Sundry Photography

Introduction & Investment Thesis

CrowdStrike (NASDAQ:CRWD) is a cybersecurity company that has outperformed the S&P 500 and Nasdaq 100 YTD. The company reported its Q4 FY24 earnings in March, where revenue and earnings grew 36% and 85.9% YoY, beating expectations. The company continues to drive new customer deals at a rapid pace while deepening adoption of its platform, with 64% of customers having adopted at least 5 modules, resulting in a record number of customers with at least $1M in Annual Recurring Revenue (ARR). At the same time, the company continues to build strategic partnerships while expanding its margins.

For FY25, the company is expected to grow its revenue and earnings by 29.2% and 34.5% YoY, respectively. The company operates in a large and growing total addressable market (TAM), and the management believes that it can continue to streamline its operating expenses further over the coming years to expand its operating margin.

Assessing both the “good” and the “bad,” I believe that the stock is a “buy” for a long-term investor, given the company’s excellent operational metrics, secular tailwinds of AI, and increasing enterprise platform consolidation.

About CrowdStrike

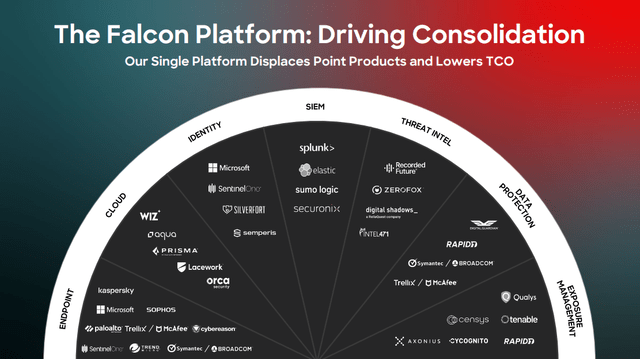

The CrowdStrike Falcon is a cloud-native cybersecurity platform that is built with AI capabilities to harness vast amounts of security and enterprise data to deliver automated protection and provide threat hunters to stop security breaches. The company achieves this by deploying lightweight agents on endpoint devices that consume fewer endpoint resources but still provide robust security by harnessing the power of the cloud. This approach enables them to protect their customers across endpoints, cloud workloads, identity, and data across new and emerging areas of enterprise risk.

In terms of its business model, CrowdStrike offers 27 cloud modules on its Falcon platform that it sells via a subscription-based pricing model. These modules provide customers with a unified set of solutions across Endpoint Detection & Response (EDR) and Extended Detection & Response (XDR), Identity Threat Detection & Response, Threat Intelligence, Cloud Security, SIEM, Log Management, and more.

The company leverages its direct sales team and channel partners to go-to-market, where they employ a “land and expand” strategy to deepen adoption and spend on its platform. I believe CrowdStrike’s business model is a powerhouse of cybersecurity products and services, creating multiple avenues for compounded growth due to the benefits the platform has from its network effects and high switching costs.

Q4 FY24 Earnings Slides: The CrowdStrike Falcon Platform

The good: Deeper platform adoption, partnership with Google Cloud and Nvidia, Expanding margins

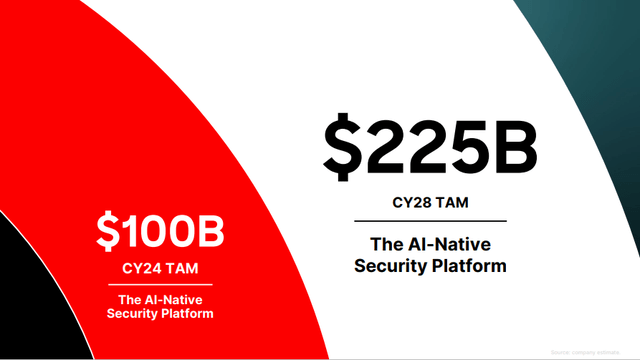

CrowdStrike operates in a large TAM that it estimates at $100B as per its Q4 FY24 earnings report. Given that it generated $3.06B in revenue in FY24, its market share would currently stand at approximately 3%. Meanwhile, the management believes that its TAM will expand to $225B by 2028, which would represent a compounded annual growth rate (CAGR) of 22.5%. For perspective, CrowdStrike’s TAM had been growing at a CAGR of 15% per investor briefing in 2022. Since then, the company has seen an acceleration in its TAM, and I believe it could be attributed to the proliferation of AI since last year, as the company changed the scope of their target market from cloud-native to AI-native.

Q4 FY24 Earnings Slides: CrowdStrike’s growing TAM

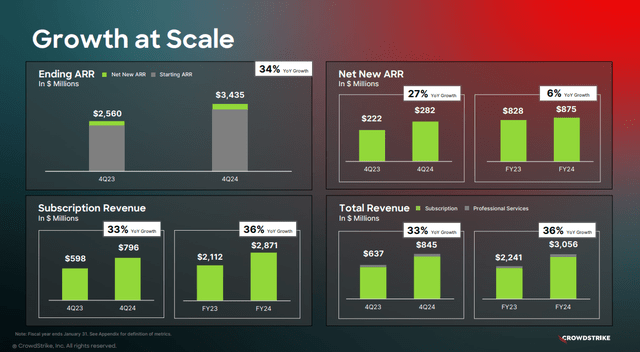

In FY24, CrowdStrike grew its revenue by 36% YoY to $3.06B. Subscription revenue, which contributed to 93.7% of Total Revenue, grew at a similar pace of 36% YoY to $2.87B. This is driven by a combination of new customer deals as well as growing customer adoption across its Cloud Security, Identity Security, and LogScale Next-Gen SIEM solutions on the Falcon platform.

In terms of new customer deals, CrowdStrike recorded a net new ARR of $282M, which grew 27% YoY, while finishing the quarter with $3.44B in ending ARR, which grew 34% YoY. When it comes to driving platform adoption, CrowdStrike now has 580 customers with at least $1M in ending ARR, which grew 33% YoY, as we are seeing an increasing number of customers purchasing more modules on the Falcon platform, with 64% of them having adopted 5 or more modules. I believe this is a broader trend where we are seeing enterprises leaving point products to realize the benefits of platform consolidation in the form of higher return on investment (ROI), especially as budgets continue to be under scrutiny in a high-interest rate macroeconomic environment. This is what George Kurtz, CEO of CrowdStrike, said during the earnings call, which demonstrates the rationale behind increased platformization among enterprise customers.

A recent IDC report echoes this, showcasing $6 of return for every dollar invested in the Falcon platform. That is ROI. Free is never free. Customers understand the difference between product pricing and the total lifetime cost of operating inferior technology. Given the Falcon platform’s ROI and TCO savings, we believe we will continue to see favorable pricing dynamics.”

Q4 FY24 Earnings Slides: CrowdStrike’s growing revenue

During the earnings call, CrowdStrike also announced their intended acquisition of Flow Security, which is a cloud data runtime security solution. In my opinion, this acquisition will enhance CrowdStrike’s native data protection module, allowing it to offer a cloud-centric data protection alternative with superior security measures in a market that is plagued by legacy Data Loss Prevention (DLP) vendors across devices.

At the same time, CrowdStrike continues to build its leadership by extending a partnership with Google Cloud (NASDAQ:GOOG) in order to stop breaches across multi-cloud and multivendor environments, with cloud intrusions having grown 75% in the past year. This will provide Google Cloud customers with protection from CrowdStrike’s Falcon platform through the Google Cloud Marketplace. Simultaneously, CrowdStrike also announced a strategic partnership with Nvidia (NASDAQ:NVDA) in March to combine their Falcon Platform with Nvidia’s GPU-optimized AI pipeline and software such as Nvidia Morpheus and Nvidia NIM microservices to help their customers get better visibility into threats and proactively defend against vulnerabilities as modern security attacks grow faster and more sophisticated. I believe this partnership will drive higher customer confidence as they adopt AI technologies at a faster pace to enhance business performance while protecting their businesses from security threats at the same time.

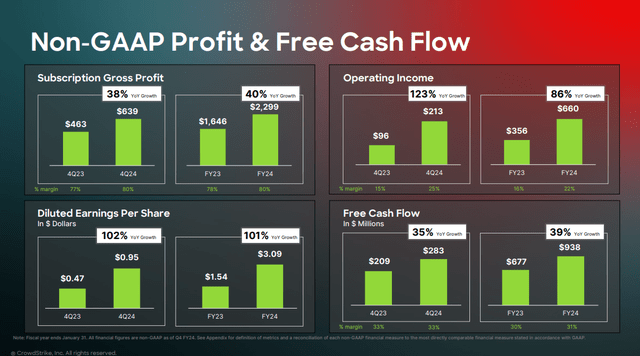

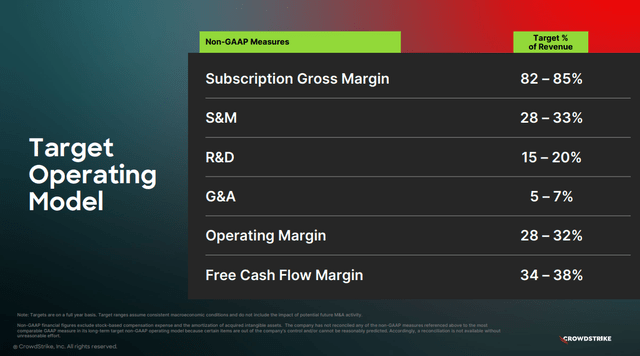

Shifting gears to profitability, CrowdStrike generated $660M in non-GAAP Operating Income, which grew 86% YoY at a margin of 21.5%, compared to 15.8% in FY23. This was driven by streamlining operating expenses, which was possible as CrowdStrike benefited from deeper platform adoption and higher spend per customer. Furthermore, the management believes it can continue to drive higher profitability as per its long-term operating model, where the non-GAAP operating margin is expected to grow to 28-32% as it continues to drive adoption and spend on the platform, thus streamlining the Sales and Marketing costs to acquire net customer deals.

Q4 FY24 Earnings Slides: CrowdStrike’s improving profitability

The bad: Competitive forces could dampen CrowdStrike’s growth trajectory

Although CrowdStrike is rapidly benefiting from increasing platform consolidation, as customers buy more modules on the platform given its robust product and ongoing innovation, the market for cybersecurity products is fiercely competitive and evolving.

In my opinion, CrowdStrike faces competitive threats from two main segments, which include 1) Traditional Security Vendors and 2) Emerging Technology Security Vendors. The Traditional Vendor space includes endpoint security providers such as Broadcom (NASDAQ:AVGO) and network security networks such as Cisco (NASDAQ:CSCO), Fortinet (NASDAQ:FTNT), and Palo Alto Networks (NASDAQ:PANW), where they have transitioned from on-premise to cloud security to better position against CrowdStrike. Meanwhile, the emerging technology vendors include SentinelOne (NYSE:S) and Cloudflare (NYSE:NET), which are better positioned to compete with CrowdStrike in cybersecurity markets such as EDR, Managed Threat & Response (MDR), Identity Access Management (IAM) and Threat Intelligence.

Tying it together: CrowdStrike is a “buy”

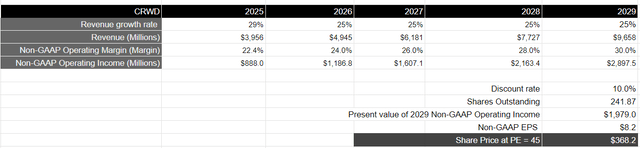

CrowdStrike expects to generate approximately $3.956B in revenue in FY25, which would represent a growth rate of 29.2%. Assuming that CrowdStrike continues to grow in the mid- to high-twenties region over the next 4 years, while its TAM also expands by 22.5% during this time to $225B, it should generate close to $9.6B in revenue by FY29. I believe this would be possible as CrowdStrike continues to drive new customers while driving product innovation, growing its leadership by forging partnerships, and deepening its relationship with its existing customers.

In terms of profitability, CrowdStrike expects to generate approximately $888M in non-GAAP operating income, which would represent a growth of 34% on a YoY basis, with an improvement in margin of 100 basis points to 22.5%. Taking the management’s long-term operating model into consideration, I believe that the company should continue to improve its operating expenses as it unlocks higher leverage with deeper platform adoption. Assuming that non-GAAP operating margin grows to 30% by FY29, the company should generate a non-GAAP operating income of approximately $2.9B, which would be equivalent to $1.98B when discounted at 10%.

Q4 FY24 Earnings Slides: CrowdStrike’s long-term operating model

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe that CrowdStrike should trade at 2.5-3x the multiple, given the growth rate of its earnings during this period of time. This would translate into a forward PE of 45, or a price target of $368, which represents an upside of 21%.

Author’s Valuation Model

While there could be short-term volatility in the stock, given its elevated forward PE ratio of 77 based on its FY25 earnings projections, as well as the S&P 500, which is trading over its 5- and 10-year average PE ratio, I believe that CrowdStrike has performed excellently thus far, navigating an uncertain macroeconomic environment where it continues to drive growth while improving profitability at the same time. Given its strong momentum driving adoption amid secular trends in AI and cybersecurity, I believe that the stock is a “buy” at current levels.

Conclusion

I believe that CrowdStrike will continue to climb higher over a 5-year investment horizon as the company gains market share in a growing TAM, fueled by the secular forces of AI, deepening product adoption, and expanding profitability. As an investor, I will be watching the overall competitive landscape and monitoring the trend in ARR and adoption rate to continue to assess my bullish thesis in the coming quarters. At the moment, I believe the company is well positioned to grow its revenue in the mid-to-high twenties range over the next 5 years while expanding its operating margins to its long-term target of 28-32%, which would translate to the stock having an upside of at least 21% with a price target of $368.