Matthew Nichols

AMC Entertainment (NYSE:AMC) reported in June that it had its highest grossing weekend of FY 2024 in the U.S. and worldwide due to the strong cinematic performance of Inside Out 2 and Bad Boys: Ride or Die. However, AMC Entertainment continues to struggle financially, and the company is not yet capable of generating positive operating or net income.

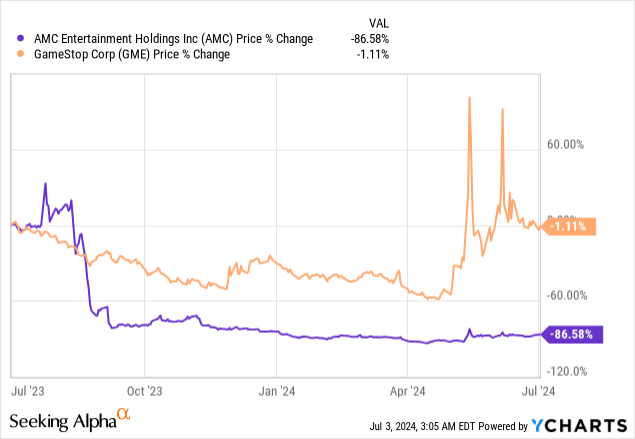

Recently, shares of AMC Entertainment surged as high as $12 on a new short squeeze hopes. As was the case in 2020 and 2021, action around GameStop (GME) was chiefly responsible for AMC’s short-lived price explosion, not an improvement in fundamentals. As a result, I believe AMC’s valuation multiplier is not supportable here, and I expect shares to drop back to the $3 price level in the short term!

Previous rating

I warned of AMC Entertainment being dead money in FY 2024 as the company continued to suffer from overall weak attendance numbers at its cinemas. Although some movies have drawn in more visitors lately, such as Inside Out 2, AMC Entertainment still operates a deeply unprofitable enterprise. I believe AMC Entertainment will continue to report high operating losses which in turn should add pressure to the movie theater’s inflated valuation.

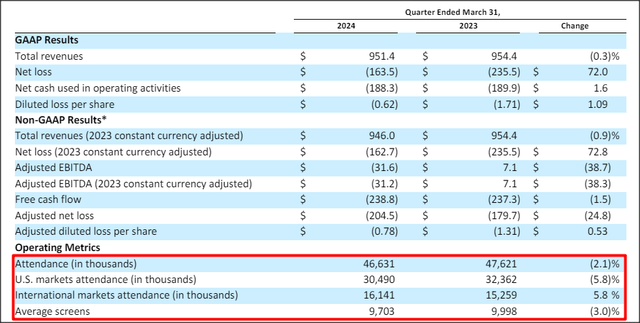

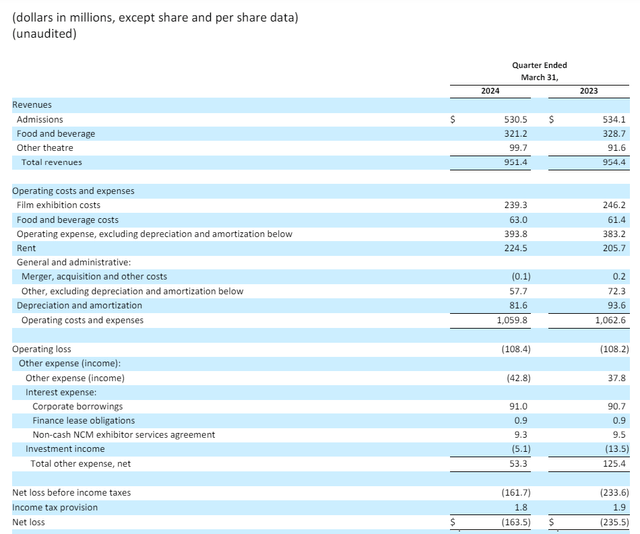

AMC Entertainment continues to run an unprofitable business model

AMC Entertainment may have recently had its highest-grossing weekend of FY 2024, but the company’s fundamentals still point to a challenging path going forward. In the first fiscal quarter, AMC Entertainment generated $951.4M in revenues from its theater operations, most of which came from ticket sales, showing a decline of 0.3% year over year. Attendance numbers have increased during the post-pandemic recovery, but are still not great on a year over basis: in Q1’24, 46.6M visitors dropped by one of AMC Entertainment’s movie theaters, which was down 0.3% compared to the year-earlier period.

AMC Entertainment

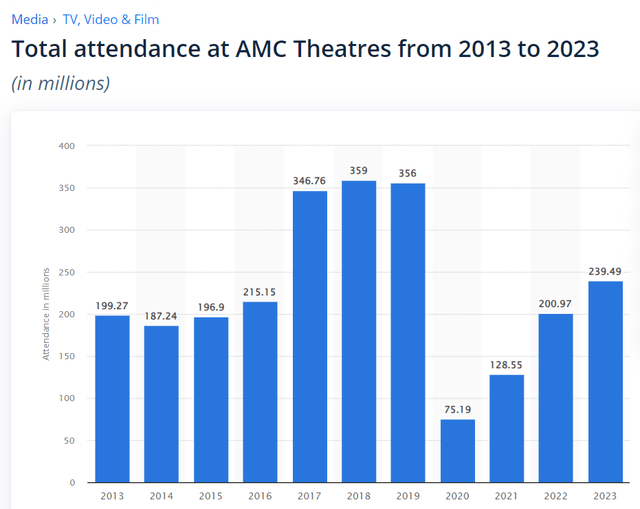

Although attendance numbers are recovering from the massive drop-off that occurred in FY 2020 and FY 2021 due to COVID-19 restrictions, AMC Entertainment’s attendance is still way below the pre-COVID peak. As a result, the theater chain is still not in a position to post either positive operating income or net income.

Statesman

AMC Entertainment lost $163.5M in net earnings on its move theater operations in the first fiscal quarter which translated to a 17 cent loss for each dollar the company took in per dollar of revenue. For the second-quarter, the earnings picture is unlikely to have significantly improved which may refocus investors’ concerns on where they belong: AMC Entertainment is not even close to running a successful movie theater business at scale.

AMC Entertainment

Recent short squeeze

Shares of GameStop — the original meme stock of 2020 — recently exploded higher by a couple of hundred percent after a well-known trader, Keith Gill, also known as ‘Roaring Kitty’, materially increased his investment in the video game retailer. The hype around GameStop, and the possibility of a short squeeze, also caused shares of AMC Entertainment last month to briefly surge from about $3 to $12. Since then, shares have fallen back to the $5 price level which may be a good opportunity for investors to get out once and for all.

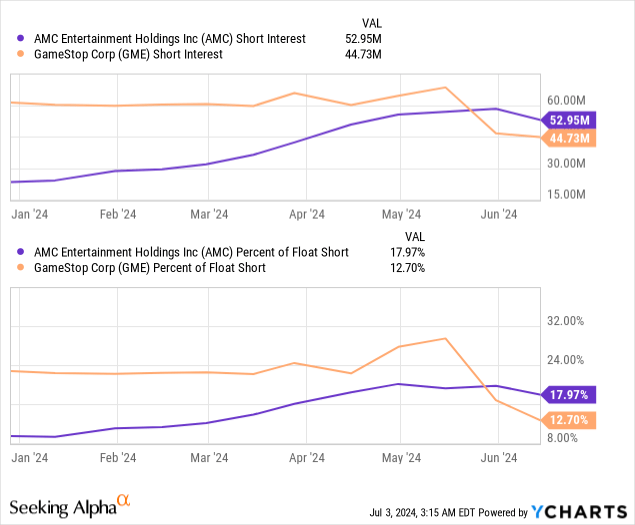

AMC Entertainment had about 53M shares sold short which is the equivalent of a short interest ratio (based off of float) of nearly 18%. Compared to AMC, GameStop is not as heavily shorted, but the short interest is nonetheless high at almost 13%. As I explained in my work, Don’t Fall Into The FOMO Trap, investors don’t have any fundamental reasons to buy into either of these two companies, and this especially goes for AMC Entertainment after the movie theater chain indicated that it had its highest-grossing weekend in FY 2024.

No discernible equity value

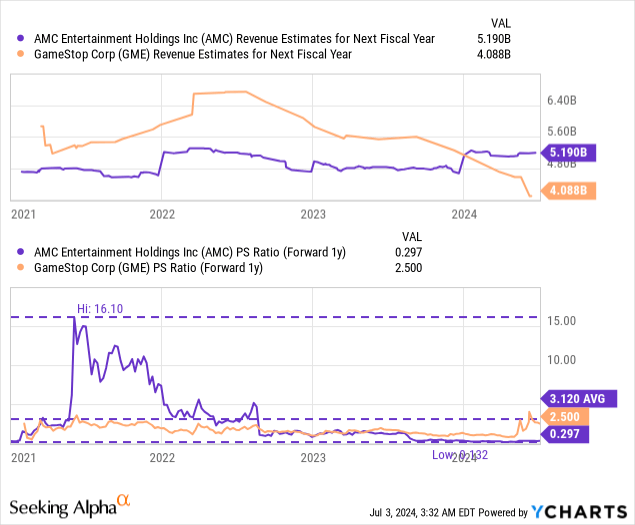

AMC Entertainment does not have a sustainable valuation and is overvalued even at a relatively low price-to-revenue ratio. Currently, shares of the struggling movie theater chain are priced at a P/S ratio of 0.3X, well below the 3-year average P/S ratio of 3.1X and much lower than GameStop which is valued at a price-to-revenue ratio of 2.5X. AMC Entertainment’s revenue estimates have also falling rapidly in the last two years.

The movie theater chain had no equity value as of the end of the March quarter with a stockholder deficit of $2.0B (negative equity value). With the company’s liabilities exceeding its assets, AMC Entertainment doesn’t have any discernible value for investors, other than maybe speculative value as a potential short squeeze candidate. For those reasons, I continue to believe that AMC is overvalued with a market cap of $5.2B, and I don’t see any specific, fundamental reason why shares are worth something more than zero. Investors buying into AMC Entertainment could therefore potentially suffer a complete loss of capital.

Risks with AMC Entertainment

There are upside and downside risks for AMC Entertainment. The upside here is obvious as AMC Entertainment remains heavily shorted and has the potential for a short squeeze. The downside risk is that the theater chain could go out of business if the company fails to convince shareholders to fund its persistent operating losses. What would change my mind about AMC Entertainment is if the movie theater chain were to see drastically growing attendance numbers and its operating income profile were to improve, both of which, given the underlying trends discussed here, is unlikely.

Final thoughts

This may be your last chance to get out of AMC Entertainment… a theater chain that may have seen a record-grossing weekend in June, but is still struggling fundamentally and the second-quarter is likely to see a continuation of such trends. AMC Entertainment continued to see dwindling attendance numbers in Q1’24, flat revenue growth, and it is still losing money hand over fist. AMC Entertainment also has effectively no equity value left, something investors seem to sometimes forget when short squeeze rumors circulate around the market. I believe the risk profile here is exceptionally unfavorable and there is likely a high risk that AMC Entertainment’s share price will drop back to the $3 price level… which is where AMC was trading at before the recent short squeeze hype!