pcess609

By Elizabeth Bebb

Indices that not only track the broad equities market, but also offer the potential for enhanced dividends may appeal to those searching for income within the equity asset class. In this blog, we investigate what the Dow Jones U.S. Select Dividend Index has historically brought to the table, including high dividend income, superior risk-adjusted performance over the long term, strong defensive characteristics in the face of market downturns, and its current low valuation metrics versus the benchmark.

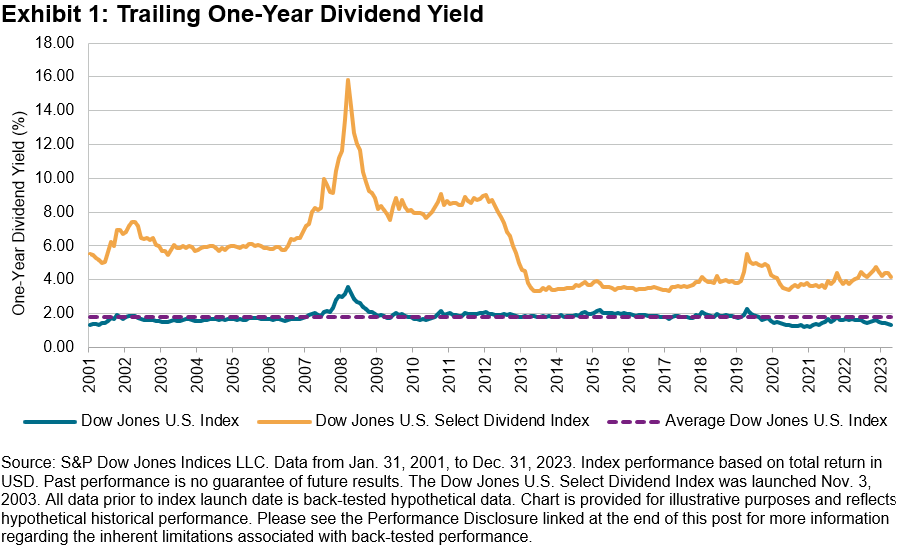

For some market participants, the potential for income generation drives a long-term strategic decision; others may have a more tactical view. Historically, in a lower interest rate environment, tactical investors have turned to high dividend yield-focused indices in search of the benefits associated with income-generating assets. The Dow Jones U.S. Select Dividend Index, which celebrated its 20th anniversary in November last year, is one such index, with a yield that has been significantly higher than the benchmark since 2001 (currently 4.16% versus 1.32%, as of March 28, 2024). Its yield was also high versus other dividend-focused indices in the market, with a yield premium of 30%.1 During periods of elevated interest rates, fixed income strategies may have had more appeal; however, in the event that interest rates start to fall consistently, equity income products may come into sharper focus.

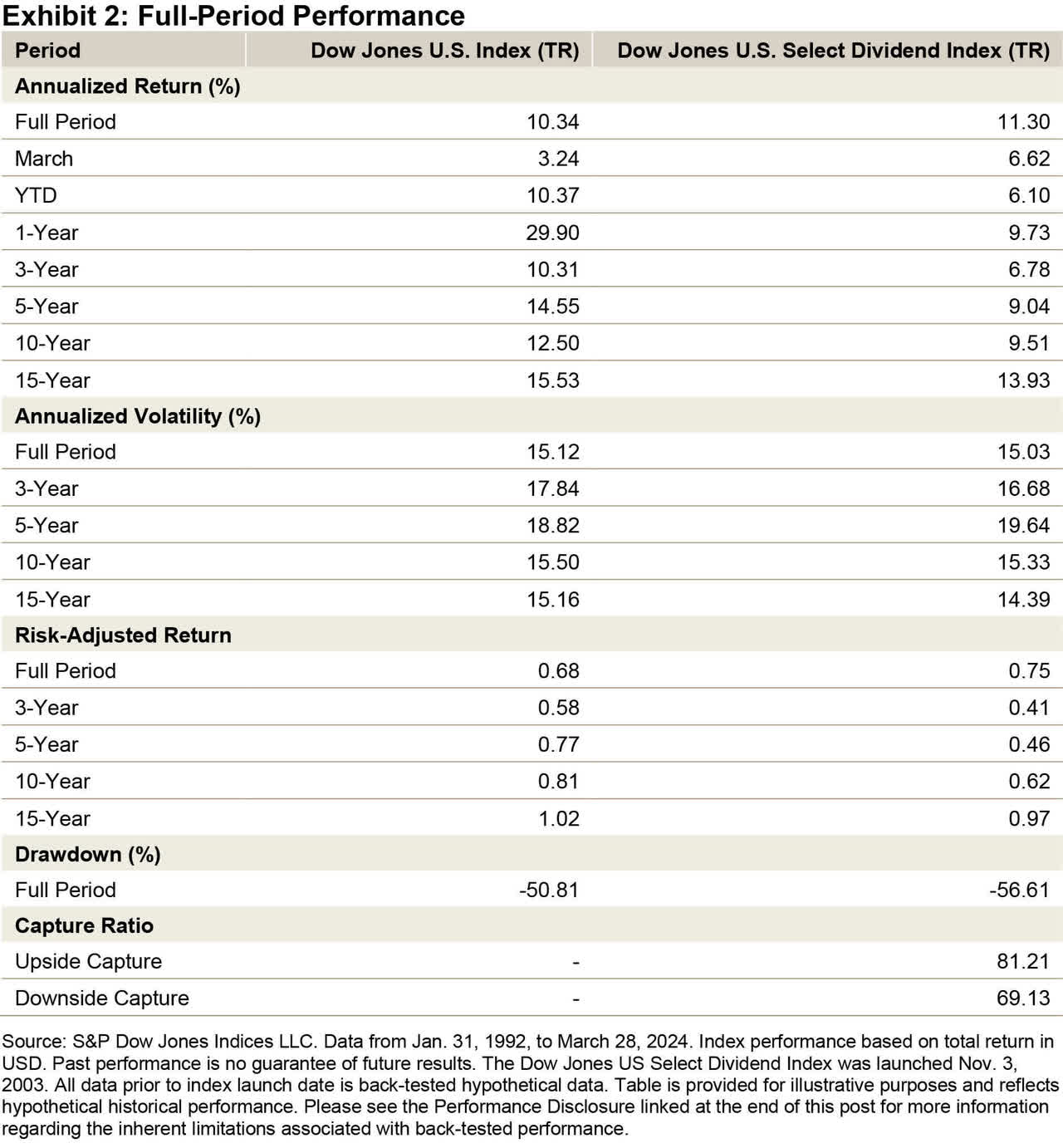

The Dow Jones U.S. Select Dividend Index has outperformed the benchmark over the long term on an absolute and risk-adjusted basis.

Exhibit 2 shows the long-term performance of the Dow Jones U.S. Select Dividend Index versus the benchmark. Performance has been robust over the full period in both absolute and risk-adjusted terms. In recent years, when the Magnificent 7 (those S&P 500® mega-cap companies that have been performing strongly in recent periods: Meta Platforms, Amazon, Apple, Netflix, Alphabet, Microsoft and Nvidia) have been so dominant in driving U.S. returns, the Dow Jones U.S. Select Dividend Index has underperformed due to under-representation in the Information Technology sector and especially in these companies.

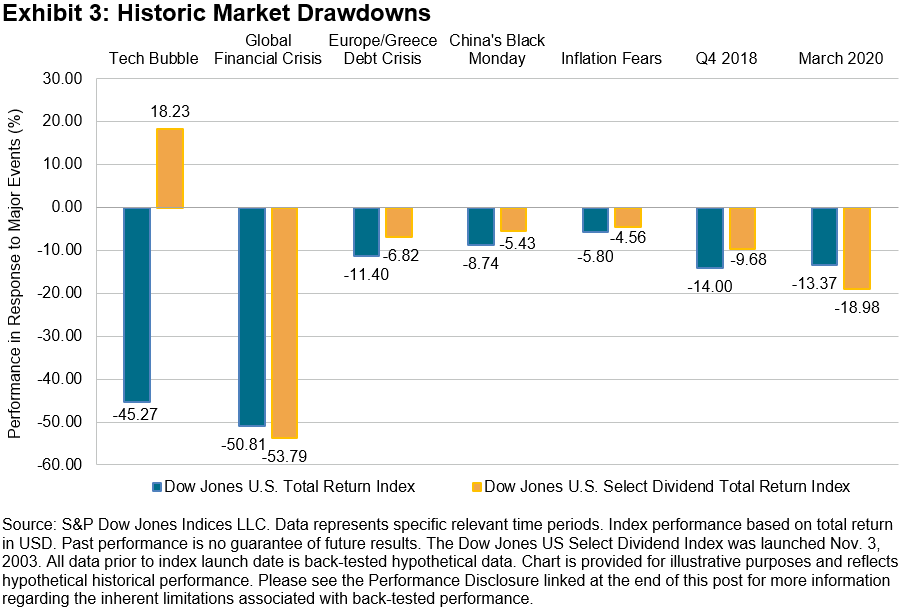

The Dow Jones U.S. Select Dividend Index outperformed the benchmark during most major market events (except during the height of the Global Financial Crisis and COVID-19 sell-off), demonstrating its defensive characteristics.

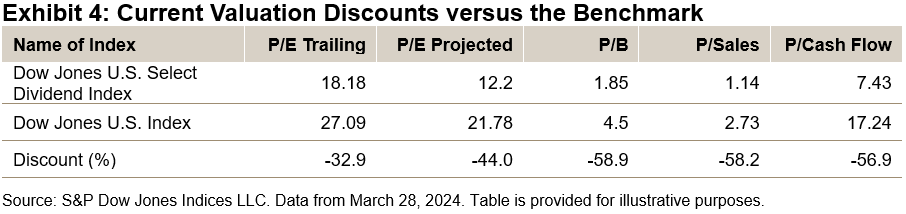

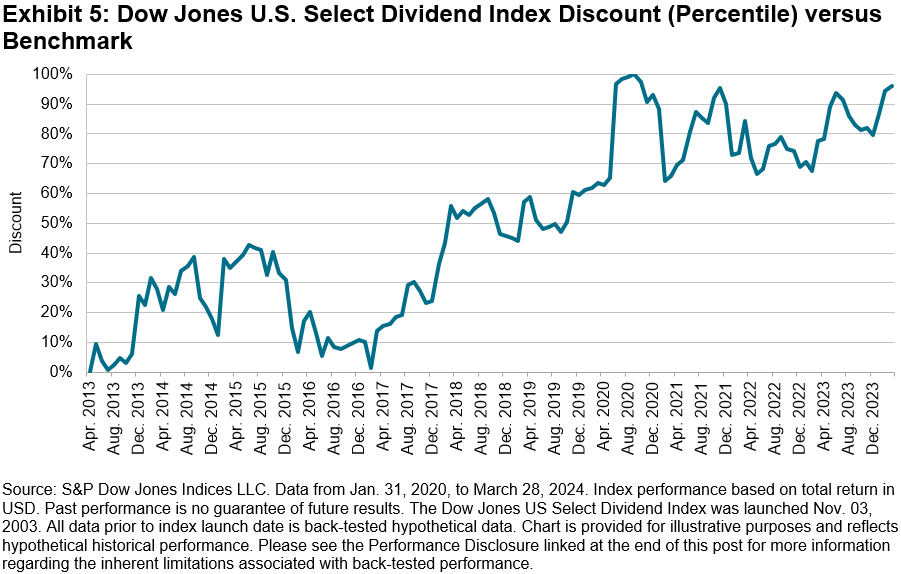

The Dow Jones U.S. Select Dividend Index is trading at a significant discount to the benchmark; -33% on a price-to-earnings basis and -58% for the price-to-book and price-to-sales ratios, as of March 28, 2024.

The Dow Jones U.S. Select Dividend Index is currently highly discounted to the benchmark, trading at a 94th percentile reduction; i.e., versus the benchmark on a composite basis (a simple average of the price-to-book, price-to-earnings and price-to-sales ratio), the discount has only been greater 6% of the time occurring between June and October of 2020. Discounts have been at an elevated level (above 50%) since 2020. However, over the long term (since 2013), the valuation was not always so compelling.

Investors searching for income and equity participation could look to high yield dividend indices to inform strategies geared toward meeting their objectives, especially in markets where interest rates may be falling. Currently, the Dow Jones U.S. Select Dividend Index offers a large yield premium to its benchmark and to other U.S. dividend indices, as well as a significant valuation discount to the benchmark.

1 3.30% is the average dividend yield of Morningstar data reflecting global categories of US equity large cap value, US equity large cap blend, US equity mid-cap, US equity small cap and US equity large cap growth.

Disclosure: Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures, please visit www.spdji.com/terms-of-use.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.