Tipping pad

Introduction & Investment Thesis

Doximity (NYSE:DOCS) is a cloud platform for US medical professionals that has severely underperformed the S&P 500 and Nasdaq 100 YTD. I initiated a “hold” rating on the stock on January 16, and it predicated on my belief that the company was seeing its revenue growth slow, despite displaying financial robustness by improving margins.

The company reported its Q3 FY24 earnings in February, where revenue and earnings grew 17% and 32% YoY, respectively, beating expectations. The management also raised their guidance for both revenue and Adjusted EBITDA for FY24. Although the company remains focused on driving robust AI-led product innovations while growing profitability, the company’s slowing revenue growth remains a concern.

The company is seeing the number of customers with at least $100,000 in subscription revenue decline, while the Net Retention Rate (NRR) is weakening as well, indicating that it is having issues with customer churn and adoption relative to the pace of new customer wins. At the same time, macroeconomic headwinds continue to persist, dampening pharmaceutical budgets. While I believe that Doximity has the potential to be able to revive its growth story, given its culture of innovation and the executive hiring of Lisa Greenbaum as Chief Commercial Officer, the management hasn’t provided clear forward guidance. Therefore, I will continue to stay on the sidelines and look for evidence of a turnaround in order to initiate a position, rating it a “hold.”

A quick primer about Doximity

Doximity is a digital platform for US medical professionals that helps them collaborate with their colleagues, conduct virtual patient visits, stay up-to-date with the latest medical news and research, and better manage their careers, thus allowing them to unlock productivity and provide better care for their patients.

In terms of their business model, the platform is free for all physicians, making it the largest medical professional network in the US. The company generates revenue from pharmaceutical manufacturers and healthcare systems on a subscription-based pricing model, where their customers get access to a suite of commercial products, such as Marketing, Hiring and Telehealth solutions, which benefit from broad physician usage.

Doximity’s ecosystem benefits from powerful network effects with deeper engagement from medical professionals that increases the breadth of their tools, attracts more members, and drives value for their revenue generating pharmaceutical and health system customers, which in turn enables Doximity to drive targeted product innovation, creating a win-win for all.

The good: Revenue met expectations and margins are expanding with a robust product pipeline

Doximity reported its Q3 FY24 earnings, where both revenue grew 17% YoY to $135.3M, exceeding expectations by 6%. In my previous post, I talked about Doximity’s total addressable market (TAM) which was estimated at $18.5B. During the earnings call, Jeffrey Tangney, CEO of Doximity, raised the midpoint of their revenue guidance for the full FY24 by $8M, or 2%, to approximately $474M. This would represent a YoY revenue growth rate of roughly 13.1%.

During the earnings call, the CEO outlined that engagement reached a new high watermark in Q3, with active users on a quarterly, monthly, weekly, and daily basis up double-digit percentages on a YoY basis. As Doximity continues to grow its social network of medical professionals by adding new members, I believe usage on the platform will increase, thus deepening adoption, with 289 customers paying $100,000 in subscription revenue in the Trailing Twelve Months (TTM) period. At the same time, the company successfully landed several major hospital clients in Q3.

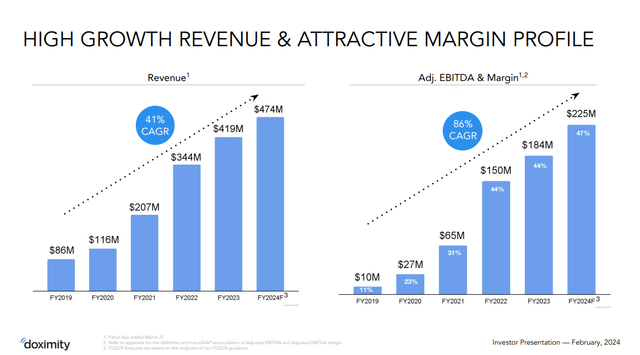

Q3 FY24 Earnings Slides: Revenue and Earnings growth

Furthermore, Doximity’s management is laser-focused on driving continued product innovation and believes that the next phase of their growth will be led by AI. During the earnings call, the CEO outlined how their HIPAA-compliant GPT product has already been helping doctors improve their productivity by reducing their administrative load. Simultaneously, the company will unveil their new client portal at the Pharmaceutical Client Summit in May, which is going to have features such as real-time engagement reports and prescription sales data, which will improve overall transparency and ease of use.

Shifting gears to profitability, Doximity generated an Adjusted EBITDA of $73.3M, which grew 32% YoY at a margin of 52.2%, compared to 48.2% in Q3 FY23. This was driven by streamlining operating expenses, which grew at roughly 8% YoY, much slower than the rate of revenue growth. For the full FY24, the company is raising its Adjusted EBITDA guidance by 6% to $225M, which would represent a margin of 47%, an improvement of 310 basis points from 43.9% a year earlier.

The bad: Customers with $100K+ spend is declining, NRR is weakening, Macro headwinds persist.

In my previous post, I talked about slowing revenue growth and declining NRR. Unfortunately, the company hasn’t made such progress on this front, despite strong product innovation. With revenue projected to grow 13.1% YoY, it is a significant slowdown from the 41% compounded annual growth (CAGR) it saw between FY19 and FY24. At the same time, consensus estimates point to even slower revenue growth of 10% in FY25.

There are two reasons for that. The first reason is tied to the slow growth rate of customers with $100K+ in subscription revenue, which grew 2% YoY to 289. However, at the end of FY23, there were 294 customers with at least $100K in subscription revenue, which would indicate that there is actually a decline of 1.7%, indicating that customers are reducing their spend and adoption on the platform. This ties with the second reason, where we see NRR dropping to 115%, down from 119% a year ago, which further reinstates the issue that Doximity is facing with customer churn and not being able to drive adoption compared to the rate of new customer deals, which is making investors cautious about its future growth story.

During the earnings call, the CEO mentioned that macroeconomic headwinds continue to persist, which is negatively impacting pharma budgets. In my previous post, I talked about the study by Deloitte, where it found that the average cost to develop an asset from discovery to launch had been rising while the average sales per asset were on the decline, resulting in higher budget scrutiny in pharma companies. This has been putting downward pressure on the overall sales momentum at Doximity.

Tying it together: Upside remains, but the growth story needs to come back.

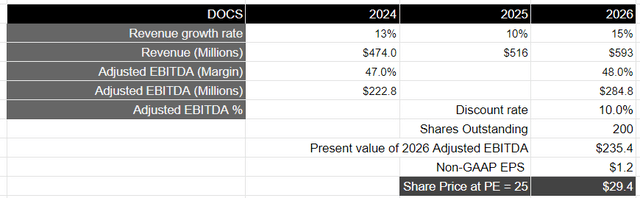

Looking forward, Doximity is projected to grow its revenue and earnings by 13.1% and 22% YoY, respectively, in FY24. Given the lack of forward guidance by the management, I will assume that Doximity will be able to return to growing faster than its current rate by FY26 at 15%, should its current efforts at product innovation and hiring Lis Greenbaum as the Chief Commercial Officer translate into a higher number of new customer wins and deepening adoption of its platform amongst existing customers. This would result in a higher number of customers with $100K+ in subscription revenue and an improving NRR. At the same time, I will assume that Doximity management will remain focused on profitability, and therefore the company will be able to maintain its current Adjusted EBITDA margins of 47–48%. This would translate to a total Adjusted EBITDA of $284M by FY26, which would be equivalent to $235M when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period with a price-to-earnings ratio of 15–18, I believe that should Doximity be able to revive investor confidence by reigniting its growth story, it should trade at approximately 1.5x the multiple of the S&P 500. This would translate to a PE ratio of approximately 25, or a price target of approximately $29.4, representing an upside of 27.9% from its current levels.

Author’s Valuation Model

While I believe that the upside can be realized should the company return to growth mode, I believe it will be a volatile journey. The management has a lot to prove to translate its current product innovation and executive hiring into new customer wins and continue to retain them while driving deeper adoption at the same time. So far, the lack of forward guidance beyond FY24 is dampening investor confidence. And given my risk appetite, I will choose to be on the sidelines and wait for further direction in the management commentary or an uptick in sales momentum to initiate a position. For now, I will rate it a “hold.”

Conclusions

While Doximity is driving robust product innovation and expanding its profit margins, its revenue growth rate has been slowing, driven by a decline in customers with $100K+ in subscription revenue, weakening NRR, and persisting macroeconomic headwinds. Should the company be able to revive its growth story once again, given its innovation pipeline and the addition of Lisa Greenbaum as Chief Commercial Officer, I believe there could be a sizable upside from its current levels. However, given the lack of forward guidance from the management, I will choose to be on the sidelines and rate the stock a “hold.”