Sumedha Lakmal

Thesis

GitLab Inc. (NASDAQ: GTLB) presents a compelling investment opportunity due to its strong position in the rapidly growing DevOps market, innovative product offerings, and potential for continued growth despite facing intense competition.

Company Overview

GitLab is a complete DevOps platform delivered as a single application, covering the entire software development lifecycle from planning to monitoring. Founded in 2011, the company went public in October 2021.

Reasons to Consider Investing

1. Strong Market Position in a Growing Industry

The global DevOps market is experiencing rapid growth, with a projected CAGR of 24.7% from 2021 to 2028, according to Grand View Research. GitLab’s all-in-one platform positions it well to capitalize on this trend as companies increasingly adopt DevOps practices.

2. Compelling Product Offering

GitLab offers a single product with tools for the entire DevOps lifecycle. This is different from competitors who often have fragmented solutions, and need integrations with other applications. The integrated approach of GitLab can increase efficiency as engineers don’t need to piece together multiple applications, this in turn, can lead to cost savings for customers, which can increase adoption.

As a Software Developer myself I have personally used only GitHub. That is up until this point. This is because using GitLab I have everything in one place. And I can assure you that one of the hardest parts of software development is integrating tools.

More reasons for using it here.

3. Strong Revenue Growth

GitLab has put out impressive revenue growth. Reporting a revenue of 667$ million for Q1 2025 and a 2-year CAGR of 39%. Which is more than the CAGR for the industry, with a 5-year historical of 15.90% and a 2-year projection of 22%. This growth trajectory indicates strong market demand for their products.

4. Expanding Customer Base

The company has shown consistent growth in its customer base, more importantly, among larger enterprises. As of Q1 FY2025, GitLab reported 1,025 customers with annual recurring revenue (ARR) of $100,000 or more, up 6.82% just from last quarter and a 25.85% year-over-year increase.

As companies start using GitLab instead of its alternatives, more developers will be familiar with it, prompting further adoption by other companies and trickling down to smaller companies.

5. High Net Dollar Retention Rate

GitLab’s net dollar retention rate was 129% for Q1FY2025, indicating strong customer satisfaction and increased spending from existing customers. This metric suggests the company’s ability to upsell and expand within its current customer base.

Valuation

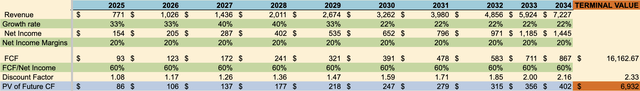

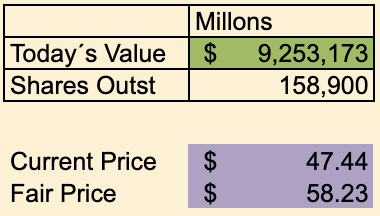

Using a discounted cash flow technique we can calculate a fair price for the stock.

Assuming a revenue growth of 33% (similar to the 39% CAGR presented above) for the first 2 years and a subsequent increase to 40% as the product becomes a strong option and followed by a 22% following the projected market growth presented above. As for the net income, we took as reference historical data for the Software (System & Application) industry.

Author with data from the company Author with data from the company

In the current context of a stagnant market and only a few companies doing well, this 22.75% increase is promising.

Risks and Considerations

1. Intense Competition

The DevOps market is highly competitive, with players like GitHub (owned by Microsoft(MSFT)), Atlassian(TEAM), and JFrog(FROG). GitLab needs to continue to innovate to maintain its market position. This is something that can affect the path to profitability since greater investments might be needed.

2. Path to Profitability

Like many high-growth tech companies, GitLab is not yet profitable. In FY2024, the company reported an operating loss of $187,44 million. Investors should consider the company’s path to profitability and potential future capital needs that can lead to dilution.

3. Valuation Concerns

As of August 2024, GitLab’s stock price has experienced significant volatility since its IPO. The company’s high price-to-sales ratio (around 11.86x as of August 2024) may concern value-oriented investors. But, we need to take into account that this is a tech stock, and as such it carries a premium.

4. Cybersecurity Risks

Due to the nature of its business, GitLab is exposed to security breaches that could significantly impact its reputation and drive stock prices down. And as more high-profile companies move their assets to GitLab’s products, it becomes an increasingly rewarding target.

Conclusion

GitLab offers an intriguing investment opportunity for those bullish on the DevOps market and who are willing to accept the risks associated with high-growth tech stocks. The company’s strong market position, compelling product, and impressive growth metrics make it attractive. However, investors should carefully consider the competitive landscape, path to profitability, and current valuation before making an investment decision.

Also, investors should consider personal financial goals and risk tolerance before investing in GitLab.