brightstars

I have been holding gold as a counter-weight to my equity portfolio for more than five years now and in this relatively short time period we had a number of peaks and troughs in sentiment towards the precious metal.

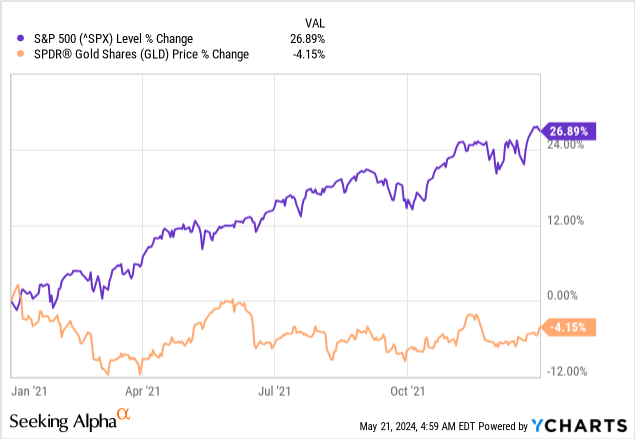

During periods when the price of gold or that of the SPDR® Gold Shares ETF (NYSEARCA:GLD) lags behind the S&P 500 or the equity market more broadly, we usually witness significant skepticism towards the precious metal.

A good example of such time-frame was 2021, when extreme liquidity within the market has caused a significant risk-on trade. What followed was unsustainably high valuations in equities (and more specifically high duration loss making growth stocks) and significant underperformance of the GLD against the S&P 500.

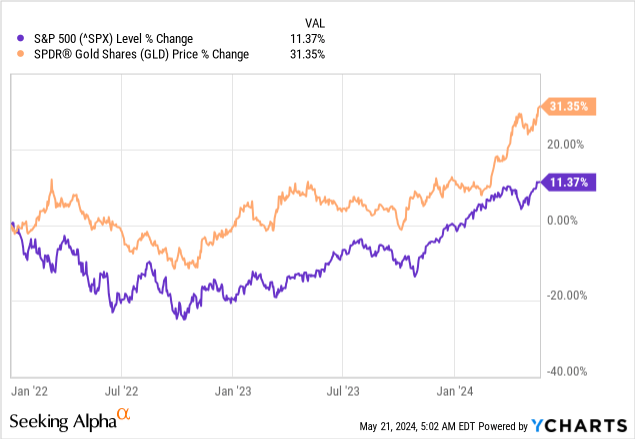

In hindsight, the end of 2021 marked a very good period to buy gold just as many analysts out there were trumpeting the obsolescence of gold as a mean to improve returns. Since then, GLD has done far better than the S&P 500.

Although I’m not timing the market with my gold position, I highlighted the importance of holding gold in addition to an all-equity portfolio just as the GLD was trading at multi-year lows in the summer of 2022.

Seeking Alpha

At present, we see a different narrative occurring. Gold and other precious metals are up significantly since the beginning of 2024 and we once again hear about gold hitting $3,000 an ounce or even higher levels by year end.

With gold now trading at $2,400, the $3,000 mark appears to be within reach. Although it is certainly possible that we see gold trading at these levels this year, the though process of anticipating it is a flawed one in my opinion.

As opposed to productive assets and assets that offer some kind of cash distributions, gold is not an asset class that needs to be valued or one that needs a price target. Especially when it comes to short-term periods of about a year or two.

The Right Way To Think About Gold

Over the years, I have seen many gold price forecasts and various “valuation” models that rely on all kinds of esoteric assumptions.

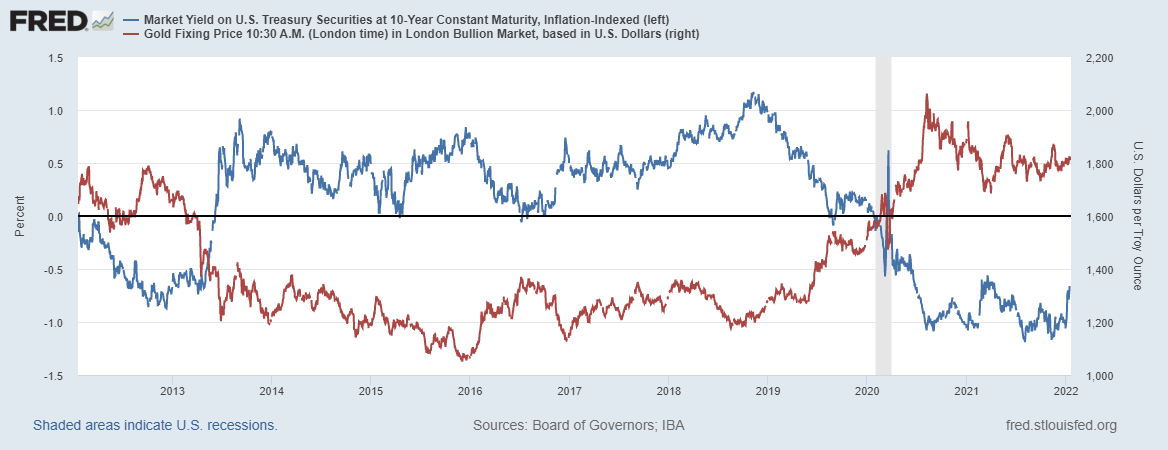

One of the most popular ways to predict the price of gold, however, used to be the level of real interest rates. There was a solid reason behind it with the precious metal exhibiting negative correlation with real interest rates over the years. On top of that, the narrative that gold is in competition with interest paying instruments was also easy to digest. After all, gold has an opportunity cost behind it since it doesn’t pay any interest.

As the narrative proliferated, many investors were led to the conclusion that gold should fall sharply in the coming years as negative to near-zero interest rates were not sustainable. Indeed, ultra-low interest rates are not sustainable and as we see now are likely headed higher for longer, but the problem was that gold is not inversely related to real interest rates once you have a long enough investment horizon.

I dedicated a whole article on this issue back in early 2022 when arguing against this relationship was hard to conceive by most market participants.

FRED

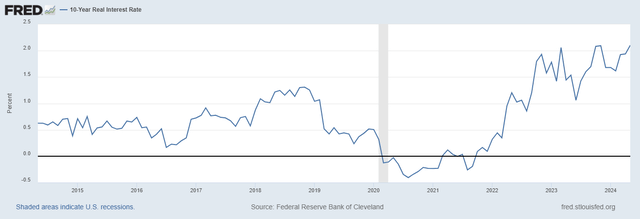

All of a sudden, no one seems to be talking about the price of gold in relation the real interest rates as the negative relationship has suddenly turned positive and both are now significantly higher to what they were back in 2022.

FRED

This clearly illustrates why trying to predict the price of gold even based on what appear to be solid relationships is a futile exercise and at the end of the day price targets are as good as guessing.

Instead of arbitrary price targets that often bring in positive emotions associated with spectacular returns, the whole argument for holding gold resides around the risks for the existing monetary system. That is also why inflation is often a major tailwind for gold, but not because the precious metal should necessarily keep up with consumer prices, but rather because high and persistent inflation is a major risk for the monetary regime.

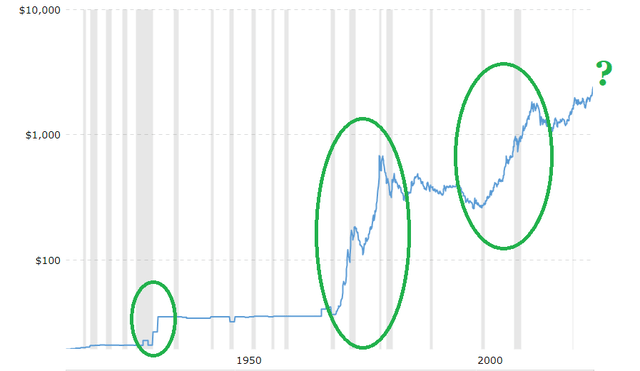

In a nutshell, holding gold makes sense as an addition to equity portfolios during periods of heightened risk for the monetary system. This has been the case during the three periods marked in green on the graph below, when risks for the existing monetary system skyrocketed and necessitated a major shift. I covered all that in a thought piece back in 2019, called “A Long-Term Take On Gold And Trust In The Monetary System”.

Gold Prices – 100 Year Historical Chart

Macrotrends website (log scale)

All that brings us to today when more than a decade-long quantitative easing, helicopter money and negative interest rates have been the symptoms that the current monetary system is ripe for a change and hence gold has been performing well. Levels of sovereign debt and fiscal deficits are also a cause of concern and signal that implied risk for the monetary system is high.

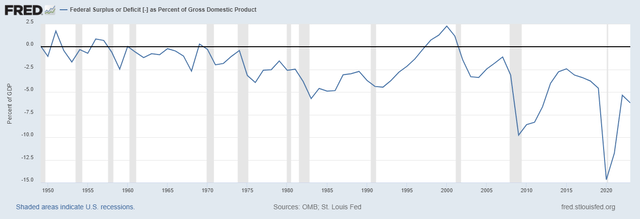

For example, we haven’t seen a proper recession in the U.S. for roughly 15 years and at the same time the U.S. government is running a very high deficit. Historically, the opposite has been true – during times of economic prosperity the deficit has been narrowing down, only to expand during downturns.

FRED

With all that in mind, gold remains highly attractive and the GLD is among the most popular ways to get direct exposure. Having said that, however, fluctuations in the short-term are to be expected both on the upside as well on the downside.

How Am I Playing It

Instead of using arbitrary price targets I have been having direct exposure to gold for more than five years now just on the basis of everything said above.

Even though market participants’ sentiment shifts in either direction over the years, I intend to hold gold until the current risks for the global monetary system are resolved. A laid out some of these risks back in early 2019 and although they evolve over time, the underlying hypothesis remains unchanged.

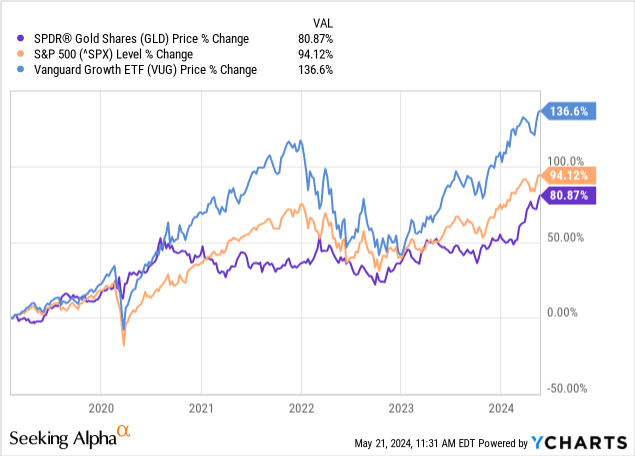

Since then, the GLD has returned more than 80% which is not very far off from the S&P 500. However, on a risk-adjusted basis, the GLD has done far better with significantly lower volatility.

Growth stocks, as measured by the Vanguard Growth Index Fund ETF Shares (VUG), have returned nearly 140% over the period, but as we see above this has come at a price – even higher volatility than the S&P 500. Just recently, investors were reminded of these risks when growth stocks collapsed in 2022, while the GLD held-up in value.

On top of all that, growth stocks are once again trading at extremely high levels and the broader equity market is valued near all-time highs with the Shiller P/E ratio being higher only two times in history – during the dot.com bubble and in late 2021.

multpl website

In addition to direct exposure to precious metals I sometimes take concentrated positions in high quality gold and silver miners. I don’t do this for the same reason that I hold gold, but rather as a more speculative way to time the market with relatively small positions.

One such example has been Agnico Eagle Mines Limited (NYSE:AEM), which I bought in 2022. The stock has now delivered a total return of more than 70% in a span of less than two years and I am now trimming down my position. Although this trade has been highly successful it is not part of my core investment strategy that I outline for subscribers of my Investment Group. It also involves a very different approach to simply investing in gold and is not a way to minimize risk to the extent that the GLD is.

Investor Takeaway

As gold continues to make new all-time highs, the optimism around the precious metal seems to have returned. Arbitrary price targets are everywhere to be seen and ultimately some of these will be hit. Although I remain positive on the price of gold, it is impossible to predict short-term movements which is the reason why having a longer investment horizon is crucial. Equally important is not to get caught up in short-term shifts in sentiment as well as specific models that try to produce some specific numbers as a target for the price of the precious metal.