JHVEPhoto

Introduction

Generally speaking, I have to say I’m pleased with the way things are going. My portfolio, which is massively overweight energy royalties, defense, and transportation, just finished one of the best months ever, supported by a great earnings season and the rotation from growth to value we have discussed a lot recently.

However, not everything is going according to plan.

One of the stocks in my portfolio I have been very bullish on in the past isn’t doing at all what I expected it to do. That company is CME Group Inc. (NASDAQ:CME), a company I called “One Of My Best Ideas In Finance” in the title of my May 25 article.

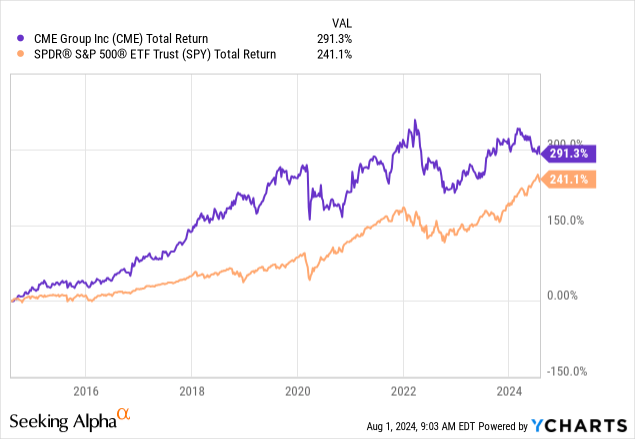

Since then, shares have fallen another 8.5%, lagging the 4% return of the S&P 500 by a substantial margin. The good news is that over the past ten years, the Chicago-based company is still beating the S&P 500 (SP500, SPY) by roughly 50 points.

With that said, I thought a lot about the company recently. I looked at it from every angle and decided not to change my stance on the company.

Although risks of new competition aren’t helping, the company remains a cornerstone of the modern financial world, providing key futures and options with terrific growth rates — despite the current low-volatility environment.

In this article, I’ll update my thesis using its latest earnings and explain why I will continue buying CME stock.

Moreover, I will be buying CME stock for an income-focused family portfolio of ours, as the total yield potential has gotten extremely attractive at current levels as well.

So, as we have a lot to discuss, let’s get to it!

A Wide-Moat Giant

A few years ago, I started buying CME Group, as I believed it offered the perfect mix of growth and value with a wide-moat business model that has become a key component of the modern financial world.

In a financial sector dominated by banks, CME stands out as a highly efficient owner and operator of exchanges. In fact, it owns four of the biggest exchanges in the world, each offering key products for a wide variety of clients, including corporate treasuries who hedge their supply chain, active traders (both institutions and private), and many others.

CME (Chicago Mercantile Exchange) offers a diverse range of futures and options contracts, including interest rates, equity indices, foreign exchange, agricultural commodities, and more.

CBOT (Chicago Board of Trade) trades futures and options contracts for agricultural products, interest rates, and equity indices.

NYMEX (New York Mercantile Exchange) specializes in energy and metals trading, including contracts for crude oil, natural gas, and various metals like gold and silver.

COMEX (Commodity Exchange, Inc.) focuses on metal products, offering contracts for gold, silver, copper, and other base metals.

These exchanges cover some of the world’s most active futures, including the e-mini S&P 500 future, NYMEX crude oil, NYMEX Henry Hub (natural gas), COMEX gold and silver, as well as CBOT corn, soybeans, and a wide range of interest rate futures.

This comes with moat benefits, as the company owns the go-to futures for most market participants and has exclusive licensing agreements, as I discussed in my prior article as well.

In 2010, CME Group acquired a majority stake in Dow Jones Indexes, which was combined with S&P’s index business in 2012 to form S&P Dow Jones Indices LLC, of which CME Group now has a 27% ownership stake. S&P Dow Jones Indices LLC combines the world class capabilities of the S&P and Dow Jones Indices, and is a significant player in passive investing, including the exchange-traded fund (ETF) industry value chain. As part of the joint venture, we acquired a long-term, ownership-linked, exclusive license to list futures and options based on the S&P 500 Index and certain other S&P indices. – CME 2023 10-K.

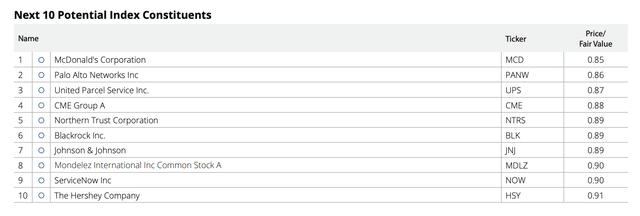

Moreover, regarding what we’ll discuss in the second part of this article, CME is on the list of “potential index constituents” from the VanEck Morningstar Wide Moat ETF (MOAT). This is an actively managed ETF that buys companies with an economic moat at attractive prices and sells companies they deem overvalued.

VanEck/Morningstar

While I don’t know what happens behind the scenes of that ETF, I greatly enjoy the value CME brings to the table.

CME Has Become A Deep-Value Play

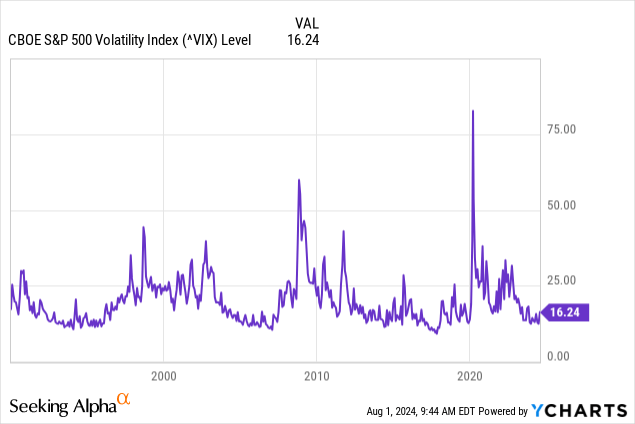

Although CME’s stock price is not anti-cyclical, its business model has defensive features. For example, whenever panic erupts in the stock market, stocks sell-off, sending volatility higher. That’s bullish for transaction volume.

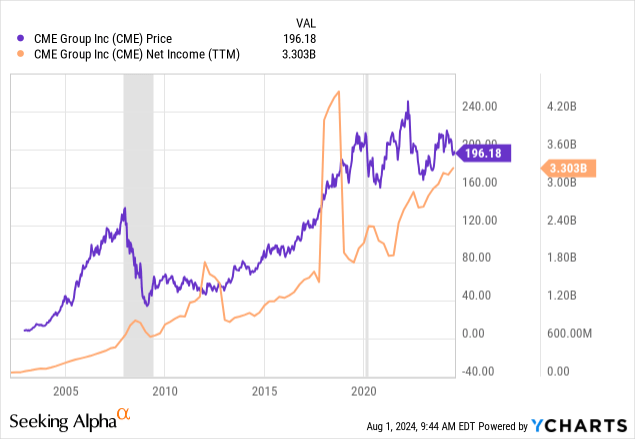

Hence, historically speaking, CME’s earnings have massively improved during market sell-offs, even if its stock price did not reflect it.

Currently, volatility is subdued, as measured by the CBOE S&P 500 Volatility Index (VIX). In fact, volatility is close to prior cycle lows.

Based on that context, one thing people have brought up in the past is that CME has not diversified its business enough. Peers like Intercontinental Exchange (ICE) have used aggressive M&A to increase recurring revenue and become less dependent on transaction volumes.

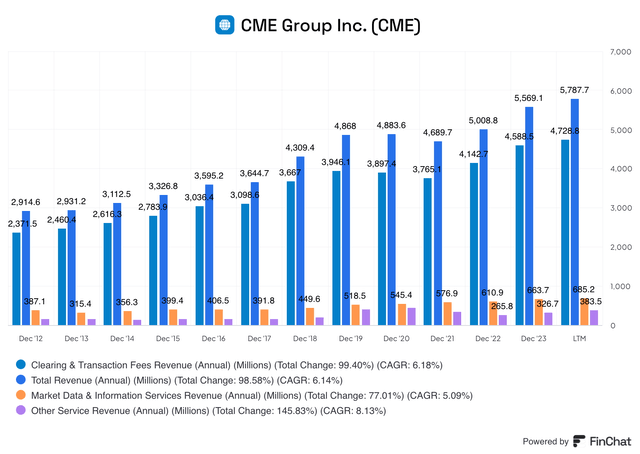

Looking at the chart below, Clearing & Transaction Fees account for the majority of total revenue.

FinChat

The good news is that the company’s focus on transaction-related income continues to pay off, even in a low-volatility environment.

In the second quarter, the company achieved the highest quarterly revenue in its history at over $1.5 billion. That’s a 13% increase compared to the prior year quarter.

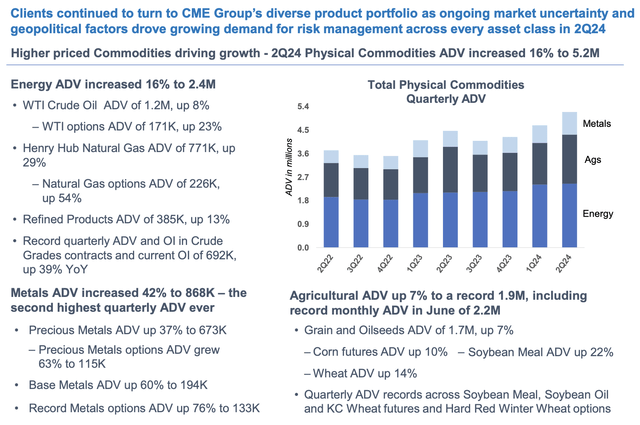

This impressive growth rate was driven by an increase in average daily volume (“ADV”) across all asset classes. To be specific, the company’s physical commodities asset classes saw a major 17% year-over-year increase in quarterly revenue. In this segment, revenue reached $444 million, which accounts for more than a third of the company’s clearing and transaction fees.

CME Group

Other areas were not less impressive (emphasis added):

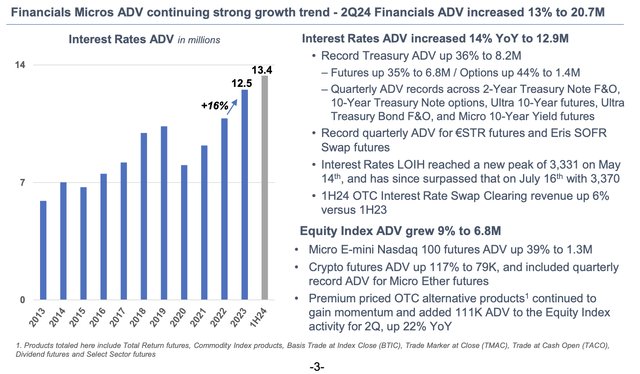

Turning to our financials. Total ADV across the complex increased 13% from Q2 last year, including record treasury ADV of 8.2 million contracts were up 36%. Our U.S. treasuries set a new daily volume record of 34.4 million contracts during the quarter on May 28. The continuing high levels of issuance and deficit financing are tailwinds, even in the absence of Fed rate changes. Also, foreign exchange second quarter ADV grew 20% versus Q2 last year. – CME 2Q24 Earnings Call.

CME Group

Even better, these results were supported by a 7% increase in market data revenue, which rose to $175 million.

It also grew margins, as its operating margin rose to 69.1%, up from 66.8%. This allowed the company to grow its EPS by 11% with an adjusted net income margin of 61%.

At 61%, the company has one of the highest net income margins in the S&P 500, which has a net profit margin hovering in the 10-12% range.

Moreover, the company is innovating, including through its partnership with Google Cloud. According to the company, this collaboration aims to build a next-generation trading platform leveraging advanced cloud technology, ultra-low latency networking, and high-performance computing.

INQDATA

Generally speaking, it’s expected to improve CME’s trading infrastructure, offering clients more connectivity options and the ability to use AI and data analytics for better trading strategies.

It’s a fantastic case of a company that uses its existing platform and data to produce value-adding services and products.

With that said, there are two things that the market may see as negative.

Increasing competition from new exchanges. Lower RPC (rates per contract).

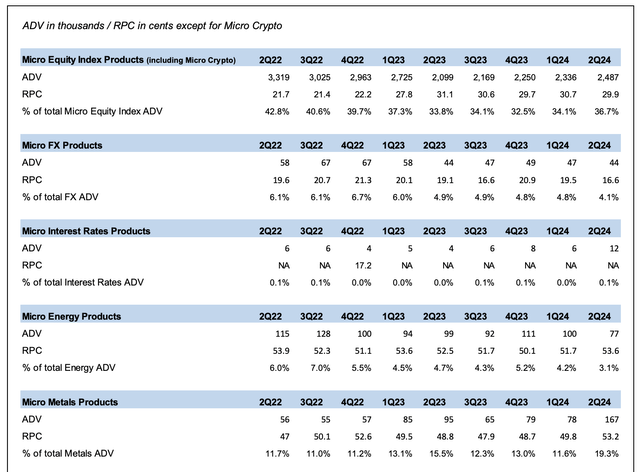

Regarding the second point, RPC is key, as it shows how much money the company makes on each contract. As we can see below, in areas like micro equity products and micro FX products, RPC was down. That’s not a great trend.

CME Group

However, it is important to mention that RPC is volatile and often dependent on other factors.

During the 2Q24 earnings call, the company noted three important factors that impact RPC:

Volumes: The increased trading volumes we just discussed resulted in more transactions falling into lower-fee tiers, pressuring RPC. Product Mix: Although there was a positive mix shift towards long-term rates, which typically have higher RPCs, the overall impact was pressured by a higher proportion of trading in lower RPC products, including treasuries. Membership and Block Volume: An increase in member trading and a decrease in block trading (which typically carries higher fees) further pressured RPC.

Regarding new entrants like FMX, CME has a competitive edge, including “unmatched” capital efficiencies that result in margin savings for customers.

Moreover, the company used its earnings call to note that it has prepared extensively for potential competition and is well-positioned to compete effectively.

It downplayed the threat from new market entrants, especially those that are unable to clear futures or provide cross-margining benefits. CME’s infrastructure and regulatory approvals provide a substantial barrier to entry.

If anything, the past few decades have shown that new exchanges provide more opportunities to cross-trade and create new value for all operators. Hence, I’m not at all worried about new competition.

Dividends & Valuation

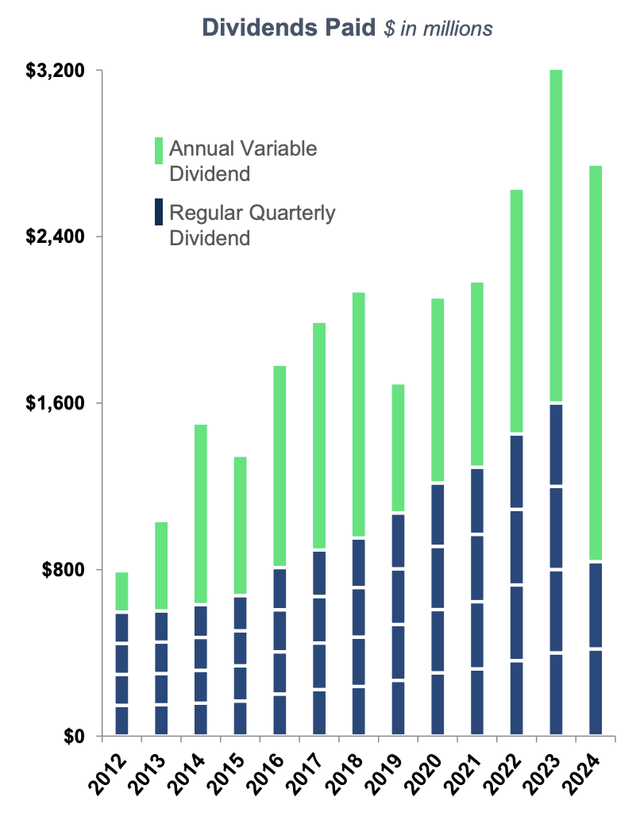

On top of all the aforementioned benefits, CME Group has the habit of distributing all of its free cash flow to shareholders.

It does this by paying four regular quarterly dividends and one annual special dividend, announced in the fourth quarter and paid in the first quarter of the following year.

CME Group

The quarterly dividend was hiked by 4.5% on February 8. It now yields 2.4% and has a five-year CAGR Of 9.2%.

Even better, this year, analysts expect $3.8 billion in free cash flow. This is 5.4% of its market cap, indicating a potential annualized yield of 5.4%.

Although I cannot guarantee anything (special dividends need to be approved by the Board), the company will likely pay a total yield of more than 5%, with decent growth potential if it keeps growing its business.

This is a massive reason why I love the value CME brings to the table at current prices.

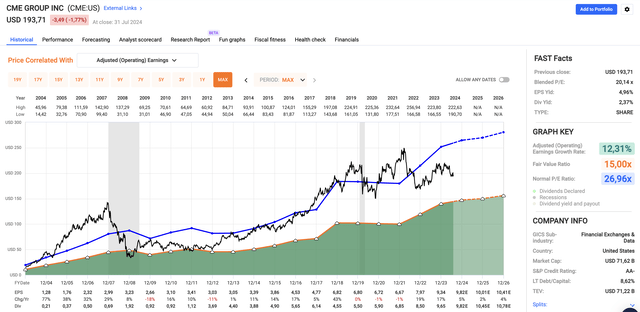

Moreover, the company, which has an AA- credit rating, is very attractively valued using other metrics as well.

Currently trading at a blended P/E ratio of 20.1x, CME trades a mile below its normal P/E ratio of 27.0x. While this may look like an elevated multiple, we need to be aware that we’re dealing with a company with a net income margin of more than 60% and a favorable business model.

FAST Graphs

This gives the stock a fair price target of $280, roughly in line with the target I gave in my prior article.

Although I don’t know when CME will start its next rally, I’m happy to add to my position while it’s still “cheap,” as I consider CME to be one of the most underappreciated opportunities in the market.

Takeaway

Despite the recent underperformance of CME Group, I’m holding firm.

The company continues to show its value with strong earnings growth, a resilient business model, and a compelling dividend yield.

While there are concerns about competition and revenue per contract, CME’s wide moat and strategic advantages keep me optimistic, as there’s little evidence competition and RPC worries are justified.

I believe the current price offers a prime opportunity to buy, with an eye on long-term gains and substantial value creation in the years ahead.

Pros & Cons

Pros:

Strong Market Position: CME’s wide-moat business model dominates key financial exchanges, as it offers key futures and options. Impressive Financials: Recent earnings show record revenue and high margins, even in a low-volatility environment. Attractive Dividends: CME is a consistent dividend payer with a total yield potential above 5%, making it a solid income vehicle. Valuation: CME trades at a steep discount to its historical valuation.

Cons:

Increased Competition: New market entrants could challenge CME’s dominance, though I see this as manageable. Dependence on Volatility: Low market volatility can pressure transaction volumes, impacting revenue. Unlike some peers, CME is still highly dependent on volumes/transactions. RPC Pressure: Lower rates per contract, especially in key product areas, could affect profitability.