Thomas Barwick/DigitalVision via Getty Images

Investment Thesis: I still take a long-term bullish view on InterContinental Hotels Group, but the stock might see modest growth over the short to medium-term.

In a previous article back in November, I made the argument that InterContinental Hotels Group (NYSE:IHG) (OTC:ICHGF) has the capacity for further upside, on the basis of growth in RevPAR and occupancy across the Holiday Inn Express brand.

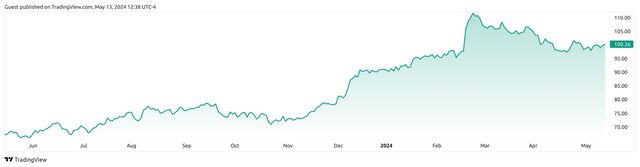

The stock has appreciated considerably since then, up by over 30% to $100.36 at the time of writing:

TradingView

The purpose of this article is to assess whether InterContinental Hotels Group has the capacity to continue its growth trajectory from here, taking recent performance into consideration.

Performance

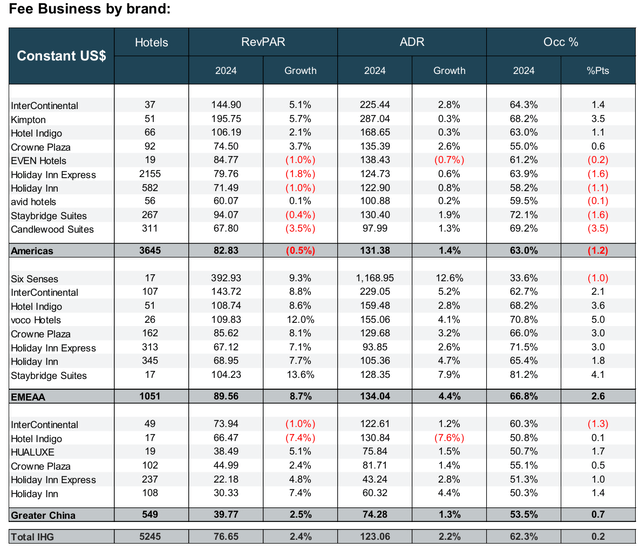

When looking at Q1 2024 financial results for InterContinental Hotels Group as released on May 3, we can see that total RevPAR (revenue per available room) across all brands was up by 2.4% from that of the prior year quarter.

IHG Supplementary Information – Q1 2024

Across the Americas, we saw RevPAR decrease by -0.5%, which was the result of a drop in occupancy of -1.2% despite an ADR (average daily rate) increase of 1.4%.

Moreover, we also see that growth in ADR outpaced that of occupancy with growth of 2.2% versus 0.2%, respectively. This indicates that revenue growth has been largely price-driven, and across the Americas in particular – we are starting to see a decline in occupancy in the face of rising prices.

Notably, while I had previously expressed optimism of upside in the stock on the basis of growth in RevPAR and occupancy for Holiday Inn Express (which is the largest brand for InterContinental Hotels Group by number of hotels globally), we can see that RevPAR was down by 1.8% for the brand – which (with the exception of Candlewood Suites) marked the largest drop in RevPAR for brands across the Americas.

My Perspective and Looking Forward

As regards my take on the above results, there are clear signs of a plateau in RevPAR growth and occupancy across several brands has started to fall in the face of rising prices.

At the same time, the company’s global pipeline of 305,000 rooms is up by 6.6% year-on-year, with development signings across Greater China having risen by 22% YoY. IHG has also reached an agreement with NOVUM Hospitality to allow 108 open hotels as well as 11 hotels under development to join the IHG brand between now and 2028, and this would be expected to double the size of the company’s hotel portfolio in Germany – a country which already generates the second-highest number of overnight hotel stays in Europe at 450 million.

We can see that RevPAR growth remained comparatively strong across EMEAA at 8.7%. In this regard, I take the view that the company’s focus on expansion across the German market is a prudent one, and provided RevPAR growth across EMEAA remains on its current growth trajectory – the company has the capacity to bolster overall revenue further going forward.

While the stock saw considerable upside in late February to above the $100 mark, this was in significant part due to the announcement of an $800 million share buyback programme when 2023 full-year results were released on 20 February 2024 – which is now 30% complete with 2.3 million shares repurchased to date at a cost of $239 million.

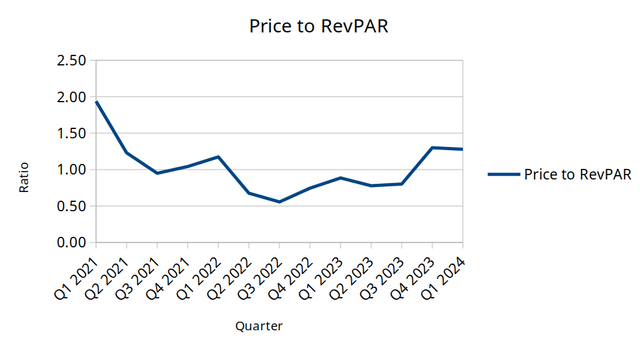

We can see that the price to RevPAR ratio has increased slightly over the past couple of quarters – and currently stands at 1.28x, which is higher than the average of 1.03x from Q1 2021 to the present.

Price to RevPAR ratio calculated by author.

From this standpoint, I take the view that the stock is likely to be fairly valued at this point in time, and while IHG did see significant upside on news of the company’s share buyback programme, the stock has started to see a gradual descent since then.

Risks

In my view, while the stock has the potential for long-term upside given strong RevPAR performance across EMEAA and continued expansion across the German market – there is a risk that RevPAR could see a plateau in growth given that we are already seeing signs of occupancy falling in response to higher ADR.

With brands such as Holiday Inn Express accounting for a substantial portion of the company’s overall portfolio – InterContinental Hotels Group caters largely to the mainstream market. For instance, companies such as Hyatt Hotels (H) that cater largely to the luxury sector have demonstrated a capacity to continue increasing both ADR and occupancy across their brands, given that luxury customers show lower price sensitivity.

However, this is not the case for InterContinental Hotels Group – and should we see RevPAR across EMEAA decline given lower occupancy in the face of higher prices – then we could see downward pressure on overall RevPAR which in turn would be expected to lead the stock lower.

Conclusion

To conclude, I take the view that InterContinental Hotels Group has the capacity for longer-term upside given its continued growth across the German market and overall strong RevPAR performance across EMEAA.

However, I take the view that the stock is fairly valued at this time, and we would need to see evidence of renewed RevPAR growth more broadly to justify further upside in the short to medium-term.