DustinSafranek/iStock Editorial via Getty Images

Introduction

It’s time to talk about Union Pacific Corporation (NYSE:UNP), one of the first additions to my dividend growth portfolio and one of my highest-conviction investments.

In the past, I have gone with very bullish titles, with my last articlepublished on April 26, titled “Vena Magic! Why Union Pacific Just Hit A Grand Slam.”

Back then, Union Pacific became the most efficient railroad among Class I giants in North America. Jim Vena and his team had figured out how to position the railroad effectively in a very challenging environment of sticky inflation, weak growth in manufacturing output, poor consumer sentiment, and ongoing operational headwinds.

Here’s a part of my takeaway back then:

Union Pacific’s recent earnings report highlights its remarkable resilience and operational strength in a challenging economic landscape.

Despite stagnant revenue growth, the company has significantly improved its operating ratio, proving its efficiency even in light of inflationary pressures.

By strategically addressing market challenges and enhancing customer engagement, Union Pacific is poised for sustainable growth.

Now, I have the opportunity to update my thesis using the just-released earnings. The numbers confirmed my thesis and made me believe that UNP has become one of the most promising railroads among its peers.

It’s both implementing measures to offset current headwinds and positioning the railroad to be one of the biggest winners in an environment of returning demand.

So, as we have a lot to discuss, let’s dive into the details!

Union Pacific Keeps Performing Well

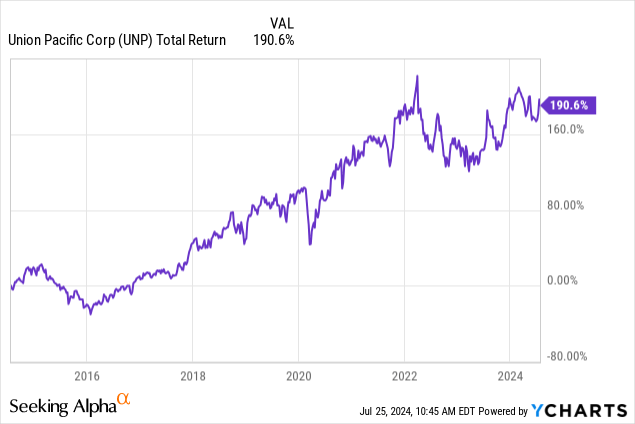

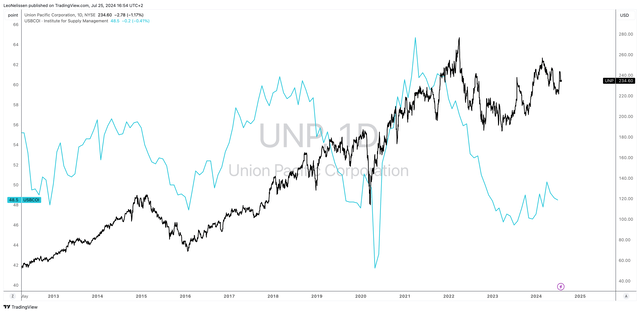

Union Pacific’s stock price peaked in March 2022. Since then, it has gone sideways. The reason behind this sideways trend is weaker economic growth expectations.

The chart below compares the ISM Manufacturing Index (blue line) to the Union Pacific stock price. Cyclical economic growth expectations peaked in early 2021, briefly after the global economy ran red-hot due to massive stimulus and the end of lockdowns.

TradingView (ISM Index, UNP)

In general, the past few years have been tough, as weakness in manufacturing was not the only problem. Consumer sentiment and extreme headwinds in intermodal posed issues as well, as retailers started to reduce inventories, lowering demand for new goods.

Nonetheless, despite these headwinds, Union Pacific has been doing very well since Jim Vena took over as CEO of America’s largest public railroad.

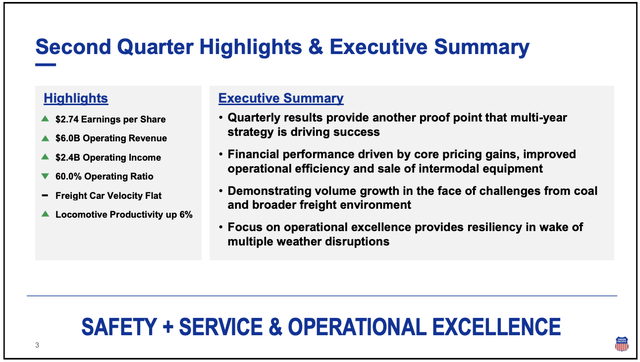

This continued in the second quarter, as the company grew revenues by 1% to $6.0 billion.

Union Pacific Corporation

According to the company, despite challenges like weak coal demand (caused by, i.e., very low natural gas prices), it achieved solid pricing gains and secured new business.

To be specific, freight revenue, which is the majority of the company’s revenue, totaled $5.6 billion. This also reflects a 1% increase. This growth was mainly driven by core pricing gains that added 150 basis points to freight revenue.

So far, so good.

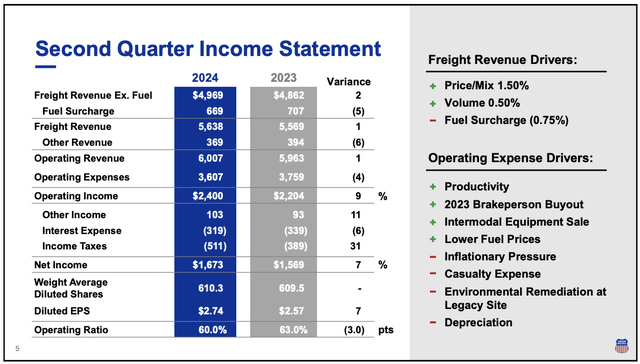

What caught my eye wasn’t just positive revenue growth in an environment of very poor manufacturing sentiment, but also that the company was able to cut costs in an environment of elevated inflation.

Union Pacific Corporation

As we can see above, operating expenses fell by $152 million to $3.6 billion. This was achieved by significant productivity improvements “across most cost categories,” according to the company’s 2Q24 earnings call.

One specific example is that compensation and benefits expenses were reduced by 6%, driven by a 5% decline in headcount and improved productivity.

It also helped that fuel expenses fell by 6%, mainly due to lower fuel prices.

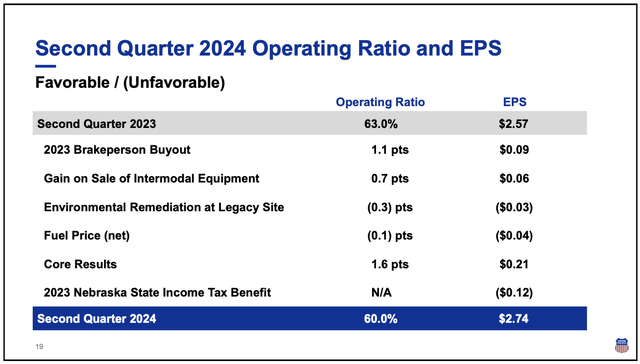

Thanks to higher revenues and lower costs, the company grew operating income by 9%, lowering the operating ratio to just 60.0%, a number I did not expect to be possible in this environment.

Union Pacific Corporation

Net income came in at $1.7 billion, paving the road for a 7% increase in EPS.

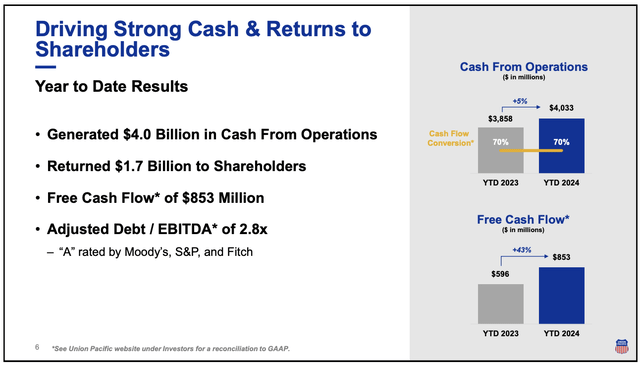

Moreover, cash from operations increased by $175 million to $4 billion. Free cash flow improved by 43% to $853 million, allowing the company to improve its financial position and ability to grow its dividend and buy back stock.

Union Pacific Corporation

After having abandoned stock buybacks to protect its A-rated balance sheet, the company restarted buybacks. It bought back $100 million worth of stock in June. Including dividends, it distributed $1.7 billion.

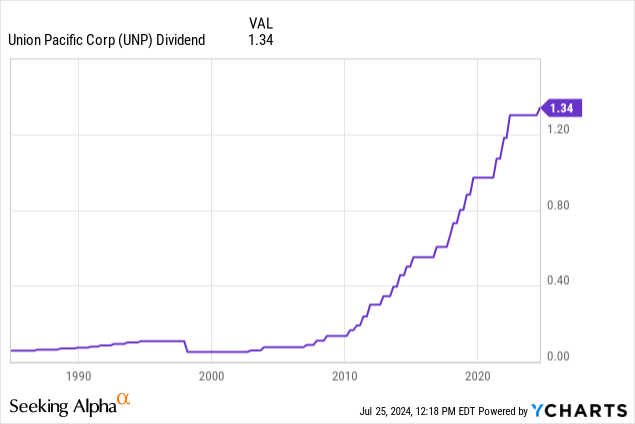

It also hiked its dividend again – this time by 3%. UNP currently yields 2.3%.

Although this growth rate is well below its five-year CAGR of 9.1%, it extends the growth streak of the dividend to 18 consecutive years.

Personally, I did not care much for this dividend hike. It would not have bothered me if the company had kept its dividend flat until it saw a bigger upswing in economic growth. However, if the company wants to use small hikes to work on a consistent dividend growth track record, I obviously won’t object to that.

What’s Next?

During the earnings call, the company made clear it is strategically positioned to capitalize on market opportunities. For example, its focus on business development, mainly in the petroleum and petrochemical markets, has allowed it to capture new business and increase volumes.

The company’s investments in the Gulf Coast are expected to support continued growth in these markets.

Additionally, Union Pacific’s automotive segment is set to benefit from business development wins with major manufacturers like Volkswagen and General Motors, providing the company with continued year-over-year growth despite some market softening.

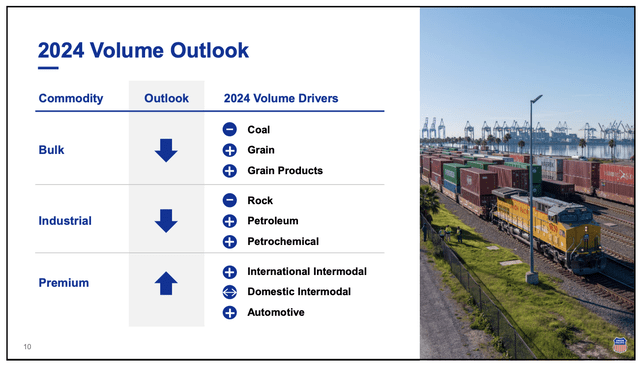

As we can see below, automotive production is one of the company’s positive drivers of demand, with factors like coal and rock being headwinds.

Union Pacific Corporation

With that in mind, segments like grain and petrochemicals are expected to perform well. Meanwhile, the company expects continued strength in intermodal imports and growth in the automotive sector due to the aforementioned business wins.

The company is also seeing strong improvements in its operations.

Despite severe weather events causing disruptions, Union Pacific explained it managed to maintain strong service levels and network performance compared to 2023.

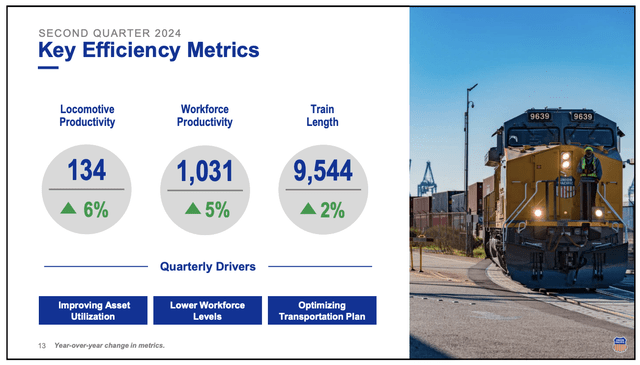

To give you some numbers, the Nebraska-based railroad reported a 6% improvement in locomotive productivity and a 5% increase in workforce productivity compared to the second quarter of 2023.

These gains are attributed to improved network fluidity, better asset utilization, and the implementation of new labor agreements.

Moreover, train length improved by 2% year-over-year and 3% on a sequential basis.

Union Pacific Corporation

The railroad also increased its intermodal service performance index by four points to 93.

To further support operations, the company is adopting automation and real-time analytics. According to the railroad, this technological integration improves current operations and positions the company for future growth by increasing mainline capacity and optimizing asset usage.

Essentially, if economic growth improves, the railroad should be able to take on a lot more cargo without having to substantially increase capital spending. This should bode very well for its operating ratio/operating income during the next economic upswing – whenever that may be.

In September, the company will update us on new operating improvements during the Investor Day.

UNP Stock Outlook & Valuation

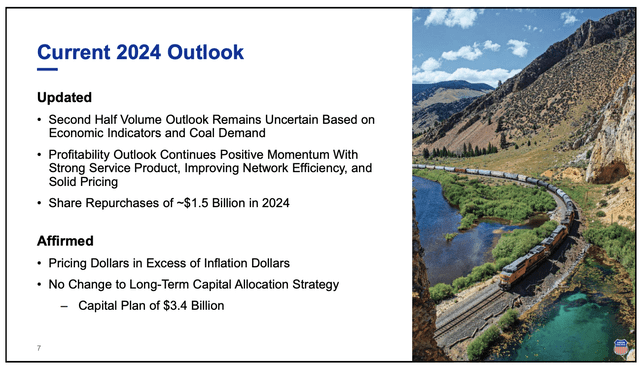

While I am writing this, UNP shares are flat after earnings. Although I had expected a bit more optimism, it makes sense, as the company sees lasting demand uncertainty in the second half of this year – although with positive momentum in its profitability outlook.

Union Pacific Corporation

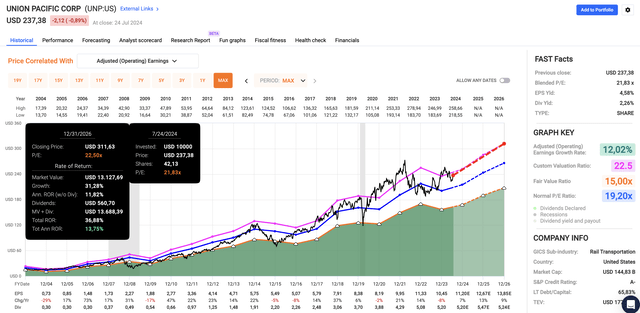

That said, using the FactSet data in the chart below, analysts agree with the positive momentum part, expecting 7% EPS growth in 2024, potentially followed by 13% and 9% growth in 2025 and 2026, respectively.

FAST Graphs

These are highly favorable growth expectations for a market that continues to deal with economic headwinds.

Applying the 22.5x P/E multiple I have used in the past, the stock has a fair stock price of $312, 32% above the current price.

Since 2004, UNP has returned 15.2% per year. Although I cannot make promises, I expect elevated double-digit annual returns to last, especially if we get an economic rebound after three years of cyclical weakness.

As a result, I will continue to gradually add to my UNP position. We also own it in the majority of family accounts that I help manage.

Takeaway

Union Pacific remains a cornerstone of my dividend growth portfolio and continues to justify my high conviction.

Despite economic headwinds, UNP’s strategic measures and impressive operational efficiency have led to revenue growth and cost reductions.

The company’s second-quarter performance, which came with a 9% increase in operating income and a 7% EPS growth, supports my bullish outlook.

With promising developments in key sectors like automotive and petrochemicals and a focus on technological improvements, I believe UNP is well-positioned for future growth.

As a result, I remain committed to adding to my UNP position, expecting strong returns as economic conditions improve.

Pros & Cons

Pros:

Operational Efficiency: UNP has significantly improved its operating ratio, showing its resilience even in light of unfavorable macroeconomic developments. Revenue Growth: Despite weak manufacturing sentiment, UNP achieved 1% revenue growth, driven by solid pricing gains and new business. Cost Reduction: Impressive cost-cutting measures, including reduced headcount and lower fuel expenses, have improved profitability. Dividend Growth: With an 18-year streak of dividend increases, UNP offers a reliable income stream for dividend growth investors.

Cons:

Economic Uncertainty: Continued demand uncertainty in the second half of the year could impact short-term performance. Weaker Growth Expectations: The sideways stock price trend since March 2022 reflects broader economic headwinds and weaker growth expectations. Coal Demand: Weak demand in the coal sector, influenced by low natural gas prices, presents a challenge. However, as I am bullish on natural gas, I expect coal to turn into a tailwind next year.