Building a Big-Yield Portfolio, Blue Harbinger ansonsaw Ares Capital Corporation

If you are an income-focused investor, building a big-yield portfolio (6% to +11% yields), across a variety of categories (such as BDCs, CEFs and REITs), can help you achieve your goals. In this report, we share updated data on the top 7 securities (by market cap) in each of the three categories, and then dive deep into BDC Ares Capital (NASDAQ: ARCC) (including its business strategy, current market environment, valuation, dividend safety and risks). We conclude with our strong opinion about constructing a big-yield portfolio, and about investing in Ares Capital in particular.

The Top 7 BDCs

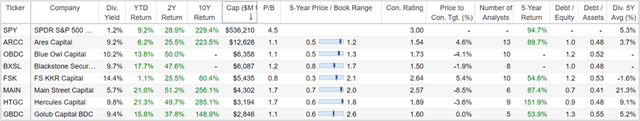

Most investors will agree, putting all your eggs in one basket is a bad idea (too risky). That’s why we choose to invest in multiple securities across multiple categories, within our Blue Harbinger “High Income Now” portfolio. So before getting into Ares Capital in particular, let’s take a look at how it compares to the other top big-yield Business Development Companies (BDCs):

Stock Rover

(FSK) (MAIN) (HTGC) (GBDC)

As you can see, Ares is the largest BDC, and it has a reasonable price-to-book value (a basic BDC valuation metric) as compared to peers and its own historical range. Wall Analysts tend to have a positive opinion (a strong 1.54 “buy rating,” on a scale of 1 to 5), but don’t see much upside for any of these BDCs (performance has been very good in recent years).

Ares Capital (ARCC) Overview:

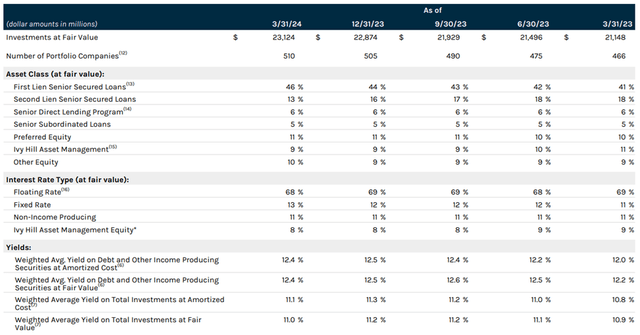

As a BDC, Ares Capital Corporation (ARCC) provides financing solutions to middle-market companies, including loans and equity co-investments. You can see the breakdown of Ares’s investments (at the end of the most recent quarter) in the following table.

Ares Q1 Investor Presentation

A few things that stand out about Ares (besides it being the largest publicly traded BDC) is its wide investment diversification (in terms of sheer numbers and industries), but also Ares generally has more second lien and fixed rate loans than many other BDCs. Also, Ares has a strong investment grade credit rating despite its riskier second lien loans because in aggregate the company is financial strong and healthy. This also helps Ares earn high yields on its investments, including a 12.4% weighted average yield on its loans (debt), as you can see in the table above. These high yield investments help Ares support its big dividend payment to investors (more on the dividend later).

Current Market Environment

Ares acknowledged during the most recent quarterly call that there is market uncertainty regarding interest rates (there are different opinions about which way rates move next), but not as much uncertainty regarding the investment environment (as Ares continues to originate new deals).

Ares Q1 Investor Presentation

Ares’ “financial health” positions it for a variety of interest rate environments, including its fixed and variable rate loans, as well as its relatively lower leverage as compared to history. For example, on the most recent quarterly call, newly promoted CFO, Scott Lem explained (emphasis ours):

“We also ended the first quarter with a debt-to-equity ratio net of available cash of 0.95 times as compared to 1.02 times a quarter ago and our lowest net leverage ratio since the end of 2019.

We believe our significant amount of dry powder positions us well to continue supporting our portfolio company commitments, remain active in the current investment environment, and eliminate any refinancing risk with respect to the this year’s remaining term debt maturities.”

Ares also noted the market is increasingly competitive for deals (as the public and private BDC space gets more crowded), but that Ares benefits from direct origination with people already in their large network (this helps drive new investments).

Additionally, there have been talks of traditional banks returning more to the middle market lending deals that BDCs have dominated since the Great Financial Crisis, but Ares explains this has not been a big deal for their business. According to CEO, Kip DeVeer:

“it’s not a huge driver, frankly, of what we’re doing. There’s been a lot of press, I’d say, about the bank’s returning to the market and perhaps a more risk on way to try to arrange and underwrite to syndicate more traditional leveraged finance transaction.”

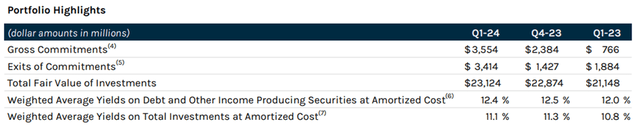

Also worth mentioning, Ares has been steadily raising capital by increasing shares outstanding, but the increases have been commensurate with increased investment income per share (as you can see below).

Ares Q1 Investor Presentation

Valuation

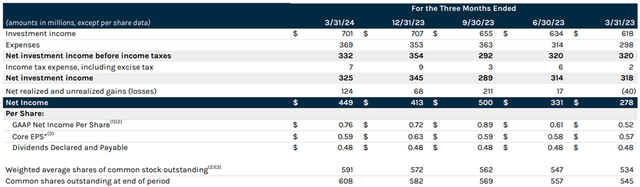

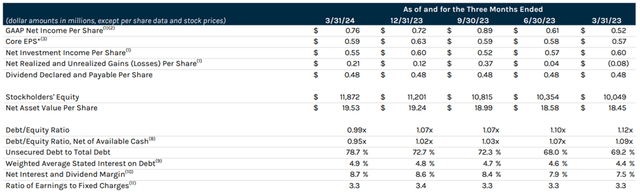

Ares just achieved a new all-time high in net asset value (“NAV”) per share at quarter end ($19.53, as you can see in the table below).

Ares Q1 Investor Presentation

This is generally a good sign for investors as it indicates increased earnings power (i.e. the company is working off a higher base, and not destroying value).

Furthermore, Ares’ price-to-book value (one of the most basic high-level BDC valuation metrics) remains reasonable at ~1.1x.

As mentioned earlier, leverage (or borrowed money) is down slightly (see debt to equity ratio above), which gives Ares more dry powder to deal with stress or opportunities potentially caused by interest rate volatility or deteriorating market conditions.

Dividend Safety

As you can see in our earlier tables, Ares continues to easily cover its quarterly dividend ($0.48 per share) with both net income per share (recently $0.76) and core EPS (recently $0.59). And the dividend has remained steady to increasing for the last 14 years.

Ares has historically paid a special dividend from time to time, and there is some question if Ares will do that later this year considering they announced taxable earnings spillover of $1.05 per share (enough to cover more than two quarters of dividends). According to CEO Kipp DeVeer, on the quarterly call:

But we’re in a little bit of a tricky position as you can probably appreciate, because while we have loads of earnings in excess of the regular dividend, the trajectory for rates going forward is reasonably uncertain.

I think if you ask around the table, folks would have very different views. So, combining that with the fact that we really aren’t in a position, in my opinion, any way where we want to put the company in a place where we would have to reduce its regular dividend, we just feel better materially out earning it today and building the NAV.

Risks

Ares continues to face a variety of risks, ranging from interest rate uncertainty/volatility to increasing market competition (from other BDCs and perhaps even a soft return to the space by traditional banks). However, the company maintains that its wide network allows it to continue to source attractive deals, and that (combined with its size and scale) is helping Ares avoid some of the pressures that other BDCs may be feeling.

Per a recent BDC peer review, Fitch ratings is:

“affirming 19 issuers’ ratings and upgrading Blackstone Secured Lending Fund’s (BXSL) and Blue Owl Capital Corporation’s (OBDC) ratings to ‘BBB’ from ‘BBB-’. Fitch revised the Rating Outlooks for Ares Capital Corporation and Sixth Street Specialty Lending, Inc. (TSLX) to Positive from Stable, revised the Outlook for Barings BDC, Inc. (BBDC) to Negative from Stable and placed BlackRock TCP Capital Corp.’s (TCPC) ratings on Rating Watch Negative. All other Outlooks remain Stable.”

”Fitch’s 2024 sector outlook for BDCs is ‘deteriorating’, reflecting Fitch’s expectation for weaker asset quality metrics given the challenging economic backdrop and elevated interest rates. Fitch also expects more competitive underwriting dynamics in the middle market in 2024, compared to 2023, as the rebound in the broadly syndicated market and growth in perpetual non-traded BDCs could further pressure deal terms.”

We believe Ares is well-positioned to handle financial challenges while continuing to deliver attractive shareholder returns. We’ll have more to say about Ares in the conclusion of this report.

Top 7 Closed-End Funds (CEFs):

In addition to considering BDCs, CEFs are also worth considering when constructing a big-yield portfolio, especially considering many BDC valuations currently appear rather full, while many CEF valuations may have more immediate price appreciation potential (in addition to their large distribution yields).

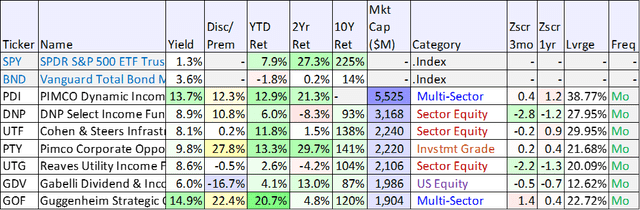

Here is a look at seven of the largest CEFs (by market cap), and as you can see they offer very competitive yields (some of them paid monthly).

Stock Rover, CEF Connect

(DNP) (UTF) (PTY) (UTG) (GDV) (GOF)

The BDCs we reviewed earlier are generally providing capital (mainly loans) directly to middle market companies, whereas the CEFs in the table above are building and managing debt portfolios by purchasing bonds and securitized loans. The two groups are quite different in this sense, but also similar in that they’re both mostly investing in debt/loans.

And unlike BDCs (many of which have weathered recent interest rate volatility relatively unscathed), many bond CEFs have experienced significant price declines. This creates some opportunities to invest in CEFs with big distribution yields and perhaps a little more potential for price appreciation too.

PDI Price vs NAV (CEF Connect)

One such example of a bond CEF that we like is PIMCO’s Dynamic Income Fund (PDI), which we recently wrote up in detail this report:

PDI: 13.7% Yield Attractive, Despite Section 19 Notices

Top 7 Real Estate Investment Trusts (REITs):

The price performance of many REITs have been downright ugly in recent years. The combination of rising interest rates and secular real estate market changes have likely created some permanent damage as well as some attractive investment opportunities. For starters, here is a look at recent data for seven of the largest big-dividend REITs.

Stock Rover

(PLD) (AMT) (SPG) (O) (PSA) (DLR) (CCI) (VICI) (EXR)

Property REITs don’t generally offer yields as high as some BDCs and CEFs, but some REIT yields are currently higher than normal (as prices fall, dividend yields mathematically rise, all else equal), perhaps an indication that they are undervalued and providing a buy low opportunity.

You can see how Wall Street analysts rate these REITs (on a scale of 1 to 5) in the table above, with several of them having more than 20% upside from here (i.e. their current share prices versus price targets).

Bottom Line

The bottom line is that not all big-yields are created equally. And thank goodness for that because by investing in a portfolio of them you can keep your income high and your risks lower (through diversification).

And if you are trying to build a big-yield portfolio, Ares (and PIMCO’s PDI) can be an important part of that (we currently own both in our “High Income NOW” portfolio). But at the end of the day, you need to do what is right for you.