fotokostic

Introduction

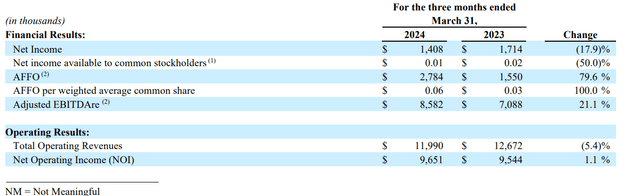

Farmland Partners (NYSE:FPI) announced its latest quarterly results on April 30th. The results came mostly in line with expectations where the company reported an adjusted FFO of 6 cents per share ($2.8 million) while analysts were looking for 5 cents and revenues came at $11.99 million when analysts were looking for $12.15 million. In other words, AFFO showed a small beat and revenues showed a small miss, but both numbers were close enough to the estimates within a range of a rounding error.

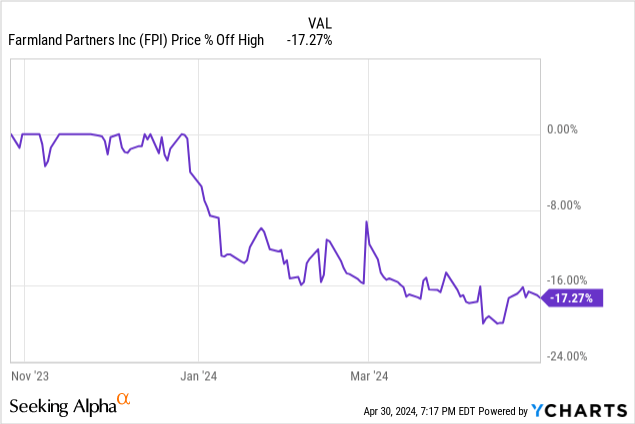

I previously covered this company in an article titled Farmland Partners: Unique Business But Pricey. Since then, the stock is down close to 20% which means it is now less pricey but still not particularly cheap, which we will get to after reviewing its most recent results.

Farmland Partners Q1 Earnings Results

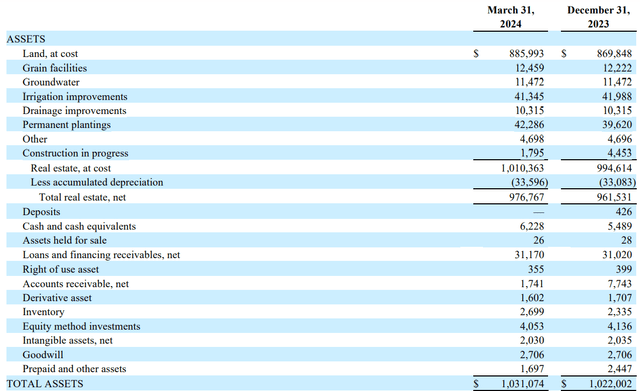

During the quarter, the company’s book value and revenues came slightly lower than last year with operating revenues dropping 5.4% and gross book value dropping from $1.14 billion to $1.00 billion, but this was due to a number of property dispositions made by the company. As a result, the company’s operating costs also came lower by $1 million or 12.7%. This indicates that the dispositioned properties had higher operating costs on average than those properties still kept by the company. The company also increased its forward guidance range from 15 to 23 cents (mid-point being 19 cents) to 19 to 26 cents (mid-point being 23 cents) so basically the mid-point of the new guidance corresponds to the high-end of the previous guidance, which is a positive. Most of the improved guidance comes from better cost management and lower operating costs overall.

Earnings Overview (Farmland Partners )

Property Transactions

This year, the company is not all about cost-cutting, though. After selling some property last year, it is back to acquiring properties this year. In the first quarter, the company reportedly spent $16 million on acquiring 3 new properties which will start generating income right away. We don’t know what the operating cost structure looks like for these new properties and how profitable they will be right away, but considering the company’s history of focusing on buying and keeping highly efficient properties while offloading low performers, we can at least remain hopeful that they will perform above average. Then again, we are dealing with farms and their productivity can depend on a lot of external factors such as weather events, so there are never any guarantees. Another factor that will affect the profitability of a particular farm is the type of crop it produces and pricing for that particular crop for a given year, which can fluctuate a lot from year to year.

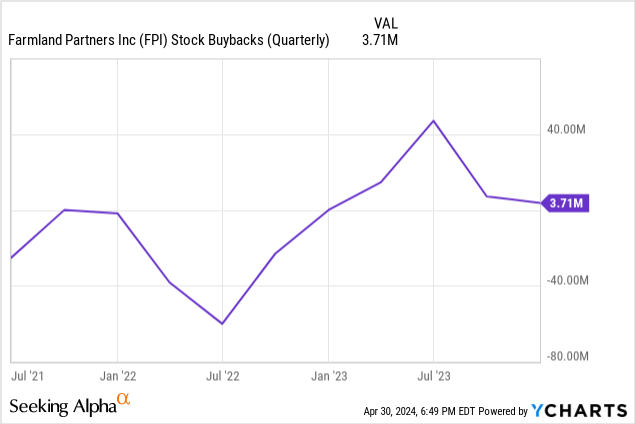

Last year, one implication of FPI selling properties was that it was able to afford a large stock buyback. This is also why the company’s book value dropped because if it had kept the crash from property sales, it would have been reflected as an asset in its balance sheet, but it didn’t because much of the proceeds from those property sales were put to work to reduce its share count. As a result, the total book value dropped but so did the share count, which is not a net negative for investors.

Book Value Update

The company’s book value will also fluctuate from quarter to quarter based on property prices. While land prices are not as volatile as crop prices, they are still related. When a particular crop’s price rises sharply, lands that are suitable for growing that particular crop also rise, and the opposite effect also happens when crop prices drop. Of course, this happens at a smaller scale. For example, if Apple prices rise by 30%, farmlands that produce Apple could see their prices rise by about 5-10% which means farmland prices will have a correlation to crop prices, but it won’t be a perfect correlation and volatility will be much smaller. Having said that, the company’s book value actually rose slightly from QoQ (partially due to acquiring new land) even though it dropped on YoY basis. Keep in mind that when Farmland reports the value of its land assets, it will typically report “at cost” price which is the price it paid to acquire such land, so it will not include any price fluctuations on that line item.

Assets Statement (Farmland Partners )

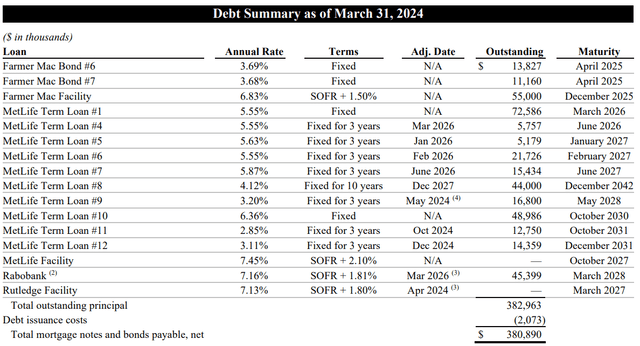

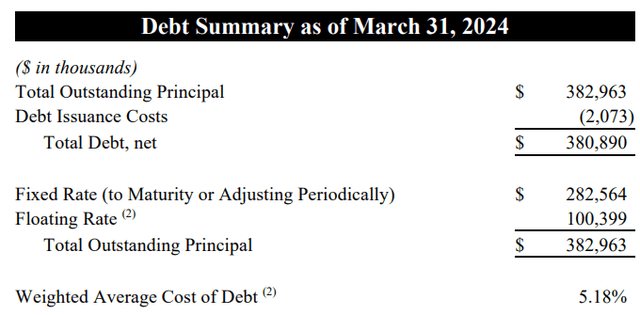

Debt Update

The company’s debt situation shows a couple of maturities happening a year from today in April 2025, but nothing maturing this year. The negative aspect of this is that both of these debts had fixed rate and relatively low interest rate of 3.69% so if the company chooses to refinance them, it will have to pay a higher interest rate. As of right now, the weighted average interest rate for the company’s debt is at 5.18% which is slightly higher than last year. We could also expect the company to be able to refinance near these rates next year when this portion of the debt becomes due. Furthermore, the company also has a few adjusted rate debt items that due for adjustment, which is likely to increase its debt servicing in the future. For example, MetLife Term Loan #9 is due for adjustment next month (May 2024) and it had a low rate of 3.2% for the last 3 years. It will likely jump higher next month. There are also adjustments happening in October and December of this year to a couple of debt items which are worth watching.

Debt Structure (Farmland Partners )

The company says that only $100 million of its $380 million debt is on floating rate, but this is misleading because a lot of its debt is only fixed for a period of 3 to 10 years, after which it is converted into floating rate. Out of all the debt the company has, only about $96 million is truly in fixed rate without an adjustment date.

Debt Summary (Farmland Partners)

FPI Stock Valuation and Dividend

The stock is still pricey even after its share price saw a correction. Based on its guidance of 19 to 26 cents per share (mid-point of 23 cents), the current price of $10.76 gives it a forward P/AFFO of 47. Since this is a REIT, we are looking at P/AFFO (price to adjusted funds from operations) instead of P/E which is typically used to price traditional companies.

Currently, the company is paying a dividend of 6 cents per share per quarter, which annualizes to 24 cents per share. Considering that the company’s guidance ranges from 19 to 26 cents, it may or may not be able to fully cover this dividend this year. If we take the mid-point of its guidance and assume 23 cents per share, it gives us a payout ratio of 104% which is a stretch and makes the dividend difficult to sustain. Also, keep in mind that the current dividend yield is only 2.2% which is considered low for a REIT when the benchmark REIT index (VNQ) currently yields 4.3% and “risk-free” government bonds yield 5.5%.

Conclusion

In conclusion, the company’s results were mostly in line with expectations and its guidance was better than expectations, but it still looks pricey, and its dividend yield is still too low for a REIT not to consider it may not be fully covered with the current income. I still don’t see a compelling value in this stock.