thehague/iStock via Getty Images

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

What is an inflection point? Well, if we guide ourselves by Mr. Webster, it is “a moment when significant change occurs or may occur.” That’s precisely where we find ourselves with Ali Baba (NYSE: BABY) (OTCPK:BABAF) stock.

And, quite openly, this one could go either way. Now, this is not to proffer two paths and then whichever the market chooses, we would claim victory. We will discuss how the structure of price will provide clear indicators from this moment forward that tell the observer where the probabilities lie. How are we able to provide this type of clarity? What is the fundamental snapshot for BABA at the moment? Answers ahead – read on!

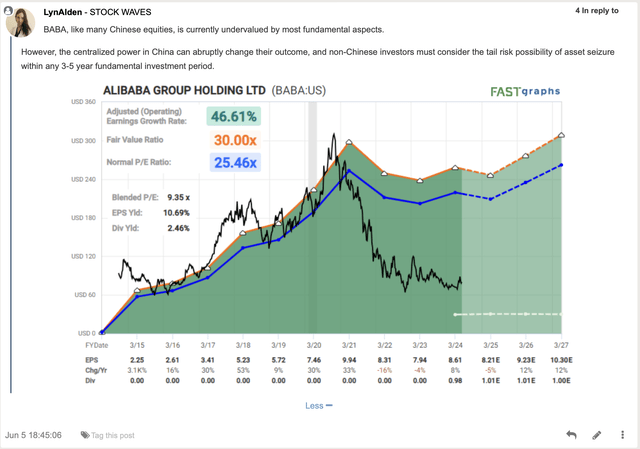

Lyn Alden Comments On Alibaba

Lyn Alden – Elliott Wave Trader

Note that Lyn’s comments are certainly sobering for anyone who may contemplate a long-term buy and hold strategy here. Many others, whether they are pundits or public, have their own respective opinions. Some are well-grounded, others not so. We highly value Lyn’s commentary and viewpoint as one of our lead analysts. This is a warning flag raised. What else can we consider via the structure of price formed on the chart? Let’s see.

Context Is Key

I like Mr. Webster. He’s a helpful chap. Let’s lean on him once again for more depth regarding this word, “context.” It is “the circumstances that form the setting for an event, statement, or idea, and in terms of which it can be fully understood and assessed.” If we wish to further simplify this definition, we might put it as “how we arrived at this moment.” It is the “how” that is so important in our methodology. Why is this?

Allow me an ever so brief digression. There are many other analysis methods out there. Some use technical indicators. Others use candlesticks. There are books written about the meanings behind the formation of these. What we find lacking in that certain viewpoint is that much information is lost inside the stick. The formation of the move up or down contains pertinent price action that will tell the properly trained analyst what is more likely to happen next. How does it do this?

The market is fractal in nature. It also displays self-similarity at all degrees of its structure. These forms will repeat at the smaller and then the larger time intervals. “How” a stock or an index arrives at a certain place on the chart will tell us what the probable path going forward will look like.

How does this help us in the BABA chart?

The Structure Of Price For BABA

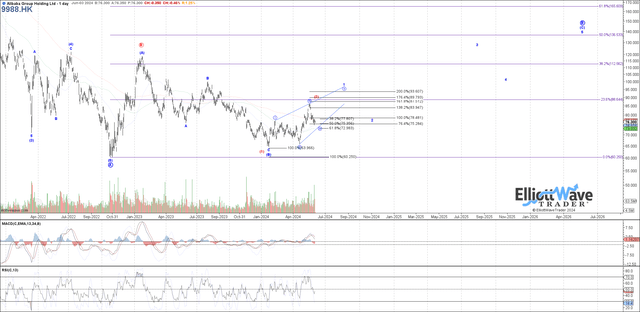

Note our two lead analysts as they share their current views.

chart by Garrett Patten – Elliott Wave Trader chart by Zac Mannes – Elliott Wave Trader

Garrett is showing two possible paths, while Zac is simply sharing what he views as more likely. There will be a confirming moment that will crystallize probabilities in the near term. How are we able to make this assertion? Context!

Let’s zero in on Garrett’s chart and see what this is telling us. The nomenclature placed on the structure of price identifies degrees and then the probable path for the road ahead. He is showing price as having found a Primary ‘A’ wave low in late 2022. Since ‘B’ naturally follows ‘A,’ that is anticipated next. While it is supposed that this ‘B’ wave would take a bit more time, there is the possibility that the Primary ‘B’ wave has already filled out. This is shown in the Red path, with that ‘B’ wave high being struck at the early 2023 high.

Why is this possibility shown? In great portion because the move up from the early 2024 low is a clear 3 wave structure. That puts us on alert that it is corrective in nature. What’s more, the move down from the swing high struck a week ago appears to be more impulsive than corrective in its form. What does this mean for the probabilities going forward?

It raises a caution flag. In fact, this could end up being a classic sell setup. For the moment, until further clarification presents itself, we will maintain the 3-tier rating at a hold. There is not a clear ‘Buy’ setup here.

Here’s the inflection point: should price hold in this current region and then make a new swing high, it could favor the blue count on Garrett’s chart. But, should price only bounce correctively and stay under the recent June high, it would provide further warning that the red path may assert itself sooner rather than later.

This Is A Whole Lot Of Technical Talk!

Actually, once you understand the nomenclature labeling for the degrees and the basic premise of how markets work, it all begins to make so much more sense. If you have not been exposed to this type of methodology, then it is almost a foreign language. Are you willing to put forth the requisite energy and effort to expand your horizons?

I might suggest giving this methodology a fair shake. Why? If you have heard of Elliott Wave Theory, what was the source? Surely, you would want to consult someone who has performed an in-depth study of the how’s and why’s of the method. As well, this comprehensive investigation would be backed up with published studies on the matter and a body of work that shows the utility of said methodology in real-time.

Conclusion

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

(Housekeeping Matters)

If you would like notifications as to when our new articles are published, please hit the button at the bottom of the page to “Follow” us.