DKosig

Hercules Capital, Inc. (NYSE:HTGC) is a BDC with a market cap over $2.62. billion, which easily ranks it as one of the largest BDCs in the U.S.

Besides the average or common characteristics of a BDC, there are three elements that distinguish HTGC without even looking deeper into the underlying substance.

First, HTGC lends and invests in VC-type businesses such as life sciences, technology, SaaS finance and renewables. The typical range of the ticket size is from $5-$200 million spread across asset finance, growth capital and pre-IPO (including M&A) transactions. While there are a couple of other BDCs that focus on the VC segment, there are not many or at least it could definitely not be deemed as a standard, where most BDCs tend to focus on non-cyclical and already established businesses.

Second, HTGC has an attractive yield of ~9.1% despite having a payout ratio of 79% and a price to NAV premium at ~1.5x. This is mostly driven by high-yielding investments (including loans and equity) that are associated with inherently more volatile VC exposure that demands higher premium.

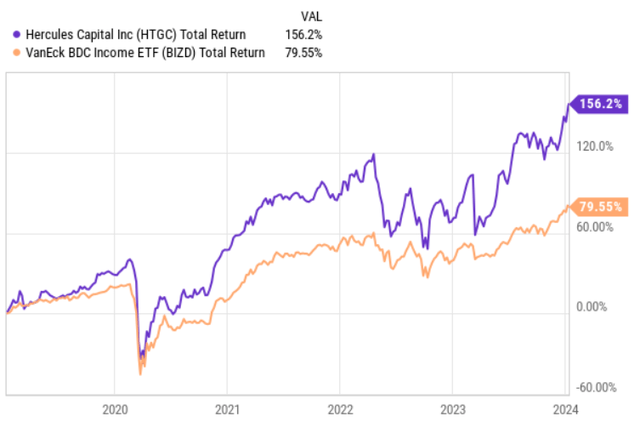

Third, HTGC has showcased an ability to outperform the market (i.e., BDC index) even considering the drop in early 2020 and higher interest rates, which are unfavorable for VC-type business activity.

YCharts

So, currently, HTGC’s case seems rather interesting with only a theoretical concern stemming from the reliance on VC businesses.

Let’s now assess the portfolio and some of the underlying elements in a more detailed manner to understand whether it might be worth considering going long HTGC at this moment.

Thesis

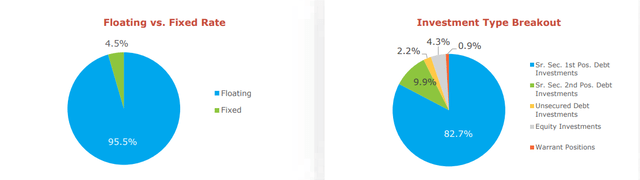

In terms of the portfolio structure, HTGC is well-positioned and really in line with what we can see among solid BDCs. Namely, the lion’s share of the total investments come from floating rate instruments, which come in handy during times when SOFR is at elevated levels. Then, the breakdown by investment type is also nicely structured, where ~83% of the total exposure lies in senior secured first lien, ~10% in one category below that and only ~7% in very speculative (in VC context) assets such as unsecured debt, equity investments and warrants.

HTGC Investor Presentation

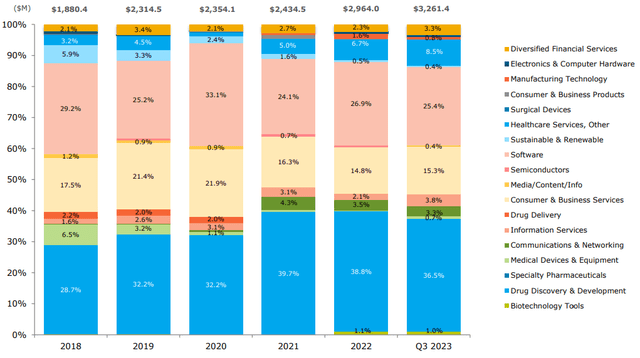

The industry diversification angle could have been better. From the graph table below we can see how HTGC is considerably exposed to three major industries: drug discovery & development, consumer and business services, and software. Together these three industries account for ~67% of the total AUM.

Yet, having said that, while this is above average compared to the average BDC, if we contextualize with VC-focused BDCs, we would observe a similar pattern (i.e., concentration risk in a couple of industries).

HTGC Investor Presentation

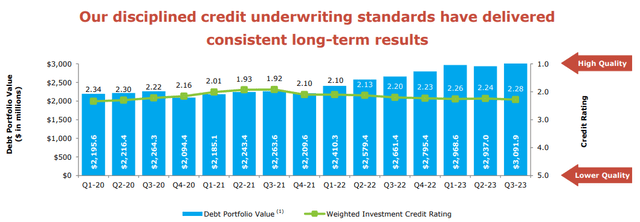

Now, what is rather interesting (to say the least) is the fact that HTGC has managed to maintain solid and consistent portfolio quality during pandemic and high interest rate periods, which per definition should introduce notable headwinds for VC businesses that are still reliant on external financing, which tends to ebb and flow with the market dynamics.

On average, HTGC has maintained a portfolio quality of ~2.2x, which means that most of the portfolio has performed as expected without registering major losses.

HTGC Investor Presentation

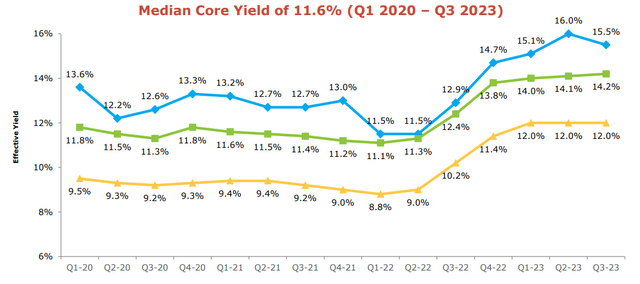

It is also interesting to look at the core yield statistics (i.e., the green line below), where we can see yield levels that are actually not significantly above the average what is usually observed across the BDC peer landscape. Core yield of ~14.2% could be deemed even in line with that of the average BDC, which lends and invests in non-VC businesses.

This signals that the assumed risks in HTGC’s portfolio are not actually that elevated or at least significantly above what we can see in standard BDCs. If we couple this with the favorable rating dynamics, it makes sense why HTGC has succeeded in outperforming the benchmark even taking into account the COVID-19 and high interest rate period.

HTGC Investor Presentation

Finally, the external leverage load of HTGC is also structured in a prudent and favourable manner, allowing the BDC to capture an increased spread from the portfolio yield and its cost of capital.

HTGC Investor Presentation

There are two specific items that are worth highlighting in this context:

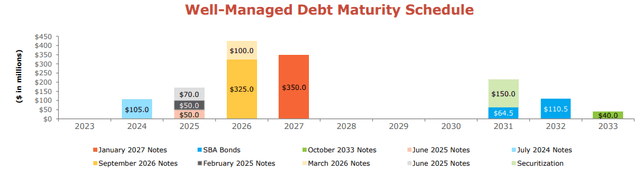

HTGC carries a debt to equity ratio at 98%, which is materially below the sector average of 117%. Most of HTGC’s borrowings are fixed (locked in at relatively low or below market interest rates) with distant maturity dates, where first major refinancings are set to take place starting only from 2026.

The bottom line

As most of my readers know, I am a huge skeptic when it comes to BDCs which put an emphasis on VC-type businesses as, in my humble opinion, this brings in a major sensitivity to economic cycles and available liquidity into the system.

Nevertheless, HTGC is a different kind of VC-focused BDC. The portfolio quality is robust and resilient, which we can see not only by looking at the track-record across COVID-19 and high interest rate environments, but also from the underlying yield levels, which indicate no astronomical risk premiums.

Then the fact that HTGC is less leveraged than the average BDC out there and has a well-structured external debt profile in terms of the fixed debt maturity profiles introduces an additional layer of safety (or at least buffer to the current dividend).

I would rate HTGC a buy with an assumption that this BDC does not constitute a notable chunk of the overall portfolio given (still) the VC-focus and its recent gains over the BDC index.