Klaus Vedfelt/DigitalVision via Getty Images

Main Thesis / Background

The purpose of this article is to evaluate the broader emerging markets equity market, with a specific look at the iShares MSCI Emerging Markets ETF (NYSEARCA:NYSEARCA:EEM). This is a broad, passive ETF, with an objective “to track the investment results of an index composed of large- and mid-capitalization emerging market equities”.

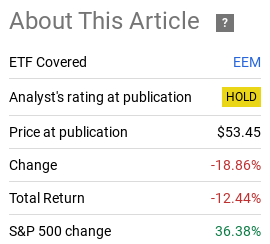

I cover US markets, non-US developed markets predominately, but I also consider emerging markets when the time is ripe. This includes through the use of vehicles such as EEM, although I have generally been put off by the sector (and this fund) for a while. In fact, my last review had a cautious outlook on the future prospects of EEM and I was proven right in hindsight:

Fund Performance (Seeking Alpha)

However, this was a long time ago and things do change, so I wanted to take another look at EEM to see if I should change my rating going forward.

After review, I do see a couple potential catalysts for emerging markets as a whole. But to me those are overshadowed by the risks facing this thematic idea. Further, I continue to see value in large-cap US stocks, so the idea of shifting positioning to favor a fund like EEM seems misplaced for the time being. As such, I am keeping the “hold” rating in place and will explain why in greater detail below.

Interest Rates A Tailwind? Maybe Not

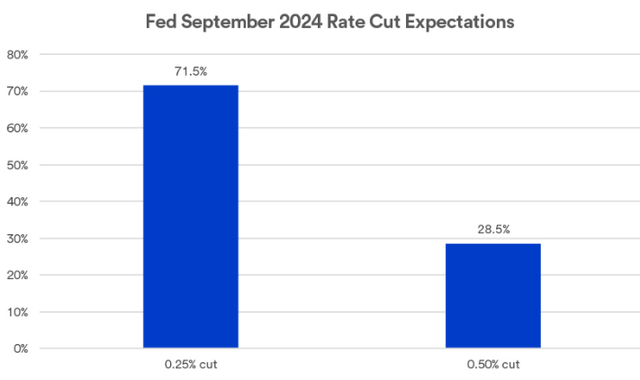

One factor that is driving the markets – here and abroad – is the US central bank. The Fed has been patient on keeping rates steady but the time the market has been waiting (impatiently) for may finally be here. That is the beginning of a Fed rate cut cycle in the US, with a growing likelihood of a .50 basis point cut coming in the next few weeks:

Upcoming Fed Meeting Expectations (CME Group)

Of course, readers may wonder why this belongs in this article. After all, EEM holds emerging market equities, so who cares about the US Federal Reserve?

The answer lies in the fact that many emerging market countries (and companies) are heavily dependent on what is happening state-side. Often we hear that rising interest rates in the US are collectively bad for emerging markets. That is because much of their debt is priced in USD – so as the USD rises the cost of servicing that debt in local currency goes up. This challenges social spending and financial flexibility in those emerging economies and can often be a significant headwind.

So one might think that declining rates here would now be a tailwind. Kind of makes sense, doesn’t it? While it may be on the surface, I have my concerns. One is the reason why rates are going to decline in the US. It is because of worries of high government spending, declining inflation, and a potential recession in 2025. The catch here is that if the US does enter into a recession, that could hit emerging markets particularly hard.

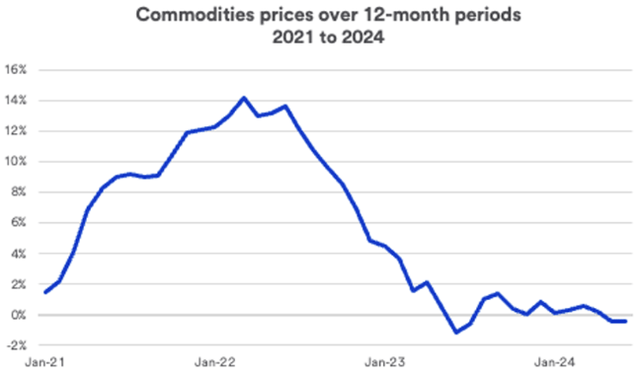

This is especially true of nations (many of them EM in regions like Latin America, the Middle East, and Asia) that rely on exporting goods like commodities. In fact, according to a report by the World Bank, roughly two-thirds of the emerging market and developing economies “heavily rely on commodities for export, fiscal revenue, and economic activity”.

So why does this matter? Well because the past few years this has been a headwind for commodity-rich nations as prices (on average) have been on the decline:

Basket of Commodities (Average Price) (US Bank)

The point I am trying to convey here is that there are concerns are global economic activity and the future demand for many commodities. Perhaps items like gold and silver could be well as recessionary hedges, but exporting nations want to supply the world with items like oil, cooper, coffee beans, and a myriad of other commodities that rely on economic development and growth. To see the prices come down on these resources presents uncertainty for investors and especially for emerging market companies and governments.

This ties back to the potential Fed rate cuts. While lower rates in the US may be a benefit for global and emerging market firms, the reasons behind why cuts are needed balance that out as a potential positive catalyst. This is why I don’t buy the “lower rates are good for funds like EEM” and remain cautious on my forward outlook.

China Remains In The Cross-hairs

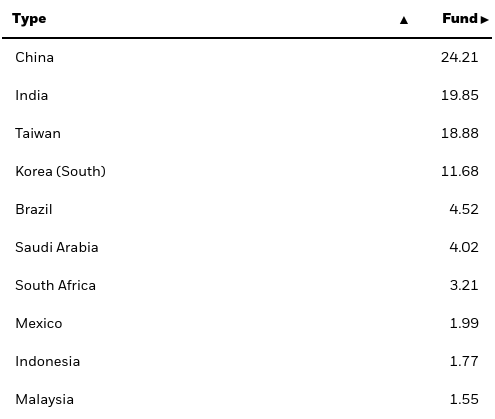

Another reason for my neutral outlook on EEM has to do with the fund’s overweight allocation to Chinese equities. With almost one-quarter of total assets invested in this single country, investors in EEM will want to be bullish on China before buying this particular product:

EEM Geographic Breakdown (iShares)

Broadly speaking, I have concerns over China’s economic recovery and geo-political tensions are not going away. In fact, they may be worsening, which puts strain on my forward outlook.

For example, the EU announced tariffs on imports of Chinese electric vehicles earlier this month. Fortunately, (for investors) the tariffs were not as high as were previously being considered, clocking in 9%, down from a proposed rate of nearly 21%, according to a press release from the European Commission.

So there is some good news that cooler heads prevailed a bit, but I don’t think the trade battle is anywhere near over. In response to the EU’s move, Canada is also considering a similar measure. And, of course, the US has already put in place steep tariffs on Chinese election vehicles.

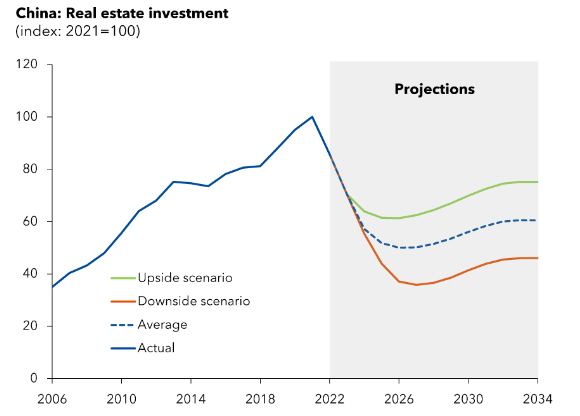

The net result from all this is that China has some diplomacy problems. When I couple that with the ongoing housing crisis in that country that has investors rattled, I am reluctant to get behind investing in this territory. For perspective, consider that even the more optimistic scenarios still show Chinese residential property investment well off their prior levels:

Chinese Real Estate Investment (By Year) (IMF)

To emphasize this point, this reality has left big developers (think Evergrande and Country Garden as examples) on the brink financially. It has stalled investment in this sector and clouded future investment returns. When I see this ongoing backdrop and a rise in geo-political tensions with key trading partners like the US and EU, I can’t get bullish on a fund like EEM that has so much Chinese exposure.

Expense Ratio Off-Putting

My next topic is a quick – but important – one. It has to do with EEM in isolation and nothing about the investment case for emerging market equities. Rather, this concerns the expense investors are paying for this particular fund. As a relatively passive ETF, an expense ratio of .70% just seems high to me on the surface:

Expense Ratio (EEM) (iShares)

Personally, this is quite high for most ETFs across the investment spectrum and makes me question why iShares has it this elevated.

But the good news is investors have plenty of choices out there. Popular emerging markets from other big names like Vanguard and Charles Schwab offer similar exposure for a fraction of the annual cost:

SCHE Expense Ratio (Charles Schwab) VWO Expense Ratio (Vanguard)

Of course these funds are not identical, but they do hold many of the same top holdings (often very close in terms of percentage) and the country exposure is also very similar. So it stands to reason that even if one was bullish on emerging markets at the moment, EEM probably isn’t the smartest way to play that idea.

India, Brazil Not Expensive, But Not Cheap Either

Through this review I have certainly been fairly pessimistic. I don’t see EEM as a buy right now and I stand by that call. But I also don’t think it is fair to have it as an outright “sell” either. There are a couple of reasons for that.

One, EEM has performed very poorly over the past few years and could be due for a turnaround. While I don’t personally see that playing out, tides do turn and the time to go short or sell-off this fund have probably passed. The disconnect between EEM and the S&P 500, for an example, tells me that a narrowing of the performance gap is certainly in the cards. So I don’t think it pays too be overly bearish here.

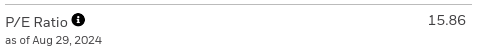

Second, much is made over the valuation gap between emerging markets and the developed world. And that rings true today. For those looking for “value”, which is probably a lot of us given how frothy the S&P 500 and NASDAQ 100 look, the a fund like EEM could have some merit:

EEM’s Current P/E Ratio (iShares)

This offers a stark discount to the S&P 500 – which is the most common benchmark – and could interest some investors who may otherwise not have been interested.

But how “cheap” is cheap really? As I mentioned before China makes up a good chunk of this ETF, but it is by no means the other country represented. Other nations, such as Taiwan, India, South Korea, and Brazil are in the mix and worth considerable thought.

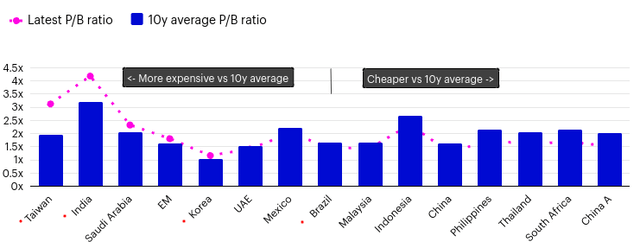

But there’s the rub. While these nations may appear cheap compared to their developed market peers, they are actually trading (on average) at valuations above their own historical average. That is a key factor to keep in mind:

Current Valuations (By Country) (S&P Global)

I bring this up as a word of caution. We need to consider more than just a nation’s relative valuation to the US. We should also consider its own trading history in isolation to give a fuller picture on how likely further gains are. In the examples given above, I would wait for a better opportunity to present itself.

Bottom-line

EEM has been a loser long-term and I don’t see a much brighter future ahead. There are plenty of risks for US investors when branching overseas and a fund heavy with China exposure is not on my radar for now. When I add in the mix that nations like India and Taiwan are trading at elevated valuations relative to their own history and that a fund like EEM is quite expensive to own, I am put-off from upgrading my view for now. Therefore, I am keeping the “hold” outlook in place and urge my followers to be very selective with any prospective positions at this time.