To say PayPal’s (NASDAQ: PYPL) stock has struggled over the past three years is a bit of an understatement. Heading into 2024, the stock saw negative returns the past three years, and it was down nearly -75% during that period.

Looking to spark interest in the stock, new CEO Alex Chriss stated during a CNBC interview that PayPal would “shock the world” at an Innovation event it was holding in late January.

The event didn’t exactly leave investors in awe, however, as the event focused on PayPal’s Artificial Intelligence (AI) ambitions. In 2024, improving products through AI isn’t exactly cutting edge. Meanwhile, the stock sold off a couple weeks later after the company reported its Q4 results.

The question now becomes: can investors go bargain hunting in this beaten-up name?

Overpromising and underdelivering

The narrative with PayPal the last few years has been that it’s a fading business facing competitive pressures. And make no mistake, these are the biggest risks the company faces.

However, the company’s numbers don’t necessarily reflect this narrative. Key metrics for the company have consistently grown over the past three years despite the precipitous fall in its share price.

Total payment volume, which is the amount of money that flows through its payment processing system, has risen each quarter over the past few years, and growth in this metric accelerated in 2023. Number of payment transactions has also solidly grown, as has revenue. Now everything hasn’t been perfect, as the company has seen its number of active accounts stop growing.

More recently, PayPal came under pressure due to its 2024 guidance. The company forecast Q1 revenue growth of 6.5%, but didn’t issue full-year revenue guidance, while it said it expected adjusted EPS to be in line with the $5.10 it reported in 2023.

So why didn’t investors like this? Because analysts were looking for 2024 adjusted EPS of $5.53. Stock performance is often tied to future projections and how companies perform versus expectations, so when a company forecasts earnings below analyst expectations, the stock falls.

Story continues

Innovation to lead the way

Now while PayPal didn’t shock the world at its Innovation event, it did introduce some promising AI-powered offerings. One area of focus for the company is speeding up the checkout process and removing friction for consumers. On this end, the company introduced two new offerings: PayPal Checkout and Fastlane. The former replaces having to type in passwords with biometrics, such as face and fingerprint recognition, while the latter allows for one-tap purchases.

Increasing customer engagement and personalization are two other areas that PayPal is targeting. With its Smart Receipts offering, PayPal will provide customers a receipt as well as personalized product recommendations from the same merchant.

Along the same lines, the PayPal advanced offers platform will analyze transaction data via AI to deliver personalized offers to customers. This is largely an advertising tool, and merchants only pay when a customer buys the recommended product. Meanwhile, with PayPal CashPass, consumers will be able to earn cash back on purchases as well as rewards.

None of these innovations by themselves are exactly groundbreaking. However, they are solid offerings that should help drive engagement and transactions growth.

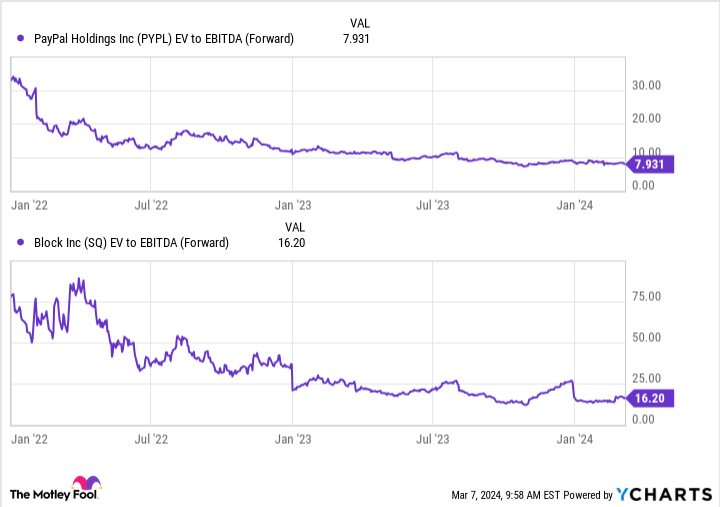

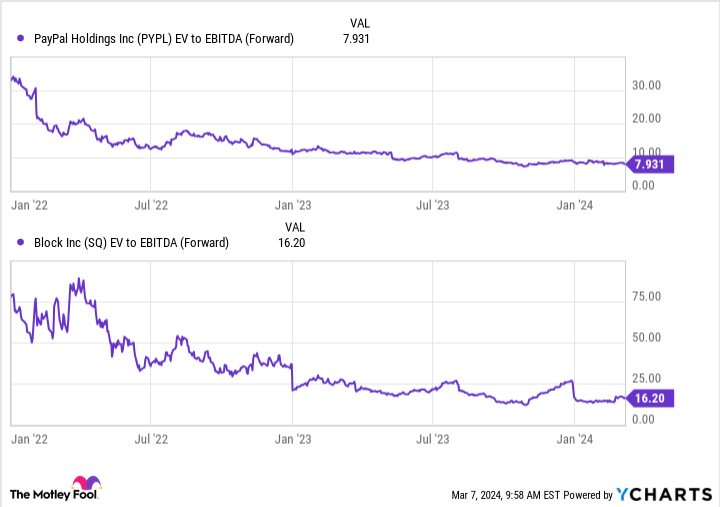

With the fall of its stock price over the past few years, PayPal’s valuation has greatly shrunk. It also trades at about half the EV/EBITDA multiple as rival and fellow payment processing company Block (NYSE: SQ). Given PayPal’s strong cash position, I prefer using this common valuation metric, as Enterprise Value (EV) takes into consideration a company’s balance sheet, while EBITDA removes the impact of any non-cash impacts.

PYPL EV to EBITDA (Forward) data by YCharts

Given its cheap historical and relative valuation, what investors need to see from the company is innovation and growth. While these new offerings didn’t shock the world, they do look like they should provide exactly that.

What about PayPal’s disappointing guidance?

Ahead on its Innovation event, CEO Chriss overpromised and undelivered, which is never a good thing for stocks, as investors are always looking for companies to exceed expectations. Meanwhile, a few weeks later, management offered up some pretty tepid guidance for 2024.

While that may seem bad, there is a good possibility that Chriss quickly learned his lesson and when the company issued its 2024 guidance, the plan was to underpromise and overdeliver. Given all the new promising offerings that PayPal is set to introduce, guidance appears to be conservative.

One of the best setups for stocks is a cheap valuation and low expectations. If PayPal can surpass what looks like a low bar, 2024 could be the start of a turnaround for the stock.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and PayPal made the list — but there are 9 other stocks you may be overlooking.

See the 10 stocks

*Stock Advisor returns as of March 8, 2024

Geoffrey Seiler has positions in Block. The Motley Fool has positions in and recommends Block and PayPal. The Motley Fool recommends the following options: short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

PayPal Didn’t Shock the World. What’s Next for Investors? was originally published by The Motley Fool