While there are no guarantees in Wall Street analysts’ price targets, they can be a great starting point to find promising investments. One stock that recently caught my attention was e-commerce-focused pet retailer Chewy (NYSE: CHWY).

The stock currently trades at around $16 per share, but Wall Street analysts are quite upbeat on the stock, maintaining an average price target of $31.62. That implies a 97% upside potential. Recently, the company received updated buy ratings from analysts Eric Sheridan of Goldman Sachs and Trevor Young of Barclays, who set price targets of $36 and $30, respectively.

After examining Chewy’s recent results, along with the strategy that management outlined during its investor day in December, I can’t help but agree with Wall Street. Down 86% from its all-time highs, Chewy looks like an outstanding growth stock to buy at its current all-time-low valuation.

The No.1 specialty pet retailer in the U.S.

Despite only being founded in 2011, Chewy has grown to account for roughly one-third of the online pet retail market, generating over $11 billion in sales over the past year. Tripling its sales and nearly doubling its active-customer base to 20.3 million since its initial public offering (IPO) in 2019, Chewy’s operations have been booming.

However, following a pandemic-aided spike that saw revenue rise by 50% in 2021, the company’s sales growth decelerated to just 8% in its most recent quarter. This dramatic slowdown explains the market’s souring attitude toward the stock, but numerous reasons for excitement about the business’s growth potential remain.

First, Chewy operates in an incredibly resilient $144 billion pet retail industry that is expected to grow by 6% annually through 2027. While recent revenue-growth figures have been dipping, they should begin to stabilize.

To help quantify the stability in the company’s sales figures, consider that 85% of its revenue comes from non-discretionary consumables and healthcare products. These required (and typically repeating) sales help explain how Chewy generates an impressive 76% of its revenue from customers using Autoship, the company’s recurring-purchases service. Growing by 13% in the third quarter, Autoship continues to rise faster than Chewy’s overall revenue growth, providing sticky, consistent sales.

Story continues

Second, Chewy’s healthcare unit has continued flourishing, increasing from $1 billion in sales in 2018 to $3 billion last year — now equaling nearly 30% of total revenue. Comprised of pet medications, insurance, PetMD, telehealth, and management system for veterinarians, this unit aims to help the company become a one-stop shop for anything pet-related. These healthcare operations are vital as they command margins 10 percentage points higher than the retail unit while attracting high-value customers willing to go above and beyond for their furry friends.

Capping things off, Chewy continues to build out its private label and advertising sales — two additional higher-margin units. Currently accounting for around 5% of sales, these private-label brands are expected to grow to 15% of the company’s revenue over the long term. Private label items maintain margins seven percentage points higher than national brands, offering the potential for Chewy to further juice its bottom line.

Similarly, the company launched its sponsored ads option less than a year ago, which management believes should deliver gross-profit margins of around 70% — further boosting its profits.

Despite spending on growth areas, margins continue to improve

Perhaps the most critical portion of a bullish investment thesis on Chewy is its improving margins. Propelled by the higher-margin growth areas mentioned above in healthcare, private-label brands, and ad sales, the company is streamlining its operations despite testing new growth ideas.

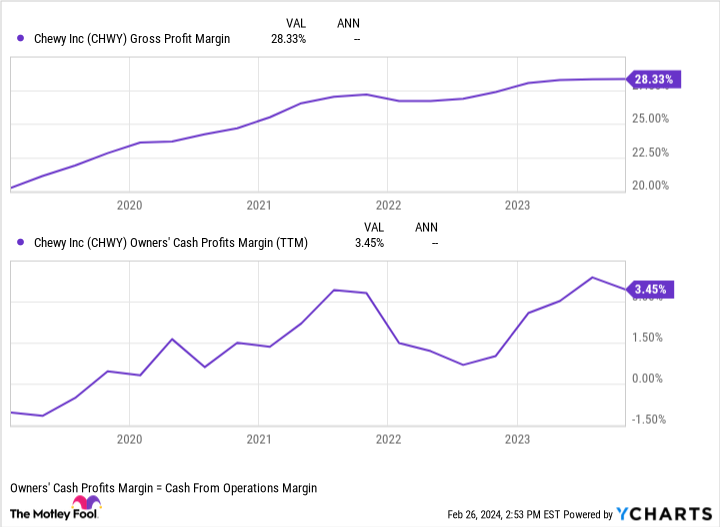

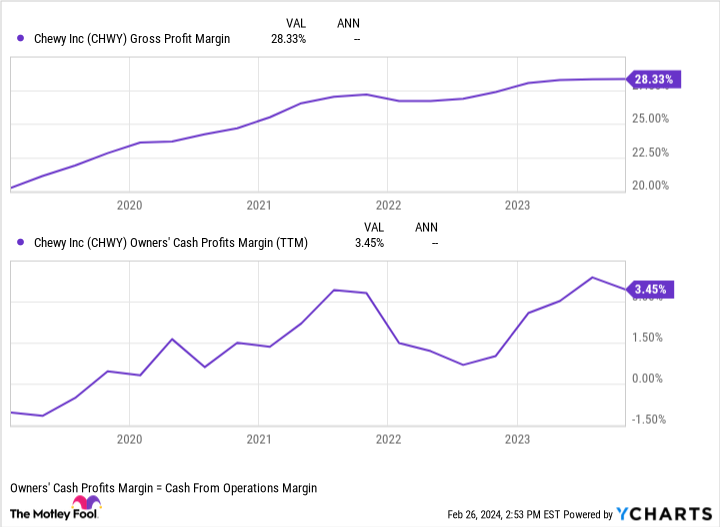

CHWY Gross Profit Margin data by YCharts.

Steadily increasing its gross-profit margin as its logistics inch closer toward peak efficiencies, Chewy has turned the corner on generating consistent positive cash flow from operations (CFO). Even accounting for stock-based compensation, Chewy’s CFO has remained positive over the last two years, allowing the company to fund its growth ambitions in-house.

An all-time-low valuation

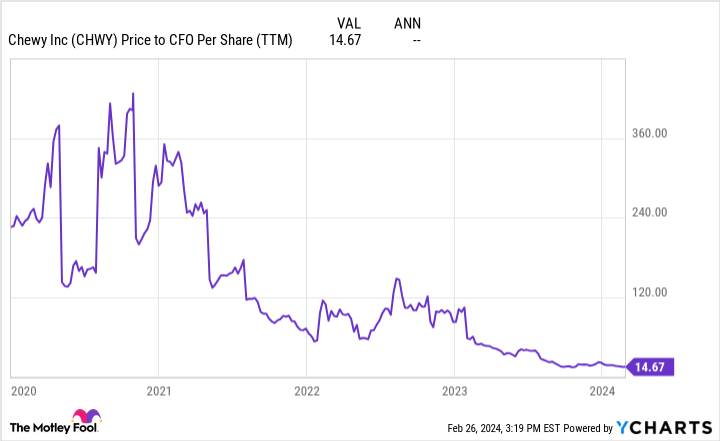

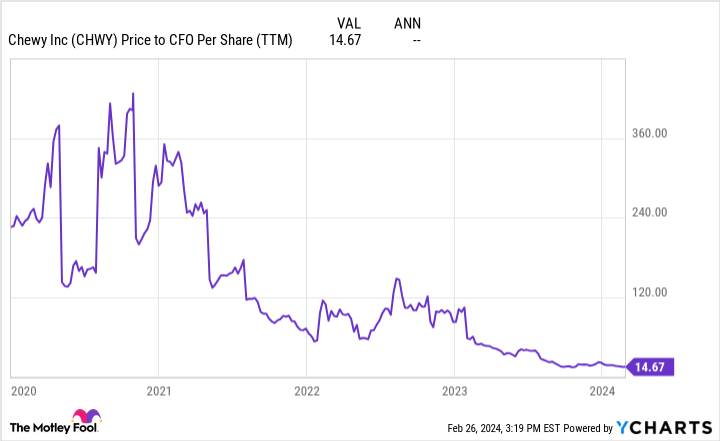

Most importantly for investors, even with Chewy’s outsized non-discretionary sales, promising growth options, and improving margins, its price-to-CFO (P/CFO) ratio sits at an all-time low.

This diminutive P/CFO ratio looks attractive, considering its behemoth e-commerce peer, Amazon, holds a ratio of 22 despite being much more mature. Best yet, Chewy is nowhere near optimized for maximum cash generation as it only recently exited its hypergrowth phase. With management expecting its CFO margin of 3.5% to roughly double over the long term as Chewy’s operations reach higher efficiencies, its P/CFO multiple of 15 looks even cheaper.

Combining all these factors — not to mention the company’s No. 1 ranking on Forrester’s Customer Satisfaction Index — Chewy looks like a stellar investment to add to your portfolio at these discounted prices and hold for decades.

Should you invest $1,000 in Chewy right now?

Before you buy stock in Chewy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chewy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 26, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Chewy, and Goldman Sachs Group. The Motley Fool recommends Barclays Plc. The Motley Fool has a disclosure policy.

1 Growth Stock Trading at an All-Time-Low Valuation That Could Rise by 97%, According to Wall Street was originally published by The Motley Fool