John Touscany

When the market offers to teach you a lesson, it’s generally a good idea to pay attention. I’ve long been quite positive on the quality of Kirby’s (NYSE: KEX) management and business, particularly with the company’s strong share of the U.S. inland tank barge market and its focus on disciplined fleet management. I was also positive on the overall dynamics of the industry, as supply and demand were developing in Kirby’s favor given the expansion of Gulf Coast petrochemical production and limited industry fleet growth.

Here’s where I screwed up – in my last article on the company I got too caught up in concerns about a weaker U.S. economy impacting demand for petrochemical products (as well as demand for the products and services provided by Kirby’s Distribution & Services segment) and how the Street may take a more cautious view on economically-sensitive carriers like Kirby. I decided that some undervaluation wasn’t good enough and wanted to wait for an even better entry price.

That was absolutely the wrong call. The shares dipped a couple of points lower after that, but only briefly, as the barge market continued to tighten, sending pricing to a multi-decade high and setting the stage for years of strong margins. With that, the shares are up more than 60% and this goes in the “missed opportunity” bucket. I don’t think that Kirby’s potential has plateaued and there are still reasons to consider this well-run play on a tightening market.

A Pretty Classic Supply-Demand Imbalance

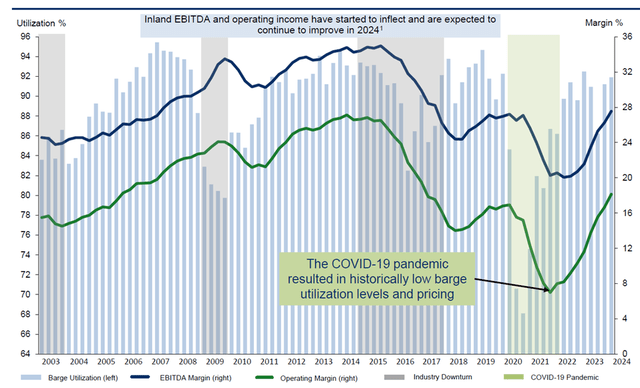

The inland tank barge market has seen plenty of cyclicality over the years, with some of that driven by economic cycles and some (arguably more) driven by operator fleet expansions and contractions. With COVID-19 squeezing many operators and with pretty minimal newbuild activity since then (less than 1% of the fleet in any particular year), as well as scrap rates above newbuilds and new maintenance regulations, there’s now a lack of barges relative to growing demand spurred by increased petrochemical refining/production capacity in the Gulf Coast area.

The following graph from Kirby’s current investor presentation highlights some of the historical cyclicality and its impact on utilization and margins:

The cyclicality of the barge business (Kirby investor presentation)

Inland spot rates are now around $9,500 to $10,000 (up from $9,000 a year ago) and Kirby’s most recent inland revenue per ton-mile figure ($0.117) was, I believe, the highest the company has achieved in over two decades if not longer. With strong pricing, healthy utilization, and disciplined cost management, Kirby is seeing 300bp-plus year-over-year margin improvements in the inland business and this momentum could last into 2027 given the lead-times on newbuilds.

Speaking of newbuilds, there isn’t as much shipyard capacity as there used to be and between limited capacity and inflation, the cost of a newly-built inland tank barge has roughly doubled from pre-pandemic levels (to around $4M). At that cost, it takes dayrates of around $14,000 to generate a double-digit IRR, though I’ll note that operators have accepted lower IRRs in past cycles, so I expect newbuild activity to pick up before rates hit that $14Kpd level.

For the time being, though, Kirby is sitting pretty with around 30% share of the inland barge market and not much new competition in sight, as well as good demand outlook from Gulf Coast producers (subject to some economic sensitivity). I’d also note that Kirby is one of the only ways to play this dynamic – MPLX (MPLX) does have a meaningful barge fleet, but also a more diverse set of midstream energy assets.

Coastal Seeing Similar Attractive Dynamics

While Kirby’s inland tank barge business is the main driver here, the coastal business has come alive here of late too. Operating conditions have been more challenging here for a while, but Kirby has stayed the course and exited some less promising parts of the business and now sits as a leaner operator (#2 in total capacity) servicing blue-chip oil and petrochemical customers.

Not unlike the inland barge market, the economics of new construction for coastal barges argue for higher prices if new capacity is going to come into the market (newbuild costs have jumped from $85M pre-pandemic to $130M).

In the most recent quarter, Kirby reported strong mid/high-90%’s utilization and contract renewal pricing was up in the low-20%’s year over year, while spot pricing was up in the low-30%’s. That, in turn, led to the best margin for the business in almost a decade at “high single-digits to low double-digits” (regrettably, Kirby doesn’t report specific earnings/margins for inland and coastal).

Inland barging economics are driven in part by the cost advantages of barges over rail or road transport, and the same is broadly true for coastal. In both cases, these businesses benefit not only from increased demand for petrochemical inputs and products, but also reluctance to approve and build new pipelines, with barges used to move crude to refineries and then move refined products to markets along inland waterways and the coast.

Powering Up D&S

Kirby’s Distribution & Services business has always been something of an odd duck, with lower margins and less consistent performance than the barging operations. While there have long been debates about whether Kirby should continue on with these operations, they’re here for the foreseeable future and merit discussion.

The first quarter of this year saw a nearly 2% year-over-year revenue decline driven in large part by weaker demand in the oil/gas segment (down 43%) as U.S. rig counts decline at a double-digit rate. Commercial/industrial was down 7%, as higher marine activity was offset by weaker on-highway demand.

The standout was the power generation business (up 50%), which has now grown to a point where the company is breaking it out for separate reporting and discussion. This business provides backup power systems for a range of customers, including industrial, retail, and data center sites, and does so as a distributor, fabricator, and service provider for system manufacturers like Caterpillar (CAT). Management believes this business could generate double-digit margin at scale (versus overall D&S margin of 6.6% in the quarter), and with increased interest in micro-grids, to say nothing of growth in data center construction, I could see this segment offering some worthwhile growth for years to come.

The Outlook

While the U.S. economy is still looking sluggish in some respects, I’m not going to double down on that mistaken idea that the market is going to avoid these shares on fears that weaker activity is going to lead to enough pressure on petrochemical demand to impact Kirby’s business in a meaningful way. Instead, I expect the company to see good leverage through 2026/2027 from inland and coastal barge fundamentals that argue for strong pricing and bull-cycle margin expansion.

To be clear, I’m not saying there’s no economic risk here, but I think the risk is more than offset by barge industry dynamics. If anything, the bigger threat to Kirby on a quarter to quarter basis is likely to be river operating conditions, with poor weather, lock delays, and other navigational hazards presenting a risk to revenue generation.

Kirby did about as I expected in FY’23 ($3.09B revenue versus my estimate of $3.08B and EBITDA of $557M versus my estimate of $565M) and first quarter results don’t give me reason to change my numbers for FY’24. I’m looking for about 7% year-over-year revenue growth this year, with about 250bp of yoy EBTIDA margin expansion and improved free cash flow generation.

I’m expecting around 6% revenue growth from 2023-2027 (roughly double the long-term trailing growth rate), with EBITDA margins heading toward the mid-20%’s and free cash flow margin peaking in the mid-to-high teens. I’m not too concerned about Kirby getting into an aggressive new-build program; historically they’ve preferred to acquire younger barges to renew their fleet.

Kirby doesn’t look that cheap on discounted cash flow, but that’s normal when the company moves into its margin expansion phase. A forward EBITDA multiple of 12.5x (a $129 fair value) can be supported by near-term margins/returns (ROIC, et al), and it’s not that rare for the shares to trade higher in the up-cycles, so if you want to argue that the Street will willingly pay 15x EBITDA for the impending earnings momentum, I don’t really disagree. Likewise, you can look at what the market has paid in P/E terms in past up-cycles and argue for a fair value in the $130’s.

The Bottom Line

Taking a neutral stance on Kirby back in October of last year and being more positive today is less about chasing the stock and more about realizing I was too focused on the short term sentiment risk and got greedy hoping for an even more attractive entry point. I thought the shares were undervalued then, and I still see an argument for a higher price based on strong pricing and expanding margins.

At today’s higher level, it’s a challenging call for different reasons. I can make an argument for Kirby trading to $150 or above on the basis of past cycle valuations and the opportunity to deliver beat-and-raise quarters, but is that enough upside to take on the risk of what has always been a cyclical stock?

I’m not willing to say today that the cycle has gone as far as it can go or that the market has fully priced in the potential of this current supply/demand imbalance and margin expansion opportunity, but I’d still advise a little caution and certainly wouldn’t consider this a buy-and-hold idea for long-term investors.