MattGush

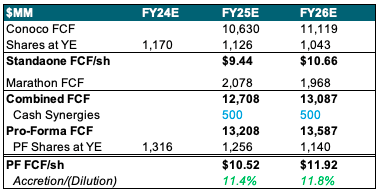

Having previously remained on the sidelines in the ongoing consolidation wave, on May 29 ConocoPhillips (NYSE:COP) announced the acquisition of mid sized shale E&P Marathon Oil (MRO), increasing production to 2.2Mboed with pro-forma US output share increasing 3 percentage points to 72%. Total consideration will be $22.5B with Conoco assuming $5.4B in outstanding debt and exchanging 0.2555 shares per share of Marathon oil, implying previous Marathon owners holding ~11% of the combined entity. Deal multiples look promising with Marathon having historically traded at a discount while Conoco was valued at the top end of US E&Ps. Alongside expected $500MM in synergies to be realized by YE25, I see higher guided share buybacks ($7B for 25E from previously $5B) to provide ~11.4% FCF/sh accretion for 25E, rising to ~11.8% by 26E.

I like the deal and remain Overweight on ConocoPhillips shares with an unchanged price target of $133 (see my previous article for further color on Conoco here). Key risks remain in weaker commodity markets, unforeseen maintenance outages and unfavorable political developments in international assets. Merger-specific risks lie in integration challenges, failure to deliver on projected synergy targets and regulatory intervention.

[Note: Comparable transactions are Exxon (XOM) – Pioneer (PXD), Chevron (CVX) – Hess (HES), Diamondback (FANG) – Endeavour and Occidental (OXY) – Crownrock. All merger-related information and projections from Conoco’s investor presentation. Marathon Oil financials from the latest 10-K.]

Key Discussion Points

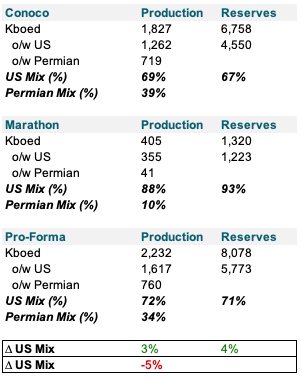

Deal boosts Conoco’s oil & gas production by a quarter and increases US share of output to 72%. Adding Marathon’s 0.4Mboe of daily production Conoco’s pro-forma output will increase by around a quarter to 2.2Mboe based on FY23 figures, putting it ahead of Norwegian Equinor (EQNR). The pro-forma entity also seems poised to overtake BP (BP) as #5 during 25E as the British major will likely hold production stable while incremental volume increases at Conoco and Marathon should push combined output to ~2.4Mboed. With management not adjusting its production outlook of ~4-5% annual production growth, Conoco should also overtake TotalEnergies (TTE) (~2-3% targeted annual growth) by the end of the decade for a #4 spot, behind only Shell (SHEL) and the US supermajors (XOM)(CVX). I estimate this unique positioning as the only independent and purely upstream-focused among a group of integrateds to further drive scarcity value for the asset and increase valuation premia to remaining E&P peers.

Largest Oil & Gas Producers by FY23 Production [excl. NOCs / Exxon and Oxy pro-Forma] (Bloomberg)![Largest Oil & Gas Producers by FY23 Production [excl. NOCs / Exxon and Oxy pro-Forma]](https://static.seekingalpha.com/uploads/2024/5/29/55844470-17170119077176273.png)

Next to providing additional scale in an industry that relies heavily on scale, acquiring Marathon also increases Conoco’s relative exposure to US-based production, generally viewed favorably by investors given high political stability and a positive framework for oil producers. Based on FY23 figures, I see the pro-forma entity having ~72% of its production contributed through domestic assets (Lower 48 + Alaska), a gain of around 3 percentage points. For reserves, the share increases by 4 percentage points to around 71%.

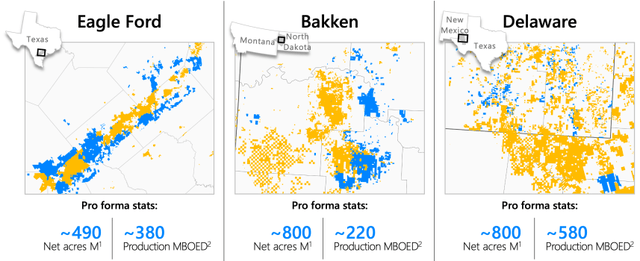

Notably however, Conoco’s share of Permian production actually decreases by a significant 5 percentage points from 39% to 34% driven by Marathon’s relative lack of exposure to the basin. Gaining 41Kboe in daily volume, pro-forma Permian output will rise by just 5% while production from the Eagle Ford and Bakken will rise by 66% and more than 100% respectively. I also note that the transaction does not add any acreage or production in the Midland, a key area of focus in recent deals (Exxon/Pioneer, Diamondback/Endeavour) and one where Conoco remains small in scale (~160Kboed vs ~500Kboed from the Delaware).

Company Filings

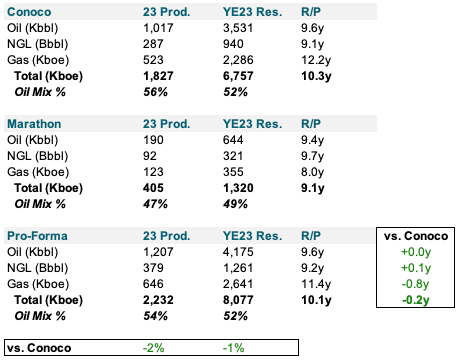

With Marathon’s production mix weighted slightly less towards oil given the Equatorial Guinea (“EG”) gas development and overall higher shares of associated gas and NGLs for its shale assets vs Conoco’s mixed shale/conventional footprint, pro-forma oil share decreases by 2 percentage points. I do note however that the overwhelming majority of Marathon’s EG gas output is distributed to associated joint ventures producing LNG for European end markets. Reserve life remains largely unchanged with slightly lower pro-forma R/P of 10.1 years as marginally higher liquids life is offset by lower gas coverage.

Company Filings

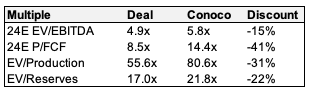

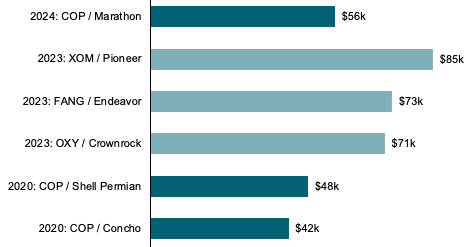

Multiples screen favorably vs Conoco trading and recent largecap E&P transactions. Acquiring Marathon at multiples of 4.9x on 24E EBITDA and 8.5x on 24E FCF, Conoco seems to continue its excellent recent history when it comes to financial terms in dealmaking. Compared to Conoco’s own trading this represents discounts of ~15% and ~41% respectively. As a rule of thumb, for all-stock transactions the deal will usually be accretive if the acquirer’s multiples are above the ones they bought out the target at. The financial terms also seem favorable on oil-specific metrics with Conoco paying ~$56 for every flowing barrel and ~$17 for every boe in proved reserves, 31% and 22% below its own trading respectively. I note that Conoco has long traded at premium to the broader US E&P space given its superior scale while Marathon has been valued significantly below peers, partly due to lacking Permian exposure, therefore an all-share deal represents an attractive structure.

Company Filings, Bloomberg

The acquisition also seems very reasonably priced compared to other recent deals and well in-line with Conoco’s previous deals for Shell’s Permian assets and Concho Resources, both of which it struck during 2020’s depressed price environment. At ~$56k per unit of Marathon’s 2023 daily production, the deal ranks higher than the Concho and Shell transactions but well below recent large-cap E&P deals which have averaged ~$75k/boe.

EV per Flowing Barrel for Recent Largecap E&P Deals (Company Filings, Bloomberg)

I do however note that there are significant differences between the acquired operators, both in terms of profitability and acreage. While Pioneer, Endeavour and Crownrock are pure-play Permian unconventional drillers, Marathon has comparably low Permian exposure with a great share of producing assets located in the Eagle Ford and Bakken shales. Marathon is also the only recently acquired player that has some sort of international exposure through its EG gas asset and associated LNG joint ventures. Acknowledging these differences, Marathon likely doesn’t come as the kind of bargain indicated by the headline figures, however I still view the transaction as very reasonably priced.

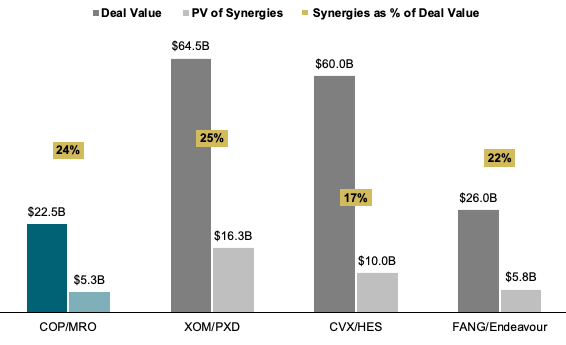

At $500MM run-rate, synergies would represent ~24% of transaction value, in line with Exxon and Diamondback deals. Management expects significant synergy potential between the two entities, leading to $500MM in targeted savings to be achieved by YE25. Around half of projected cost synergies are to be driven by elimination of double competencies and redundancies in General & Administrative (G&A) functions such as the streamlining and integration of Marathon’s HR, Finance and Legal departments. $150MM of potential savings have been identified in operating costs, focusing on consolidation of over- and underground operations in neighboring acreage plots across the Permian, Bakken and Eagle Ford with the largest impact likely concentrated in the Eagle Ford. The remaining $100MM are related to capital optimization, aiming to improve Marathon’s legacy D&C cost by leveraging Conoco’s scale.

I know IR

Assuming management’s target for synergies at $500MM from 25E onwards with zero future growth and discounting at Conoco’s WACC of ~10%, I estimate the present value of synergies at ~$5.3B, representing about 24% of the $22.5B total consideration. Crosschecking with other recent largecap E&P deals in the US, the deal ranks among the most synergetic ones, behind only Exxon’s purchase of Pioneer and ahead of both Diamondback/Endeavor and Chevron/Hess.

Company Filings, WSR Estimates

On current 2025 estimates Marathon could provide a ~11.4% uplift to FCF/sh, rising to ~11.8% by 26E. With closing expected during Q4 24, I expect the deal to be highly accretive to FCF/sh by the first year, driven by Marathon’s relative undervaluation vs Conoco. With combined FCF of $12.7B and assuming full $500MM in synergies achieved as projected by management, this implies as pro-forma FCF of $13.2B or ~$10.52 per share, compared to ~$9.44 for standalone Conoco. Management also increased its 25E buyback guidance by almost 50% from $5B to $7B which, at current pro-forma market cap, can reduce outstanding shares by ~4.6% as opposed to ~3.7% under the old buyback scheme and standalone market cap. Estimating the $7B pace to continue through 26E I see Conoco retiring up to 9.2% of pro-forma shares through YE26, driving an 11.8% FCF/sh accretion for the year.

Company Filings, WSR Estimates