also another risk. As of Q4, Block still accounts for 51% of the company’s Revenue, which is massive. While its contract with Block has been extended to June 2028, any negative developments with Block will directly impact Marqeta. However, concentration risks should dissipate as Marqeta diversifies its client base.

Thesis

Despite all the structural changes Marqeta is going through, the company’s Q4 results turned out better than expected — a testament to its unique value proposition and the evolving fintech market.

Furthermore, management provided a strong 2024 outlook with 30%+ TPV growth.

However, the stock sold off 10%+ following Q4 results with no negative news — the selloff seems unjustified given the company’s outperformance.

That said, the stock still trades at reasonable valuations with ~40% Net Cash, making it one of the most attractive fintech stocks that investors can buy today.