hapabapa/iStock Editorial via Getty Images

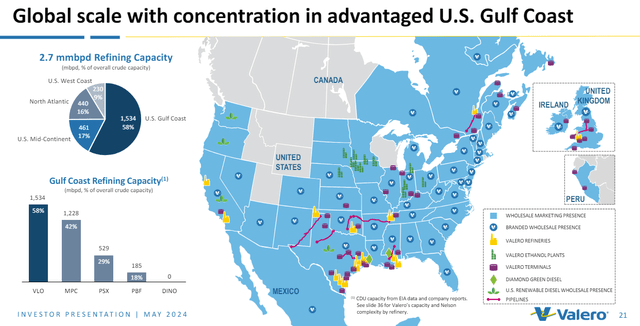

Here at the Lab, we are back to analyzing Valero Energy (NYSE:VLO). As a reminder, the company is an international manufacturer of petroleum-based products and low-carbon liquid transportation fuel. Valero’s segments include Refining, Ethanol, and Renewable Diesel, with a JV partner called Diamond Green Dieselwhich operates a renewable diesel plant in the US Gulf Coast region. Valero owns 15 petroleum refineries in the US, Canada, and the UK, and it has 3.2 million barrels per day of high-complexity throughput capacity. We still view Valero as a best-in-class operator with significant optionality in its refining system.

Valero in a Snap

Source: Valero Investor presentation May 2024

In Q1, despite heavy maintenance, the company kicked off the refining earning season with solid numbers, with all three segments beating our internal estimates. Our buy rating was supported by 1) a positive MACRO view for US refineries post-Ukraine/Russia conflict combined with Valero being the lowest cost producers in the area, 2) a DGD earning recovery story to play, and 3) a disciplined capital management company with an attractive shareholders’ remuneration. Since our last update in early January 2024, including the dividend payment, Valero’s total return has been up by double digits (17.23%), outperforming the S&P 500 performance (+14.06%).

Mare Evidence Lab’s rating update

Why are we still positive?

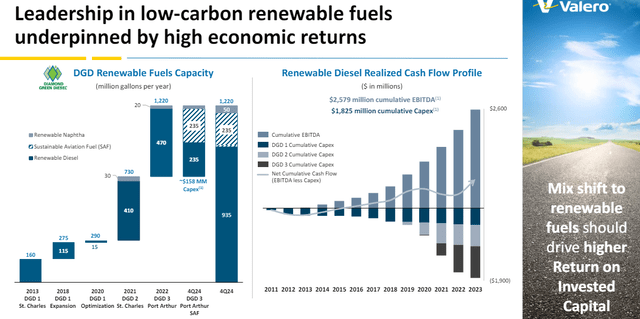

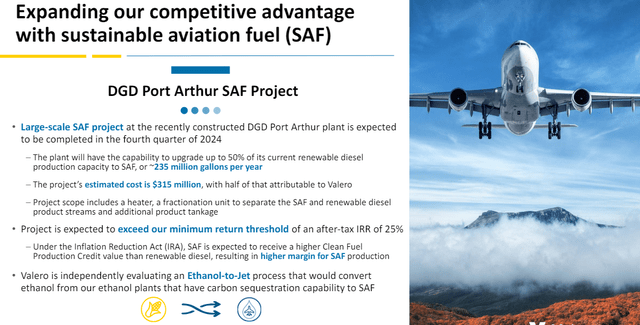

(Imbalance supply/demand in refinery products) Starting with the MACRO support, we believe there will be limited global refinery additions in the upcoming years. According to the World Energy Outlook Report, the refinery capacity expansion, estimated to be around 6 million b/d by 2030, will likely lag the global oil demand. In addition, around 21% of global oil refining capacity is at risk of closure, based on the energy consultancy Wood Mackenzie’s study. With our deep analysis, additional capacity is planned in Nigeria and Mexico; however, these assets lack the necessary infrastructure to start making a relevant amount to the refinery global supply. For this reason, we believe existing assets will likely benefit from several years of advantages (and probably a margin expansion even if we forecast a tightness from global demand). The study shows that China and Europe have the most significant number of high-risk industrial complexes, with almost 4 million barrels per day of refining capacity in jeopardy. We should also remember the Russian product embargo, especially regarding diesel solutions. Therefore, even if we assume a flattish demand, Valero has export demand in place to price in. At the JPMorgan Power & Renewables Conference, Valero estimated that refinery demand will likely double the supply needs. (Renewable Diesel margin improvements ongoing) In our previous analysis, we reported our positive view of DGD JV. In Q1, DGD reported an EBITDA margin of $0.76 per gallon compared to a $0.41 per gallon result in Q4 2023. If we account for feedstock price lag, our team found the actual EBITDA margin was approximately $1.08 per gallon. In a nutshell, the JV margin capture improved to 69% from 48%. As anticipated, feedstock prices are normalizing, and we believe the segment might capture further improvements in 2024. (SAF Upside) With the DGD JV, Valero continues negotiating for SAF mandates, which we previously anticipated kicking in early 2025 in the UK and Europe. These will create incremental demand. Valero management anticipates that DGD will be a preferred supplier of SAF and expects a startup of ~235mm gallon (per year) at Port Arthur in Q4 2024. We understand that early demand appears robust. Therefore, we might be surprised by a favorable margin tailwind from IRA and additional policy support (also in Europe). In addition, the JV left the door open for a potential SAF 2 project (Fig 2).

DGD Upside

Fig 1

SAF Upside

Fig 2

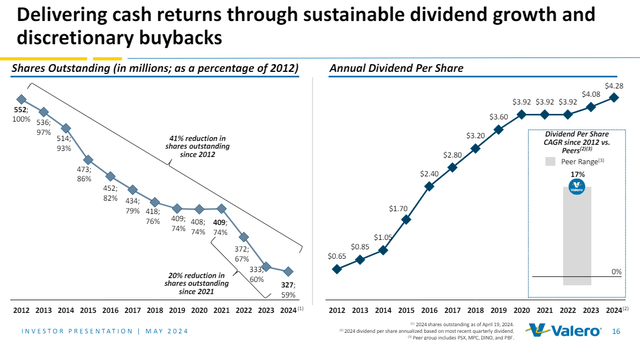

Earnings Change and Valuation

Valero sees economic activity picking up in H2, and looking ahead; the demand picture is even more supportive. In addition, refinery inventories are going down, which means that crack spread will increase. In number, the company’s payout ratio reached 74% in Q1, while payout guidance is estimated at 40%-50% at the mid-cycle margin. In Q1, Valero returned $1.4 billion to shareholders, accounting for dividends and share repurchases (Fig 3). Therefore, we project a payout at the guidance top range in our estimate. At the Lab, we model capital returns in line with the company’s free cash flow at approximately 72.5%. In our last assessment, we were projecting a 2024 EBITDA of $9.5 billion, which we have now slightly increased by $300 million thanks to better fundamentals for refining products and better-than-expected Q1 results. CAPEX remains unchanged at $1.4 billion, with a better FCF estimated at $6.3 billion (FCF yield reached 13.2%). On a dividend yield, the company is at 2.85%; however, the ongoing buyback and a deleverage in progress support Valero’s share price.

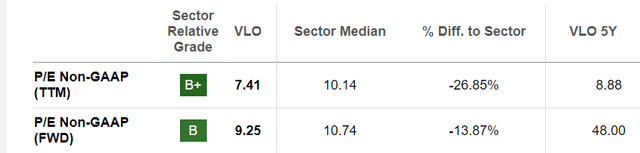

Regarding the valuation, we decided to maintain our overweight rating as we believe Valero will benefit from a capital payout perspective and from a double-digit FCF yield. In our estimates, we arrive at an adjusted net earnings of $5 billion with an EPS of $16.4. Valuing Valero with a 10x P/E, aligned with its sector median average, we increase our target price from $152 to $164 per share. On the EV/EBITDA basis, this valuation discrepancy with its peers is even higher. Valero trades at 5.5x while its comps are at 9x. This might offer additional upside on the horizon. Within our peer’s analysis, Valero is the second-highest capital returner in terms of percentage of market capitalization, second only to MPC.

Valero Shareholders’ remuneration

Fig 3

Valero SA Valuation Data

Risk

Downside risks include 1) lower Gulf Coast crude spreads, 2) a slowdown in industrial activities combined with an economic recession, and 3) lower-than-expected product export demand, especially in Europe. In addition, higher natural gas prices will hurt Valero’s operating costs. Still related to the company, CAPEX delays in DGD and SAF projects would be negative to Valero bottom line.

Conclusion

As global oil demand surges, the refining market is walking a fine line with limited additional capacity. This gap will likely drive crack spread and product prices to rise sharply. A double-digit FCF yield with an ongoing buyback supports our fundamental value approach. Despite the recent outperformance, the company is attractive and trades at mid-cycle earnings, while we believe there are upsides that the market is currently not giving credit for. For this reason, we remain overweight.