Marvin Samuel Tolentino Pineda/iStock Publishing via Getty Images

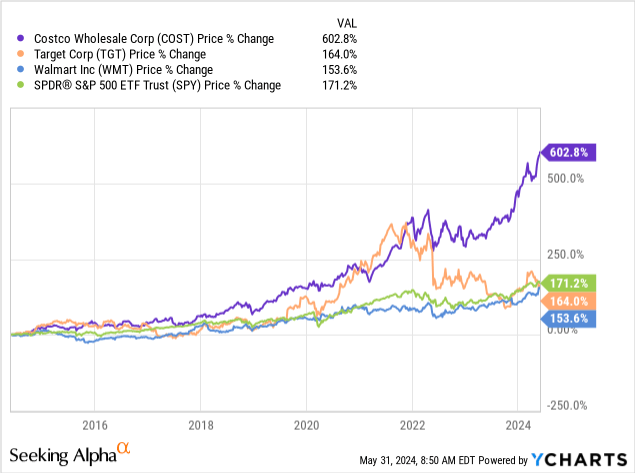

Reversion to the mean, unexpected sell-off, dips, temporary weakness. These are all things we know stocks go through from time to time. And then, we stumble across a stock that consistently defies gravity without ever going hyperbolic. We’re talking about Costco (NASDAQ:COST). Costco, of course, is a retailer. But once we understand how it runs its business, we find out it’s a one-of-a-kind company with a business model that has become almost irreplaceable.

Costco just released its Q3 earnings report. Here we have another great opportunity to understand the secret behind Costco and spend a few words on hot topics such as the membership fee, its store expansion, and the partnership with Uber (UBER).

While I have often reviewed Costco starting from its business model to present then and discuss its financials, I want to take another way today. Starting from its latest financials, we will, in a certain sense, reverse engineer the company to understand how it works and grasp the reason for its enduring success.

Costco’s Earnings

Costco’s operating results impressed and pleased investors once again.

Let’s see what was released:

Costco’s quarterly net sales increased 9.1% to $57.39 billion. For the first three quarters, net sales increased 7% to $171.44 billion. This shows Costco’s sales are strengthening as we move down the road. True, there was a favorable impact estimated to be between 0.5% to 1% due to the shift of the fiscal year because last year we had a 53rd week. But this proves once again that Costco’s sales had strength in and of themselves.

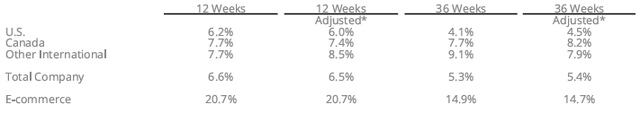

When we deal with retailers, it’s not enough to know how net sales increased. Inflation could be the reason for higher prices, while volumes trend lower or stay flat. Therefore, we need to know a company’s comparable sales.

Costco Q3 Earnings Press Release

We see that comparable sales, just like Costco’s revenues, are gaining momentum, with a 6.2% increase YoY vs. a 4.1% over the first three quarters. What does this mean? That Costco’s growth was mainly due to growing traffic in its warehouses, rather than just price hikes.

Down to the bottom line, we find that Costco’s net income was $1.68 billion, which equals to $3.78 per diluted share (a year ago Costco reported $1.3 billion and $2.93 per diluted share).

Wait a moment! Did we just see only $1.68 billion in net income before revenues of $57.39 billion? This is a 2.9% net income margin. How could a company with this low profitability be appreciated by investors?

Costco: The only metric we need

Here we are at Costco’s core idea, which I described with these words a few months ago:

Costco conceives itself not really as a retail seller but as a buyer on behalf of its members. These members, in turn, go to the warehouses to pick up whatever goods they need among those Costco has bargained and purchased. Costco usually marks up its merchandise 12%-14%, selling at almost no profit. Its profits come mainly from its membership fees. Therefore, for Costco, a decline in sales is not as concerning as for other retailers because what holds up the bottom line is the membership program. As long as its members renew their membership, Costco’s bottom line is insulated from major economic downturns. As of now, Costco’s renewal rate is 92.7% in the U.S. and Canada and 90.4% worldwide, as we can read in the last 2023 Annual Report.

So, first and foremost, we have to understand Costco’s business model doesn’t hinge on marking up merchandise. Costco basically sells its goods at full cost (purchase cost plus variable costs and a contribution margin). This makes Costco a true top-line company that needs to drive volumes higher and higher to reach scale as fast as possible to be able to create more and more value for its customers. Those who shop at Costco are not customers, but members. To shop there, people have to sign up for a membership and pay an annual fee. The relationship works in this way: Costco sells selected goods at a competitive price, and its members in exchange pay a fee to gain the right to benefit from this.

This leads us to Costco’s second cornerstone, which is even more important than what we have seen so far. Costco’s membership program continually expands and sports a consistently high renewal rate.

Now, let’s get to the “magic.” We said Costco’s net income was only $1.68 billion. But Costco also reported $1.12 billion in membership fee revenue for the quarter. However, as Seeking Alpha’s former analyst The Benjamin Fund has explained in his comment to one of my past articles on Costco, we should really focus on gross membership income to back to the membership income, to grasp the true strength of the membership program.

What does this mean? Costco offers its Executive members a 2% rebate on their sales, which we can find reported in the balance sheet as “accrued member rewards.” When Costco reports its results, its membership fees are already net of the rewards. So let me show you a few numbers to explain what I’m considering taken from the last annual report.

Paid members (in millions) Membership income (in millions) Income per member 71 4.58 $65 Click to enlarge

To understand why this is absurd, we need to know that Costco’s Gold Star members pay $60 per year, while executive members pay $120 a year. However, at the end of FY2023, executive members were 32.3 million and made up 45.4% of total members. Therefore, we should have seen a higher income per member. In fact, executive members paid $3.88 billion in membership fees, while Gold Star members paid $2.32 billion. The total is $6.2 billion. And the average income per member should be $87.3.

This means Costco reports net membership income, netting its rebate against this item.

This shows how it’s likely that Costco reports a net membership income because, against the gross membership income, the company nets its rebates.

Costco just disclosed its accrued member rewards are now $2.34 billion. At the end of its last fiscal year, Costco reported $2.58 billion and reported $4.58 billion in membership income. If we sum the two numbers together we have $7.2 billion as the possible gross membership income. However, this would give us an average income per member of $101, which may be too close to the executive fee.

So, as SA analyst The Benjamin Fund suggested, we could instead net the rebate against Costco’s sales. This helps us visualize something quite unique.

Let’s use Costco’s three past full fiscal years:

USD millions 2021 2022 2023 Reported sales 192,052 222,730 237,710 Rewards 2,047 2,307 2,576 Net retail sales 190,005 220,423 235,134 Merchandise costs 170,684 199,382

212,586

Gross profit (net retail sales-merchandise costs) 19,321 21,041

22,548

SG&A 18,537 19,779

21,590

Operating profit 784 1,262

958

Click to enlarge

Take a look at Costco’s operating profit, which moves up and down around $1 billion. This shows that Costco’s revenue dollars barely generate a profit.

But, if we net the rebate against total sales, let’s see what comes out in terms of the membership income, comparing it to what Costco reports as its operating income:

USD millions 2021 2022 2023 Membership income as reported 3,877 4,224 4,580 + rewards 2,047 2,307 2,576 Gross membership income 5,924 6,531 7,156 Operating income 6,708 7,793 8,114 Membership income as a % of OI 88.3% 83.8% 88.2% Click to enlarge

Now, we finally see where Costco makes money from: The membership fee. And it makes more money from this than we actually believe if we don’t do this exercise.

Why is this of extreme importance to assess Costco? Because, if the top-line doesn’t really matter as per Costco’s profitability, we have a very streamlined business model before our eyes which works in this way: As far as membership increase, Costco will fare better and better. As a matter of fact, we can just look at Costco in this way: Store number multiplied by paid members per store multiplied by gross membership income.

So, since Costco’s memberships keep increasing, Costco is no real need to hike its fees as many are expecting. Yes, we know Costco’s management always repeats the fee hike is not a matter of if, but of when. But we have to understand that Costco doesn’t need that hike to cover a loss or anything similar. Whenever the hike comes, the increase will augment Costco’s profits, net of tax.

Having understood this, we could just read through Costco’s report and see if Costco’s members are increasing.

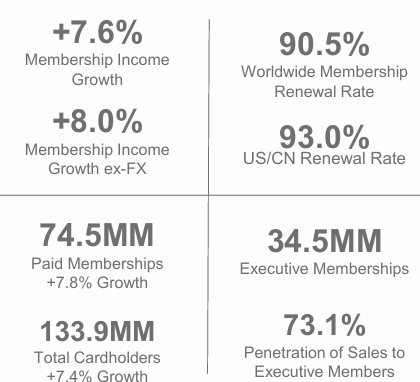

And here we are with the most important numbers of the entire report.

COSTCO Q3 Earnings Supplemental Information

Yes, Costco’s members increased by 7.8% to 74.5 million, 34.5 million of which are executive members to whom 73.1% of the company’s sales are made.

Moreover, Costco’s stores increased by 14 units in the U.S. to 605 warehouses, Canada is flat at 108, while International grew by two units to 165.

The total number of stores is now 878. With total stores and members increasing, even if the membership fee stays flat, we have additional revenue at a very high margin. As a matter of fact, this revenue goes directly to the bottom line apart from taxes.

Conclusion

We have debated over and over whether Costco is overvalued or not. Surely, its multiples are demanding (50 fwd PE). Nonetheless, investors keep flocking and piling in the stock, accumulating shares and rarely showing a willingness to let them go. This has created a solid base of loyal shareholders, resembling the same loyalty of Costco’s members. Every once in a while, the stock does dip a bit. However, take a look at what happened the day after the report: The stock was trading just below $820. It then dipped to $790, but then recovered to $810. I know many are often discouraged by this because they can never get Costco at the price they have set.

Yes, Costco is expensive, but the premium we pay is to own a company that hinges on a business model that, by now, because of its large scale and reach, seems almost unassailable. In other words, it has a competitive advantage (a moat) which sets it apart from the crowd. Few businesses I know are as strong and simple as Costco. Therefore, I have come to consider Costco in another way. We have to make up our minds and decide whether this is a stock we want, so to speak, “marry.” As former SA analyst Briar says: “It doesn’t matter how much you pay for the engagement ring, if you marry well.” The situation here is similar. Costco has many reasons to keep compounding and expanding. Those who are willing to stick with this investment for a long time will probably end up well and will profit from those rare and sudden dips by dollar cost averaging in. Therefore, I rate the stock as a buy.