Robert Way/iStock Editorial via Getty Images

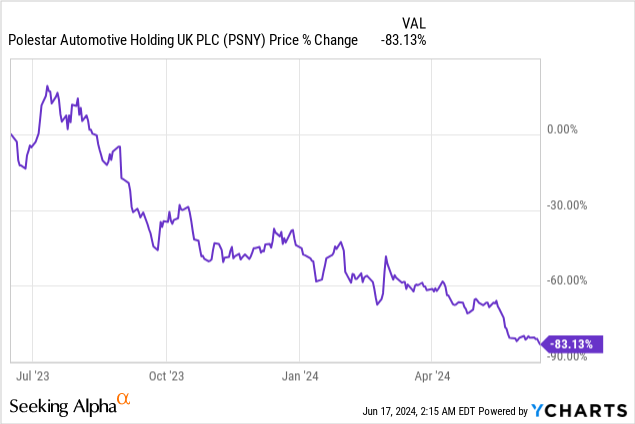

Polestar (NASDAQ:PSNY) is suffering from waning electric vehicle demand that has also crushed other electric vehicle companies including Fisker, which is said to be fighting off bankruptcy, and Lucid Group (LCID). The Swedish electric-vehicle company still has not reported its FY 2023 and Q1’24 financial results and given that the firm’s Q1’24 deliveries plunged, I don’t believe that Polestar is investable anymore at this time. As a result, I am changing my rating on the EV company to sell and believe that the most likely outcome here is a potential delisting from the stock exchange!

Previous rating

I up-graded shares of Polestar to buy in November 2023 as the company saw a promising upswing in deliveries (+50% Y/Y at the time) and the EV maker achieved positive growth profits. Since then, however, the situation has deteriorated, culminating in the company delaying the release of its annual report as well as Q1’24 earnings sheet. Although the Polestar 2 is seeing some solid customer demand, the latest delivery figures for the EV company paint a rather weak picture and indicate that the EV maker is not going to see any significant growth at all this year.

Annual report delay, weak delivery setup

Polestar announced earlier this year that it would delay its financial report for FY 2023 as well as Q1’24 due to accounting misstatements in prior years that needed to be corrected. Polestar is now expected to present those reports at the end of June. The delay has caused soaring uncertainty about the company’s financial situation, especially since Polestar also reported a significant year-over-year slump in deliveries in the first-quarter.

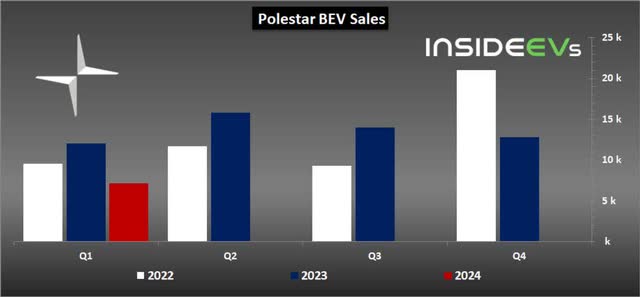

Polestar delivered only 7,200 electric vehicles in Q1’24 which showed a year-over-year decline rate of 40%. This is not the first time that Polestar disappointed in terms of deliveries as the EV maker also drastically underperformed the lower end of its FY 2023 delivery guidance. Last year, the EV maker delivered 54,600 electric vehicles, missing the lower end of its guidance range of 60-70k electric vehicles. Earlier that year, the company expected to deliver up to 80k electric vehicles.

InsideEVs

Just last year, Polestar guided for a FY 2025 delivery volume of 155,000 to 165,000 electric vehicles which will be all but impossible to achieve, in my opinion. Based off of the EV firm’s Q1’24 deliveries, Polestar is looking at an annualized delivery volume of approximately 30,000 electric vehicles. I find it very hard to envision that Polestar could scale this delivery volume up to even 60,000 electric vehicles in FY 2024 which means Polestar is likely, in my opinion, to walk this delivery goal back when it releases updated financial figures.

Polestar said that it will present its annual FY 2023 and Q1’24 reports at the end of June, but this is unlikely to improve investor sentiment toward the EV maker. Polestar likely also saw slowing EV growth in the second-quarter (weak demand for high-priced EVs hasn’t gone away in Q2) which means the company could be set to disappoint with its FY 2024 and FY 2025 delivery outlooks well: I would not be surprised for Polestar, based off of its current delivery trajectory, to cut its FY 2025 delivery goal in half.

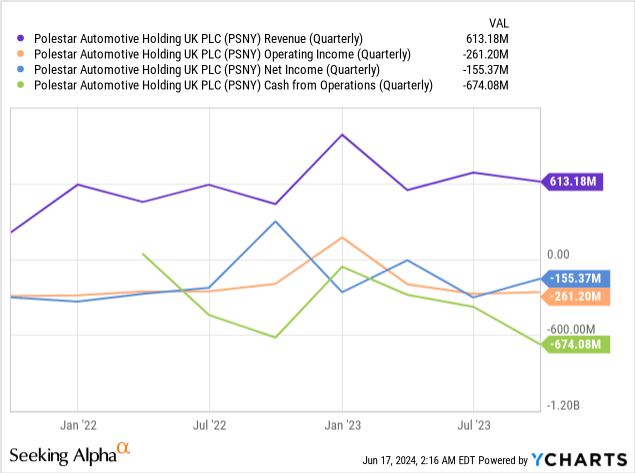

With deliveries slumping, Polestar is set to report a big drop in revenues for Q1’24 as well as high net losses. In the context of falling deliveries, Polestar’s high, negative operating cash flow is a potential concern for investors. Polestar did achieve positive gross margins in Q3’23, but was still not profitable on an operating income or net income basis.

All eyes on cash

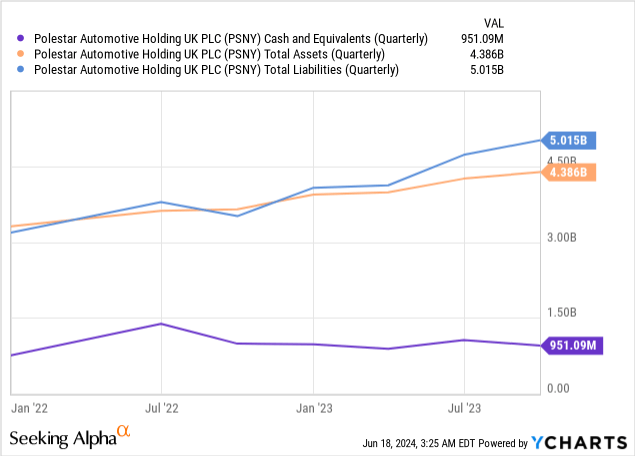

Polestar is burning through cash, like most EV start-ups, which makes the company’s upcoming earnings report very important from a liquidity perspective. Polestar had $951M in cash sitting on its balance sheet at the end of Q3’23, but since no financials have been reported since, investors face massive uncertainty about the company’s cash flows… which is one reason why I am down-grading shares to sell. Polestar had negative free cash flow of $1.7B in the first nine months of FY 2023 implying negative quarterly free cash flow, on average, of $567M. I expect a significant draw-down of the company’s cash balance as of Q1’24 and believe the company’s cash pile and cash flows are the two most important metrics to be released later this month.

Polestar’s valuation

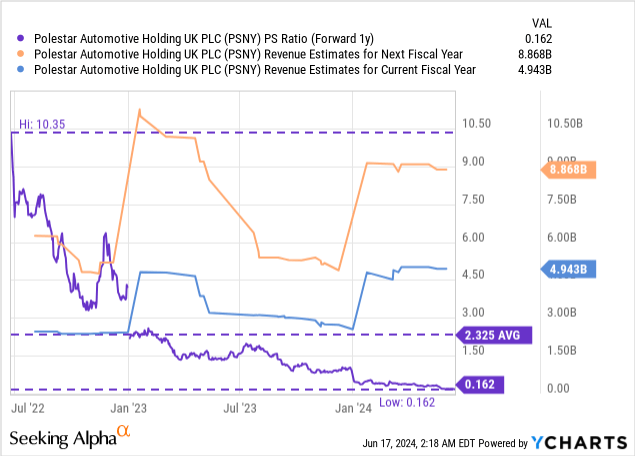

Unprecedented value destruction has taken place in the electric vehicle sector in the last two years, as investors had growth expectations that the industry as a whole could not fulfill. An especially sad example in this regard is Fisker which is struggling to survive. Polestar is currently valued at a fraction of its historical valuation, which is driven by two factors: 1) Demand for high-priced electric vehicles is waning, and 2) Investors are deeply concerned about the delay in the filing of the company’s financials.

Currently, shares of Polestar trade at 0.16X FY 2025 revenues, which indicates that the market has lost most of its confidence in the EV maker. In the last three years, Polestar was valued at an average price-to-revenue ratio of 2.3X, but it is unlikely, in my opinion, that the EV maker will return to this valuation level given the multitude of problems Polestar is dealing with right now. Since there is considerable uncertainty about the EV maker’s current revenue, income and cash situation, investors are dealing with an exceptionally high degree of uncertainty and the best option in such cases, in my opinion, is to stay away.

Risks with Polestar

The biggest risk is that the electric vehicle company follows in the footsteps of Fisker which is also seeing a drastic decline in deliveries and whose shares got delisted from the stock exchange in March 2024. A delisting means that shares get moved to the over-the-counter market, which indicates to investors that a company does not meet minimum financial requirements.

I also see the upcoming earnings release (with restated financials) as a potentially negative catalyst, as I consider it highly likely that Polestar will walk back its FY 2025 delivery guidance. What may change my mind is if the EV maker were to report a massively improved profitability situation (unlikely) or refrained from changing its FY 2025 outlook (also unlikely, in my opinion). A surge in Polestar 3 and Polestar 4 deliveries could also potentially make a positive impact on the company’s financials in the second half of the year.

If Polestar were to report strong financials at the end of June, then I could see an upside catalyst for the EV maker’s shares as well. Since the company’s deliveries dropped 40% in Q1’24, however, investors will have to brace for a disappointing delayed earnings release.

Final thoughts

Polestar is in a dangerous setup as waning demand for electric vehicles, weak delivery performance and growing revenue pressure are set to hurt the company’s delivery ambitions for FY 2025. The delayed annual filing and Q1’24 report have already been bad news for the EV company, and it hurt investor confidence. Since Polestar underperformed its delivery target in FY 2023 and the current EV slump is continuing, I don’t believe that the risk profile for PSNY is especially attractive right now. A delisting is a very real possibility, and something that would likely end the investment chapter for Polestar on a very bad note. Avoid!

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.