hapapapa

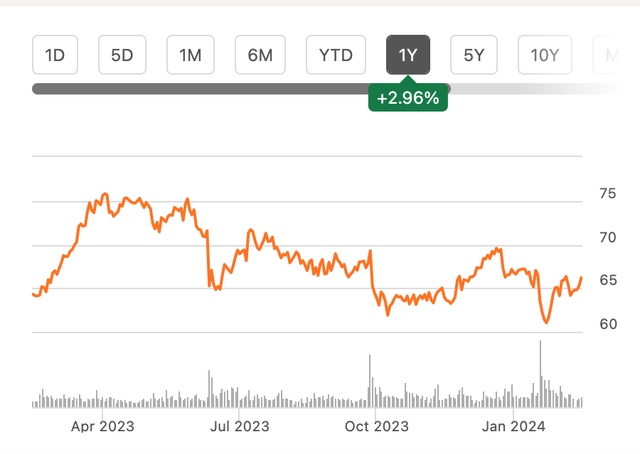

Oncology-focused pharmaceuticals company AstraZeneca PLC (NASDAQ:AZN) has had an underwhelming past year at the stock markets, with just a 3% price rise. However, the limited price change detracts from the fundamental positives of the stock. Here, I look at 5 aspects that set it apart and can provide impetus for price upside in 2024.

Price Chart (Source: Seeking Alpha)

#1. Improved revenue guidance after an outlook beating 2023

When analyzing any stock, the future financials are, of course, of key significance, and it’s no different for AstraZeneca. In this context, the company is notable, with improved revenue guidance for 2024 provided in its full-year 2023 earnings report last month.

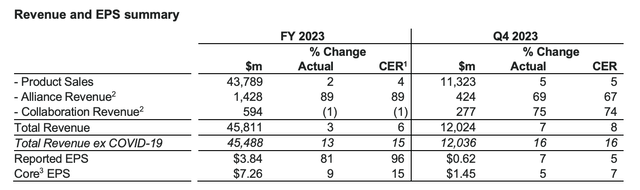

It forecasts an “increase by a low double-digit to low teens percentage.” This compares favorably with the initial guidance for last year when it expected an “increase by a low-to-mid single-digit percentage.” The forecast was upgraded to “a mid single-digit percentage” in the third quarter (Q3 2023) results. If the forecast were to be interpreted as a 5% growth, in actual fact, the number came out slightly better even than the final expectation, at 6%.

The same was true for revenues from ex-COVID-19 medications, forecasts for which were provided separately as revenues from COVID-19 medications petered off post-pandemic, skewing the revenue growth. From the initial forecast of a “low-double digit” increase, by the end of Q3 2023, the forecast was upgraded to “a low-teens percentage.” In actual fact, the number came in at 15%.

The key takeaway here is that going by the recent performance, there’s a possibility of forecast upgrades even in the current year, especially with the company’s recent drug approvals, which is discussed later here.

#2. EPS outperformance and positive guidance

Similar to revenues, the core EPS has also outperformed in 2023 with 15% growth, compared to the guidance as of Q3 2023 of “low double-digit to low-teens percentage.” Note that here too, the guidance was revised upwards from the initial “high single-digit to low double-digit percentage.”

For 2024, AstraZeneca maintains the revised guidance from last year. But like in the case of revenues, it may well be subject to upward revisions in the future if the company’s recent outperformance continues.

The one weakness in profits is the lower core EPS growth in Q4 2023 (see table below), which bears an explanation. While the revenue growth continued to be strong in the quarter, the earnings growth fell on higher operating expenses. However, the company attributes this to both the phasing of expenses and investment in new drug launches. To that extent, I’d focus on the full-year big picture.

Source: AstraZeneca

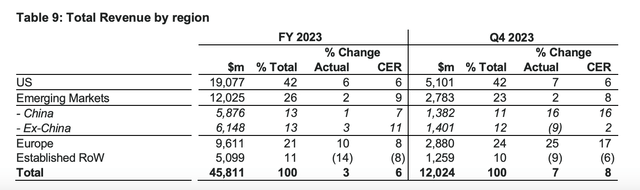

#3. Approvals in key markets

In the final quarter of the year, the company also received approvals for several drugs, that can sustain its performance. In the U.S., breast cancer treatment Truqap and nerve disorder treatment Wainua were approved. Wainua isn’t revenue generating for AstraZeneca yet, and Truqap is only a negligible contributor to revenues, the fact remains that the US is the company’s biggest market. With its 42% share in revenues as of 2023, approvals there can still enhance the contribution of these treatments to revenues.

Source: AstraZeneca

Next, the cancer treatment Imfinzi was approved in China. Imfinzi is one of AstraZeneca’s highlight treatments in that it contributed to 9% of the company’s revenues in 2023. It’s second only to the other cancer treatment Tagrisso and diabetes medication Farxiga, each of which has a 13% revenue share. China might be a relatively small market for the company with a 13% revenue share, but it’s of interest to the company. This is evident from its recent acquisition of China’s Gracell Biotechnologies and its exclusive license deal with Eccogene, also of China, for obesity treatment.

#4. The dividend edge

Despite the positive earnings developments, it’s a bit of a disappointment that the company has maintained its dividends at USD 2.9 in 2023, the same as in 2022. On the upside though, the dividend payout ratio as a proportion of the annual core EPS is now down to an even healthier 40% from 43.5% earlier.

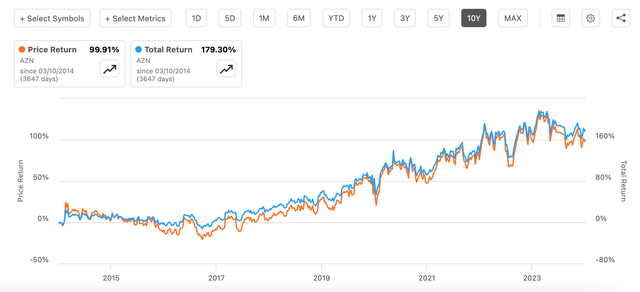

Further, the trailing twelve months [TTM] dividend yield is 2.2% is superior to the 1.5% for the healthcare sector as such. While it is still lower compared to peers like Bristol Myers Squibb Company (BMY), which I just wrote about, at 4.5% or Pfizer Inc. (PFE) at 6.4%, there’s still merit to it. Over the past 10 years, the dividends have added 80 percentage points to the returns on the stock (see chart below) thanks to the 24 years of consecutive dividend payouts.

Price and Total Returns, 10y (Source: Seeking Alpha)

#5. Market multiples

At the same time, the stock’s market multiples look good. If the core EPS were to grow at the midpoint rate of the guidance range of 12%, the number would come in at USD 8.1 per share and USD 4.1 per ADR. This results in a forward non-GAAP EPS of 16.3x, which is lower than that for the healthcare sector at 19.7x. It’s also lower than where it was when I last checked at ~18x.

What next?

AstraZeneca continues to look good. Its recent weak price trend only works in the stock’s favor as it lowers the forward P/E at a time when it has shown continued strong performance. The fact that its performance has exceeded even the upgraded guidance on both revenues and profits is a particular highlight here. The company’s recently approved drugs in key markets like the U.S. and China bode well, with the U.S. being its biggest market and China as a market where it’s expanding.

The company’s dividends have remained stagnant, but even then, there’s something to be said for their consistency, which significantly adds to returns from an investment in the stock over time. Also, while the TTM dividend yield falls behind some peers, it is still ahead of that for the healthcare sector. This aspect alone makes AstraZeneca a potentially worthwhile investment for the long term. In sum, AstraZeneca PLC stock remains a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.