JHVEPhoto

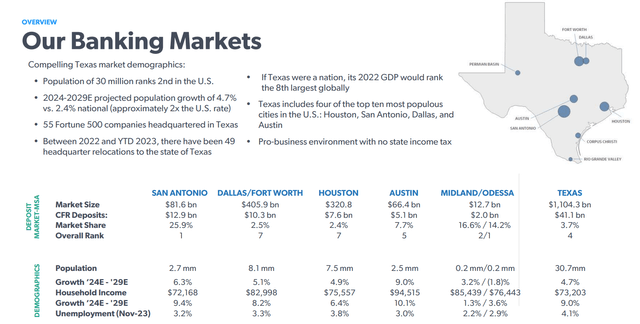

I said that there was a lot to like about Cullen/Frost Bankers (CFR) when I opened on this bank last November. The holding company for Frost Bank, this commercial and retail lender is an exclusively Texan player that controls one of the finest deposit franchises in the industry. Its growth outlook was solid too. Frost was already the top deposit gatherer in San Antonio, and was in the process of building out its franchise in other large markets like Houston, Dallas, and Austin, where its footprint remains more modest. While that was coming at a near-term cost in terms of higher expenses, implied market share gains married with solid Texan GDP growth pointed to attractive long-term potential.

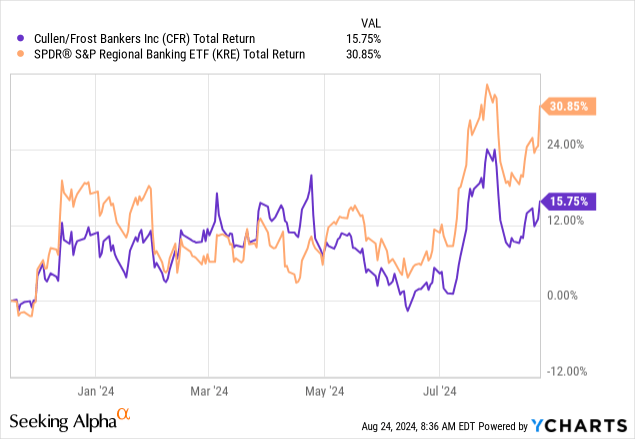

These shares have been a bit so-so in that time, returning around 15% with dividends. While that is objectively good in isolation, it looks more pedestrian next to the 30%-plus returns of the wider regional bank space.

Operationally, Frost is by-and-large performing as expected, with net interest margin (“NIM”) bottoming late last year and net interest income (“NII”) also returning to growth. Expense growth is still outpacing the top line, and this continues to put downward pressure on earnings. As for the stock, Frost trades for around 13x EPS and around 1.7x ex-AOCI tangible book value – and that remains a solid deal given its profitability and growth prospects. I leave my initial ‘Buy’ rating unchanged.

Earnings Remain Subdued

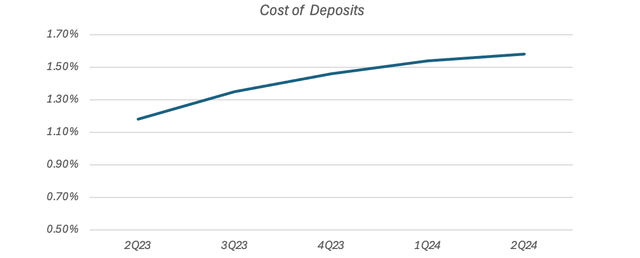

Frost’s income statement dynamics are largely playing out as expected last year. Firstly, funding cost growth continues to ease up, with the bank reporting a total cost of deposits of just 1.58% last quarter. This was up 4bps sequentially, continuing its trend of deceleration. The prior three quarters saw quarter-on-quarter deposit costs rise by 8bps, 11bps and 17bps, respectively.

Data source: Cullen/Frost Quarterly Results Releases

Frost’s deposit base deserves some extra commentary because it is by far the best feature of this bank. Despite rising recently, a 1.58% total cost of deposits remains exceptional. You will not find many mainland banks with a print this low, certainly in the $50 billion-plus asset bracket that Frost is in. What’s more, Frost is overwhelmingly funded by customer deposits, with shareholder equity making up most of the rest. There is very little debt here, which obviously attracts wholesale rates and is therefore more expensive.

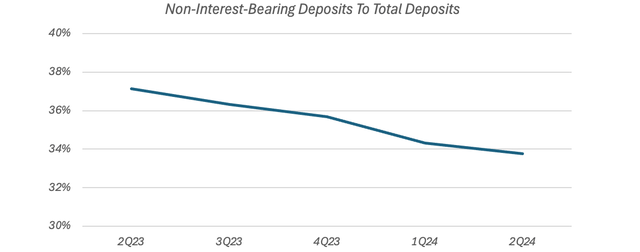

Non-interest-bearing balances continue to churn. These averaged $13.68 billion last quarter, down from $13.98 billion in Q1 and $15.23 billion in the year-ago period. Total deposits have been roughly flat in that time, meaning the underlying mix continues to shift to interest-bearing accounts. NIB balances are still a chunky ~34% of the total, albeit this is down from around 37% a year ago.

Data source: Cullen/Frost Quarterly Results Releases

NIM has started to grind higher again after bottoming at the end of last year. While funding costs have edged higher, Frost is also seeing yields on loans and securities tick up as they reprice to the current rate environment. The bank has also seen some mix shift on the asset side of the balance sheet, with maturing securities recycled into higher yielding loans. NII has started to tick up as a result, increasing ~3% year-on-year and ~1.7% sequentially last quarter to $396.7 million.

That said, earnings remain subdued, with Q2 EPS of $2.21 down around 11% year-on-year. This is for a couple of reasons. On the income side, NIM is obviously just one component of NII. The other is earning asset levels. Now, management often makes of point of describing Frost as a relationship bank. While some banks prioritize loan growth and then look for funding (e.g., deposits) afterwards, Frost attacks things from the other direction. It looks for deposits first and then thinks about deploying these into loans or securities.

Frost does this because it wants customers to be primarily banked at Frost. Primary banked customers offer a few advantages. Firstly, they are often less sensitive to rates on both sides of the balance sheet. You can see this clearly here, as Frost is able to pay just 1.58% on its deposits even though the cash rate is 5.33%. Secondly, primary banked customers offer a bank greater insight into their finances, giving it more data with which it can price products and spot potential bad debt in advance. On that note, asset quality hasn’t moved here. Net charge-offs were 0.2% of loans last quarter, down around 2bps year-on-year, while non-accrual loans were flat at just under 0.4% of total loans.

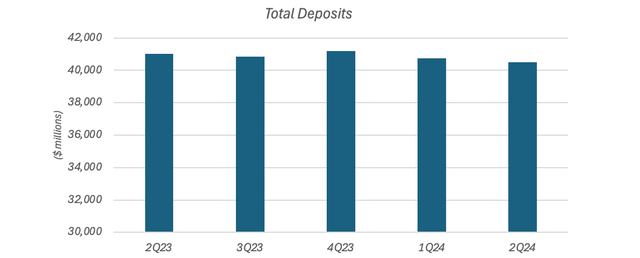

Deposit gathering has a cyclical element to it, and this is not a good point in the cycle for gaining low-cost deposits. Between 2015 and 2022, Frost grew deposits at a roughly 9% annualized clip, but balances have been flat for a while now. Because Frost overwhelmingly funds itself via customer deposits, earning assets have also flat lined at around the $45.5 billion mark. Growth will pick up again when interest rates fall, but for now, flat earning asset balances are obviously a headwind to NII.

Data source: Cullen/Frost Quarterly Results Releases

On the expenses side, Frost is still guiding for 6-7% growth in operating costs, which is ahead of revenue growth. I mentioned last time that the bank is currently expanding its footprint in places like Dallas, Houston, and Austin, where its market share is still in the single-digits. This will pay off down the line when new branches reach scale, but in the short term, it is depressing the bank’s earnings.

Valuation

Frost shares trade for $111.79 as I type, equal to around 1.7x tangible book value per share of $66. Note that this is excluding accumulated other comprehensive income from the balance sheet. I mentioned this last time but to quickly recap, Frost still holds over $18.5 billion in investment securities, accounting for around 40% of its earning assets. A significant portion of this portfolio was purchased when interest rates were lower, and this has led to large unrealized losses as rates have risen. These losses show in the AOCI line on the balance sheet. Many banks have seen the same thing, albeit perhaps not to the same degree as Frost.

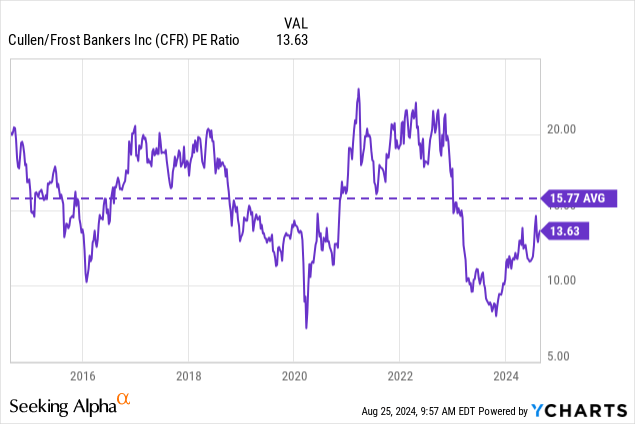

Frost earned $4.27 per share over the first two quarters, or $8.54 per share annualized. That maps to a return on tangible equity of around 13%, again excluding AOCI. Dividing this figure into a 1.7x TBV multiple implies a price-earnings ratio of roughly 13x, around 15% below the stock’s longer-term average:

Another way to look at that P/E ratio is to turn it on its head and inverse it. This produces an earnings yield of ~7.7%. Frost pays out around 45% by way of its cash dividend, equating to a yield of roughly 3.4%. Multiplying the retained earnings by a ~13% ROTE implies longer-term annualized growth potential of around 7%, all else equal.

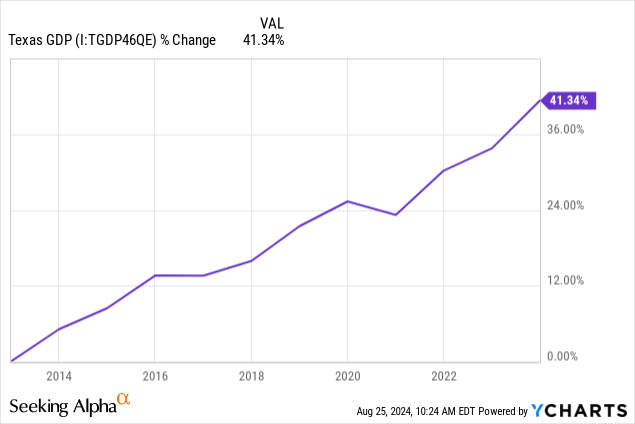

This is not unrealistic for Frost. Indeed, it grew deposits faster than before 2023. Texas is also growing its population at twice the rate of the wider United States, which alone should power above-average GDP growth for the state.

Source: Cullen/Frost Investor Presentation

Real Texas GDP growth has averaged around ~3% a year since 2012, which is more like 6% in nominal terms. Given Frost also has potential to gain market share, it shouldn’t have any problem hitting high single-digit growth through the cycle. On top of a 3.4% dividend, investors should still compound here at a double-digit annualized clip.

Summing It Up

Earnings remain somewhat subdued at Frost Bank. Funding cost pressure has definitely subsided, but elevated operating costs and flat deposits and earning asset balances are still weighing on the bottom line. That said, Frost remains a class act, ultimately controlling one of the highest quality deposit franchises in the country. These shares remain reasonably valued at 13x EPS, which is below their long-term average and can support double-digit annualized returns for investors. Given that, I keep my ‘Buy’ rating from last time in place.