Khaosai Wongnatthakan

One of the biggest advantages of older ETFs is also a major disadvantage. On the one hand, it’s easy to look at various time frames to see when it outperformed the market; this gives you opportunities to look for similar signals in the future. Ironically, that’s also a drawback because too much historical evidence can create an inherent bias in your analysis. The fund in question is the Dimensional U.S. Equity ETF (NYSEARCA:DFUS), and for these reasons, I’m going to spend very little time on analyzing this 23-year-old fund’s historical performance and dedicate more space for a forward look.

Thesis: DFUS doesn’t seem to give investors any edge over the SPY, despite the wider spread into small and mid-cap securities. You’d think it would, but that might only happen if there were a major rotation in the market out of tech and into key support sectors like consumer discretionary, healthcare, financials, and industrials. Unfortunately, I don’t see that happening any time soon.

A Brief History of DFUS

Incepted in September 2001, this Russell 3000 TR index-benchmarked fund currently has a little under $9 billion in AUM. Despite being around for more than two decades, however, it operated as a mutual fund until its listing in June 2021.

With an expense ratio of 0.09%, it’s one of the more inexpensive ways to get broad market exposure. The 2500+ holdings give you a multi-sector foundation, but the fund also uses derivatives to deliver higher returns. The fund is also intended to favor long-term capital appreciation over short-term distribution-based gains, so I see it as a viable way to ensure that upside potential is captured from a wide range of industries and sectors.

Although the fund is a little skewed toward the tech sector with a nearly 30% weighting, there’s ample diversification into financials, healthcare, consumer discretionary, and industrials, which collectively comprise nearly half of the fund’s holdings. This is a key point that I’d like you to keep in mind as I discuss the investment case later on.

The fund is actively managed but, for the most part, the composition remains fairly static with a turnover of 2%. Weightings are constantly rebalanced to mimic the various weightings of the benchmark index, and the fund’s managers adjust these weightings based on the momentum of the underlying assets, relative valuations and prices, share liquidity, and other factors.

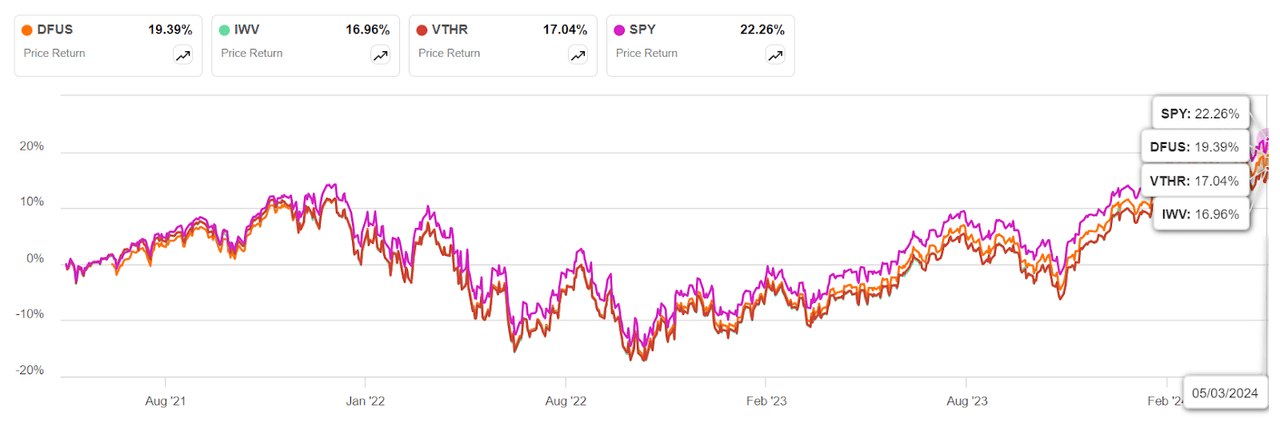

Historically, the fund has closely tracked its benchmark index, with tracking errors in a relatively tight band around the 1% mark. For the period starting in June 2021, DFUS’s performance has been arguably mediocre, but considering its outperformance against similar ETFs, this seems to be one of the better plays on the broad market.

on

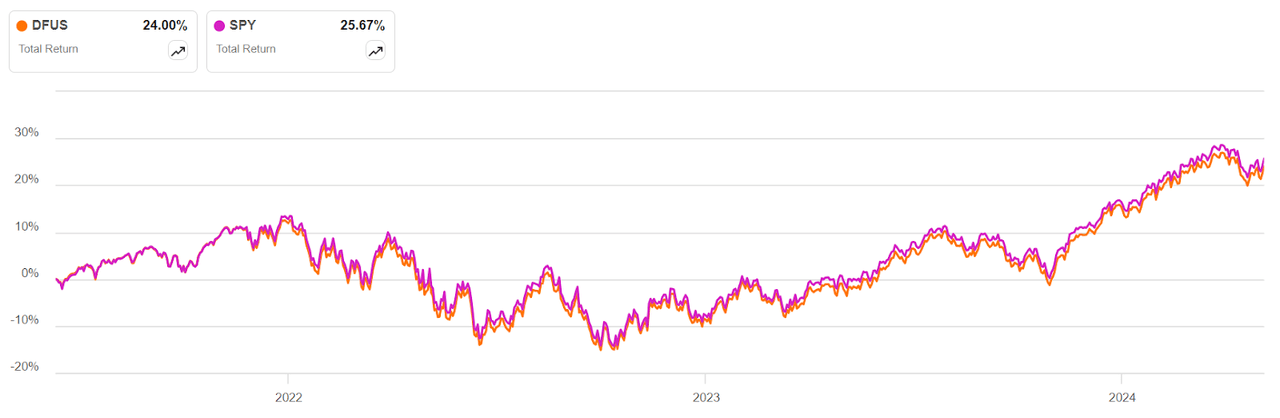

However, as the graph above shows, even on a price return basis, your money would have worked harder as part of SPY rather than DFUS. Both ETFs have similar expense ratios, but SPY has an edge in terms of distribution, so you’ll see a slightly higher 3Y return – nearly 170 basis points over DFUS.

on

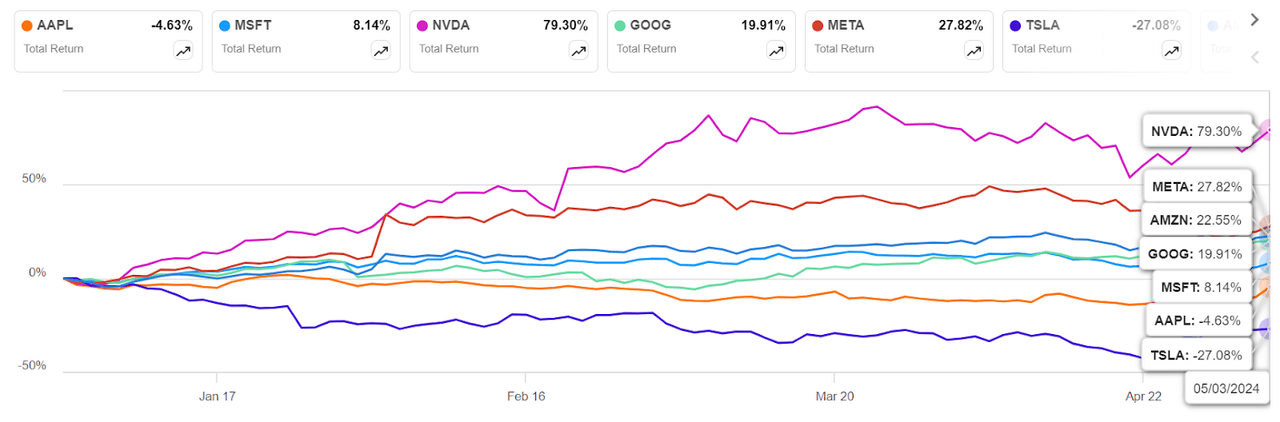

Why DFUS Might (Not) Outperform SPY in the Future

My investment case does take some elements from historical returns, but as I mentioned, it’s the forward look that’s the important consideration. The reason for this is that 2023 and a part of 2024 have been led by trillion-dollar tech companies vying for AI dominance. The jury is still very much out on who’ll get there first, but first-movers like Nvidia (NVDA), Meta Platforms (META), Amazon (AMZN), and Alphabet (GOOG)(GOOGL) have already shown impressive capital appreciation on a YTD basis.

on

This is a problem for a fund like DFUS is that, while it appears to give you much higher exposure to the SmidCap market (small to mid), it doesn’t look that way in reality. I’ll elaborate.

For instance, DFUS’s weighted average market cap is a little over $700 billion, while SPY’s is $800 billion. That’s not a huge difference. Of course, Big Tech still makes up a sizeable chunk of each of these funds, hence these apparent similarities, but if you look at SP500 vs. Russell 3000 in terms of median market cap, you’ll see a very stark difference. The Russell 3000’s median market cap is only $2.29 billion (PDF auto-download), while that figure for SP500 is over $265 billion. Their average market caps (weighted), are $700 million for the Russell 3000 and $480 billion or so for the SP500.

The difference between the mean and median is very important to this discussion, so a little bit of elementary statistics is in order. The mean – or average, as most of us know it – of a data set is simply the sum total of the individual data points divided by the number of data points. Since Big Tech is the clear skew-agent here, the averages are going to look very similar. The median, however, is the value of the middle item of the data set when it’s arranged in either descending or ascending order. If there’s no ‘middle item’ in a sorted list, as is the case when you have an even number of data points, you take the mean of the two middle data points.

Bringing that home to the SP500 vs. Russell 3000 discussion, the former’s median is much closer to its mean (median of $265 billion against a mean of $460 billion), while the Russell 3000’s median of $2.29 billion is light years away from its mean market cap of $700 billion.

The reason is obvious; because the Russell 3000 comprises 6x the number of SP500 companies, it’s only logical that the former has much greater exposure to SmidCaps. We simply validated that with the mean-median discussion.

Rounding Up My Thesis

The problem, however, is that this doesn’t give DFUS a real edge over SPY, and that’s where the thesis for DFUS essentially lies. Since it has 6x the number of holdings that SPY does, there’s a much wider spread that gives you effective exposure to the SmidCap market across multiple sectors. At least, it would seem that way; unfortunately, that doesn’t seem to have made a difference over the past three years, and I don’t think it will in the future.

That’s an important consideration because, even though Big Tech is currently at the wheel, any significant and sustained rotation into the smaller or more cyclical sectors like healthcare, consumer discretionary, industrials, and financials, which collectively make up about 50% of the Russell 3000 but only about a third of SP500, should theoretically give you greater returns for the Russell 3000.

The problem with that is that you may need to wait for such a rotation to happen, and in my opinion, that’s not going to happen soon. It’s reasonable to assume that one, or even two, of these other sectors will perform stronger than the information technology sector at some point in the future, but to expect outperformance from no less than four sectors for a prolonged period is certainly not reasonable.

Moreover, even if that improbable alignment of sector performance in favor of sectors other than tech were to happen, SPY would end up rebalancing the weightings of those sectors higher, thereby negating any advantage that a Russell 3000-benchmarked ETF might have had. Since these funds both use a float-adjusted weighting method, any market cap growth spurt in these sectors will impact the composition of every rebalancing, and that potential source of alpha is largely wiped out.

Considering all these factors, I don’t see DFUS having any sort of edge against the SPY. In fact, due to the higher yield of the SPY (TTM yield of 1.33% vs. 1.22% for DFUS), the fund has been performing marginally better than DFUS on a total return basis, as we saw in one of the graphs above. In other words, your money will work harder in SPY rather than DFUS.

As such, I can’t rate this higher than a Hold. I don’t recommend selling DFUS in favor of SPY because your transaction costs and tax implications could very well offset any potential gains from making the switch. New money, however, is best put into SPY for long-term capital appreciation as well as total return.