sturti

When reviewing the results on Home Depot (HD), I did not entirely understand the market reaction, but the results were quite along the lines of what I expected. After the initial reaction, the market reacted positively to both Home Depot and Lowe’s (NYSE:LOW) stock prices, but it got me thinking. If the leader in home improvement is posting this type of result, how bad can it get for the laggard? Was there something the market was ignoring, and is there an opportunity to hedge my portfolio by betting against the laggard?

In short, I believe there is a rare opportunity where the market is discounting the risks of holding a home improvement stock in a weak market and being a laggard potentially exposes it to a bigger downside.

Lowe’s has always been behind Home Depot

Lowe’s operates in the home improvement space and operates over 1700 stores in North America. The core of Lowe’s revenue comes from retail sales of home improvement products with additional revenues from installation services, extended warranties, and professional services, including job site delivery and contractor financing options.

Home improvement space is a duopoly with Home Depot having the commanding lead over Lowe’s (62% Vs 35%). It’s easy to see how well they have fared over the years.

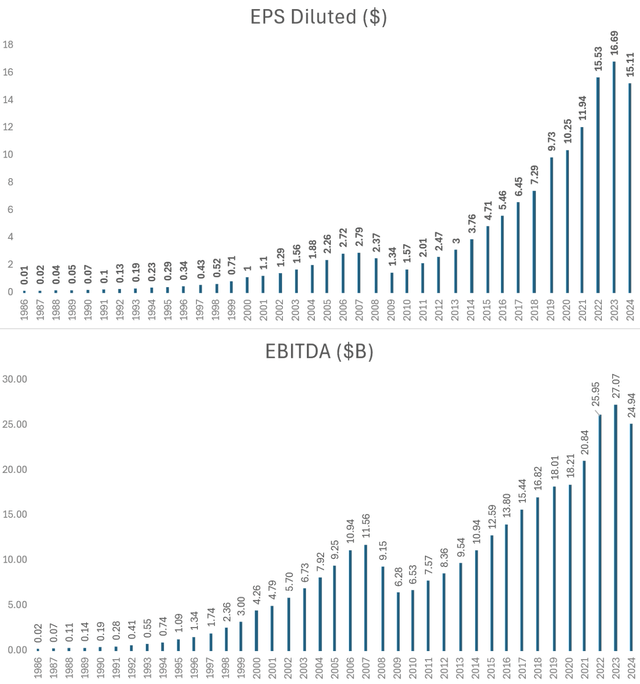

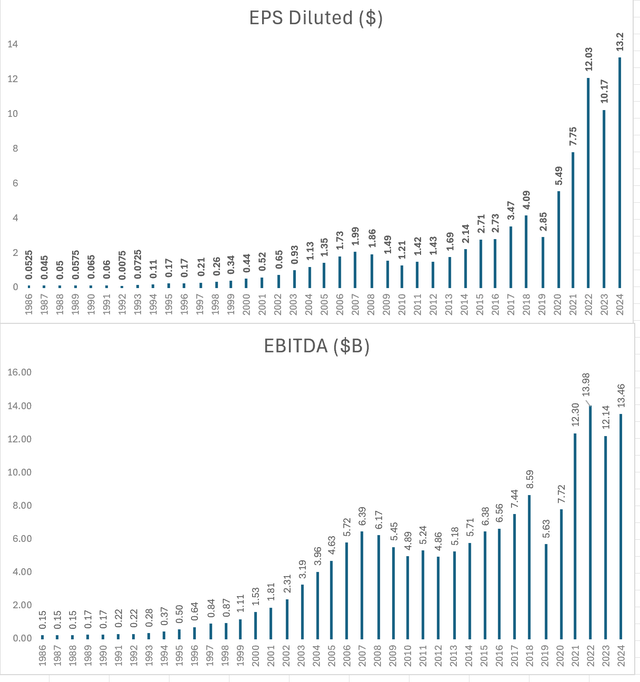

Since the company went public, Home Depot has continuously grown its bottom line, except for 2008-2009 and the latest reported year. However, for Lowe’s in the last 15 years alone it’s growth hasn’t been as steady as Home Depot’s. In addition to GFC, its EBITDA took a hit in 2012, 2019 and 2023.

Home Depot’s EPS and EBITDA (Author Generated from company data)

Lowe’s EPS and EBITDA (Author generated from Company data)

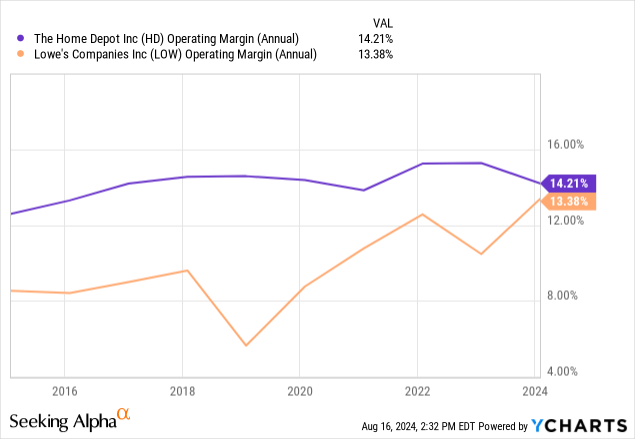

Home Depot’s acquisition and operational strategy has seen success and the company has commanded higher margins. Lowe’s expansion strategy has failed (It had to pull out of Mexico and Canada) and in the past management has cited missteps in inventory control resulting in low same-store sales. In 2018, Lowe’s made a leadership change with the goal of Lowe’s aiming to maximize its operational potential. So it’s easy to see in the chart how Lowe’s started to close the gap in the years since then.

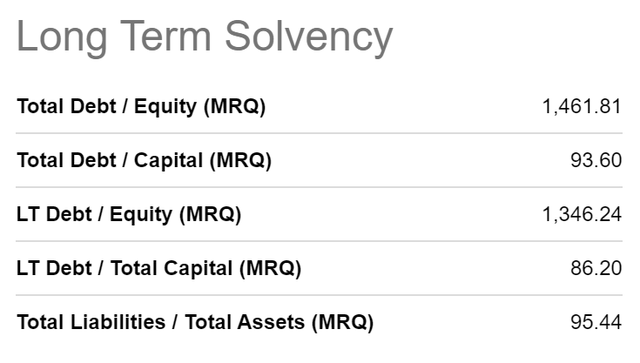

Even when it comes to the balance sheet, Lowe’s fares worse than Home Depot

Long-term solvency metrics of Home Depot (Seeking Alpha) Long-term solvency metrics of Lowe’s corporation (Seeking Alpha)

But going forward the road is going to be more difficult. With many signs of a weak consumer and Home Depot warning us of a difficult period for home improvement space, it is reasonable to think that the laggard will be more affected.

The reasoning is straightforward. With all else being equal and the industry facing challenges as a whole, with a bigger market share, the leader has more economies of scale than the laggard. With higher margins, the leader has more operational leeway than the laggard. With better financial health, the leader has more balance sheet flexibility than the laggard.

Lowe’s upcoming Q2 earnings and clues from Home Depot

Seeking Alpha

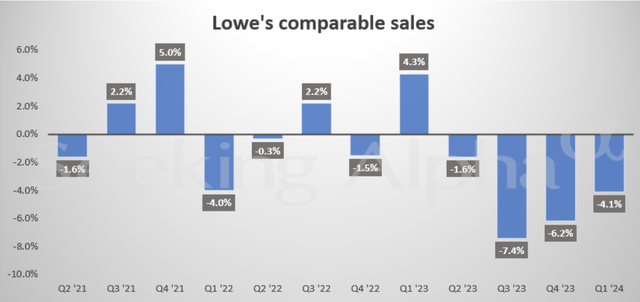

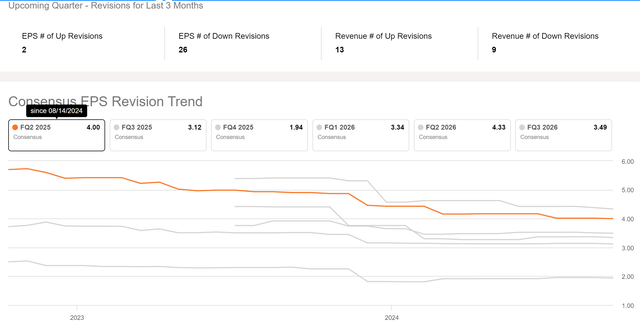

It wouldn’t be surprising to see another down quarter after seeing four consecutive quarters of declining growth. Consensus numbers have been coming down and more aggressively in recent months. The number of up revisions is only 2 for EPS, whereas the number of down revisions is 26!

Upcoming quarter Earnings Revisions (Seeking Alpha)

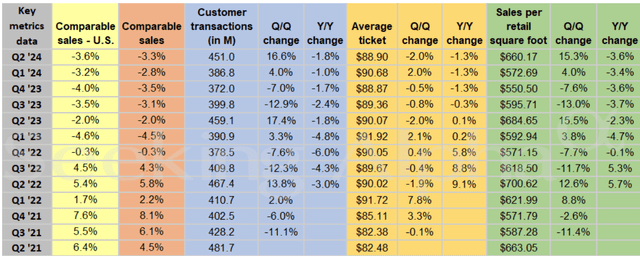

But are there specific clues that we can get from Home Depot which reported earnings recently? For Home Depot, comparable sales for the quarter fell by 3.6%, worse than the expected -2.4%. Customer transactions dropped by 1.8% to $451M, with the average transaction value down 1.3% to $88.90. Sales/sq. foot also decreased by 3.6% to $660.17. Looking ahead, Home Depot anticipates a decline in comparable sales of 3 – 4% for FY24, a more pessimistic outlook than the previously expected 1% decline.

Comparable numbers (IN)

The underlying long-term fundamentals supporting home improvement demand are strong… During the quarter, higher interest rates and greater macroeconomic uncertainty pressured consumer demand more broadly, resulting in weaker spend across home improvement projects.

– Home Depot CEO

So this is where the bearish thesis starts taking a bigger hold. If the argument is that home improvement or maintenance activities would re-accelerate when the Federal Reserve cuts interest rates, I doubt a 25 or even a 50 basis point cut would have any noticeable effect (Mortgage rates have already started to drop in anticipation of rate cuts). If there are deeper cuts that would likely happen in the event of a recession which won’t bode well for a consumer discretionary company such as Lowe’s.

Risks to this thesis (Mixed signals from the economy)

While there are certainly warning signs that there is a looming danger to the economy, there have been contradicting signs as well.

Warnings signs have come in the form of a weakening labor market, the Conference Board’s Leading Economic Index (LEI) on a downward trend, and the highest credit card account delinquency in more than a decade.

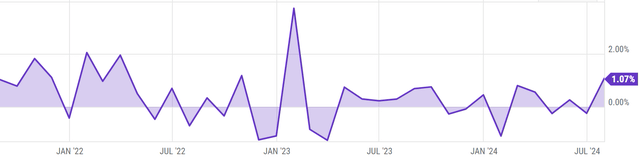

But we have also seen the highest retail sales in July since early 2023 (1% acceleration, excluding auto-related items it was 0.4% better than expectations of 0.1%).

Retails Sales MoM (Ycharts)

Additionally, earnings from Walmart (WMT) show that it topped Q2 estimates and also raised its FY25 outlook. Its net sales and operating income were the highest in the past two years. I, for one, will be eagerly watching the earnings call of Lowe’s and also of Target next week to see if the recent positive signs were outliers in an otherwise down-trending economy or if I should completely revisit my thesis. Watch and learn!

Lowe’s valuation does not hold up in risky scenarios

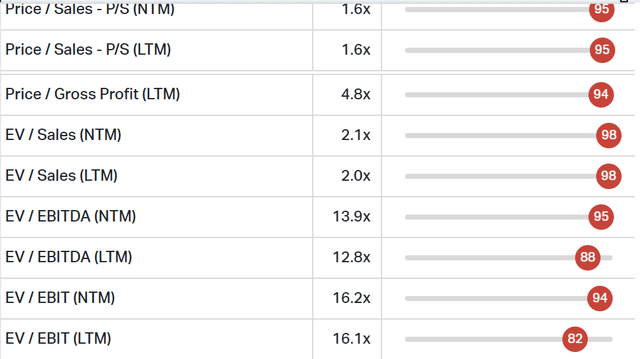

Currently, Lowe’s Companies trades at a PE multiple of 19.3x and the outset does not look bad and may even be fair when compared to its sector. But this is only as far as it goes. Its PE ratio does not hold up under a down-trending scenario and its enterprise value to EBITDA is trading at close to its highest levels compared to its history (Percentile ranks show that almost 90% of the time the valuation ratios were below the present values)

Percentile Rank of Valuation ratios (Koyfin)

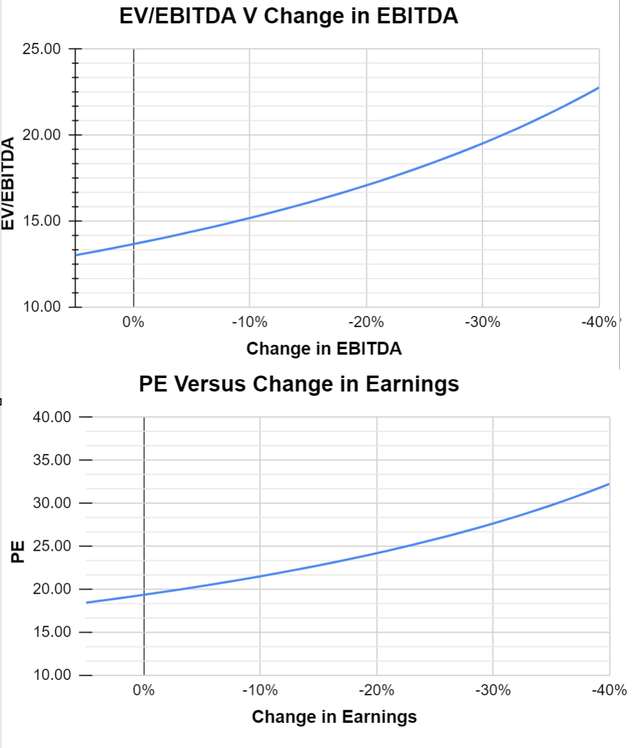

But how bad can it get? We can see that by observing the ratio over a range of drops in earnings. If some of the pessimistic situations from a downturn turn out to be true, then ratios start climbing above 15x for EBITDA and 22x for PE (10% drop). Under such scenarios, it is likely that the stock will correct from its present levels.

Author generated

Action

I will be acting on my short-term bearish view through the use of far-out-of-the-money put options. These options have the benefit of a big payoff if the stock undergoes a big correction in the upcoming months, but I will lose small if I am wrong.

While buying this, a few things of note –

Deep OTM put options with at least 3 months to expiry have asymmetry but rely on high volatility or significant price correction to provide any real benefit (Payoff is significant in case my thesis works out and the price moves in my favor or implied volatility resets to a significantly higher value). I have exposure to contracts expiring in October and November at various strike prices ($190, $200, $210). Payoffs vary depending on the premiums paid and the move of the stock. Far OTM puts can potentially generate 10x – 50x the investment Sufficient Liquidity and volume to ensure the spread between bid and ask is reasonable This strategy or modifications of this strategy (Ex: Shorter-dated puts such as September 20 expiry and closer strike price) could also work for individuals with significant long exposure to Lowe’s or stocks exposed to the economy in general and who want to protect themselves from any short-term downside. The far expiry provides protection to a high beta portfolio (Any volatility in the market should be reflected in the stock as well as its beta is 1.16. The source of volatility is not as important as the effect on the portfolio itself )

It has to be stressed, that the implied volatility is higher than usual as earnings are imminent (pre-market August 20) and market participants are expecting a move in the stock (up to 10% moves could be priced-in for earnings). So if the stock moves up due to a favorable reaction to earnings, does not react, or even moves down matching the expected move, the premiums paid to the options could lose their entire value.