Motion Loop/iStock via Getty Images

C4 Therapeutics, Inc. (NASDAQ:CCCC) pioneered targeted protein degradation [TPD] with its TORPEDO platform to design molecules to break down disease-causing proteins. Its pipeline includes CFT7455, CFT1946, and CFT8919, which are biodegradable oral catalytically efficient degraders for target proteins causing conditions like Multiple Myeloma, Non-Hodgkin’s Lymphoma, and various cancers marked by mutations like BRAF V600X and EGFR L858R. These drugs are in Phase 1 clinical trials and have a clear plan for 2024. Also, the company collaborates with Merck (MRK) based on the advantages of the innovative TORPEDO platform. However, after looking at its valuation, CCCC appears quite expensive, which tempers my optimism about the stock. Thus, I lean towards a neutral rating, balancing both sides.

Business Overview

C4 Therapeutics is an early clinical-stage biopharmaceutical company founded in 2015 and based in Watertown, Massachusetts. The company develops drug candidates for targeted protein degradation [TPD] in the fight against oncological, autoimmune, and neurological conditions provoked by disease-causing proteins. However, C4 still hasn’t generated any revenue from product sales since inception and has posted a $132.5 million loss for 2023. Moreover, the company expects to continue requiring additional funding to pursue its business objectives, mostly centered around the TORPEDO platform.

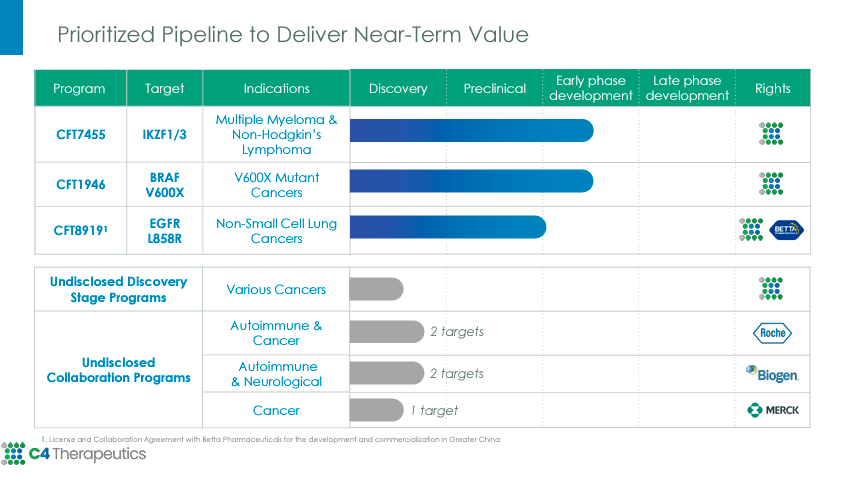

Source: Corporate Presentation, February 2024.

As for CCCC’s product pipeline, the company’s portfolio mostly includes CFT7455 for IKZF1/3 protein target for Multiple Myeloma & Non-Hodgkin’s Lymphoma therapy and CFT1946 against BRAF protein with the V600X mutation for V600X Mutant Cancers. However, these therapies are in the early stage of clinical development. Also, CFT89191 is another degrader for therapy against EGFR with L858R mutation that produces Non-small-cell lung cancers. Fortunately, CFT89191 is at the end of the preclinical trials but is still far from any concrete FDA approvals. Furthermore, CCCC has two additional programs in an undisclosed discovery stage for various other cancers and autoimmune and neurological disorders.

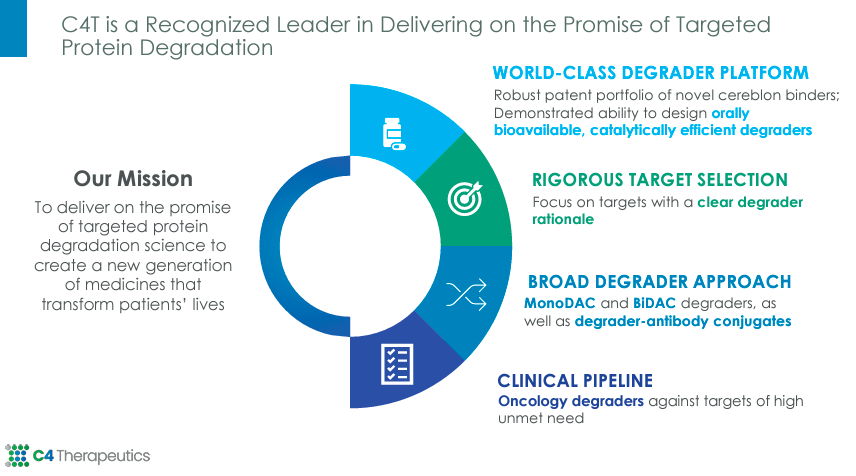

Therefore, we should focus on CCCC’s scientific platform, TORPEDO (Target Oriented Protein Degrader Optimizer). This is actually quite a fascinating technology that allows targeting almost any disease-causing protein, so its implications could be significant for researchers. TORPEDO uses computer-based tools to design molecular glues with two functional ends: one binds to the target protein and the other to an E3 ubiquitin ligase, a key enzyme in the ubiquitin-proteasome system. Once the E3 ubiquitin ligase is close to the target protein, it catalyzes the transfer of a small molecule of ubiquitin that serves as a tag that activates proteasome to degrade and recycle proteins. Thus, this breaks them down into its component peptides.

Source: Corporate Presentation, February 2024.

This matters because decreasing harmful proteins usually alleviates symptoms of various diseases. More importantly, TORPEDO lets researchers selectively remove damaging proteins beyond traditional inhibitors that only block the protein function. This mechanism could theoretically skip causing unwanted side effects as it avoids other pathways. Interestingly, TORPEDO’s degraders are also taken orally and are bioavailable, convenient, and cost-effective without additional drug administration costs. CCCC’s degraders seem more convenient than other protein degraders, usually administered intravenously. So, C4’s platform is revolutionary, even though it is still experimental.

C4’s R&D And Collaborative Milestones

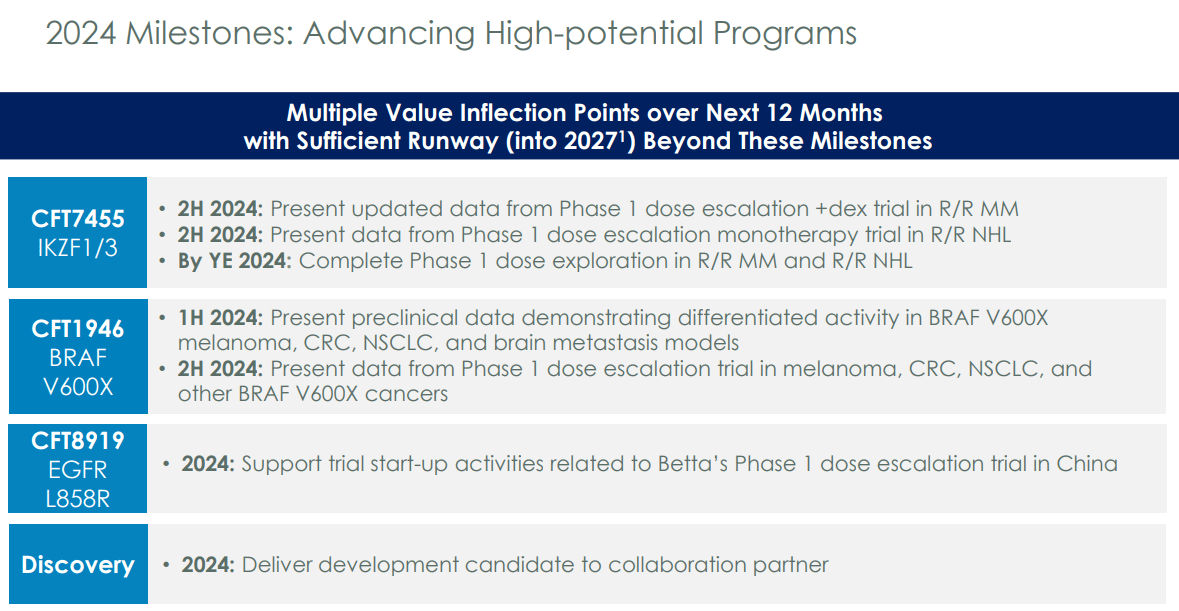

On C4’s February 2024 Corporate Presentation, they announced their plan to focus on two research programs: 1) CFT7455 / IKZF1/3 and 2) CFT1946 / BRAF V600X. There, CCCC outlined its plans for the second half of 2024, which I believe can be understood as the two most promising programs in its research pipeline.

Source: Corporate Presentation, February 2024.

For the first research program, CCCC aims to present updated data from Phase 1 for relapsed/refractory multiple myeloma [R/R MM]. Also, in this period, the company expects to present data from Phase 1 for relapsed/refractory non-Hodgkin lymphoma [R/R NHL]. By the end of 2024, the completion of Phase 1, dose exploration, for R/R MM and R/R NHL is planned. As for the second part of their research program (i.e., CFT1946 / BRAF V600X), CCCC will present preclinical data during 1H2024 to differentiate the activity in BRAF V600X melanoma, colorectal cancer [CRC]non-small cell lung cancer [NSCLC]and brain metastasis models. Then, In 2H2024, CCCC plans to present Phase 1 data, dose-escalation trial results in melanoma, CRC, NSCLC, and other BRAF V600X cancers.

Aside from these two main research programs, CCCC is also developing CFT8919 / EGFR L858R with trial start-up activities for Betta’s Phase 1 dose escalation trial in China. Also in 2024, the company will deliver a development candidate to a collaboration partner for autoimmune, neurological, and cancer diseases.

C4’s Partnership With Merck

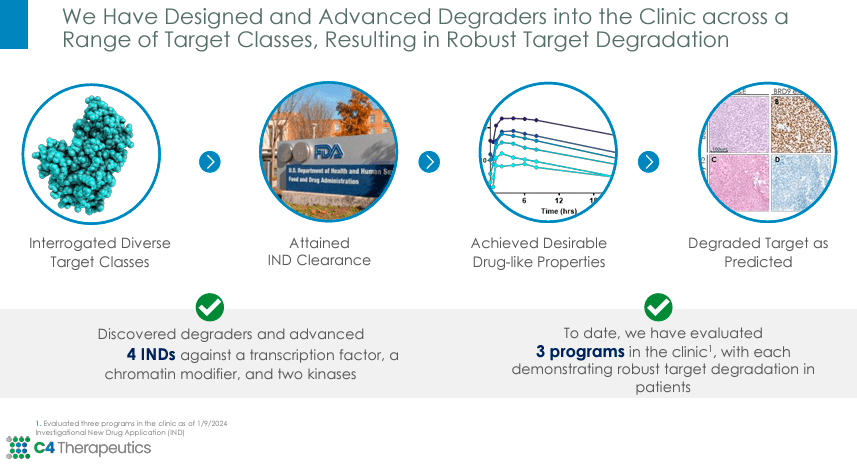

On December 12, 2023, CCCC made an exclusive license deal with Merck to develop degrader-antibody conjugates [DACs] for cancer with its proprietary TORPEDO platform to discover degrader payloads. Merck will be responsible for antibody conjugation to generate DACs and develop them through preclinical and clinical trials and commercialization. CCCC will receive $10 million upfront plus tiered royalties on sales and approximately $600 million milestone payments for DACs directed to the oncology target.

Source: Corporate Presentation, February 2024.

Moreover, Merck could also extend the collaboration to include three additional targets, producing further payments for exercising this option and potential milestones and royalties for up to around $2.5 billion. Thus, the deal with Merck could be a main value driver for CCCC in the long run if the collaboration is extended to 3 more target proteins. Still, it’s worth noting that this partnership is based on the results that the TORPEDO platform promises. So far, this proprietary technology seems to be gearing up to deliver capabilities for designing molecules that degrade almost any disease-causing protein, but its ultimate success is not guaranteed.

Quite Expensive: Valuation Analysis

From a valuation perspective, C4 presents a mixed picture. On the one hand, it seems like it’s implementing cost-cutting measures that could improve its cash runway and, by extension, the odds of succeeding in its partnership with Merck. For context, on January 10, CCCC stock seemed to react positively to the announcement of a restructuring plan that includes a 30% workforce reduction, prioritizing the development of the protein degraders CFT7455 and CFT1946. The plan also aims to support Phase 1 clinical trials for CFT8919 developed by Betta Pharmaceuticals in China. After this announcement, the stock traded higher, likely because investors seemed optimistic about prioritizing this portion of their IP. Since then, the stock has traded lower, from the post-announcement high of $7.66 to approximately $5.30 per share by the 5th of February.

C4 stock increased to a local top on January 10. (Source: TradingView.)

Nevertheless, I believe that this restructuring effort worked, as the earnings report on February 22 showed an improvement in net income over expectations. The market had anticipated a $0.70 loss per share, and C4 reported a $0.68 loss per share instead. Naturally, losses are still piling up, but this improvement likely implies better margins due to the cost-cutting measures announced. However, quarterly revenues came in below expectations by roughly $410.97 thousand.

Source: Seeking Alpha.

On January 5, CCCC reported $253.7 million in cash, cash equivalents, and marketable securities that the company believes will fund its operations until 2027. I estimate their quarterly cash burn at $24.2 million, which implies a yearly cash burn of $96.8 million. I obtained this figure by adding the company’s quarterly CFOs and CAPEX and annualizing them. Thus, my calculations suggest a cash runway of roughly 2.6 years. This means there’s enough cash to last until 1H2026, but I imagine that CCCC anticipates cash flow improvements by then. So, their claim of having enough cash until 2027 seems a bit optimistic, but not impossible.

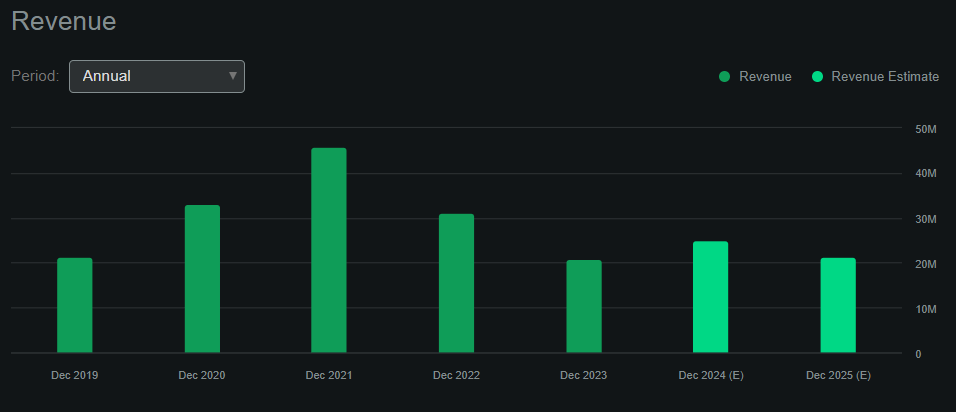

That is key because if CCCC’s bet on TORPEDO and the rest of its product portfolio works out, its revenues could jump significantly. After all, the partnership with Merck alone could be worth billions of dollars if it’s fully exploited. However, as of today, CCCC is expected to generate roughly $21.24 million in revenues by 2025. Hence, the current market cap of $753.24 million implies a forward P/S ratio 35.5. If we compare this valuation multiple to C4’s sector median forward P/S ratio of 3.99, it immediately looks substantially overvalued. In fact, since CCCC is burning cash and accumulating losses, most of its valuation multiples are substantially above its sector peers. All this leads me to temper my optimism on CCCC stock, giving it a “hold” rating.

Conclusion: A Mixed Bag

CCCC is a promising biopharmaceutical that could pay off if its bet on TORPEDO and the rest of its product pipeline works out. However, at its current stage, CCCC trades at a significant premium according to most valuation multiples because it continues to pile up losses and burn cash. Therefore, there are tangible concerns regarding the company’s long-term success, even though it appears to have enough money to see through its research. I am optimistic about TORPEDO and its potentially revolutionary technology, but at the same time, the investment perspective is plagued with severe risks. Thus, I lean towards a neutral rating on CCCC and give it a “hold” for now.