Donald Trump slammed President Joe Biden’s plans to cancel student loan debt as “vile” and suggested that the program will be “rebuked” if he is elected.

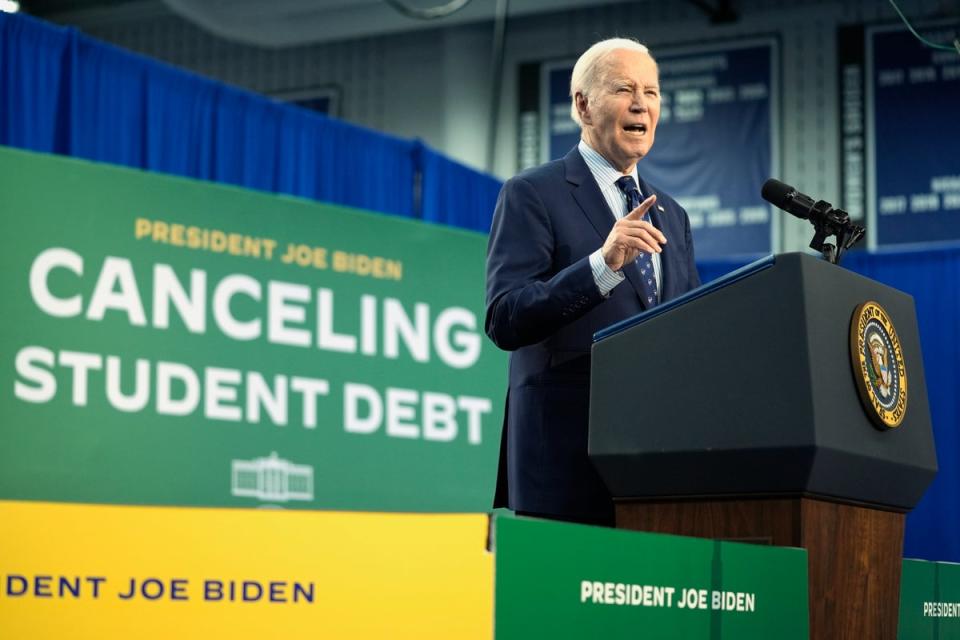

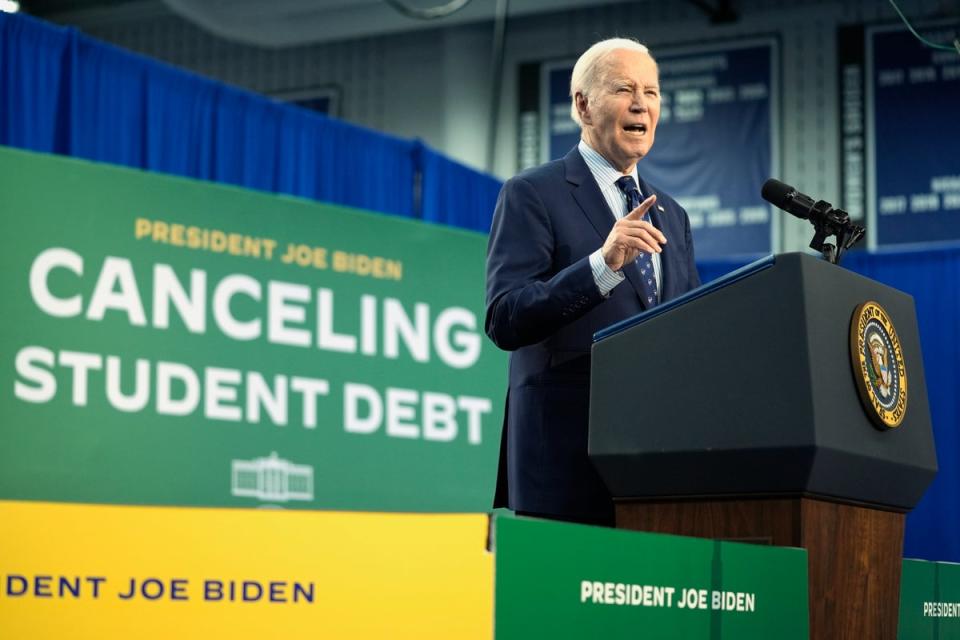

The Biden administration has canceled loan balances for nearly 4.8 million people by relying on a mix of existing programs and new policies after the Supreme Court struck down his campaign-trail promise for sweeping relief last year.

In a rambling campaign rally speech in Racine, Wisconsin, on Tuesday, Trump compared debt relief to what he said is “illegal amnesty” for immigrants married to American citizens.

“He did that with the tuition and that didn’t work out too well, he got rebuked, and then he did it again, it’s going to get rebuked again, even more so, it’s an even more vile attack, but he did that with tuition just to get publicity with the election,” he said.

Twenty minutes later, he blamed student loan relief for a climbing federal budget deficit.

“Because he’s throwing money out the window,” Trump said. “This student loan program, which is not even legal, it’s not even legal, and the students aren’t buying it, by the way. His polls are down. I’m leading in young people by numbers that nobody has ever seen.”

Last year, the Supreme Court blocked Biden’s plans for student debt relief after a pair of lawsuits from Republican attorneys general and conservative legal groups.

At a campaign event that same day, Trump hailed the decision and called Biden’s plans “very unfair to the millions and millions of people who paid their debt through hard work and diligence.”

Project 2025, a right-wing special interest-backed plan for Trump’s return to the White House, has also called for reversing student debt cancellation and eliminating the Office of Federal Student Aid.

Earlier this year, more than a dozen GOP-led states launched another federal court battle to challenge Biden’s latest debt relief plans. Biden is “unilaterally trying to impose an extraordinarily expensive and controversial policy that he could not get through Congress,” according a lawsuit led by Missouri’s Republican attorney general.

Before Biden’s plan was struck down, millions of people who took out federally backed student loans were eligible for up to $20,000 in relief.

Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants.

Roughly 43 million federal student loan borrowers were eligible for that relief, including 20 million people who could have had their debts entirely wiped out, according to the White House. Sixteen million people had already submitted their applications and received approval for debt cancellation prior to the court’s ruling.

Still, the administration has been able to speed relief for nearly 5 million Americans by leaning on programs that have existed for years, including during Trump’s administration.

Last month, the administration aided $7.7 billion in relief, including wiping out debts for nearly 67,000 public servants enrolled in the Public Service Loan Forgiveness program, according to the Education Department.

Another 54,000 borrowers had their balances cleared under a new repayment plan that promises to cancel debts from loans of less than $12,000 if they had made their payments over 10 years. Another 39,000 borrowers who have been in repayment for more than 20 to 25 years as part of an income-driven repayment plan also had their balances cleared.

The administration’s student loan plans are also fuelling a federal budget deficit, which will hit $1.9 trillion this fiscal year, according to the Congressional Budget Office.

That includes a projected $145 billion spike from changes to the student loan forgiveness plan, including a proposal to waive interest for millions of borrowers.

The amount of debt taken out to support student loans for higher education costs has exploded within the last decade, alongside surging tuition costs, private university enrollment growth, stagnant wages and a lack of investments in higher education and student aid, which puts the burden of college costs largely on students and their families.

Many borrowers also have been trapped by predatory lending schemes with for-profit institutions and sky-high interest rates that have made it impossible for many borrowers to make any progress toward paying off their debt, with interest adding to balances that have exceeded the original loans.