FOX news could see strong revenue upside from 2024 e;ection. Win McNamee/Getty Images News

Caution to investors in media: Forget Mr. Rupert Murdoch and son Lachlan at your own peril.

Yes, Rupert is 92 and believed to mean it when he finally anointed son Lachlan as his successor at Fox Corporation (NASDAQ:FOX). And yes, there is an echo of the ups and downs of Fox and family media dynasties to be found in the hit Showtime series Succession.

The difference is that the patriarch, so deftly portrayed by Brian Cox, is far afield from the real Rupert, who was not bullheaded but an avid, patient, student of the game.

During the early 2000s, I did a consulting assignment for Fox print media units to raise visibility of several of their properties in the gaming industry. The goal was to build ad revenue from the casino sector. I worked with a top Fox executive, a long time close associate of Rupert, Mr. Martin Singerman (d.2023 at 96).

Once, at lunch, I asked Marty what it was that convinced Rupert back in the day to undertake a massive challenge to broadcast TV by trying to cobble together a new FOX network from stations he had bought. He’d picked TV executive Barry Diller (Now CEO of IAC Interactive) to run the nascent network. It seemed an odd decision at the time, since Diller came out of the ABC Network—a business model far afield of what Rupert was aiming at as groundbreaking entity with an attitude.

Paraphrased best from memory, here’s what Marty told me:

“Above all, Rupert is a student, He sees the Fox effort as a learning experience. And he is among the fastest learners in the media business. He saw what Fox would become five years from the day he bought his first TV station. He fooled all the skeptics who warned he was throwing good money after bad trying to enter the exclusive club of the three legacy TV networks… Murdoch has the gambler’s instincts. Decades later, his son now faces disruption in the sector in a far more complex media world. But he has learned from the master.

Rupert’s aggressive operational legacy, IMHO, has been deeply rooted in his son Lachlan. Yet I see value in its shares that has by in large, have been overlooked by investors.

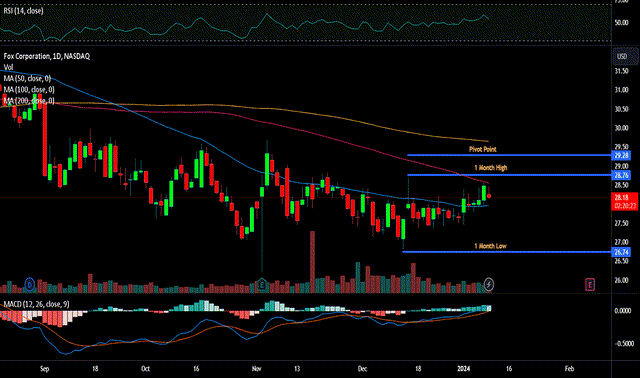

If you scan 90% of the published financial articles on the great battle for survival in the tempest-tossed media world, you’ll find virtually nothing about the ongoing prospects for Fox and its shares. It has attained the status of also-ran in the streaming game. Its TV product sits knee-deep in linear media woes. But counting Fox as essentially out is dangerous. Safer is contemplation as to whether its shares trading ~$26 at writing might present an interesting entry point.

google

Above: FOX is dead pooled in the twenties when a deeper dive into its prospects should support a more generous valuation.

It took the announcement of FOX’s one-third participation in a potential sports streaming all-in-one service to raise a few eyebrows here and there among investors. Its partners presumptive are Disney (DIS) and Warner Bros. Discovery (WBD).

The two biggies in the space here have brought Fox into the deal not because they like the cut of Lachlan’s jib.

What brings FOX into the picture its many sports deals, the gold mine of which is its 11-year pact with the NFL for NFC games through 2031.

fox sports

Above: FOX NFL team continues to lead in many viewer polls. It will likely continue if and when the new service arrives this fall.

The Fox presence is sports programming has a long history and continues to have real heft. Its Fox News business in what is expected to be a hotly contested, screaming match of a presidential election this year could ignite a major ad revenue bonanza. Add that to the prospects of a sports streaming partnership that could launch by fall and you have prospects of a Fox earnings profile getting a positive lift.

FOX’s prime time lineup has 38% of total viewers, 62% in the valued 25-34 demo, despite its tilt toward older demos in comparison with peers.

Bear in mind FOX now controls 55% of all sports rights going into the proposed new service. Their presence in the possible success therein is crucial. Some industry observers believe the new service will be looking for $40 a month from subscribers, others think it could go as high as $100. Such prices may foretell a looming disaster for the new service—nothing is certain in this new world of media. However, realistically it appears to be a roll of the dice closer to betting the line and taking odds rather than a wildly stupid proposition bet, to use crap shooters parlance.

Going forward, then, FOX valuation at present has yet to bake in two powerhouse catalysts we see coming by this fall: its participation in the proposed all-sports streaming service, and its ad gusher pouring big revenue gains from the upcoming presidential elections. Last year, FOX revenue from its linear and cable businesses was $6.6b. We could see as much as another $50m to $75m in revenue increases ahead. Citi analysts have lifted the price target, or PT, on Fox from $31 to $36.

Despite the continuing expectation that linear TV will lose 10% of its audience this year and the foreseeable years ahead, we see FOX ad revenue holding share. Advertisers still appear to value its audiences despite their demos, which trend significantly older than its network peers.

An alpha just sitting there, few investors bake into the FOX share price at this point – but it’s major

We don’t presume here that FOX holders are oblivious to the value of an option that the company holds on 18.8% of the equity of FanDuel of Flutter Entertainment (FLUT). But it seems the greater pool of would-be investors in the space may not understand how it could play in a forward PT of the shares.

Here’s the state of play on the FLUT option

Around 2020, FOX had done a deal with FanDuel parent Flutter Entertainment, then traded in London with ADR’s in the U.S. under ticker symbol PDYPY. Part of the deal was a partnership on FoxBet, a real money wagering platform—since closed. But the magic was in an option Fox got to buy 18.6% of Flutter, and by extension, in sector leading FanDuel. The deal translated to 4.5m shares of Flutter to be acquired over 10 years.

Subsequent to the original deal, the value of FLTR shares rose dramatically as the U.S. sports betting market exploded. FLTR then asserted the original pricing for the option was out of whack with the present value.

FOX insisted its original price was valid. Lawsuits were filed, and in November of 2022, a three person arbitration panel ruled in favor of FLTR shares at $3.7b. Now that the company has become a NYSE traded stock traded at $210, with strong prospects in the growth of U.S. sports betting, the option has grown immensely in value.

It is hard to estimate going forward as to when and if FOX will exercise its option, which today represents about 5% of FanDuel equity. But is mere presence suggests it cannot be avoided in calculating the value of the shares at this juncture.

A relative value menu of media sector leaders

Each of the peers in the media/entertainment space run smack into one another in every operational, tech and marketing challenge. Investors have found the mad chase for eyeballs at best confusing. But the values of the shares for each reflect sentiment that may have something to hide on a very rudimentary basis. We think FOX is below sector radar.

Here below we lay out the menu for investors on what may appear to be simplistic terms that do not reflect many key metrics investors like to have in making judgements. The numbers below are only shown to reflect sentiment based on fundamentals. Price, debt load and estimates of intrinsic or discounted cash flow (“DFC”) value forward to a five-year terminus.

Company Revenue ’23 LT debt PAW* Intr/DCF*

Walt Disney $88. 9b $476b $107 $125,43

WBD 41.32 47.2 9.4 60.23

Paramount (PARA) 11.21 16.9 11.17 25.16

FOX 14.07 9.4 27.41 40.00

Lions Gate (LGF.A) 3.8b 4.5 9.12 5.40

*Price at writing.

**Intrinsic or DCF value as calculated by alpha spread, guru focus and/or my own data set projections.

In brief, what we see here is that Fox trades at the second highest price in the group. And its debt burden is the fourth highest. Its revenue is third highest. Assuming the two going forward catalysts we cited do materialize, we can see FOX moving closer, faster, to its DCF value than its peers. The bugaboo, of course, is Mr. Market’s negative view of the prospects of linear TV — i.e., Fox’s deep stake in that business.

Yet we believe, on a comparative basis, Fox Corporation shares represent good value at the present price. We think its possible ramp towards its FCF value could be faster than peers.

On that basis, we are raising our guidance on FOX stock to $38.50 by mid-year.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.