Olemedia

If you have been following lithium stocks, it has been a very volatile experience to say the least. Lithium prices have all but imploded and with that, lithium stocks followed. Yet, I think we have many good companies that are beat up and when good times come back, they could recover and thrive. Such is the nature of a cyclical industry. Lithium has had many boom-and-bust time periods, maybe this one has a slightly different flavor, though.

You see, China is taking massive losses and appears to be cutting back supply. Per Carboncredits.com:

Jiangxi province, located in southeastern China, accounts for about 5% to 6% of the global lithium supply. Despite its large reserves, CATL’s Jiangxi mine has faced financial strain due to rising production costs and falling prices. According to BMO (Bank of Montreal) analysts, mining lepidolite has become unprofitable because, despite its high lithium content, lepidolite is costly to convert into usable lithium.”

and

“According to UBS Lithium Analyst Sky Han, this mine accounts for roughly 5% of the world’s primary lithium supply and about 20% of China’s supply. The mine was expected to increase production from 60,000 tons of lithium carbonate equivalent (LCE) in 2024 to 95,000 tons in 2025, positioning it as the fifth-largest lithium mine globally.

While the closure is notable, it is not expected to drastically alter the overall market surplus for 2025. However, a tighter supply situation could develop if other lepidolite producers in China follow suit.”

A recovery in lithium prices might be in the works. Let me explain.

The Geopolitics of Lithium

When thinking about lithium, we have to consider the geopolitics impacting the price of lithium. Normally, supply and demand would lead to price discovery but in this case, we have an interesting theory.

Rumors are circulating that some Chinese operations are producing lithium at $20,000 a tonne and selling it at $10,000 a tonne. Fastmarkets places this figure lower at $11,000 to $17,000 a tonne. Per Reuters / Fastmarkets:

It costs about 80,000 yuan ($11,120) to 120,000 yuan to process a ton of LCE from lepidolite in China, while it costs around 40,000 yuan and 60,000 yuan to get the same volume from brine deposits and spodumene, respectively, analysts say.

If we look at Chinese lithium companies, they have been selling at a loss for some time and this is obviously impacting the market by pushing the price of lithium down. Now, I’m not saying this is the sole cause of lithium’s price decay. Additional supply also came online during the lithium boom times. Some brine plays were starting to spin up such as Lithium Americas (Argentina) (LAAC) and hard rock plays like Sigma Lithium (SGML) popped up. These projects contributed to lithium prices dropping. Meanwhile, while demand is increasing globally, the pace did slow down due to inflation and high interest rates. China could be playing a long-term game by flooding the market to the tune of massive short term financial losses. How long can they continue to play this geopolitical game? One does not know. Let’s look at the potential motivations of China.

China’s Long-Game

Thinking of China, they have a few large Achilles heels (aka weak points). They import most of their oil needs and 2nd they are weak when it comes to semiconductor production. Both are critical when it comes to maintaining an economy and projecting power. If one were to cut off imports (of either variable) the results could be disastrous during a crisis period (such as a response to invading Taiwan). Note: This assumes that TSMC’s domestic semiconductor projection would not fall into Chinese hands.

Conversely, China is estimated to refine 67% to 80% of the world’s lithium, depending on what source you read. Add in that China controls the bulk of the world’s rare earth elements production and refining, and you can see why taking some short-term pain might be logical. It would allow China to hinder foreign lithium production and refining.

So far, the strategy has been successful (with China subsidizing various industries to the tune of $100 billion to $231 billion). The result is various US-based lithium projects are on hold. Other projects seeking partnerships are withering on the vine; at the mercy of those with capital who refuse to take a long-term viewpoint and invest. Still others are cutting back or not funding expansions. Projects in Africa are wondering how things will play out and if they can obtain funding.

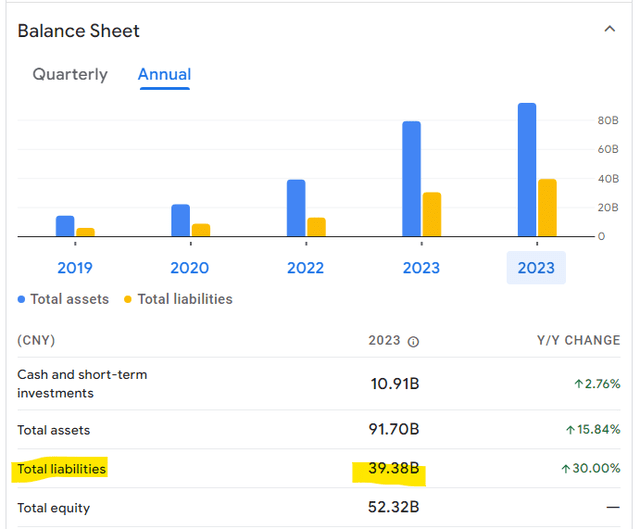

This bodes well for the theory of why China is selling at a massive loss. China can disrupt investment and delay projects. Yet, maybe even China has limits. After all, the last thing China wants is for the car industry to revert back to near 100% oil use vs the growing EV market (with its Chinese lithium refining). Furthermore, Chinese lithium companies are feeling the pain too. Ganfeng (OTCPK:GNENF) has liabilities keep increasing and losses are mounting. Note: Figures below are in CNY (Chinese). Below, we can see liabilities are rising quickly.

Ganfeng liabilities (Google Finance)

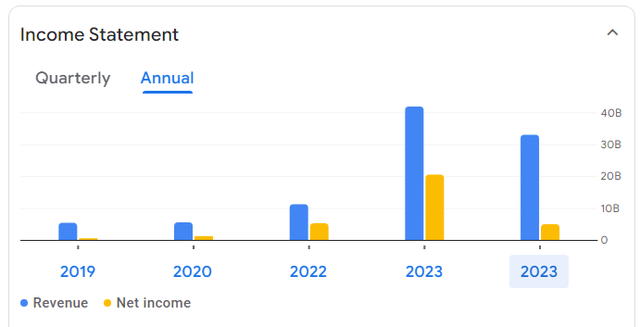

Looking at annual revenue and profits, we can see a shift for the worse.

Ganfeng Annual Revenue and Profits (Google Finance)

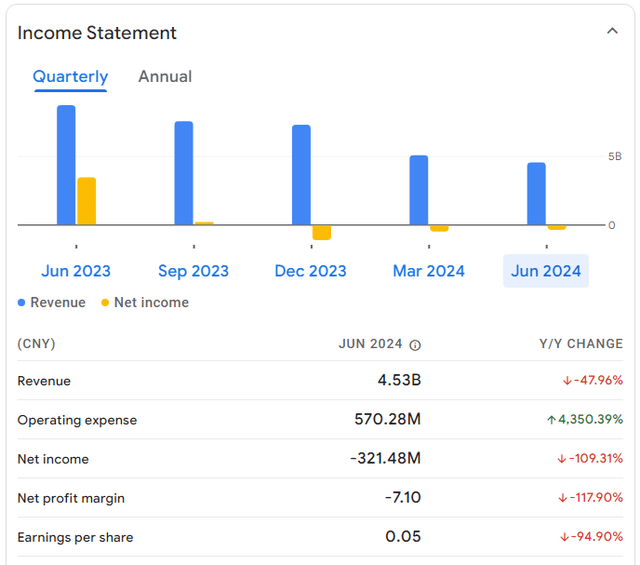

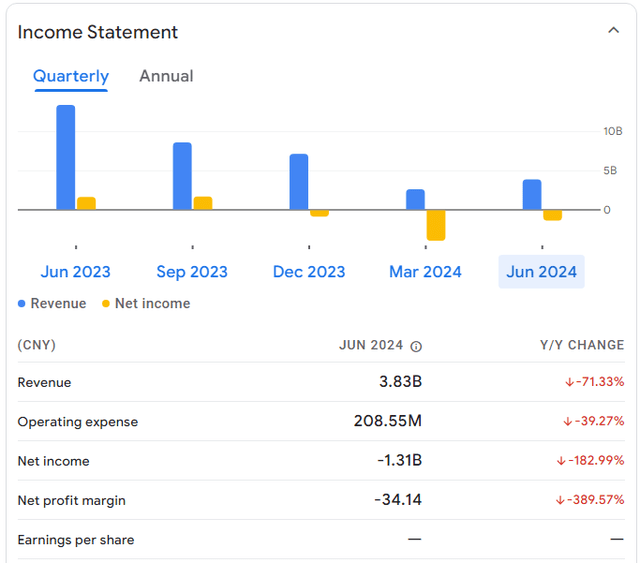

When we move this to quarterly, we can see losses adding up.

Ganfeng Quarterly Revenue / Profits (Google Finance)

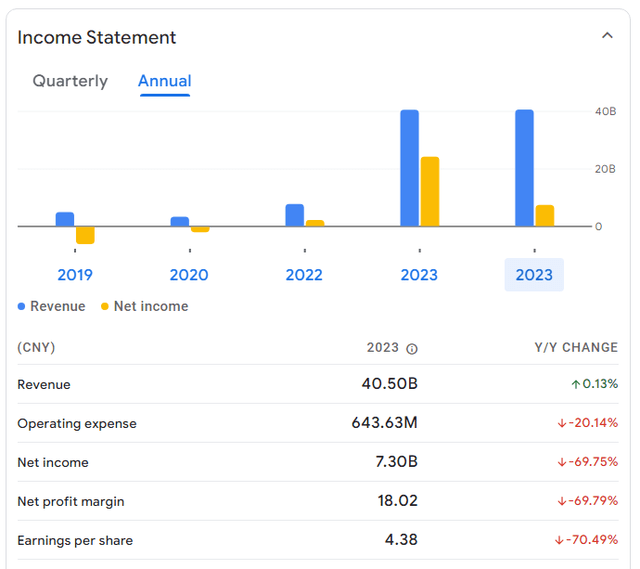

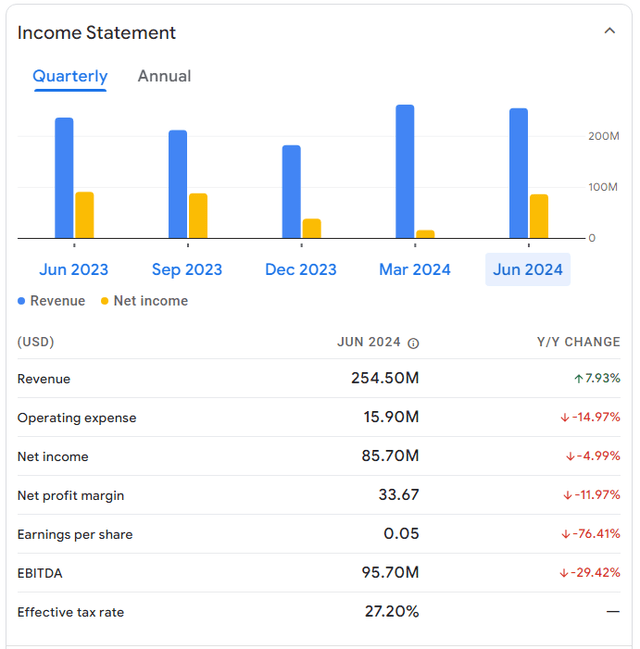

Ganfeng is not alone. Other Chinese lithium producers are suffering as well. Tianqi Lithium posted a loss of $5.21 billion yuan ($734 million) for its first two quarters of the year. The graphics look similar to Ganfeng. Looking at the annual revenue, we see:

Tianqi Lithium Annual Revenue / Profits (Google Finance)

When we shift to quarterly, we can see the glut of lithium is depressing prices and taking quite a toll on the company.

Tianqi Quarterly Revenue / Profits (Google Finance)

Maybe we are starting to see a shift, just recently, powerhouse Chinese CATL announced they were cutting back lithium production. To take this a step further, we might need to cover how a normal cycle for minerals works to understand what stage we are currently in.

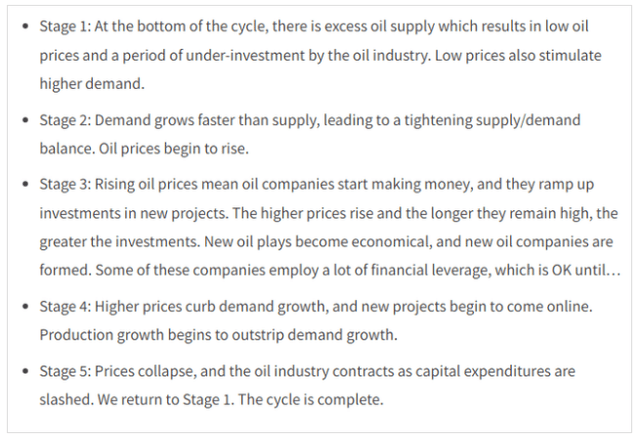

A Cyclical Cycle For Minerals

To understand how things might play out, we need to have a rough overview of the cyclical cycle of minerals. A good explanation can be found in the oil industry:

Cyclical Life Cycle (Financial Sense)

What Lithium Companies Should We Invest In?

Given that global growth in the EV market (which we covered in our last article) is growing and factoring in that future EVs will be cheaper, we might assume demand will also be higher. If we are betting on a lithium future, then the question is, what companies do we invest in?

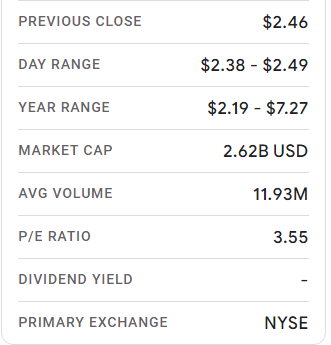

Arcadium Lithium (ALTM) is our number 1 pick. Large and profitable in this poor lithium market (and geographically diversified) with operations world-wide. Arcadium is hands down our 1st pick and while risky, has less risk than many pre-revenue projects. ALTM:

ALTM Market Data (Google Finance)

ALTM Quarterly Income Statement (Google Finance)

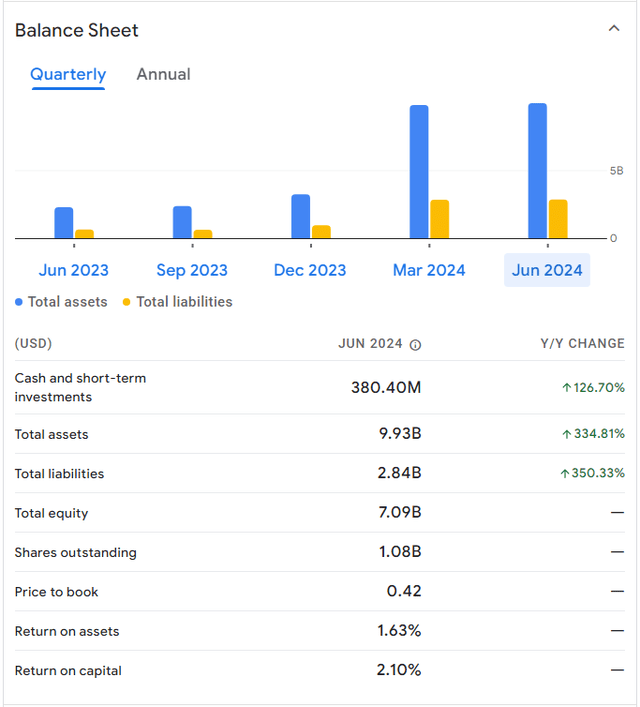

Arcadium Balance Sheet (Google Finance)

Standard Lithium (SLI) is another favorite. At a mere dollar and change, the stock is cheap. The company has a large partner via Equinor (EQNR) that acquired 45% of two of the three projects that Standard has. In other news, Standard received $100 million from Koch a few years ago and just recently a Koch 28-year veteran became the CEO of the company when Robert Mintak handed over the reins. SLI:

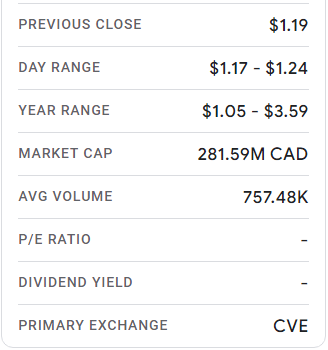

Standard Lithium Market Data (Google Finance)

Being at the development stage, they do not have revenue, but they do have quite a war chest built up. Partner Equinor injected $30 million USD into the company, $60 million of development, and up to $70 million in future potential payments if final investment decisions are agreed upon.

Lithium Americas (LAC) is based in mining friendly Nevada. While they are pre-revenue and years away from projection, they have won every single environmental legal case against them. The Department of Defense has helped fund the Thacker Pass lithium project, and the Department of Energy is on standby to loan the company over $2 billion dollars. In our opinion, the holdup is a low share price. General Motors and the company are currently in talks to determine a solution where GM can invest $330 million into the company. This should trigger the Department of Energy loan. Then it will be a matter of building out the mine, which will take years. Still, they offer excellent value if one is patient and comfortable with taking on risk. LAC:

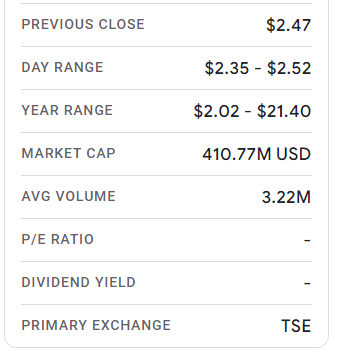

Lithium Americas Market Data (Google Finance)

Albemarle (ALB) intrigues me. While I do not own them currently, I often look at them since they border Standard Lithium in Arkansas. The company produces a chemical called bromine in the natural state, but they are now starting to look at producing lithium in Arkansas. Exxon moved into Arkansas by acquiring 120,000 acres, and it is rumored another oil major is looking to move in as well. Albemarle also has an operation next door to Century Lithium (OTCQX:CYDVF) in Silver Peak, Nevada. ALB:

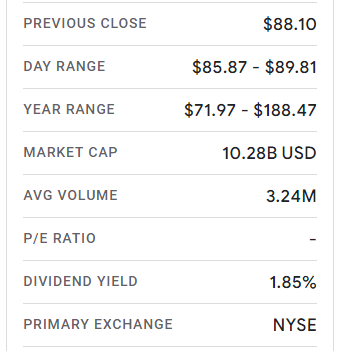

Albemarle Market Data (Google Finance)

Lastly, Nano One (OTCPK:NNOMF) addresses two key issues when it comes to lithium batteries. First, they eliminate a waste stream called sulfates. We wrote about that in detail. Second, they increase battery life, which addresses the battery life issue that some people consider. Per the Atlanticcouncil.org:

“The market for electric vehicles is already problematic as consumers realize that fully electric vehicles still suffer from range issues as batteries start to degrade.”

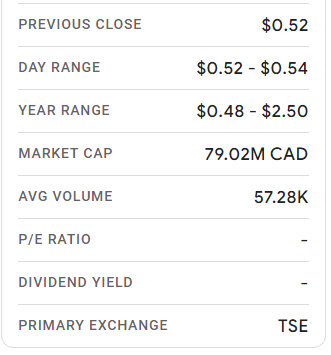

While outside the scope of this article, we have written about Nano’s black box technology in the past. Cash for Nano One is getting lower and that should be of some concern, yet the company also has an uncanny ability to receive support via the Canadian government via grants. It is very likely the company is in talks with the DoD and DoE for funding, but if and when these loans might pan out is anyone’s guess. NNOMF:

Nano One Market Data (Google Finance)

Assessment And Risk

Chinese CATL cutting back on lithium production is a good start, but it is only a start. We do not know if this is the beginning of a long road to lithium price recovery or not. Yet, outside of China supporting the lithium industry, at some point the Chinese lithium companies have to throw in the towel. Producing lithium at $17k and selling it for $10k is not sustainable for China. Something has to give. The risk profiles differ for each company. From a macro level, the biggest risk is no one knows how long it might take for lithium to reverse, and then you have the broad economic picture. If the economy continues to deteriorate, this may impact auto sales. From a micro viewpoint, readers would be well served to study the cash and burn rates of each company in addition to the technology or projects they are engaged in. DoD and DoE loans also come into play. Right now, we are buying ALTM primarily followed by SLI, NNOMF, LAC, and LAAC. Each has different risk profiles that you can read about in my prior articles. For a more diversified stance, one might invest in an ETF like Global X Lithium & Battery Tech ETF (LIT).

Conclusion

Lithium investing defines risk. It defines patience, but if you think EV is the future, and you can stomach the price rollercoaster, this might be a sector for you.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.