Tero Vesalainen

Heading into 2024, I revisited my bearish thesis on Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD), upgrading the fund to “Buy”. I argued:

Looking into 2024, SCHD’s fortunes may be poised for a notable shift, as a confluence of economic factors and market dynamics may strengthen demand for dividend assets.

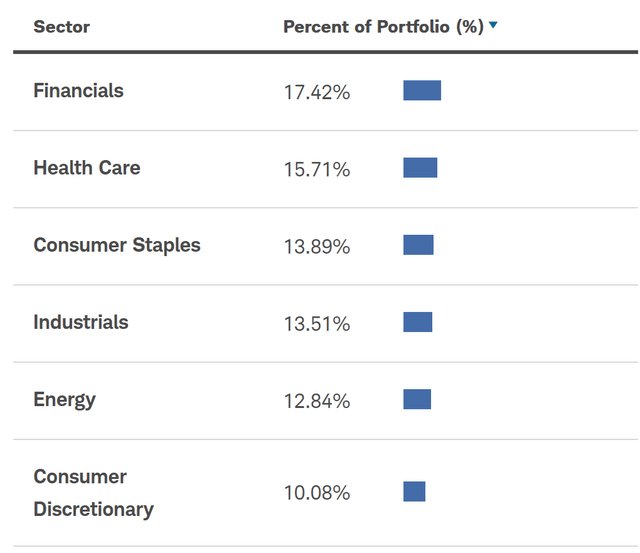

[…] I point out that the projection of falling interest rates may greatly improve the relative attractiveness of dividend-paying stocks vs. fixed income securities, especially as the yield on the 10 year treasury may drop below the 3.5% implied yield seen in SCHD. Meanwhile, SCHD’s exposure to macro-sensitive sectors such as Industrials (18% allocation), Financials (15% allocation) and Consumer Discretionary (15% allocation) may benefit from a better than expected cyclical growth backdrop in the U.S.

However, reflecting on the thesis once again today, I understand that my early enthusiasm about SCHD was wrong: The market’s bullish expectation for aggressive rate cuts did not turn out as expected, while the economic backdrop in the U.S. for cyclical assets–although still solid–has slowed. Under such circumstances, the outlook for dividend assets is much less favorable. And in fact, YTD SCHD stock has grossly underperformed the broader U.S. stock market. Since the beginning of the year, SCHD shares have appreciated approximately 5%, compared to an 11% gain for the S&P 500 (SP500).

Seeking Alpha

Adding to the less favorable macro backdrop, there is another pressure point that feeds into my returning pessimism – SCHD’s stock picking strategy.

SCHD’s Stock-Picking Misses On Growth

SCHD prospectus

Notably, I point out that SCHD’s capital allocation strategy with focus on Financials, Health Care, Consumer Staples, Industrials, Energy and Consumer Discretionary completely misses the favorable business tailwind coming from GenAI, 8.7% in Information Technology and 4.7% in Communication Services industry. And while the Financials and Health Care industry will likely see significant efficiency gains due to GenAi adoption, most notably in customer service and compliance departments, these benefits will likely only materialize on a longer-dated time horizon.

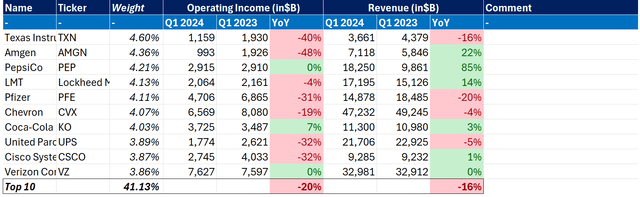

To underscore the issue of SCHD’s capital allocation mismatch with the current macroeconomy, I highlight a Q1 revenue and earnings deep-dive for the top 10 holdings of SCHD versus the S&P 500. During the period from January to the end of March 2024, SCHD’s top 10 holdings have experienced an allocation-weighted 16% YoY decline in revenues and a 20% YoY decline in operating income.

SCHD prospectus; Refinitiv; Author’s modelling

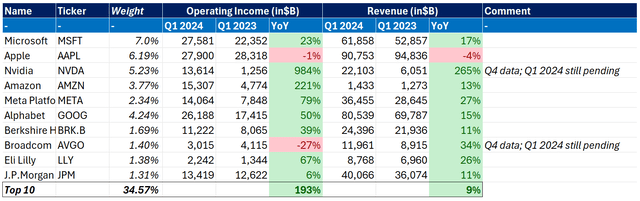

During the same time period, the top 10 holdings for the S&P 500 have enjoyed an allocation-weighted 9% YoY expansion in sales and a 193% YoY surge in operating income.

Refinitiv; Author’s modelling

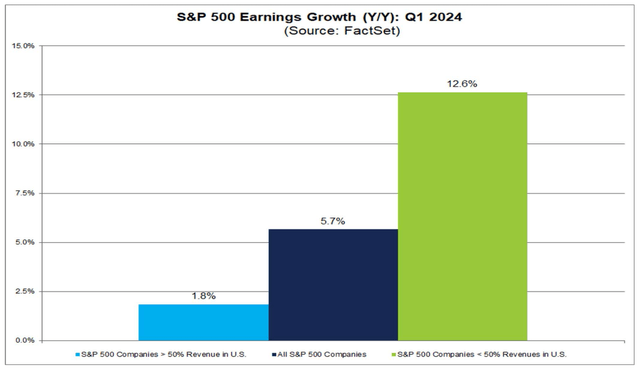

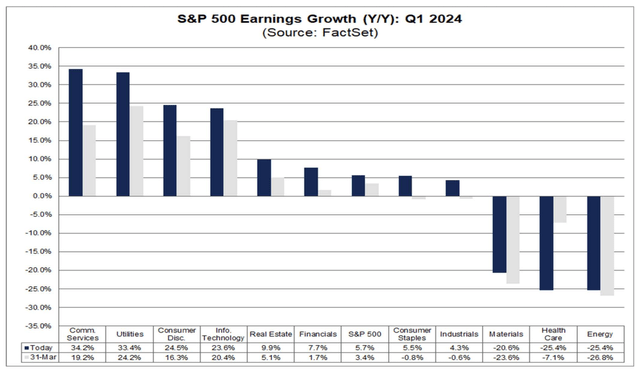

Thus, the performance of SCHD’s top holdings in Q1 was very disappointing; with a negative operating earnings growth YoY, while the top 10 holdings in the S&P 500 reported booming profits. On an aggregate level, the S&P 500 allocation-weighted earnings growth was positive 5.7%, thus also outperforming SCHD’s key holdings.

FactSet FactSet

Adding to the disappointing stock-picking performance, I also highlight that SCHD’s misfortune (or mistake) was compounded by “confidence”: the top 10 holdings in the SCHD ETF claimed 41% of the total portfolio, while the top 10 holdings in the S&P 500 barely touched 35%.

SCHD’s Dividend Yield Underperforms Treasuries

While SCHD disappointed on growth in Q1, some readers will likely claim that the ETF may still be an attractive opportunity for income-seeking investors. On that note, another issue with SCHD in the current market environment is that its yield underperforms compared to U.S. Treasuries across both short- and long-term durations. For context, the 2-year note is yielding approximately 4.8%, and the 10-year note about 4.2%, while SCHD’s income yield is around 3.3%. This discrepancy is notable for investors because typically, Treasuries, being “risk-free” fixed income securities, should yield less than stocks to compensate investors for the additional equity and volatility risk. Accordingly, in my view, potential SCHD investors are currently much better positioned by investing in a combination of the S&P 500/ Nasdaq 100 and the 2-year Treasury yield.

Waiting For Macro To Turn More Favorable

I point out that SCHD’s fund holdings are quite cyclical, with little exposure to structural growth trends such as AI. On that note, SCHD’s attractiveness as an investment is to a large extent contingent on a bullish macro backdrop, including favorable economic growth and supportive interest rates. However, the outlook for broad cyclical growth has darkened over the past few months. Real GDP increased at an annual rate of 1.6% in the first quarter of 2024, down from 3.4% in the fourth quarter of 2023. This slowdown reflects a combination of restrictive monetary policy, geopolitical disruptions, and fiscal constraints. Arguably, the most notable headwind is the persistent high interest rates, as the Federal Reserve fights the potential resurgence of inflation. Although consumer spending has contributed positively to economic expansion recently, its pace is unsustainable long term. Households are depleting their savings and reaching borrowing limits, leading to slower future spending growth. Additionally, increased government borrowing for defense and other expenditures is likely raising capital costs, further constraining the sustainability of economic growth, especially in the private sector.

In my view, investors should wait on the sidelines for a potential SCHD investment until the macro backdrop turns more favorable. On that note, I would like to see the 10-year yield drop sustainably below 4%, while economic growth accelerates back to 2% YoY. Both of these pillars will likely depend to a large extent on the inflation and interest rate outlook.

Investor Takeaway

My early 2024 enthusiasm for SCHD was misplaced. The market’s bullish expectation for aggressive rate cuts did not materialize, and although the U.S. economic backdrop for cyclical assets remains solid, it has slowed. Under these conditions, the outlook for dividend assets is much less favorable. Additionally, SCHD’s stock-picking strategy has become another pressure point, contributing to my renewed pessimism. SCHD’s top holdings performed disappointingly in Q1, with negative operating earnings growth YoY, while the top 10 holdings in the S&P 500 reported booming profits of nearly 200% YoY. As long as the macro backdrop for cyclical equity assets remains challenged, I shift back to a Sell/ Underperform rating for SCHD.